Table of Contents

Amended guidelines for submissions of Form 15CA & Form 15CB Certification

Paying outside India needs some adherence. This one enforcement is to apply Form 15CA and Form 15CB, if applicable. The different situations in which you need to apply these forms have been mentioned in this post.

1. Here are all the details

2. If payment is made, Rs 5 lakhs or less

3. If payment is made in excess of Rs 5 lakhs

4. When the reimbursement received is not taxable under the income tax act,

The revenue tax department has amended the regulations for the preparation and presentation of Form 15CA and Form 15CB (see former Form 15CB guidelines). The revised regulations became applicable as of 1 April 2016. The massive changes are as follows

• Forms 15CA and 15CB would NOT be allowed to be sent to a person for remittance, that does not involve RBI permission.

• The scope of payments of a particular surface referred to in Rule 37BB, which do not include submission of Forms 15CA and 15CB, has been extended from 28 to 33, including payments for imports.

• Form No. 15CB would only be necessary for payments made to non-residents that are taxed and where the transaction exceeds Rs. 5 lakhs.

Also Read: https://carajput.com/blog/basic-provision-of-form-15cb-15ca/

What is the need for 15CA and 15CB?

Previously, a person making remittance to a non-resident was required to send a certificate in a prescribed format circulated by RBI.

The main aim was to raise taxes at a point where remittance is made because it would not be feasible to obtain tax from non-residents at a later stage.

In order to track and track money transfers in an effective way, it was suggested that the e-filling of knowledge in the certificates be presented.

Section 195 of Income Tax Act, 1961 requirements the deduction of income tax from payments made to non-residents. A person making a transfer to a non-resident must provide a task (in the form 15CA) followed by a Chartered Accountants Certificate in the form 15CB.

Applicability of 15CA and 15CB w.r.t Taxability in compliance with the IT Act?

- Section 5 of the IT Act itself specifically describes the definition of taxable income, but the ambiguity occurs when it comes to Section 9,

Applicability of all the details under 15CB :

The person involved in making the payment to a non-resident or a foreign company need to provide the following details

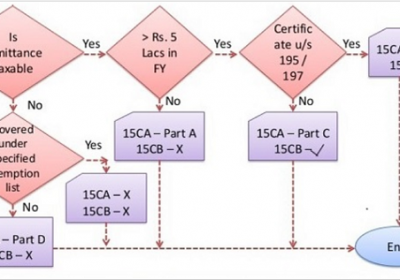

Where payment is made below Rs 5 lakh

- Data on these payments is provided in Part A of Form 15CA

If payment is made higher than Rs 5 lakh

- Part B of Form 15CA must be issued

- Certificate from the Accountant in Form 15CB

- Form 15CA Part C

Where expenditure is not subject to tax under the IT Act

- Form 15CA Part D

- In the following situations, no information is needed

- The remittance shall be made by a person and shall not need the prior approval of Reserve Bank of India [as provided for in Section 5 of the FEMA ACT, 1999 as set out in the Third Schedule of the Foreign Exchange Regulations, 2000].

Payment / Remittances do not need 15CA & 15CB?

Individuals are not needed to include the details in Forms 15CA and 15CB for remittances that do not require RBI approval. List of payments (33 items) referred to in Rule 37BB that do not require compliance and reporting by submission of 15CA and 15CB. The essence of the remittance is as follows:

https://www.incometaxindia.gov.in/Rules/Income-Tax%20Rules/103120000000007406.htm Annexure A

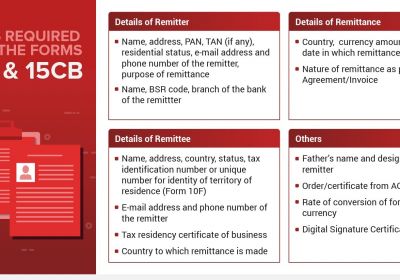

Documents are needed for Forms 15CA and 15CB certification:-

Appropriate information of the Remitter

• Name of the Remitter

• Name of the Remitter

• The Remitter 's PAN

• Key place of operation

• E-mail address and telephone number of the Remitter .

• Remitter status (Firm / Company / Other)

• DSC of the Remitter for submission of Form 15CA (since the form must now be filed electronically)

Details required of Remittee

• The name and position of the Remittee;

• Name of the Remittee;

• Key place of business

The State of the Remittee

Details of Remittance

• The nation to which the transition is being

• Currency:

• Remittance amount in Indian currency

• Proposed date of remission

• The purpose of the transfer pursuant to the Contract (Invoice Copy)

No bank details of the Remitter

• Title and bank of the Remitter;

• Name of Bank Branch

• The Bank's BSR Code

Documents are needed for the DTAA benefit

• Tax Residency Certificate (TRC) of the Remittee (Tax Registration of the country in which the Remittee is registered).

• Form 10F duly filled out to the Authorized Person of the Respondent (Self Declaration).

• No declaration of PE (permanent establishment). It is necessary because the income is the profitability of the business.

Form 15CA has been broken into four parts this time:

I. Part A of Form 15CA: If the amount of payment or the total amount of such payments made during the financial year does not exceed Rs. 5 lakh, In this situation, there is no need to get a Form 15CB.

II. Part B of Form 15CA: After obtaining a certificate from the Assessing Officer under Section 197 or an order from the Assessing Officer under Sections 195(2A), information in this section must be filled out for payments (other than the payments referred to in Part A, i.e. where the payment or aggregate of such payments made during the financial year exceeds Rs. 5 lakh).

III. Part C of Form 15CA: After obtaining a certificate in Form 15CB from a Chartered Accountant, information in this section must be filled out for payment (other than the payments referred to in Part A, i.e. where the deposit or aggregate of such deposit made during the financial year exceeds Rs. 5 lakh).

IV. Part D of Form 15CA: This section of the form must be completed in order to make a payment that is not taxable under the Income Tax Act.

However, information in Part D of Form 15CA is not required to be provided for any amount that is not subject to taxation –

- if the remittance is made by an individual and does not require prior Reserve Bank of India approval as per Section 5 of the Foreign Exchange Management Act read with Second Schedule of the Foreign Exchange (Current Account Transactions) Rules, 2000; or

- (ii) If the remittance is in the form of payment, the following 33 items from the Specified List must be included:

(As per Notification No. 93/2015 dated 16.12.2015, which is now in effect, the Final Specified List lists 33 items of payments.)

Sl.No. |

Purpose code as per RBI |

Nature of payment |

|

1 |

S0001 |

Indian investment abroad -in equity capital (shares) |

|

2 |

S0002 |

Indian investment abroad -in debt securities |

|

3 |

S0003 |

Indian investment abroad -in branches and wholly-owned subsidiaries |

|

4 |

S0004 |

Indian investment abroad -in subsidiaries and associates |

|

5 |

S0005 |

Indian investment abroad -in real estate |

|

6 |

S0011 |

Loans extended to Non-Residents |

|

7 |

S0101 |

Advance payment against imports |

|

8 |

S0102 |

Payment towards imports-settlement of invoice |

|

9 |

S0103 |

Imports by diplomatic missions |

|

10 |

S0104 |

Intermediary trade |

|

11 |

S0190 |

Imports below Rs.5,00,000-(For use by ECD offices) |

|

12 |

S0202 |

Payment for operating expenses of Indian shipping companies operating abroad. |

|

13 |

S0208 |

Operating expenses of Indian Airlines companies operating abroad |

|

14 |

S0212 |

Booking of passages abroad – Airlines companies |

|

15 |

S0301 |

Remittance towards business travel. |

|

16 |

S0302 |

Travel under basic travel quota (BTQ) |

|

17 |

S0303 |

Travel for pilgrimage |

|

18 |

S0304 |

Travel for medical treatment |

|

19 |

S0305 |

Travel for education (including fees, hostel expenses, etc.) |

|

20 |

S0401 |

Postal services |

|

21 |

S0501 |

Construction of projects abroad by Indian companies including import of goods at the project site |

|

22 |

S0602 |

Freight insurance – relating to import and export of goods |

|

23 |

S1011 |

Payments for maintenance of offices abroad |

|

24 |

S1201 |

Maintenance of Indian embassies abroad |

|

25 |

S1202 |

Remittances by foreign embassies in India |

|

26 |

S1301 |

Remittance by non-residents towards family maintenance and savings |

|

27 |

S1302 |

Remittance towards personal gifts and donations |

|

28 |

S1303 |

Remittance towards donations to religious and charitable institutions abroad |

|

29 |

S1304 |

Remittance towards grants and donations to other governments and charitable institutions established by the governments. |

|

30 |

S1305 |

Contributions or donations by the Government to international institutions |

|

31 |

S1306 |

Remittance towards payment or refund of taxes. |

|

32 |

S1501 |

Refunds or rebates or reduction in invoice value on account of exports |

|

33 |

S1503 |

Payments by residents for international bidding |

- In other words, if the payment is related to any of the above 33 things, no Form 15CA is necessary. The ‘specified List' is also known as an exemption list, as it exempts individuals from filing Forms 15CA and 15CB.

- There is one further instance where an individual does not need to submit Form 15CA: if the remittance does not require prior clearance from the RBI under FEMA.

Form 15CA Verification and Digital Signature

- The information on Form 15CA must be submitted electronically and signed with a digital signature. Prior to this 2015 notification, the digital signature was not required for electronic filing of Form 15CA prior to payment remittance. DSC is required for TAN users to file Form 15CA.

- In some circumstances, however, Form 15CA can be filed without a digital signature.

- The person in charge of paying a non-resident, who could be a director or another employee of the company/firm, or the assesses himself, must verify Form 15CA.

- A quarterly statement in Form 15CC for each quarter of the financial year is also needed to be sent to the income tax department electronically under digital signature within 15 days of the end of the quarter to which such statements apply.

As a result, the following is a summary of the new Rule 37BB, which is currently in effect:

- Individuals will not be required to submit Form 15CA and Form 15CB for remittances that do not require RBI approval under the Liberalized Remittance Scheme (LRS).

- (ii) In addition, the list of payments of a specified nature listed in Rule 37 BB that do not need the filing of Forms 15CA and Form 15CB has been increased from 28 to 33, including payments for imports.

- (iii) A CA certificate in Form No. 15CB will be required only for payments made to non-residents that are subject to tax and for which the total amount paid during the year exceeds Rs. 5 lakh.

The modified Rules became effective on April 1, 2016.

- Similarly, unlike manual certificates in the past, the certificate issued by a CA in Form 15CB must be issued online.

- In this regard, it's worth noting that the Finance Act of 2015 replaced section 195's sub-section (6). The words ‘person referred to in sub-section (1)' have been replaced with the terms ‘person responsible for paying to a non-resident in the new present provision. The impact is that previously, only those who were due to deduct income tax under section 195 were needed to fill out Form 15CA and Form 15CB. All persons making payments to non-residents must now fill out Form 15CA and Form 15CB to indicate whether the payment is taxable or not.

The new replacement clause, which is currently in effect, reads:

“(6) The person responsible for paying any sum to a non-resident (other than a company) or a foreign firm, whether or not chargeable under the provisions of this Act, shall furnish the information pertaining to such payment, in such form and manner as may be prescribed.”

The purpose of the adjustment to section 195(6) is stated in the following paragraphs.

- The person referred to in section 195(1) of the Act is required to disclose prescribed information under the existing provisions of sub-section (6) of section 195 of the Act.

- Any person responsible for paying any interest (other than interest referred to in sections 194LB, 194LC, or 194LD of the Act) or any sum chargeable to tax (not being salary income) to a non-resident, not being a company, or to a foreign company, shall deduct tax at the rates in effect, according to section 195(1) of the Act.

- The technique for getting information on remittances achieves two goals: ensuring that tax is deducted at the right rate from taxable remittances and identifying remittances on which tax was deductible but was not deducted by the payer. As a result, collecting information solely for taxable remittances stated by the remitter violates one of the fundamental reasons of acquiring information for international remittances, namely, identifying taxable remittances on which tax was deductible but not deducted.

- In light of this, section 195 of the Act was amended to provide that the person responsible for paying any sum, whether taxable or not, to a non-resident, not being a company, or a foreign company, shall be required to furnish the prescribed sum information in the form and manner as may be prescribed.

Can read about: LIST OF PAYMENTS FOR WHICH E-FORMS 15CA AND 15CB ARE MANDATED

Certification Work

Various types of certificates are required for a business to resume its course without any obstacle. The procurement of the certificate takes a long time. The thorough analysis of the documents and the approval from the authorities can extend up to days.

Certification Work in Delhi

In such a situation seeking experienced advice can help you find the solution to the problem. We at CA Rajput are reliable providers of certification services. We have great experience in managing the documents and drafting of the important documents required for the issuance of the certificate.

Also read: An NRI’s Guidance on Forms 15CA and 15CB for International Remittances

Certification Work – All Types of Certification Services Available

Certification of statutory liabilities, Fare Values of Share Company certificate, financial and annual financial statement services, certifications under Income tax deductions, Certification under Indirect taxes, certificates for claiming deductions, and government policies under proper rules and regulations.

Popular blog:-

- Basic Provision of Form 15CB & 15CA

- Complete Understanding about Form 15CA, Form 15CB

- New Form 15CA & 15CB Submission Process redesigned

- Certificate Form 15CA CB for making payments abroad

- Form 15cb To Be Issued For Payment To NRI

- How to file e-form 15ca & 15cb-process

- New rules for form 15ca/cb under rule 37bb

- Form-15cb-to-be-issued-for-payment-to-non-resident-for-using-immovable-property-situated-in-india