Shifting of Registered Office(RO) of the Company from One State to the Another which has more compliance than shifting the Registered Office within the State.

Detailed Procedure According to Section 13 read with Rule 30 of Companies (Incorporation) Rules, 2014:-

- Prepare Draft Memorandum and Articles of Association of the Company.

- Call and Convene Board Meeting & Get the Notice calling Extra-ordinary General Meeting signed by the Directors.

- Convene Extra-Ordinary General Meeting (EOGM), Pass the Special Resolution by the Members for change in Memorandum and Articles of Association of the Company.

- File Form MGT-14 within 30 Days of passing the resolution to the ROC.

- File Application in form INC-23 along with the following:-

- Copy of Altered MOA/AOA

- Copy of Notice Calling EOGM and copy of the Explanatory Statement.

- Special Resolution passed by the members for Alteration of MOA/AOA.

- Copy of the recorded Minutes of the EOGM.

- Affidavit verifying Application of Shifting (that application is true and fair in all respect).

- Copy of List of Creditors and Debenture-Holders of the Company having particulars of Name, Address, Nature of Debt, Amount Due, etc.

- Affidavit verifying List of Creditors and Debenture-Holders (shall be signed by the Company Secretary of the Company, if any, or by the 2 Directors of the company from which one shall be Managing Director).

- Copy of Authority Letter, Board Resolution, or Vakalatnama for the person who is going to appear in the hearings, if any.

- The Application shall be sent to the Chief Secretary and Registrar of the State where the RO of the Company Situates at the time of filling application, along with a Copy of Acknowledgement of service to the Central Government(CG).

- After the service of the Application of Application, CG may provide a date of hearing to the applicant.

- Before 14 days of the hearing, advertise the Application in format INC-26 in:

- Vernacular Newspaper in Vernacular language where RO of the Company situate, and

- Once in English Newspaper in English Language circulating in the district.

- Serve the individual notice of Application by registered post to each Creditor and Debenture-Holder (Cheers! If the company does not have any Creditor or debenture-Holder).

- Serve notice of Application and copy of Application by Registered Post to the Registrar, SEBI (if the Company is listed), RBI (if the company is registered under RBI), Income Tax Department, and any other regulatory body if any special act governs the Company.

- If objection/(s) received on such Application by any person so aggrieved then the company shall serve a copy of the Objection to the CG on/before hearing.

- If no objection is received then CG may put up the Application for Order without hearing (Hurray! Try that no objection would receive).

- After look that no Creditor or Debenture-Holder is deceived, CG may confirm the Alteration by making an Order with or without Terms and Conditions.

- After the Order of CG, file form INC-28 to the ROC within 30 days of the Order to make it effective.

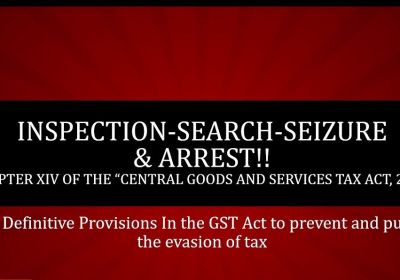

Note: No shifting of Registered Office shall take place if any inquiry, inspection, investigation, or prosecution is pending towards the Company.

Timeline: The timeline could be anything around 5 to 6 months.

So that’s all from my side! .......stay connected for further updates and knowledge.

Regards

Rajput Jain & Associates