Due Date for Filing Annual Return

All companies registered in India must file annual returns each year, irrespective of business turnover or activity. The annual return must be filed in Form MGT-7 and Form AOC-4 is also filed along with the annual return. In this article, we look at the due date for the annual return for a company.

Filing Annual Return

A company’s annual return has to be filed with the MCA within 60 days from the date of the Annual General Meeting. All companies are required to conduct an Annual General Meeting within 6 months of the closing of the financial year. Hence, the last date for conducting the Annual General Meeting would be 30th September and the due date for filing the annual return would be 29th November.

If a company cannot hold an Annual General Meeting in any year, the annual return still has to be filed within 60 days from the date on which the Annual General Meeting should have been held together with the statement specifying the reasons for not holding the Annual General Meeting. Hence, a company cannot excuse itself from filing an annual return on the plea of the Annual General Meeting not having been held.

Statutory Fee for Filing Annual Return

The statutory fee for filing is based on the authorized capital of the Company as follows:

|

For submitting, filing, registering, or recording any document Rs. by this Act required or authorized to be submitted, filed, registered, or recorded |

Rs. |

|

In respect of a company having a nominal share capital of up to 200 Rs. 1,00,000 |

Rs.200 |

|

In respect of a company having a nominal share capital of 300 Rs. 1,00,000 or more but less than Rs.5,00,000. |

Rs.300 |

|

In respect of a company having a nominal share capital of 400 Rs. 5,00,000 or more but less than Rs. 25,00,000 |

Rs.400 |

|

In respect of a company having a nominal share capital of 500 Rs.25,00,000 or more but less than Rs. 1 crore or more. |

Rs.500 |

|

In respect of a company having a nominal share capital of 600 Rs. 1 crore or more. |

Rs.600 |

Penalty for Late Filing Annual Return

In case a company files its annual return after 60 days of the date of the Annual General Meeting or after 29th November, a penalty would be the applicable date of the event and date of filing. Further, the Ministry of Corporate Affairs has proposed to increase the penalty for late filing of annual return multi-fold as follows from the year 2018:

|

Number of Days Default |

Current Penalty |

Proposed Penalty |

|

Up to 15 days |

Rs.400 |

Upto Rs.3,000 |

|

More than 15 days and up to 30 days |

Rs.800 |

Upto Rs.6,000 |

|

More than 30 days and up to 60 days |

Rs.1600 |

Upto Rs.12,000 |

|

More than 60 days and up to 90 days |

Rs.2400 |

Upto Rs.18,000 |

|

More than 90 days and up to 180 days |

Rs.4000 |

Upto Rs.36,000 |

|

More than 180 days and up to 270 days |

Rs.4800 |

Upto Rs.54,000 |

|

More than 270 days |

Rs.100 per day penalty |

Rs.200 per day penalty |

Note: The above chart has been worked for a company with a capital of share capital of Rs.1,00,000. The new penalty proposed by the MCA from the year 2018 for the late filing of annual returns is Rs.100 per day per filing. Since a company will have to file MGT-7 and AOC-4, the penalty for the day of default would be Rs.200.

Due Date of Filing Annual Return of A Company

The MCA announcement about the upcoming changes to the penalty structure has been published on the website as under:

“It is proposed to amend shortly, the Companies (Registration Offices and Fees) Rules 2014 to levy additional fee @Rs.100 per day for filings under Section 92 (Annual Return) or 137 (Annual Financial Statement) of the Companies Act, 2013. Once notified, the additional fee @Rs.100 per day (beyond the normal date of filing) shall become payable in respect of 23AC,23ACA,23AC XBRL,23ACA XBRL,20B,21A, MGT-7, AoC-4,AoC-4 XBRL and AoC-4 CFS. Stakeholders are advised to take note and plan accordingly.”

Know more about the increase in the penalty for late filing annual returns.

Rajput Jain & Associates provides an easy and online process for Entrepreneurs to file their annual return and income tax return along with financial statements and board meeting documents preparation at just Rs.19899. Talk to a Rajput Jain & Associates Advisor to know more and file an Annual Return for your company easily.

|

Annual Compliance Package for Private Limited Companies Starting @ just 5k |

Rajput Jain & Associates offers this unique package starting at an affordable price for the Chartered Accountants who are focussed on taxation aspects rather than on secretarial compliances. This package is specifically offered to the Chartered Accountants who want to outsource the Annual Filing and other secretarial work of their clients. In today’s world, it is important to form partnerships in order to expand your reach and attract more clients. Outsourcing your secretarial functions to us will help you to free up time to focus on your core professional services.

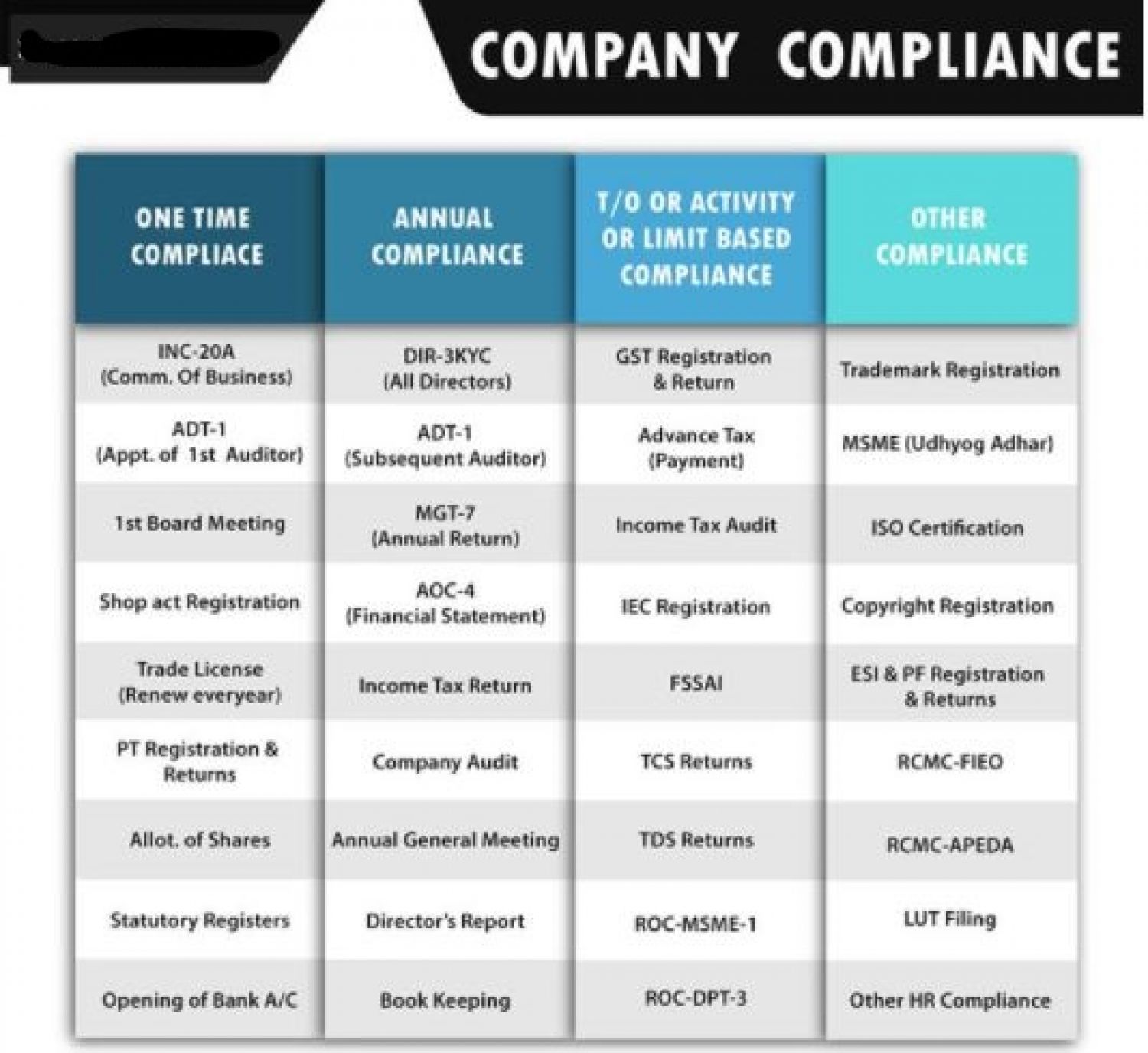

We help you meet all the necessary compliance so that you can focus on your core professional activities without worrying about any legal and secretarial hassles. We take care of your compliances and our scope of annual filing services include:

- Drafting secretarial documents including board reports, minutes of AGM, Notices, etc.

- Providing necessary certifications where required.

- Filing of ROC returns i.e. AOC-4, MGT-7, and ADT-1.

What we require from your end:

- Certified Financial Statement of the Client Company.

- Certified Auditor Report.

- Any other information regarding the directorship, shareholding, charges, or any other material information about the company.

Filing of AOC -4, AOC-4 (CFS), AOC- 4 XBRL, AOC – 4 Non-XBRL up to due date Without additional fee, if not filed till due date. Late fee will be calculated from the date originally date on which forms were required to file. Late fee Rs. 100 per day.