INCOME TAX

Modified Return (Form ITR-A) in Case of Business Reorganisation

RJA 02 Jun, 2024

All about the Modified Return (Form ITR-A) in Case of Business Reorganisation: Section 170A and the associated provisions offer a structured approach to filing modified returns in the case of business reorganization. The modified return of income is to be furnished by a successor entity to a business reorganisation as ...

AUDIT

Guidelines set by the ICAI on limits on tax audit for CA U/s 44AB:

RJA 02 Jun, 2024

Institute of Chartered Accountants of India Guidelines on Tax audit Limit The guidelines set by the Institute of Chartered Accountants of India (ICAI) regarding the limits on tax audit assignments for Chartered Accountants (CAs) under Section 44AB of the Income Tax Act, 1961, are essential for maintaining high standards ...

GST Consultancy

Physical Submission of GST Appeal Documents: Is It Necessary?

RJA 01 Jun, 2024

Physical Submission of GST Appeal Documents: Is It Necessary? In the context of filing an appeal under GST, there is often confusion about whether a physical submission of the appeal documents is required after the online submission on the GST portal. Compliance with GST appeal procedures can be efficiently managed ...

GST Filling

ITC Reversal required in case of Financial Credit Note?

RJA 01 Jun, 2024

ITC Reversal required in case of Financial Credit Note? Big Question is there, Whether ITC reversal required on Financial Credit Note received from supplier ? (in which supplier has not mentioned GST ).It is ambiguous issue since implementation of GST. Our Summary on the issue of ITC reversal for financial ...

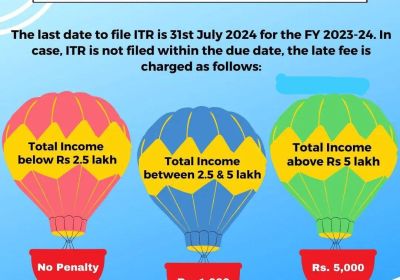

Income tax return

Comprehensive Guide on filing ITR Returns for the FY 2023-2024

RJA 31 May, 2024

Comprehensive Guide on filing Income Tax Returns for the FY 2023-2024 For the fiscal year 2023-2024, salaried individuals can start the process of filing their Income Tax Returns (ITR) in June 2024, after receiving Form 16 from their employers. Filing on or before 31st July 2024 helps avoid interest and penalties. Timely ...

INCOME TAX

Complete Income Tax Calendar 2024

RJA 31 May, 2024

Income Tax Calendar 2024 January 2024: 7th: Deposit Tax Deducted at Source and Tax Collected at Source for Dec 2023. 14th: Issue Tax Deducted at Source certificates (Section 194-IA, 194-IB, 194M). 15th: Submit quarterly Tax Collected at Source statement (Dec 31, 2023). 30th: Issue Tax Collected at Source certificate (quarter ending Dec 31, 2023). 31st: Submit quarterly ...

INCOME TAX

Overview of Section 119(2)(b) Application for Condonation of Delay

RJA 29 May, 2024

Overview of Section 119(2)(b) Application for Condonation of Delay Section 119 of the Income Tax Act empowers the Central Board of Direct Taxes (CBDT) to issue instructions to lower levels of tax authorities for the proper administration of the tax laws. This section provides the CBDT with the authority to ensure ...

TDS

Correcting TDS Errors through filling New Income Tax Form 71

RJA 28 May, 2024

Form 71 helps to claim TDS Credit in respect of income disclosed in Income tax return submitted in earlier years CBDT has issued Notification No. 73/2023, dated August 30, 2023: The Finance Act 2023 introduced Section 155(20) of the Income-tax Act, effective from October 1, 2023. This provision addresses situations where income has been reported in an earlier ...

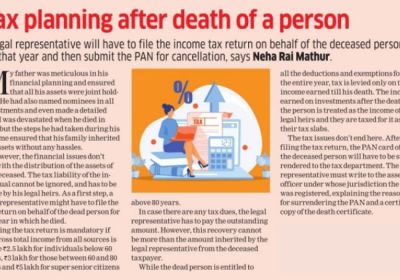

INCOME TAX

Do legal representatives Required to intimate about the death of taxpayer?

RJA 25 May, 2024

Do legal representatives need to intimate about the death of the taxpayer to the IT Department? Legal representatives of a deceased taxpayer are not legally mandated to notify the Income-Tax (IT) Department about the death of the taxpayer. This position was confirmed by the Delhi High Court in the case ...

INCOME TAX

Taxability of Reimbursement of Medical Treatment by the Employer

RJA 24 May, 2024

Taxability of Reimbursement of Medical Treatment by the Employer With Reference to Section 17(2) of the Income-tax Act, 1961, the reimbursement of medical expenses by an employer to an employee can, under certain conditions, be excluded from being considered a taxable perquisite. Here’s a detailed explanation based on the provided ...

TDS

CBDT Circular : TDS/TCS Relief Due to Inoperative PAN

RJA 22 May, 2024

CBDT Circular : TDS/TCS Relief Due to Inoperative PAN The Central Board of Direct Taxes (CBDT) issued a circular providing relief to taxpayers who received tax demand notices due to short deduction of Tax Deducted at Source / Tax Collected at Source. This was in response to numerous grievances from taxpayers ...

Goods and Services Tax

How to Handling negative IGST liability under the GST System in India

RJA 17 May, 2024

How to Handling negative IGST liability under the GST System in India the mechanism for handling negative IGST (Integrated Goods and Services Tax) liability under the GST (Goods and Services Tax) system in India. When the tax amount of credit notes (CGST+SGST/IGST) exceeds the tax amount of outward ...

Goods and Services Tax

More than 8 lakhs ITR (income tax returns) for AY 24–25 have been filed so far.

RJA 14 May, 2024

More than 8 lakhs ITR (income tax returns) for AY 24–25 have been filed so far. The fact that over 829,000 Income Tax Returns (ITRs) have already been filed for Assessment Year 2024-25 indicates a proactive approach among taxpayers to fulfill their obligations in a timely manner. This early filing trend could ...

COMPANY LAW

Complete Guide on ROC Filing of Form MSME- 1

RJA 12 May, 2024

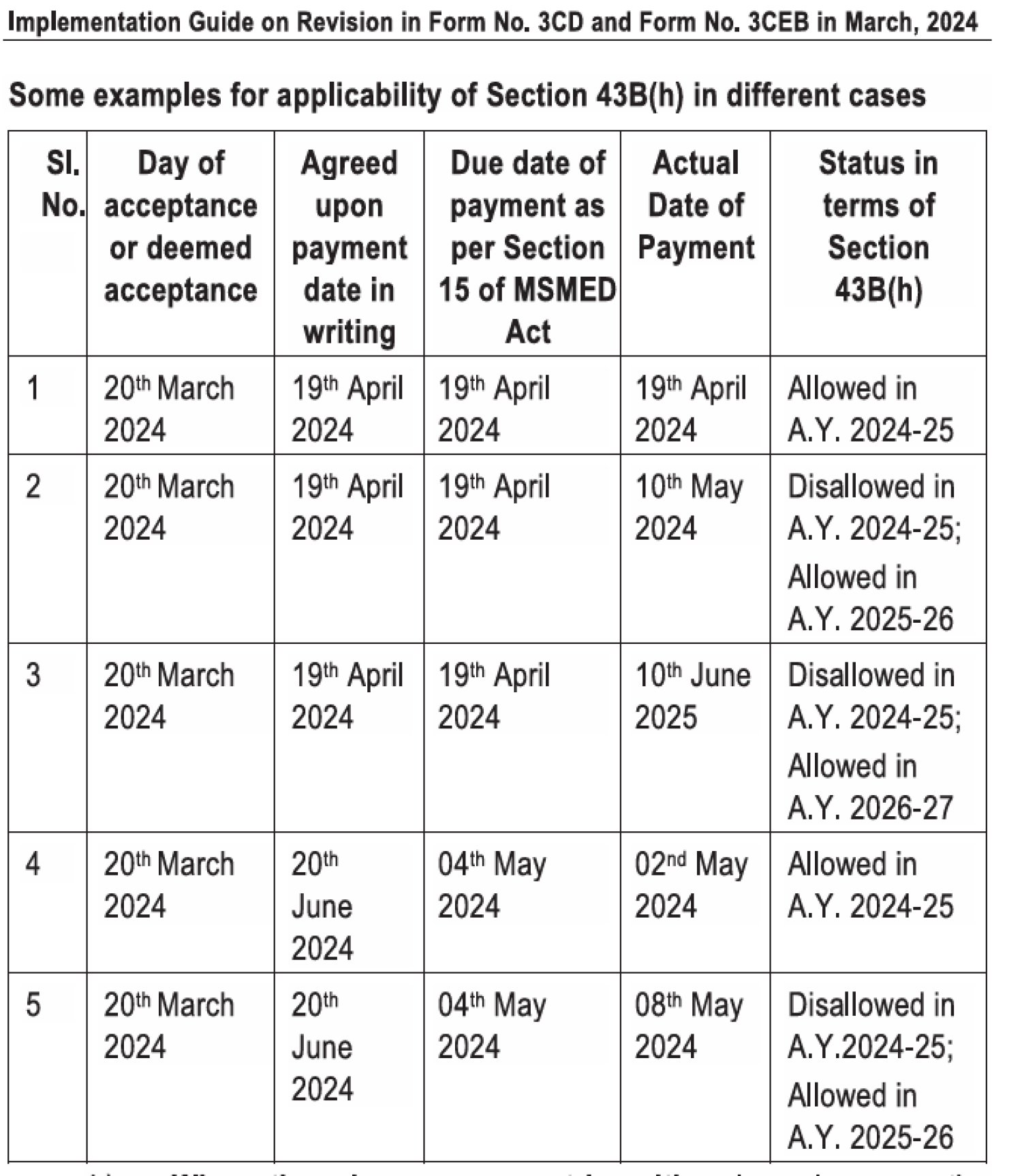

Guide on ROC Form MSME -1 : Filling Objective, Timeline Date & Penalty ROC Filing of Form MSME-1 is a statutory requirement under the Companies Act, 2013, & the Specified Companies (Furnishing of Information about payment to Micro and Small Enterprise Suppliers) Order, 2019. MSME Form 1, as mandated by the Ministry of Corporate ...

COMPANY LAW

MCA : PAS Rules -Pvt Ltd Co. to issue shares etc in Demat form only

RJA 12 May, 2024

MCA has notified amendments to PAS Rules - Pvt Ltd Co. to issue shares etc in Demat form only, MCA bring significant changes to the regulatory framework for private companies in India, especially concerning the issuance and holding of securities in dematerialized form. Private companies, excluding small companies, are now ...

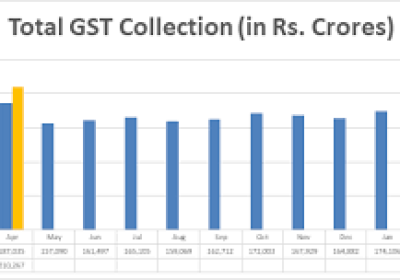

Goods and Services Tax

Goods and Services Tax Collection Hits Record High in April 2024

RJA 10 May, 2024

Goods and Services Tax Collection Hits Record High in April 2024 India's Goods and Services Tax (GST) collection for April 2024 has broken records, which is undoubtedly a positive indicator for the economy. Goods and Services Tax Collection Hits Record High in April 2024 Here's a summary of the key points: ...

INCOME TAX

CBDT Guidelines compulsory selection of ITR for Scrutiny for the FY 2024-25

RJA 07 May, 2024

CBDT Guidelines compulsory selection of ITR for Scrutiny for the FY 2024-25 The Government of India has been given the Guidelines via CBDT for mandatory selection of Income tax returns for complete scrutiny during FY 2024-25. These Guidelines via CBDT guidelines, outlined in a document dated May 3, 2024, are designed to ...

GST Consultancy

For Changing or Amendment in the Goods and Services Tax registration

RJA 15 Apr, 2024

For Changing or Amendment in the Goods and Services Tax registration Nature of your Business -New Partners’ Details - For Changing Nature of Business: You would need to provide a detailed description of the new nature of your business. you'll typically need to provide various documents to ensure ...

INCOME TAX

Ten transactions that may trigger tax authorities' income tax scrutiny

RJA 03 Apr, 2024

Ten transactions that may trigger tax authorities' income tax scrutiny In today’s world, taxpayers should ensure that the money they declare accurately reflects their actual financial activity. Transparency regarding finances is important. The Income Tax Department is employing increasingly sophisticated techniques to investigate potential discrepancies between taxpayers' reported ...

INCOME TAX

All about the Equity Linked Savings Scheme & its Returns

RJA 20 Mar, 2024

5 Golden Tips to Maximise ELSS Fund Returns ELSS or Equity Linked Savings Scheme is a type of diversified equity-oriented scheme which comes with a lock-in period of 3 years. By investing in this type of scheme, one will get tax exemptions u/s 80C of the IT Act 1961. A key interesting ...

GST Filling

New Functionality of the interest calculator in GSTR-3B

RJA 16 Mar, 2024

New Functionality of the interest calculator in GSTR-3B on GST Portal: The New GST functionality of interest calculator in GSTR-3B is now live on the Goods and Services Tax Portal. This Goods and Services Tax functionality will facilitate and assist the taxpayers in doing self-assessment. This GST functionality ...

INCOME TAX

How to respond notices for AIS (Annual Information Statement) mismatch?

RJA 09 Mar, 2024

How to respond notices for AIS (Annual Information Statement) mismatch? AIS (Annual Information Statement) mismatch means there is a discrepancy between the information provided in your tax return and the information reported by third parties, such as banks, financial institutions, or employers, to the tax authorities through the Annual ...

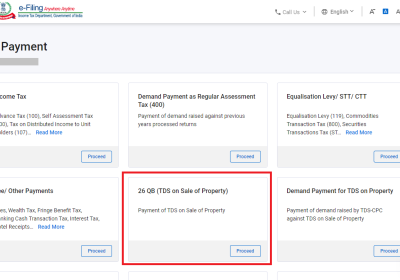

INCOME TAX

Payment of TDS via using Form 26QB on sale of property

RJA 03 Mar, 2024

Payment of TDS via using Form 26QB on sale of property transaction The following are some essential key points about Form 26QB: 1. Objective of Form 26QB : It assures that income tax is withheld at the moment of the property transaction and is specifically designed for Tax Deducted at Source on ...

RBI

RBI intends to tokenisation assets, bonds as part of the wholesale CBDC pilot.

RJA 26 Feb, 2024

RBI intends to tokenisation assets, bonds as part of the wholesale CBDC pilot. T Rabi Sankar, Deputy Governor Reserve Bank of India, said that The Reserve Bank of India (RBI) is planning to introduce tokenisation of assets and government bonds and such under the wholesale CBDC (Central Bank Digital Currency ...