IBC

No Role of COC play as a claimant whose matters had to be determined by liquidator

RJA 11 Jul, 2020

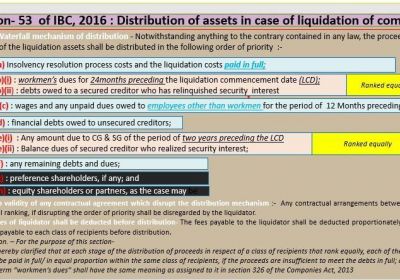

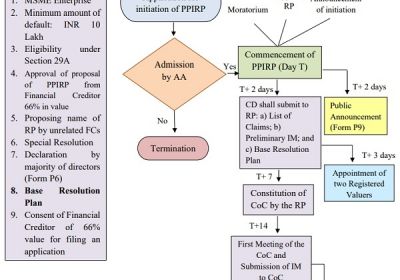

IBC : Realisation & Distribution of Assets by Liquidator Liquidation under the IBC 2016 with special focus upon priority of claims : Under section 53(1) of the Insolvency Code, 2016, the fees payable to the liquidator shall be deducted proportionately from the proceeds payable to each class of recipients, and the proceeds to the ...

INCOME TAX

FAQ’s on Deduction under section 80C, 80CCC, 80CCD & 80D

RJA 08 Jul, 2020

FAQ’s on Deduction under section 80C, 80CCC, 80CCD & 80D Q.: Can taxpayers claim the deduction of 80C while submitting the return on income tax? Claims for 80C deductions are allowed before the end of the assessment year while filing the return on income. Q.: What ...

OTHERS

Business Set up Outside India - Resident Indian made Investments outside India/abroad:

RJA 24 Jun, 2020

Business Set up Outside India When a business flows globally it is bound to be successfully assisted by professionals. Relocating your existing business or setting up business outside India is more of a challenging task that requires proper financial planning, knowledge of marketing policies, tax incentives, and a few jurisdictions. ...

Form 15CA & 15CB Certificate

Amended guidelines for submissions of Form 15CA & Form 15CB Certification

RJA 24 Jun, 2020

Amended guidelines for submissions of Form 15CA & Form 15CB Certification Paying outside India needs some adherence. This one enforcement is to apply Form 15CA and Form 15CB, if applicable. The different situations in which you need to apply these forms have been mentioned in this post. 1. Here are all ...

GST Filling

GST Latest Notifications: Review of CBIC, GST Extension Notifications

RJA 24 Jun, 2020

GST Latest Notifications: Review of CBIC, GST Extension Notifications CBIC released various notifications for enforcing the recommendations of the 40th meeting of the GST Council as follows: CBIC notifications signed on 24.06.2020 concerning interest waiver and late fees. The CBIC issued several GST notices on 24 June 2020. There is a ...

GST Registration

Is GST registration necessary for a charitable-based pharmacy store operated by NGO?

RJA 22 Jun, 2020

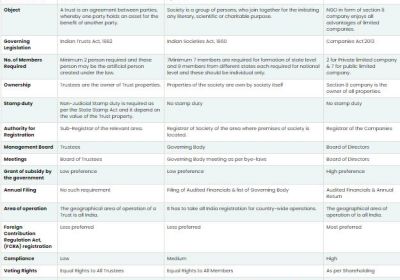

Conditions for exempting a charitable trust from GST A charitable trust or non-profit organisation must satisfy specific criteria to be exempt from the Goods and Services Tax. The charitable trust or NGO must be registered under Section 12AA of the income tax Tax and the services it ...

GST Consultancy

Late fee Exemption for GST Return filing those are not been able to file GST Return.

RJA 19 Jun, 2020

Late fee Exemption for GST Return filing those are not been able to file GST Return. Great effect on tax revenues due to lock-out of coronavirus A relief of late interest and fees will be given to small taxpayers with a minimum turnover of up to 5 crores if they ...

TDS

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

RJA 07 Jun, 2020

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N Present TDS exclusion No currency purchases above 1 Crore -Chapter 194N To discourage cash transactions and to continue heading towards a cash-free economic structure, a new Section 194N has been enacted under the Income Tax Act with effect from 1 September 2019 to ...

IBC

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016

RJA 06 Jun, 2020

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016 PURPOSE OF FORENSIC AUDIT INSOLVENCY AND BANKRUPTCY CODE 1. Events describing, if any, Financial Statements with inconsistencies / Red Flags, The misuse/diversion of bank funds; Overvaluation of current/fixed assets and their non-existence; Documentation breach; To ...

Goods and Services Tax

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption.

RJA 06 Jun, 2020

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption. After a complaint filed against them by Mrs. Chitra Kumar for profit-making under the GST, the Barbeque Nation refused to provide invoice details in the official inquiry. NAA directed DGAP to guide Barbeque Nation to supply its invoice ...

RBI

RBI Announced the refinancing of Rs 50,000 crore to SIDBI etc

RJA 06 Jun, 2020

The Reserve Bank of India Governor Announced the refinancing of Rs 50,000 crore for all Indian financial institutions such as Nabard, SIDBI, and NHB. The Reserve Bank of India has turned its focus to fulfilling the borrowing needs of NBFCs, MFIs, and housing markets by offering special refinancing facilities of ...

OTHERS

Complete understanding about Senior Citizen Savings Scheme (SCSS)

RJA 04 Jun, 2020

Complete understanding about Senior Citizen Savings Scheme (SCSS) In 2004 the government announced the Senior Citizens Savings Scheme to ensure a guaranteed return to senior income, thereby creating a guaranteed regular income flow. Investing in the Senior Citizen Pension Fund is a successful way for senior citizens aged 60 years of age ...

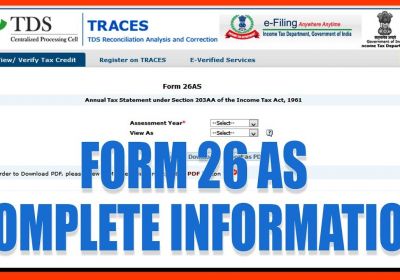

INCOME TAX

Latest revised Form 26AS with effective from 1 June 2020 : CBDT

RJA 04 Jun, 2020

Govt Notified: Latest revised Form 26AS with effective from 1 June 2020 Latest Form 26AS with effect from 1 June 2020: With effect from 1 June 2020, all data of the taxpayer will be available in the new Form 26AS: Tax withheld at source and tax assessed at source Details of financial transactions listed Income tax ...

INCOME TAX

Basic understanding of Rebate U/s 87A of I. Tax Act

RJA 02 Jun, 2020

Basic understanding of Rebate U/s 87A of I. Tax Act The main obligation of any Govt of India should protect the citizens of its nation, and the Govt of India is constantly working towards that goal. To order to help the government achieve this vision efficiently, the people ...

GST Consultancy

NAA Allowed by Court to visit offices for collection of documents & Information

RJA 27 May, 2020

The National Anti-profiteering Authority (NAA) has obtained clearance from the High Court of Bombay for a visit to the offices of Saphire Foods Pvt. Ltd. to gather documents and information during the locking process. In this writ petition, it was brought to the court's notice that the &...

OTHERS

The Prime Minister cares fund is now entitled to accept donations under the CSR

RJA 27 May, 2020

The Prime Minister’s CARES Fund is now entitled to accept donations under the CSR The Center has also made it available for contributions from multiple organizations through the PM CARES Fund for Corporate Social Responsibility ( CSR). The Ministry of Corporate Affairs has proposed changes to the Companies Act. ...

OTHERS

ICAI shall extend the time for the initiation of the Practical Article Training to 31 July 2020

RJA 21 May, 2020

I ICAI official statement Extend the period of time for the beginning of practical training on or before 31 May 2020 until 31 July 2020 for inclusion in the final examination to Be conducted ...

Goods and Services Tax

Government may not understand calls to lower GST

RJA 20 May, 2020

The exemption would block input-tax credit that would have a negative effect on companies and would not have a direct impact on customers, two finance ministry officials said on Tuesday. The Cabinet does not approve proposals from industry to substantially reduce the Goods and Services Tax (GST) for a period ...

INCOME TAX

CBDT CLARIFYING Compiling the new Section 115BAC tax legislation implemented in the Budget 2020

RJA 18 May, 2020

AMOUNT IS DEDUCTED OF TDS ON SALARY-DEDUCTION OF TDS ON SALARY-CBDT CIRCULAR CBDT CIRCULAR CLARIFYING THE PROCESS FOR DEDUCTION CLARIFYING THE METHOD FOR DEDUCTION IN THE EXISTING AND CURRENT SCHEMES OF TAXATION: Income tax Amendment 2020 adopted a revised income tax system for individual taxpayers. The new tax scheme is offered ...

IBC

Fresh IBC has been suspended for one year. As per the declaration of FM

RJA 17 May, 2020

Fresh IBC has been suspended for one year. As per the declaration of FM. Important notifications to reduce the burden of compliance under the Atmanirbhar Scheme 1. IBC related - debts related to COVID 19 are out of IBC default 2. No new IBC can be initiated up to 1 year 3. The minimum ...

OTHERS

COVID-19 and Disappointment of Lease Deeds:

RJA 07 May, 2020

COVID-19 and Disappointment of Lease Deeds: A Perspective – Shubham Garg We are facing an ongoing global health problem, as a result of which the Indian Government placed a national lockout under the Disaster Management Act of 2005 as a protective measure to restrict the dissemination of COVID-19 to the population. ...

IBC

Insolvency & Bankruptcy Code 2016 for Creditors

RJA 07 May, 2020

Insolvency & Bankruptcy Code 2016 – Panacea for Creditors but Business Course? It is vital that IBC is never presented as an anti-business law meant to penalize and liquidate industry or to make it a battle between rich and poor (class war). Instead, however, IBC rules can be seen as a ...

GST Filling

Key considered for GST PMT 09 under the GST Regime

RJA 07 May, 2020

Relevant points to be considered for GST PMT 09 under the GST Regime Form PMT-09 can be found on the GST page. The taxpayer will also move the cash balance available under one heading to another head of tax, i.e. from CGST to SGST or interest or fine, or ...

OTHERS

Pnb Scam Case Sunny Kalra And Cbi Bring Accused Sunny Kalra To India From Muscat

RJA 07 May, 2020

PNB SCAM CASE SUNNY KALRA AND CBI BRING ACCUSED SUNNY KALRA TO INDIA FROM MUSCAT Fact of the Company: White Tiger Steels Private Limited is a private company. it was founded on 18 December 2012. It is listed as a non-government corporation and registered with the Registrar of Companies, Delhi. The approved ...