Table of Contents

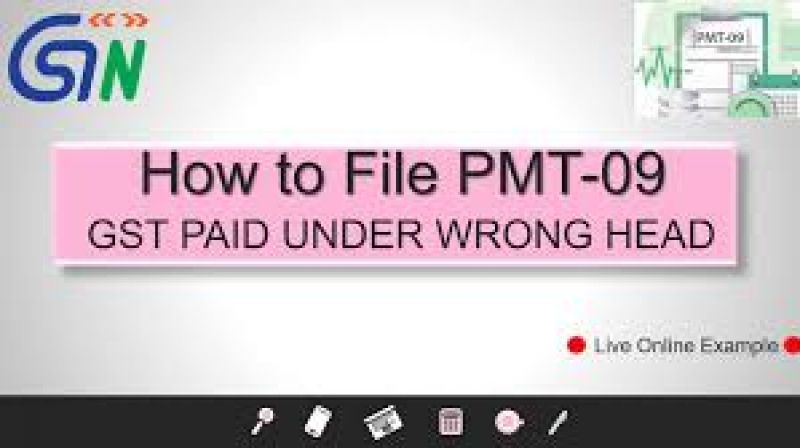

Relevant points to be considered for GST PMT 09 under the GST Regime

Form PMT-09 can be found on the GST page. The taxpayer will also move the cash balance available under one heading to another head of tax, i.e. from CGST to SGST or interest or fine, or vice versa, which ensures that the GST invested under the incorrect head will be reversed.

For GST Challan PMT-09 After different taxpayers made errors when the GST Challan Payment was made by filling the sums in the wrong hand. Then there might be a chance that the taxpayer who wants to file the number in the CGST head had falsely paid tax in the IGST head or vice versa and there could be a lot of cases irrespective of the head of the CGST head, the head of the SGST head, the head of the IGST head, the head of the CESS head.

The government has come up with a plan to pass the tax from one to another in the form of PMT 09 PMT 09, which consists of small and wide hands. You should note the amount of tax you want to transfer as in the specifics of the money to be moved from one account to another. The reallocation of tax can be from the top to the bottom and vice versa. The PMT 09 can be filled by any taxpayer. This can be reached via the GSTN app.

Few points to be noted around GST PMT 09:-

1. This should be able to manage just one case, and this is where payment is made in the wrong head and is not used.

2. When the data in exchange is incorrect, the antagonist will be accurate, but it will be changed as well.

3. The amount that has been used and deducted from the Cash Register can not be reallocated.