AUDIT

Indian Government and ICAI going to issue the FAIS (Forensic Accounting and Investigation Standards)

RJA 03 Sep, 2020

ICAI going to issue the FAIS (Forensic Accounting and Investigation Standards) ICAI is proposing to come up with a package of Forensic Accounting and Inquiry Standards (FAIS), said on Tuesday by President Atul Kumar Gupta. The new standards are expected to be ready by the end of December, ...

INCOME TAX

CBDT implements functionality for banks to verify the ITR filing status.

RJA 03 Sep, 2020

CBDT implements functionality for banks to verify the ITR filing status. Wednesday, the IT Dept said it introduced a service for financial institutions to verify the status of tax filings submitted by entities based on their PAN. On Wednesday, the IT Dept said it introduced a service for banks to ...

IBC

Use of Disclaimers, Limitations & Caveats by Registered Valuers in his Report :IBBI Guidelines

RJA 01 Sep, 2020

Use of Disclaimers, Limitations, and Caveats by the Registered Valuers in his Report: IBBI Issue Guidelines The IBBI released guidance called India's Insolvency and Bankruptcy Board Guidelines (Use of Caveats, Limitations, and Disclaimers in Valuation Reports), 2020. The guidance is issued pursuant to Rule 14(i) of the Companies Rules (Registered ...

Goods and Services Tax

Big Relief for SMEs Business in India:- annual revenue of up to Rs 40 lakhs is now exempt from GST

RJA 25 Aug, 2020

On 24 August 2020, the Union Ministry of Finance announced that companies with an annual turnover of up to Rs 40 lakh will now be excluded from GST. The Ministry added that those with up to Rs 1.5 crore turnover will apply for the Composition Scheme and pay just 1 percent tax. Now firms with ...

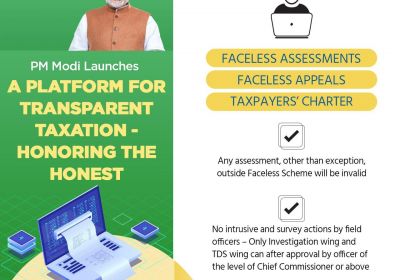

INCOME TAX

Key highlights of PM Modi's speech on Transparent Taxation: Seamless, painless, Faceless Assessment

RJA 13 Aug, 2020

Key highlights of PM Modi’s speech on Transparent Taxation: Seamless, painless, Faceless Assessment On 13 August PM Modi will launch the platform 'Transparent Taxation – Honoring the Honest', The upcoming platform would help CBDT's reform agenda to make the tax filing process clearer and simpler, the Ministry ...

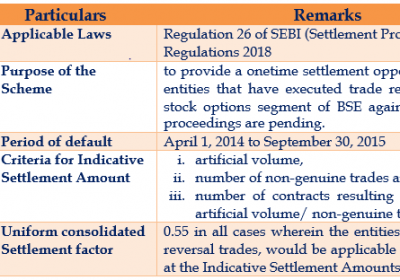

SEBI

SEBI introduce a One-Time settlement scheme- Sebi Settlement Scheme 2020

RJA 10 Aug, 2020

SEBI INTRODUCE A ONE-TIME SETTLEMENT SCHEME- SEBI SETTLEMENT SCHEME 2020, SEBI issuse a One-time settlement New scheme - SEBI Settlement scheme 2020, vide Public Notice dated 27th July, 2020 called Settlement Scheme (“the Scheme”) in terms of Regulation 26 of SEBI (Settlement Proceedings) Regulations 2018. Most of the ...

Goods and Services Tax

GST compliance deadlines and Compliance Due date

RJA 01 Aug, 2020

GST compliance deadlines end 31st August 2020 Due to COVID 19 Situation and after Hon'ble FM Ms. Nirmala Sitharaman Ji "Corona is an act of God" and business loss now is the time to avoid late Fee, Interest, and Penalties. Deadlines are as under: ·Refund Application FY 2017-18: ...

ROC Compliance

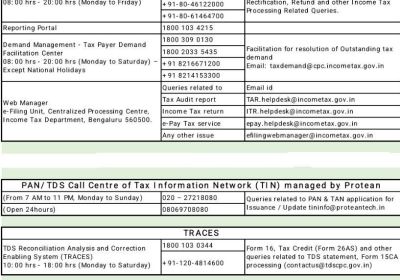

ROC open new corporate help desk operational number

RJA 30 Jul, 2020

Corporate Affairs Ministry (ROC) Open New Operational Number of Corporate Helpdesk New Helpdesk Number has been made successful by Corporate Ministry Seva Kendra and CRC Helpdesk to answer stakeholder queries on Company Name Availability and Company Incorporation, accessible July 17, 2020 (8:00 a.m.) A new contact number for the CRC Helpdesk and ...

Goods and Services Tax

Basic Impact after implication of GST on the Personal Loan

RJA 28 Jul, 2020

Basic Impact after the implication of GST on the Personal Loan The impact of GST on personal loans has been remarkable reforms in the new tax regime under the One Nation, One Tax, One Market concept under GST. Basically, the aim of tax structure impacted every sector of the ...

OTHERS

Five reasons why you should use a Credit Card

RJA 26 Jul, 2020

Five reasons why you should use a Credit Card A credit card is a service that allows you to earn a credit of up to forty-five days from the bank without any interest. You will use a card to pay travel expenses for your regular grocery expenses. A credit card ...

OTHERS

ICAI claims that Institute ICWAI has not approved & unlawfully used the term ICAI

RJA 26 Jul, 2020

ICAI claims that Institute ICWAI has not approved & unlawfully used the term ICAI The trademark 'ICAI' is a registered trademark of the Indian Chartered Accountants Institute (ICAI) [Trade Mark No. 2121118] with the date of product 01.07.1949. Therefore, the Institute of Indian Chartered Accountants (ICAI), as its licensed owner/owner and ...

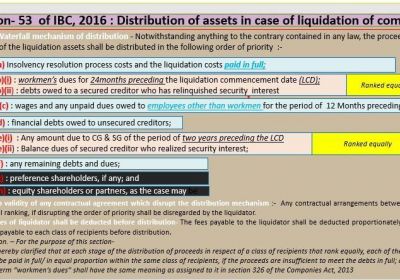

IBC

No Role of COC play as a claimant whose matters had to be determined by liquidator

RJA 11 Jul, 2020

IBC : Realisation & Distribution of Assets by Liquidator Liquidation under the IBC 2016 with special focus upon priority of claims : Under section 53(1) of the Insolvency Code, 2016, the fees payable to the liquidator shall be deducted proportionately from the proceeds payable to each class of recipients, and the proceeds to the ...

INCOME TAX

FAQ’s on Deduction under section 80C, 80CCC, 80CCD & 80D

RJA 08 Jul, 2020

FAQ’s on Deduction under section 80C, 80CCC, 80CCD & 80D Q.: Can taxpayers claim the deduction of 80C while submitting the return on income tax? Claims for 80C deductions are allowed before the end of the assessment year while filing the return on income. Q.: What ...

OTHERS

Business Set up Outside India - Resident Indian made Investments outside India/abroad:

RJA 24 Jun, 2020

Business Set up Outside India When a business flows globally it is bound to be successfully assisted by professionals. Relocating your existing business or setting up business outside India is more of a challenging task that requires proper financial planning, knowledge of marketing policies, tax incentives, and a few jurisdictions. ...

Form 15CA & 15CB Certificate

Amended guidelines for submissions of Form 15CA & Form 15CB Certification

RJA 24 Jun, 2020

Amended guidelines for submissions of Form 15CA & Form 15CB Certification Paying outside India needs some adherence. This one enforcement is to apply Form 15CA and Form 15CB, if applicable. The different situations in which you need to apply these forms have been mentioned in this post. 1. Here are all ...

GST Filling

GST Latest Notifications: Review of CBIC, GST Extension Notifications

RJA 24 Jun, 2020

GST Latest Notifications: Review of CBIC, GST Extension Notifications CBIC released various notifications for enforcing the recommendations of the 40th meeting of the GST Council as follows: CBIC notifications signed on 24.06.2020 concerning interest waiver and late fees. The CBIC issued several GST notices on 24 June 2020. There is a ...

GST Registration

Is GST registration necessary for a charitable-based pharmacy store operated by NGO?

RJA 22 Jun, 2020

Conditions for exempting a charitable trust from GST A charitable trust or non-profit organisation must satisfy specific criteria to be exempt from the Goods and Services Tax. The charitable trust or NGO must be registered under Section 12AA of the income tax Tax and the services it ...

GST Consultancy

Late fee Exemption for GST Return filing those are not been able to file GST Return.

RJA 19 Jun, 2020

Late fee Exemption for GST Return filing those are not been able to file GST Return. Great effect on tax revenues due to lock-out of coronavirus A relief of late interest and fees will be given to small taxpayers with a minimum turnover of up to 5 crores if they ...

TDS

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N

RJA 07 Jun, 2020

New TDS deduction No cash transactions exceeding 1 Crore -Section 194N Present TDS exclusion No currency purchases above 1 Crore -Chapter 194N To discourage cash transactions and to continue heading towards a cash-free economic structure, a new Section 194N has been enacted under the Income Tax Act with effect from 1 September 2019 to ...

IBC

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016

RJA 06 Jun, 2020

BASIC FORENSIC AUDIT ASPECTS IN INSOLVENCY AND CODE BANKRUPTCY 2016 PURPOSE OF FORENSIC AUDIT INSOLVENCY AND BANKRUPTCY CODE 1. Events describing, if any, Financial Statements with inconsistencies / Red Flags, The misuse/diversion of bank funds; Overvaluation of current/fixed assets and their non-existence; Documentation breach; To ...

Goods and Services Tax

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption.

RJA 06 Jun, 2020

NAA disputes DGAP 's view that Barbeque Nation Hospitality Ltd alleges corruption. After a complaint filed against them by Mrs. Chitra Kumar for profit-making under the GST, the Barbeque Nation refused to provide invoice details in the official inquiry. NAA directed DGAP to guide Barbeque Nation to supply its invoice ...

RBI

RBI Announced the refinancing of Rs 50,000 crore to SIDBI etc

RJA 06 Jun, 2020

The Reserve Bank of India Governor Announced the refinancing of Rs 50,000 crore for all Indian financial institutions such as Nabard, SIDBI, and NHB. The Reserve Bank of India has turned its focus to fulfilling the borrowing needs of NBFCs, MFIs, and housing markets by offering special refinancing facilities of ...

OTHERS

Complete understanding about Senior Citizen Savings Scheme (SCSS)

RJA 04 Jun, 2020

Complete understanding about Senior Citizen Savings Scheme (SCSS) In 2004 the government announced the Senior Citizens Savings Scheme to ensure a guaranteed return to senior income, thereby creating a guaranteed regular income flow. Investing in the Senior Citizen Pension Fund is a successful way for senior citizens aged 60 years of age ...

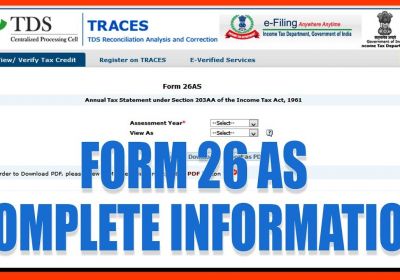

INCOME TAX

Latest revised Form 26AS with effective from 1 June 2020 : CBDT

RJA 04 Jun, 2020

Govt Notified: Latest revised Form 26AS with effective from 1 June 2020 Latest Form 26AS with effect from 1 June 2020: With effect from 1 June 2020, all data of the taxpayer will be available in the new Form 26AS: Tax withheld at source and tax assessed at source Details of financial transactions listed Income tax ...