SEBI INTRODUCE A ONE-TIME SETTLEMENT SCHEME- SEBI SETTLEMENT SCHEME 2020,

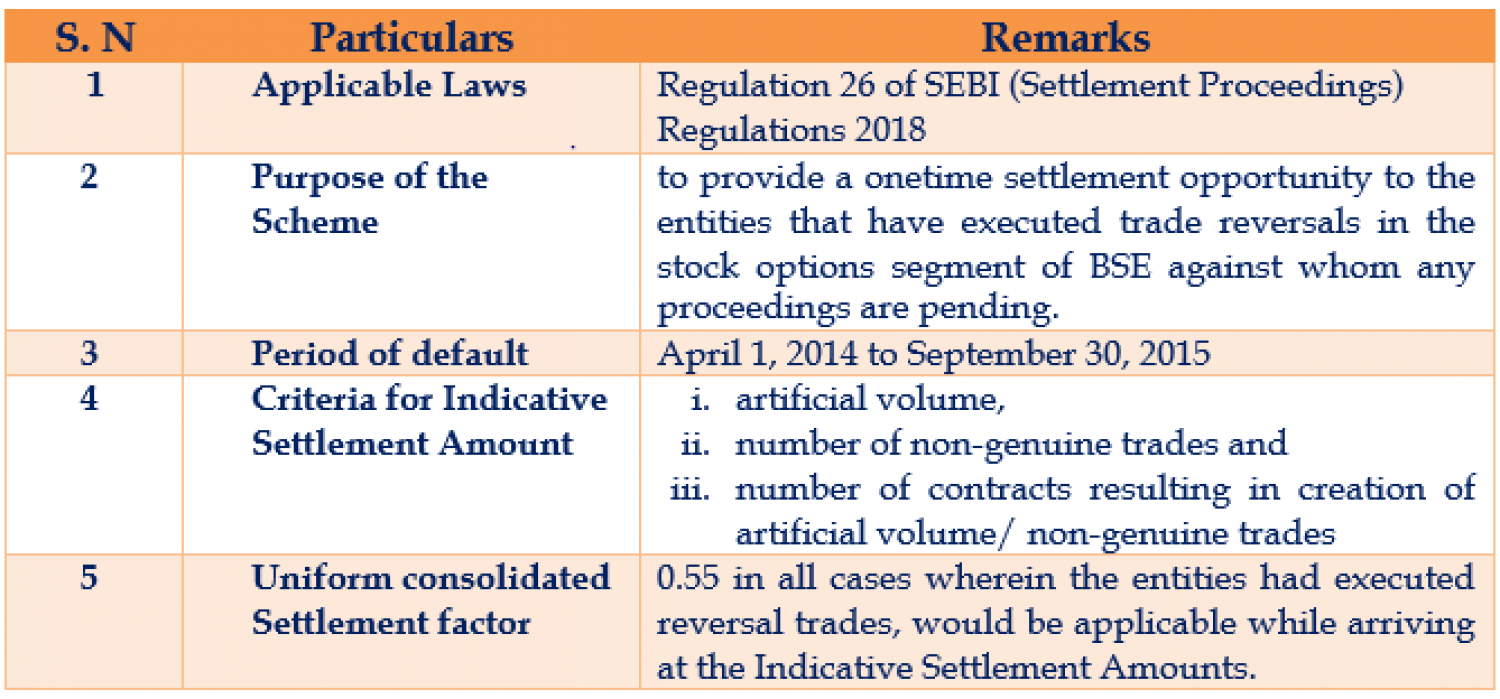

SEBI issuse a One-time settlement New scheme - SEBI Settlement scheme 2020, vide Public Notice dated 27th July, 2020 called Settlement Scheme (“the Scheme”) in terms of Regulation 26 of SEBI (Settlement Proceedings) Regulations 2018.

Most of the Common Key Takeaways of Settlement Scheme 2020

SEBI and relevant issues concerning the SEBI Settlement Plan, 2020. i.e. released by the Indian Stock Exchange Board vide Public Notice dated 27 July 2020. In compliance with Regulation 26 of SEBI (Settlement Proceedings) Regulations 2018, the notice was entitled as Settlement Scheme ('the Scheme'). SEBI Settlement Scheme, 2020:

The aim behind the Scheme is to provide an incentive for a one-time settlement to the substances that have executed trade reversals the venture openings segment of BSE during the period from April 1, 2014, to September 30, 2015, against whom any techniques are pending. The characteristics of the 2020 settlement scheme are summarized below-

1. Condition of eligibility to avail the Scheme –

- The scheme is applicable to those organizations who have made trade reversals in the BSE Segment of stock options,

- The above transaction was supposed to take place between 1 April 2014 and 30 September 2015.

- The lawsuits against those organizations would have been pending.

2.The timeframe to benefit from the scheme-

- In the period 1 August 2020 to 31 October 2020, the qualifying parties can submit. The one-time settlement period as per the Scheme will start on August 01, 2020, and end on October 31, 2020 (the two days complete).

3. Applicable fees for applying in the scheme-

- The entity filing a settlement application under the scheme is required pay the following fees-

Type of applicant Applicable fees

Individuals Rs. 15,000

Companies/corporates Rs. 25,000

Any component consuming of making an application for a one-time settlement under the Scheme can introduce a Settlement application nearby an application charge of INR 15,000 if there ought to emerge an event of individuals and INR 25,000 in case of body corporates in the predefined gathering.

4. Provocative amount for settlement-: Following three objective parameters, the Board considered achieving suggestive settlement amount-

- Artificial volume,

- No of non-genuine trades completed

- The number of contracts which result in artificial volumes or non-genuine trades

Additionally, a combined settlement factor of 0.55 will refer to indicative settlement sum in all cases (where the company has conducted trade reversals).

5. Some other features of SEBI SETTLEMENT SCHEME 2020

- The party is expected to pay the balance of the settlement through an electronic portal, which is available on the SEBI website.

- The persons protected by the agreement but do not take advantage of the settlement 2020 plan will be liable for action pursuant to Section 15-I of the SEBI Act 1992.

- The act was established with the main goal of offering a one-time settlement incentive for qualifying entities that have concluded a trade reversal in the BSE stock options segment between 1 April 2014 and 30 September 2015, against which any litigation are ongoing.

DOCUMENTS AND INFORMATION REQUIRED SEBI SETTLEMENT SCHEME 2020: List of self-attested copy documents required under the SEBI Settlement Scheme 2020:

- Identity Proof: Copy of Permanent Account Number (PAN) of Katra Of HUF (Mandatory)

- Address Proof: Copy of valid Passport/Driving Licence/Aadhar/Telephone Bill/Electricity Bill (not older than 2 months)/ of the applicant

- Latest passport size photographs of Karta / of the applicant

- Aadhar card of Karta/ of the applicant

- All the Notice and Communication with SEBI

- Soft copy of all notices, show cause notices, orders, if any of, and copy of all correspondence to or by SEBI in this matter

- Copy of the self-attested Income Tax Returns of the applicant for the last 3 years.

- Rest documents will be drafted on receipt of documents from point 1 to 3 and any supplementary document and information required (Documents to be signed by applicant thereafter Payment of application fee and settlement fee)

Government Fee payable

- Registration Government Fee/ Application fee to be paid online 15000 per applicant nonbody corporate at SEBI,

- For Corporate Fee is 25000/- for application

Settlement fee

- Settlement fee to be paid online Amount of determined by SEBI on Settlement payable Directly To SEBI,

About Rajput Jain and Associates

Let me introduce our company as We, Rajput Jain and Associates are amongst the leading corporate legal, RBI, SEBI consultancy & Secretarial groups based at the heart of Delhi in Connaught Place. We have a team of highly competent professional’s viz., Company Secretaries, Chartered Accountants & Lawyers. Who each has experience of 15 Years or more years in their respective fields. The Company Profile enclosed will help you make the most of what we can offer. If you have any questions, please contact us. Profile: https://carajput.com/assets/RJA.pdf

The ICAI has masterminded and given FAQs on this Scheme which is participated in the encased record FAQ issued By ICAI on the One-time settlement scheme under SEBI Settlement scheme 2020

We would be pleased to provide any further clarification. We trust that you shall find the above in order in doing the needful, looking forward for your continuous patronage!!