GST Compliance

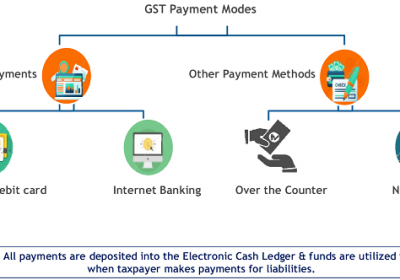

Delayed in payment of GST then Interest to be paid on net GST liability from Sep 1, 2020.

RJA 23 Nov, 2020

September 2020 as the date of the entry into force of the provisions of Section 10 of the Delhi Goods and Services Tax (Amendment) Act, 2019 (Delhi Act 06 of 2019)" The Government has admitted that interest on late payment of goods and services tax (GST) will be charged on net tax liability with ...

TDS

COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

RJA 12 Nov, 2020

Compliances of TDS/TCS One of the main concepts of the Income Tax Act 1961 is tax Deducted at Source (TDS) and Tax collected at Source (TCS). All registered assessee who&...

IBC

Overview on Personal Guarantor as per IBC Code

RJA 08 Nov, 2020

Overview on Personal Guarantor as per IBC Code The Govt Of India, through the MCA, issued a notification dated on15.11.2019, came into force Part III of the IBC Code (with the exception of the fresh start process) which deal with the insolvency and bankruptcy of partnership ...

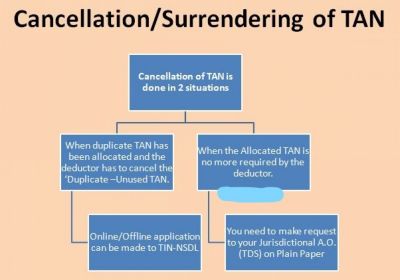

TDS

Process of Cancellation / Surrendering of multiple TANs Allotted

RJA 08 Nov, 2020

What is the Process of Cancellation / Surrendering of multiple TANs Allotted? Although we know, many times the assessee acquires Tax Deduction and Collection Account Number only to make some Tax Deduction at Sources payments, and there is no need for that Tax Deduction and Collection Account Number (TAN) in the ...

Business Setup in India

Steps for Closure of Liaison Office

RJA 06 Nov, 2020

Basic Steps for Closure of Liaison Office Liaison Offices (LOs) are a popular approach for foreign investors to explore the Indian market for the first time, and they are not sure how the country's liberalising FDI caps will affect their business. Unlike other business frameworks, Liaison Offices allow foreign ...

Goods and Services Tax

Complete Overview about GST on OIDAR

RJA 05 Nov, 2020

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL (OIDAR) Businesses are not restricted by geographical borders in today's Scenario. One of the means of delivering services from abroad in India is through the use of the internet. There are several mechanisms in which service users are delivered these services. For instance, ...

COMPANY LAW

Avail Companies Fresh Start Scheme 2020

RJA 04 Nov, 2020

You may Avail Companies Fresh Start Scheme & File ROC Pending Compliances-Save Bulk ROC Penalty -Act Now If you are a struck-off company under Section 164 that has not been able to revive till now or if you are a disqualified director looking to activate your DIN then this is a&...

OTHERS

President promulgates Ordinance on Arbitration and Conciliation (Amendment) Ordinance, 2020

RJA 04 Nov, 2020

President promulgates Ordinance on Arbitration and Conciliation (Amendment) Ordinance, 2020 The President of India today passed the Arbitration and Conciliation (Amendment) Ordinance, 2020, which amended Section 36 of the Arbitration and Conciliation Act byways of amendments. The Eighth Schedule of the Arbitration Act, which addresses the qualifications and experience of arbitrators, has been ...

INCOME TAX

How to get Tax Relief Through TRC under DTAA

RJA 04 Nov, 2020

How to obtain a Tax Resident Certificate for tax relief under a double tax evasion deal Tax Residency Certificate (TRC) The Government of India has modified the Section 90 & 90A of the I T Act, 1961 appears with finance Bill, 2012 to make the provisions provide the submission of the Tax Residency ...

GST Consultancy

What to be do when issue of summons to a person under GST

RJA 01 Nov, 2020

Power to summon persons to give evidence and produce documents in GST Provision of the CGST Act, 2017 under Section 70 mentioned hereunder: Power to summon persons to give evidence and produce documents. The proper officer under this Act shall have the power to summon any person whose ...

Goods and Services Tax

Frequently Asked Questions (FAQs) on Basic concepts of GST

RJA 31 Oct, 2020

Frequently Asked Questions (FAQs) on Basic concepts of GST Q.: How will imports be taxed under GST? Answer: The Additional Excise Duty or CVD, which are now known as the Special Additional Duty or SAD, being levied on imports are subsumed under GST. As per explanation to ...

Business Setup in India

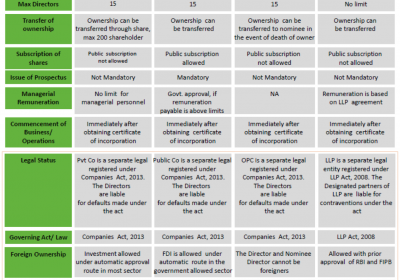

Comparative feature of different type of business entity in India

RJA 31 Oct, 2020

Comparative features of different type of business entity in India can be formed In India, we have three major types of business frameworks, respectively sole proprietorship, partnership, and company (Pvt or public), but several years ago a new hybrid form of partnership and company are known as Limited Liability (LLP) ...

Business Setup in India

Private Limited Company Compliance Due Dates in a Year

RJA 30 Oct, 2020

Private Limited Company Compliance Due Dates in FY 2020-21 The compliance requirement for the private limited company has drastically changed over the years 2020 and 2021. Every company registered in India, including private limited, limited company, one-person company, and section 8 company must file annual returns with ROC every year. It ...

NBFC

Reserve Bank of India cancels registration certificate of 7 NBFCs

RJA 29 Oct, 2020

The RBI has been scrutiny of non-banking firms and tightening monitoring over the years. The Reserve Bank of India has cancelled the registration certificates of 7 Non-banking finance companies. These are mentioned below : U K Fin Services Limited, Prabhat (India) Limited, Compusta Securities Private Limited, Malpani Financial Services Private Limited, Harshad ...

RBI

RBI: From January 1 2021, inform bank otherwise Large Value cheques will bounce

RJA 29 Oct, 2020

Reserve Bank of India RBI: From January 1, 2021, inform bank otherwise Large Value cheques will bounce The positive pay system for cheque payments to come into effect from January 1, 2021. The RBI circular released on 25 September 2020 notes that the Indian National Payment Corporation (NPCI) will establish the positive pay service in the ...

OTHERS

MEF Form FY 2020-21 Re-extended last date: ICAI

RJA 24 Oct, 2020

MEF Form FY 2020-21 Re-extended last date: ICAI Multipurpose Empanelment Form MEF Form For FY 2020-21 the last date extended again: ICAI Committee The MEF for the year 2020-21 is live on https:/meficai.org w.e.f. 23 September 2020. The initial submission date was 12 October 2020 and was increased to 23 October 2020. ...

COMPANY LAW

COMPANY ANNUAL RETURN UNDER SECTION-92

RJA 23 Oct, 2020

COMPANY ANNUAL RETURN SECTION-92 ANNUAL RETURN The annual return is required to be filed by every company in Form No. MGT.7 containing all the particulars as on the closure of the financial year of the company. An extract of all the annual returns in Form No. MGT.9 shall form parts ...

OTHERS

Document requirement Import Export Registration

RJA 16 Oct, 2020

Document requirement Import Export Registration What's the Import Export Registration (IEC)? Importer and Exporter Code is abbreviated as IEC, which means that you will need an Import Export Registration certificate if you are operating in foreign countries or if you are carrying out any import and export procedures. It ...

COMPANY LAW

Complete Concept of Rights issue of Shares Company Under Companies Act 2013

RJA 14 Oct, 2020

Rights issue of Shares Company. The right issue of shares is basically the way through which a company raises additional funds. The right issue is an invitation to existing shareholders to purchase additional new shares in the company. The company is giving the shareholder the chance to increase the shareholding ...

OTHERS

key takeaways Digital Signature Certificate (DSC) - process of getting DSC, DSC Categories, Benefit

RJA 03 Oct, 2020

Digital Signature Certificate Digital Signature Certificate is a technique of verifying and validating the authenticity of a digital document or a message. It can provide the assurances of evidence of origin, transaction and can acknowledge informed consent by the signature. Compliance with statutory requirements Businesses and individuals needed to ...

OTHERS

Ready-Made Shelf Company Service

RJA 03 Oct, 2020

Ready-Made Shelf Company Ready-made shelf companies are the best way to get a business started and to create corporate longevity which may boost investor’s confidence. According to a general rule, a company can be incorporated in India within a minimum period of 16 weeks and employees’ lower level ...

OTHERS

Foreign Exchange Management Act Service

RJA 03 Oct, 2020

FEMA Indian Central Bank regulates the business ventures and investments of foreign companies. Ca in India share expertise in getting approvals, clearances for foreign companies in India. We provide compliance services in proper sync with the provisions under the Foreign Exchange Management Act and under the Reserve Bank of India. ...

RBI

Reserve bank of India Consultancy service

RJA 03 Oct, 2020

RBI Consulting Reserve Bank of India plays an important role in developing, strengthening, and diversifying the country’s economic and financial structure. It is the central banking institution, which supervises the monetary policy of the Indian Rupee. The primary objective of RBI includes ensuring inflation, full employment, stable economic ...

SEBI

Security Exchange Board in India Consultancy Service

RJA 03 Oct, 2020

CUTS OFF THE REGISTRATION FEES FOR INVESTMENT ADVISORS: SEBI As per a New SEBI Notification issued, Individual & Firms (Partnership) will now have to pay Two Thousand Rupees while making an applying for a financial advisor. Previously, according to the Security Exchange Board of India notification issued on Monday, ...