Table of Contents

Document requirement Import Export Registration

What's the Import Export Registration (IEC)?

Importer and Exporter Code is abbreviated as IEC, which means that you will need an Import Export Registration certificate if you are operating in foreign countries or if you are carrying out any import and export procedures. It is a 10 digit number assigned by DGFT (Directorate General of Foreign Trade). It will allow you to make use of the advantages of Export Promotional Councils, Customs, or DGFT. Let me also inform you that, according to the report, India is the 17th top nation for exporters and the 11th top country for importers.

There are many more companies willing to join the import-export market and to use the Import Export Registration code, so here in this essay let us understand the specifications and documentation for Import Export Registration in India.

For seamlessly channelizing out the export and import process and complying with the legal business standards obtaining an IEC code is the fundamental requirement. IEC code stans for import export code which is considered important for carrying out activities of import and exports in and outside India.

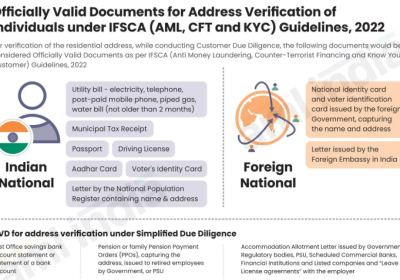

It is a 10-digit number issued by the Directorate of Foreign Trade (DGFT). Once issued, it doesn’t require to be renewed and is a lifetime document. All the companies, individual,s or any business legal entity has to obtain IEC code for Import Export Registration in India. Permanent Address Number or PAN card, copy of current or savings account, Passport size photographs, business address proof are the important documents require for Import Export registration in India.

On getting the registration issued by the authority the company can seamlessly carry on with the import and export business, you no more will be required to file the return without any complicacy of validating the import-export code. It comes with various other benefits like availing input tax credit, high business growth, and reduces the risk of illegal transportation.

What documents do IEC Code Registration mandate?

Many enterprises may not be aware of the importance of running a company in other countries. First of all, let us make you understand that by expanding your business in the global market, you may be able to connect to customers who are waiting for your service, and, compared to your competitors, your business can also remain a generation ahead. Not only this, but you will also be able to benefit from different government programs and other incentives.

It's not fascinating and advantageous, but before that, you also need to know that it's a little hard to run an operation in foreign countries, but it can be made easy by following few other procedures, and one of them is obtaining an IEC. So let us know what the IEC is all about.

Information & Documents required for Import Export Registration Proprietorship Concern

- Soft copy of Photograph of the Proprietor.

- Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in the case the office is rented/ leased; or latest electricity /telephone bill.

- Permanent account number card Copy of the Proprietor

- Passport Copy (first & last page)/ UID (Aadhar card) (any one of these)./Voter’s I-Card/ Driving Licence

Information & Documents required for IEC registration of HUF

- Soft copy of Photograph of the Karta.

- Permanent account number card Copy Karta.

- Copy of Passport (first & last page)/Voter’s I-Card/ UID (Aadhar card)/ Driving Licence (any one of these) of the Karta.

- Ownership proof /Sale deed in case the business premise is self-owned or Rental/Lease Agreement, in case the office is rented/ leased or latest electricity /telephone bill.

- Copy of Bank Certificate as per ANF 2A(I)/Cancelled Cheque which is the name of the applicant and A/C No.

Information & Documents required for Import Export Registration of NGO / Trust

- Soft copy of Photograph of the signatory applicant/Secretary or CEO.

- Passport Copy (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/ Permanent account number card Copy (any one of these) of the Secretary or Chief Executive/ Managing Trustee signing the application.

- Ownership proof /Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity /telephone bill.

- Registration Certificate of the Society / Copy of the Trust Deed.

- Copy of Bank Certificate as per ANF 2A(I)/Cancelled Cheque which is the name of the Society or Trust and A/C No.

-

Information & Documents required for Import Export Registration of Partnership Firm

- Soft copy of Photograph of the Managing Partner.

- Partnership Deed Copy.

- Ownership proof /Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity /telephone bill.

- Copy of Bank Certificate as per ANF 2A(I)/Cancelled Cheque which is the name of the applicant entity and A/C No.

- Passport Copy (first & last page)/ UID (Aadhar card) (any one of these)./Voter’s I-Card/ Driving Licence of the Managing Partner signing the application.

Information & Documents required for Import Export Registration of LLP

- Soft copy of Photograph of the Partner/Director of the Company signing the application.

- Ownership proof /Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case of office is rented/ leased; or latest electricity or telephone bill.

- Copy of Bank Certificate as per ANF 2A(I)/Cancelled Cheque which is the name of the company and A/C No.

- Permanent account number card Copy of the applicant entity.

- Passport Copy (first & last page)/ UID (Aadhar card) (any one of these)./Voter’s I-Card/ Driving Licence of the Managing Partner/Director signing the application.

- COI as issued by the RoC

If the IEC registration process has been completed, you can access the IEC certificate and download it online. CA Rajput is the experienced team of professionals that help the clients throughout the process of Import-export registration in New Delhi by undertaking various lawful considerations like preparing the application in the prescribed format, Filing the application with the help of your Digital Signature Certificate. You can contact us for any assistance regarding the import-export registration.

So are you prepared to take a step forward in running your company in other countries and to go ahead with IEC Registration? If it seems complicated or if you're lost anywhere in the documents, there's no need to worry about it, LegalDocs will be there to help you, just contact our specialists and get it done with ease.

DGFT Amends Import Export Code Provisions

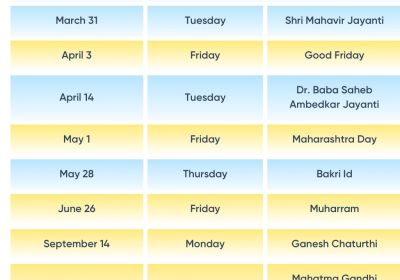

Every year, from April to June, all IEC holders are legally obligated to update and confirm their IEC Details, even if no changes have occurred, through an online system, failing which their IEC would be deactivated and no import or export activity would be permitted.

In Chapters 1 and 2 of the Foreign Trade Policy, 2015-2020, IEC-related provisions are revised or eliminated, and new provisions are added. It is stipulated that every year, between the months of April and June, an IEC holder must ensure that the details in its IEC are updated electronically. When there are no changes to IEC details, these must be confirmed online as well.

If an IEC is not updated within the specified time, it will be decommissioned. If the IEC is successfully updated, it can be reactivated. This would be in addition to any additional actions taken for violations of the FTP's other requirements.

IEC applications and updates are completed entirely online, and IEC can be generated by the applicant following the approach outlined in the Handbook of Procedure.

Are you looking for IEC Registration?

RJA's professionals will assist you in completing your IEC Registration as quickly as possible. Process and documentation are simple and straightforward.

Import Export Business Consultants

How to Become an Importer/Exporter:

1. Identify a product that you want to represent.

2. Create a product line.

3. Ensure that you have complete product knowledge.

4. Conduct Competitor Research

5. Confirm that you are aware of any safety regulations.

6. Decide on the territory you want to represent (Local, National or International)

7. Recognize Circumvention Clauses

8. Make Certain You Get Samples

9. Make Certain That You Have Promotional Materials

10. Before entering into negotiations know what commission rate you want.

11. How to Become an Import-Export Agent the Correct Way.

12. First and foremost, we must concentrate on becoming a successful import export agent, and in order for this to become a reality, we must put in the necessary effort, time, and dedication. As we all know, any new career or skill that we want to learn will always necessitate some level of effort and dedication. Nothing worthwhile comes easily or for free.

13. Product knowledge, hard work, and understanding international trade are all essential components of becoming a successful import export agent. Honing your negotiating skills, understanding international payment methods, and understanding international contract law are all wise investments.

Import Agents Are Divided Into Two Types

The good news is that companies are always looking for import/export agents. The job descriptions for import and export agents for the two types of roles are provided below. You'll have to decide which one is best for you and the products you want to represent.

Agent of Commission

A commission agent introduces a buyer to a seller and receives a commission for closing the deal as well as any future sales from that same deal. As a commission agent, you'll be dealing with buyers who want the product but don't know much about international trade, such as which Incoterm to buy under, the best method of payment, or customs clearance procedures. That's where your expertise becomes invaluable, and you'll be able to hold their hand through the entire import export process, earning your import export agent commission with confidence, professionalism, and the best possible terms for you.

Agent for Stockists

As a stockist agent, you will purchase the goods or products yourself, keep and store them, find buyers for them, and sell them to whomever you want. You have the option of selling regionally, nationally, or internationally. To work as a stockist agent, you must have a thorough understanding of international trade and the entire import/export process from beginning to end.