CUTS OFF THE REGISTRATION FEES FOR INVESTMENT ADVISORS: SEBI

As per a New SEBI Notification issued, Individual & Firms (Partnership) will now have to pay Two Thousand Rupees while making an applying for a financial advisor. Previously, according to the Security Exchange Board of India notification issued on Monday, people had to cough up a higher amount of Five thousand Rupees as an application fee for investment advisors.

Market regulator Security Exchange Board of India has reduced application & registration fees for individuals along with companies seeking the status of registered investment advisors.

Now individuals & firms (partnerships) would have to pay INR 2,000/- bucks while applying for certificates of a financial adviser. In the previous years, According to a SEBI released Notification, they had to cough up a higher INR 5,000/- as an application fee. The application fee has been reduced from INR 10,000 to INR 25,000 for corporations & LLP.

Once the certificate is granted, individuals & firms must discharge a fee by corporate bodies in the amount of INR 3.000 & INR 15.000/-, Previously, the registration fee for individuals, firms, and companies was INR 10,000 & INR 5,00,000/- respectively. The reduction in fees is as helpful for those who are seeking registration as an investment advisor.

The step follows by the Securities and exchange board of India (SEBI) after a set of tougher requirements/ Norm for registered investment consultants

Security And Exchange Board of India provided a comprehensive guide for investment consultants to ensure that customer consulting and delivery activities are separated.

Security and Exchange Board of India also set an investment advisors' (IA) fee from customers. It had developed put in place a procedural framework pertaining to audit and record-keeping.

SEBI Updates:

- The Securities and Exchange Board of India has started an inquiry into the affairs of pharma major Sun Pharmaceutical Industries on the basis of a whistle-blower complaint, said regulatory sources. The sources said the market regulator was in receipt of a 150-page letter in which the whistle-blower accused the company of committing corporate governance and tax-related lapses, besides other securities market-related violations.

- Sun Pharma, its Managing Director Dilip Shanghvi, and nine others had settled the insider trading probe, paying Rs 1.8 million against the settlement charges in 2017. But SEBI had not disclosed details of the case, it was probably linked to the acquisition of Ranbaxy by Sun Pharma from Japanese drugmaker Daiichi. The regulator is ready to settle the proposed adjudication proceedings linked to the violation of the internal code of conduct for prevention of insider trading. No enforcement action was started for the alleged defaults.

- SEBI starts checking against Sun Pharma, to also open its insider trading case. An allegation is raised by the whistleblower which was of serious nature. We will consider each one of them,” said a regulatory source. Sources said SEBI had also taken cognizance of another note by Australia-based brokerage Macquarie on the faulty audit process and dubious practices used while raising funds through foreign currency convertible bonds.

- On Monday SEBI Extended the deadline for the transfer of shares of listed companies in Demat from to April 1 The last date has been extended after taking into consideration representations from shareholders as the initial deadline was to end on December 5.

- Shares in the Demat form will maintain a transparent record of shareholding at firms amid rising concerns over beneficial ownership of entities In March, SEBI’s board decided that except in case of transmission or transposition of securities, requests for effecting transfer of securities will not be processed unless the securities are held in dematerialized form with a depository.

- These changes will come into effect from December 5. In view of the same, the deadline has been extended and the aforesaid requirement of transfer of securities only in Demat form shall now come into force from April 1, 2019," it said in a statement.

SEBI Consultancy :

Security Exchange Board in India was established on 12th April 1992, as per SEBI provision Act, 1992. SEBI plays a primary role as a regulator of the market in India and protects the interests of the investors. The SBI consultants guide the companies regarding compliance management.

CA Rajput shares expertise in advising regarding various stock exchange operations and associated roles as per market regulator requirements. We offer a clear direction to the clients complying with various rules and regulations under SEBI. SEBI consultancy in New Delhi accounts to dealing in various specialized areas of services which include representation before adjudicating bodies, assistance in compliance with SEBI rules, proper guidance and regulations on prohibition of Insider training, dematerializing of shares, advisory on public, and provide complete guidance to the companies listed under SBI Act.

Submission of certificates related to transfer and Demat of shares as required under NSDL/CDSL laws, submission of information under SEBI regulation 8, managing formalities related to book closure, preparation of Annual Report detailing the important requirements of Clause 49 of Corporate Governance are the major responsibilities of SEBI consultancy in India. If you are searching for the best SEBI consultancy in New Delhi then CA Rajput provides you the best SEBI solutions.

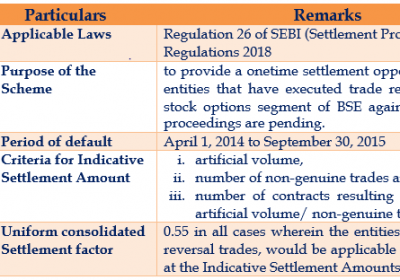

SEBI INTRODUCE A ONE-TIME SETTLEMENT SCHEME- SEBI SETTLEMENT SCHEME 2020,

Regards

Rajput Jain & Associates