Table of Contents

Basic Steps for Closure of Liaison Office

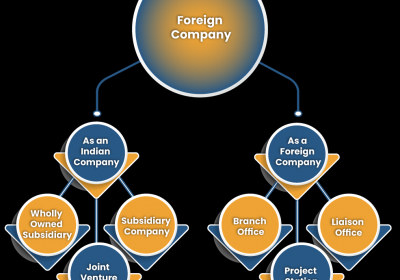

Liaison Offices (LOs) are a popular approach for foreign investors to explore the Indian market for the first time, and they are not sure how the country's liberalising FDI caps will affect their business.

Unlike other business frameworks, Liaison Offices allow foreign companies to create a slight footprint in India while keeping their financial, legal and administrative obligations low.

Usually, the LO is registered in India for a specified/limited reason and if this is done, either Liaison Offices may want to be registered as a subsidiary of an Indian company or Liaison Offices may not want to continue to function in India. In this case, the closing of the LO is compulsory.

A two-stage registration procedure in place for the Liaison Office (International Companies) of the foreign parent company. The first is the approval of the RBI and the second is registration with the Registrar of Companies (RoC). The license shall be issued for a term of 3 years and shall be extended thereafter. The closure of these foreign companies in India needs the approval of RBI and a report from RoC on the state of compliance.

Application file for the closure of the ROC Liaison Office

- Application for the closure of the RBI Liaison Office via designated AD Category – I Bank

- Remittance of income abroad and closing of bank accounts in India

Validity duration Liaison Offices

The duration of validity of the LO is usually 3 years. However, in the event of a necessity, such a period of 3 years can be prolonged by a period not exceeding 3 years.

After the expiration of the period of validity, foreign companies wish to close their business premises in India, which are formed in the form of either the Liaison Office. The detailed procedure for the closure of Liaison Offices shall be provided by RBI and provisions shall be laid down in FEMA, Company Act & other various legislative provisions applicable in India for the implementation of such closures. These offices must be closed once they have been finished for the purpose of establishing them up.

Steps for Closure of Liaison Office

Step 1: Apply to AD Bank of the LO which will forward the application to RBI Regional office where the Liaison office of the company is situated.

The following documents shall be submitted to AD Bank at first instance:

- RBI Approval / COR for the liaison office

- The balance sheet for the last three FY

- Auditor certificate

- Confirmation from the applicant regarding no legal proceedings

- Any other specific document, if required

Step 2: Liaisoning with the AD Bank and submission of any additional document or information as required by RBI

Step 3: After RBI is satisfied with all the documents then it will ask for NOC from the registrar of companies, then proceed for Filing of documents in form FC-2 with the registrar of companies for obtaining NOC for the closure of LO

Step 4: Reply to queries received from ROC and submit any additional documentation as required by ROC.

Step 5: Submission of final compliance report of ROC and any other additional document to the AD Bank, which will send it across to RBI for the closure of the liaison office.

Step 6: Remittances of pending money in the bank account of the company after approval of the RBI for the closure of the liaison office.

Step 7: Compliances of Form 15CA / 15 CB under Income tax act 1961 in relation to remittance of funds.

Liaison Offices can also donate their properties, such as old furniture, cars, computers, and other office products, to any NGO or NGOs, only if the Approved Dealer Category 1 bank is comfortable with the bonafide purpose.

Compliance to be made at MCA: Return of alteration of Compliance filings by a multinational company

A multinational company must file eForm FC-2 with the Registrar of Companies as well as a copy shall be forwarded to the respective State RoC concerned by the system in case of termination of the place of business in India. It must be filed within thirty days of the closing of the LO.

According to the terminology of Section 391(2), for the closure of any place of business in India by a foreign company, it is appropriate to comply with Chapter XX (Winding-up). However, the same has been explained by the MCA in its circular of 1/2017.

Thus, taking into account the provisions of Section 391(2) and MCA Circular, it can be argued that the winding-up provision for the closing of a place of business in India is only applicable if a foreign company has published an IDR prospectus pursuant to Chapter XXII of Company Act 2013.

Certain points to be noted

- Before the closure of the liaison office, the company must have completed all the compliances relating to the submission of Annual activity certificates to RBI

- The company must have completed all the ROC Compliances i.e.Form FC-3, Form FC-4

- All income tax compliances must be completed i.e. Form 49C

- There should not be any other default on part of the company before the closure of LO, otherwise, that default must be made good before making an application for closure of LO.

The Respective AD Category – I banker will report to the RBI (the Regional Office for Liaison Office), along with a declaration confirming that all the required documents filed by the Liaison Offices have been check & revived & found to be in order for closure of LO.

Regards

Rajput Jain & Associates