AUDIT

Internal audit strives to add value to organizations valuation

RJA 18 Sep, 2021

INTERNAL AUDIT Internal audit is the best tool for identifying opportunities to enhance the efficiency of activities, allowing you to get the information necessary to realize the goals and solve the issues facing the subject within ...

AUDIT

Assessment of Business Risk for future success,

RJA 18 Sep, 2021

ABOUT BUSINESS RISK In an extremely complex and dynamic environment, an auditor is vested with the responsibility to consider various risks associated with the business and the same be inculcated in their audit plan. Audit principles and methodologies frequently use the concept of risk to raised orient audit ...

AUDIT

Common Mistake Encountered in Businesses

RJA 18 Sep, 2021

COMMON MISTAKES ENCOUNTERED IN BUSINESSES GENERAL ACCOUNTING MISTAKES Accounting is usually seen by the entrepreneur as a necessary evil. Everyone knows that accounting is crucial and necessary for any business and yet the vast majority dread it. it's true that accounting still requires&...

NRI

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS

RJA 18 Sep, 2021

ALL ABOUT TAXATION OF NON-RESIDENT INDIANS BRIEF INTRODUCTION It is commonly seen that taxation system is an integral part of Indian economy. In India, several taxes have been levied on products and services, being available to the citizens of India. These taxes are used to finance ...

NRI

NRI RECOGNITION OF TAXABLE INCOME IN INDIA

RJA 18 Sep, 2021

RECOGNITION OF TAXABLE INCOME IN INDIA NRIs are required to tax on any sought of income, being earned in India. Thus, as an NRI, one must pay tax in respect of following income - • Income earned or received in India. • Salary received or is expected to be received ...

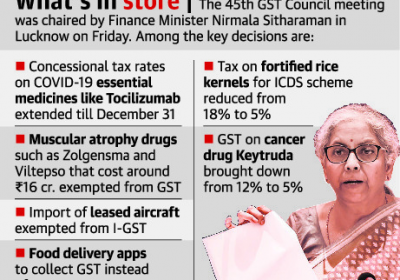

Goods and Services Tax

Key highlights of 45th GST Council Meeting : GSTN

RJA 17 Sep, 2021

Key highlights of 45th GST Council Meeting : GSTN the GST Council had its 45th meeting On the 17th of September 2021. This meeting, which took place in Lucknow, was keenly anticipated by the taxation community. It's interesting to note that this was the first time the two of them ...

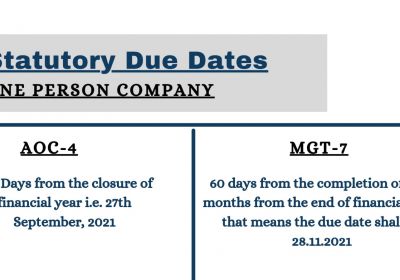

One Person Company

Overview On One Person Company(OPC) Annual Compliances

RJA 16 Sep, 2021

One Person Company Annual Compliances BRIEF INTRODUCTION One Person Company is all about a revolutionary idea, being introduced under the Companies Act 2013. In the previous Companies Act, being in force, companies can be formed, with a minimum of two directors and shareholders, which we call as Private Limited Company. However, ...

GST Compliance

Complete guide on E- commerce operator

RJA 14 Sep, 2021

COMPLETE UNDERSTANDING E COMMERCE OPERATOR MEANING Electronic Commerce Operator is basically a person, undertaking activities related to owning, operating or management of digital or electronic facility. And Electronic Commerce has been defined to mean the availability of products or services or both, including digital products over digital ...

SEBI

Compliance due date requirement under SEBI (LODR) Regulations

RJA 14 Sep, 2021

Compliance Requirement under SEBI (Listing Obligations and Disclosure Requirements) (LODR) Regulations, 2015 SEBI – Securities Exchange Board of INDIA 1. Half Yearly Compliances: Sl. No. Regulation reference (Reg.) Compliance Particulars Timeline / Due Dates Quarter 1 (For the Quarter Ended June) Due Dates 1 23(9) Disclosures of related party transactions 30 days after the release of ...

IBC

IBBI UPDATES : The MCA is working on a code of conduct for creditors under the IBC

RJA 14 Sep, 2021

IBBI UPDATES INSOLVENCY AND BANKRUPTCY BOARD OF INDIA The MCA is working on a code of conduct for creditors under the IBC: Verma According to MCA statistics, more over 17,800 cases totaling Rs 5 trillion were settled before admission under the IBC. Until July of this year, 4,570 cases were admitted for ...

COMPANY LAW

Compliance needs for the month of aug 2021 under Co Act 2013

RJA 14 Sep, 2021

COMPLIANCE REQUIREMENT UNDER THE COMPANIES ACT OF 2013 AND THE RELATED RULES Laws/Acts in force Deadlines Particulars of Compliance Filing mode / Forms Companies Act, 2013 within 30 days of gaining beneficial interest Filing of form BEN-2 in accordance with the Companies (Significant Beneficial Owners) Rules, 2018. (the ...

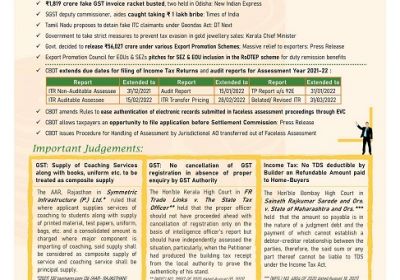

GST Filling

GST UPDATES FOR THE PERIOD OF Aug 2021

RJA 14 Sep, 2021

GST COMPLIANCE REQUIREMENTS FOR THE MONTH OF AUG 2021 GSTR –3B filing Taxpayers with an overall turnover of more than Rs. 5 Crore in the preceding fiscal year Tax period Due Date No interest payable till Particulars August, 2021 20th September, 2021 - Due date for filing GSTR - 3B return for ...

INCOME TAX

COMPLIANCE REQUIREMENTS UNDER INCOME TAX ACT FY 20-21

RJA 14 Sep, 2021

REQUIREMENTS FOR COMPLIANCE WITH THE INCOME TAX ACT OF 1961 Sl. Compliance Particulars Due Dates 1 TDS/TCS obligations for the previous month are due on this day. 07.09.2021 2. Deposit of equalization levy 07.09.2021 3 Due date for issue of TDS Certificate for tax deducted under section 194-IA, section 194-IB ...

OTHERS

“THOSE WHO USE PUBLIC FUNDS MUST ACCEPT A RESPONSIBILITY TO THE PUBLIC”

RJA 10 Sep, 2021

As per the Audited Balance Sheet of ICAI as on 31-03-2020 (https://resource.cdn.icai.org/61365annualreport-icai-2019-20-english.pdf) the Institute had Surplus and Earmarked Funds of Rs. 2269.74 Crores (PY Rs. 1963.34 Crores) and it earned a Net Surplus of Rs. 299.19 Crores (PY 283.39 Crores) for the Year ended on 31...

INCOME TAX

Income Tax Due dates extended again

RJA 10 Sep, 2021

CBDT extends due dates for filing of Income Tax Returns and various reports of audit for Assessment Year 2021-22 Saummary on Income Tax Due dates extended again Following due dates have been extended which I believe in wake of the challenges put forward by the ...

INCOME TAX

Taxation of Inter-Corporate Dividends U/S Section 80M

RJA 09 Sep, 2021

Taxation of Inter-Corporate Dividends under section 80M of Income Tax Act 1961 BRIEF INTRODUCTION The Finance Act 2020 has brought with it a slew of measures and reforms to boost the expansion of the economy and improve tax administration. In order to reduce tax and compliance burden ...

GST Filling

Priority Action Items for Financial Years 2020-21 Before Sept 2021 GST Returns

RJA 08 Sep, 2021

As September is the final & last chance to comply with different GST Regulations & rules there under the Goods and Services Tax Act in respect to FY 2020-21, vigilance or so caution should be exercised in relation to inward and outward supply before submitting GST Return for ...

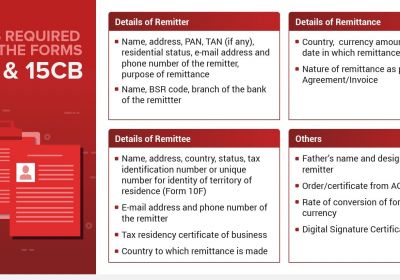

NRI

Non-Resident Indian (NRI) Repatriation Services

RJA 08 Sep, 2021

NRI REPATRIATION SERVICE An NRI, OCI and a Foreign Citizen, residing in India, are often into the transaction of remitting the money from Indian Bank accounts to foreign or NRI accounts. To undertake such type of transactions, the banks are authorized to ask for certain documents namely - Application form ...

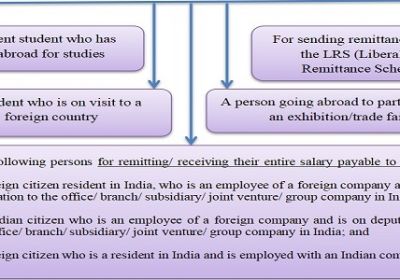

NRI

RESIDENT FOREIGN CURRENCY ACCOUNT PROVISIONS

RJA 07 Sep, 2021

FOREIGN CURRENCY ACCOUNT PROVISIONS An Indian resident going abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, and on his return to India, the balance in the ...

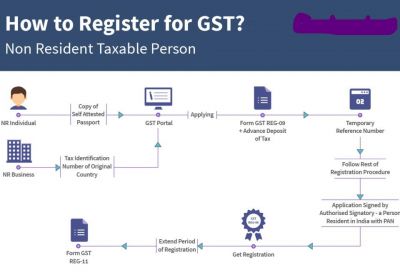

NRI

GST Law Applicability on Non Resident Taxable Person

RJA 07 Sep, 2021

Complete Guidance on NRIs GST applicablity Goods and Services Tax Act was passed in 2017, which is an indirect tax. GST was passed to subsume many indirect taxes under one law i.e., GST Law. GST Law in India is comprehensive, multi-stage, destination tax. Non-Resident Taxable Person Under GST Under ...

NRI

Requirements for Lower deduction TDS Certificate For NRI's

RJA 07 Sep, 2021

PROVISIONS TO COMPLY WITH WHILE SALE OF PROPERTY The proceeds arising from the sale of such property be received in an NRO account in India. A properly executed and stamped copy of the sale deed must be obtained for tax compliances (ITR filing) and future tax/tax/another query. Keep ...

TDS

Income Tax and Tax Deducted at Source (TDS) Forms

RJA 07 Sep, 2021

Income Tax and Tax Deducted at Source (TDS) Forms Income Tax Forms Part- 1: Application for allotment of PAN and TAN Sr. No Form Number Description 1. FORM NO. 49A Application For Allotment of Permanent account number [In the case of Indian citizens/Indian Companies/Entities incorporated in India/unincorporated entities formed ...

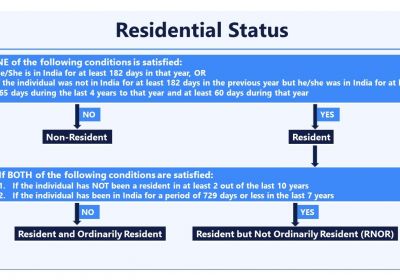

NRI

GUIDANCE TIPS FOR NRI RETURNING TO INDIA

RJA 06 Sep, 2021

TIPS FOR NRI RETURNING TO INDIA If you're an NRI returning to India permanently, this blog is for you. During this article, we would be explaining the fundamentals attached with the smoothly transition of an NRI to a Resident Indian and ...

NRI

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS

RJA 06 Sep, 2021

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS BRIEF INTRODUCTION With the rapid growth in the Indian market, NRIs have been eagerly looking for making investment in the Indian market. Several investment options are available in India, like mutual funds, equity stocks, IPOs, ETF, bonds, etc. However, ...