Goods and Services Tax

Export considered as a service offered by a sister concern located in India to a foreign Co. Abroad

RJA 06 Nov, 2021

Export is considered as a service offered by a sister concern, subsidiary or group concern located in India to a foreign company located outside India. There are major benefits to "exporting" goods or services. To constitute a transaction as "Export," however, a set of conditions must ...

Financial Services

Top 10 Financial Services Companies in India

RJA 05 Nov, 2021

Top 10 Financial Services Companies in India India’s diverse and comprehensive financial services industry is & supply drivers (new service providers in existing markets, new financial solutions and products, etc.) and growing rapidly, owing to demand drivers (higher disposable incomes, customized financial solutions, etc.). The Indian financial services ...

OTHERS

What are the Roles of a Chartered Accountants ?

RJA 05 Nov, 2021

How does a Chartered Accountants help in tax planning? Tax planning is not about avoiding taxes; it's about minimising them by taking use of allowances, deductions, refunds, concessions, and exclusions that are available within the legal framework. In reality, it's not as simple as it appears. A Chartered ...

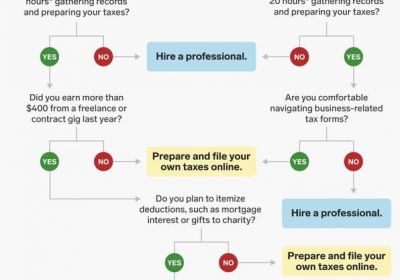

INCOME TAX

Why should you hire a CA as tax consultant?

RJA 05 Nov, 2021

Why should you hire a Chartered Accountants as tax consultant? To be honest, the necessity is mostly determined by the needs of your company. In today's world, every dollar you save can be reinvested. Accurate accounting guidance will certainly assist you in properly planning your business capital. When it ...

INCOME TAX

What is AIS (Annual Information Statement)?

RJA 05 Nov, 2021

What is AIS (Annual Information Statement)? Annual Information Statement (AIS) is a comprehensive view of information for a taxpayer displayed in Form 26AS of income tax portal. Taxpayer Information Summary (TIS) is an details category wise information summary for a income tax taxpayer. Income tax taxpayers can access the “...

Goods and Services Tax

FAQs on GST cancellation, valuation and Classification

RJA 02 Nov, 2021

FAQs on GST canceelation, valuation and Clasification Query1: Whether a person suo moto can apply for revocation of cancellation of registration whose registration has been cancelled by the proper officer and what is the time limit for submitting such application? Answer: Yes, a person ...

Goods and Services Tax

Taxability Position on IRP Under GST

RJA 02 Nov, 2021

GST rate on permanent transfers of IPR in respect of goods has been increased by the CBIC the government must issue clear instructions to avoid future controversies, tax avoidance, and subsequent litigation, as well as proper compliance to promote ease of doing business with regard to applicability of GST on ...

INCOME TAX

Consequences if you do not verify your ITR?

RJA 01 Nov, 2021

Consequences if you do not verify your ITR? What will Consequences if you do not verify your Income tax Return with 120-day deadlines; it could happen that you forgot to do so. The final phase in the tax return process of filing is verification (ITR). The ITR should ...

Goods and Services Tax

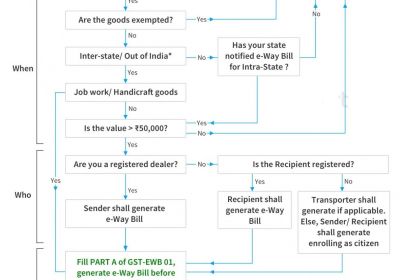

How to generate E- Way Bill Under the GST ?

RJA 01 Nov, 2021

How do I create an eWay Bill? On the e-Way Bill Portal, you can generate an E-Way Bill. All you need is a Portal username and password. Check out our article – Guide to generate e-Way Bill online – for a comprehensive step-by-step guide on e-Way Bill generation. When unregistered ...

OTHERS

Are you looking for a Top CA firm in India?

RJA 01 Nov, 2021

Are you looking for a Top CA (Chartered Accountant) firm in India? We've compiled a list of the Top 11 Chartered Accountants Firms in India as of today, complete with descriptions. There are Top CA firms based in India that have branches both in India and internationally. We also witness ...

OTHERS

Why do you need to hire a Top CA Firm in India?

RJA 01 Nov, 2021

WHY DO YOU NEED TO HIRE A TOP CA FIRM IN INDIA ? Everyone believes that a Chartered Accountants is only needed once a year to file our returns and pay our taxes, which is a major fallacy. CA can assist a company in growing and improving its financial situation. ...

INCOME TAX

CBDT Notifies E-settlement scheme 2021 for pending applications with settlement commission

RJA 01 Nov, 2021

CBDT notifies E-settlement scheme 2021 for pending applications with settlement commission CBDT of Direct Taxes by exercise power u/s 245D (11) and 245D (12) of Income-tax Act has issued a Scheme may be called E-Settlement Scheme 2021 to settle pending income-tax settlement applications transferred to a settlement commission. (Notification No. 129/2021/ F.No. 370142/52/2021...

Goods and Services Tax

SC disallowed Bharti from taking INR 923 Cr GST refund by changing GSTR Return

RJA 30 Oct, 2021

Supreme Court Bench Disallows Bharti Airtel from seeking Rs. 923 crore GST Refund by Rectifying Return Facts- The Respondent was having issues filling GSTR Form 3B due to several glitches in the Online GST Portal, according the brief facts of the case. Despite these issues, the Respondent filed its GST ...

OTHERS

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21

RJA 30 Oct, 2021

8.5% interest rate on PF Deposits: Approval by Ministry of Finance for FY21 The board of retirement fund body of EPFO had recommended an 8.5 percent interest rate for FY21. Ministry of Finance endorsed a 8.5 % interest rate for FY 2020-21 for PF, Board of retirement fund body Employees Provident Fund Organization (...

OTHERS

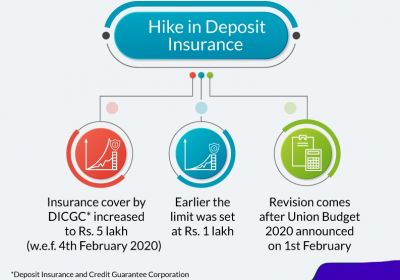

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh

RJA 30 Oct, 2021

DICGC issue a list of banks whose a/c holders will likely get up to INR 5 lakh. Deposit Insurance and Credit Guarantee Corporation Act was amended to increase the deposit insurance from earlier INR 1 lakh to INR 5 lakh. DICGC on September 21 announced it shall pay the depositors of the insured ...

Goods and Services Tax

DGGI Unit arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore

RJA 30 Oct, 2021

DGGI Unit (Gurugram) arrests 3 Persons for running multiple fake firm & Evading GST of more than INR 48 Crore Directorate General of GST Intelligence (DGGI) of Gurugram Zonal Unit (GZU) has arrested 3 persons on charges of running multiple fake firms on the strength of fake documents in two different cases under ...

FCRA

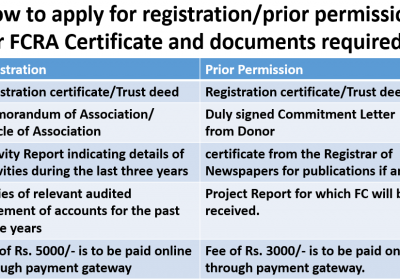

FAQs on obtain prior permission from FCRA authorities

RJA 28 Oct, 2021

FAQs on obtain prior permission from FCRA authorities Q1 What is the different type of registrations provided under FCRA 2010? There are generally two types of pf FCRA registration granted in India, namely – Prior Permission and Proper Registration. Each of the above type requires some prerequisites such as – PRIOR ...

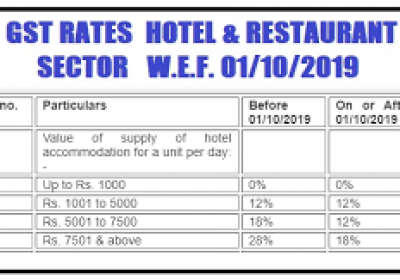

Goods and Services Tax

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY

RJA 28 Oct, 2021

FAQs ON GST ON HOTELS & RESTAURANT INDUSTRY Q.: A hotel is registered on the Fab hotels site. Fab hotels give their listing on Goibibo. During this case, Gobibo was not having any information in respect of such hotel. In this case who is susceptible to collect TCS? As ...

FCRA

Frequently Asked Questions (FAQs) on FCRA

RJA 28 Oct, 2021

Frequently Asked Questions (FAQs) on FCRA Q1: What are the various kind of FCRA registrations? The below are the two forms of FCRA registration: Proper FCRA registration Proper FCRA registration permission The eligibility requirements, as well as the duration of the registration, vary depending on the type of FCRA ...

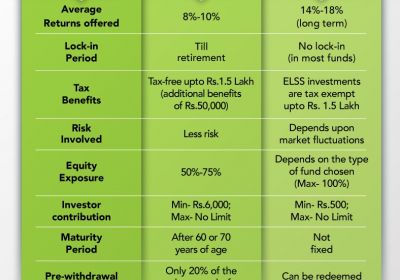

Financial Services

Why we Should invest in NPS just for the tax benefits?

RJA 28 Oct, 2021

Why we Should invest in NPS just for the tax benefits? “Since the Income Tax Act introduced a new deduction of $50,000 under Section 80CCD, NPS has grown in popularity (1b). This deduction is in addition to the 1.5 lakh deduction granted under Section 80C. As a result, investment in National ...

COMPANY LAW

Issues & suggestions in Consultation paper issued by the NFRA

RJA 24 Oct, 2021

Issues & suggestions in Consultation paper issued by the NFRA In Paragraph 1.2 of the Consultation paper dated 29.09.2021, it has been said that “As per view of significant role played by Corporates in India in Economic development & growth of the India, it is required that the regulatory environment of ...

OTHERS

Prime Minister Employment Generation Programme (PMEGP)

RJA 21 Oct, 2021

Prime Minister Employment Generation Programme (PMEGP)-Eligibility, Features PMEGP scheme was founded in 2008 by merging two schemes that were in operation till 31.03.2008 namely Prime Minister’s Rojgar Yojana (PMRY) and Rural Employment Generation Programme (REGP) for generation of employment opportunities through establishment of micro enterprises in rural as well ...

NRI

FAQ/Guidelines on Aadhaar-based PAN distribution

RJA 19 Oct, 2021

FAQ on Aadhaar-based PAN distribution What's the PAN? Answer: PAN, or Permanent Account Number, is a special 10-digit alphanumeric code. The Income Tax Department issues PAN in compliance with the Income Tax Act & Regulations. Financial institutions and agencies are also required to have PAN. What is Instant PAN ...

INCOME TAX

Validity of Partnership remuneration disallowed U/s 40A(2)(a)

RJA 16 Oct, 2021

Validity of Partnership remuneration disallowed U/s 40A(2)(a) Problem based on provisions of Sections 40(b)(v) & 40A(2)(a) of the Income Tax Act, 1961. LETS see the applicability of provision of applicable of section. SECTION 40(b)(v) of income tax provides that: Remuneration to Partners exceeding the limit prescribed ...