OTHERS

“THOSE WHO USE PUBLIC FUNDS MUST ACCEPT A RESPONSIBILITY TO THE PUBLIC”

RJA 10 Sep, 2021

As per the Audited Balance Sheet of ICAI as on 31-03-2020 (https://resource.cdn.icai.org/61365annualreport-icai-2019-20-english.pdf) the Institute had Surplus and Earmarked Funds of Rs. 2269.74 Crores (PY Rs. 1963.34 Crores) and it earned a Net Surplus of Rs. 299.19 Crores (PY 283.39 Crores) for the Year ended on 31...

INCOME TAX

Income Tax Due dates extended again

RJA 10 Sep, 2021

CBDT extends due dates for filing of Income Tax Returns and various reports of audit for Assessment Year 2021-22 Saummary on Income Tax Due dates extended again Following due dates have been extended which I believe in wake of the challenges put forward by the ...

INCOME TAX

Taxation of Inter-Corporate Dividends U/S Section 80M

RJA 09 Sep, 2021

Taxation of Inter-Corporate Dividends under section 80M of Income Tax Act 1961 BRIEF INTRODUCTION The Finance Act 2020 has brought with it a slew of measures and reforms to boost the expansion of the economy and improve tax administration. In order to reduce tax and compliance burden ...

GST Filling

Priority Action Items for Financial Years 2020-21 Before Sept 2021 GST Returns

RJA 08 Sep, 2021

As September is the final & last chance to comply with different GST Regulations & rules there under the Goods and Services Tax Act in respect to FY 2020-21, vigilance or so caution should be exercised in relation to inward and outward supply before submitting GST Return for ...

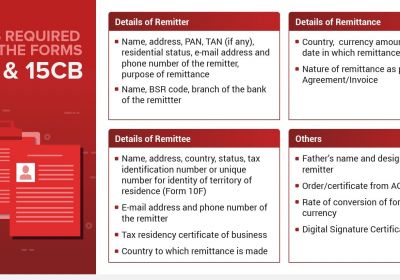

NRI

Non-Resident Indian (NRI) Repatriation Services

RJA 08 Sep, 2021

NRI REPATRIATION SERVICE An NRI, OCI and a Foreign Citizen, residing in India, are often into the transaction of remitting the money from Indian Bank accounts to foreign or NRI accounts. To undertake such type of transactions, the banks are authorized to ask for certain documents namely - Application form ...

NRI

RESIDENT FOREIGN CURRENCY ACCOUNT PROVISIONS

RJA 07 Sep, 2021

FOREIGN CURRENCY ACCOUNT PROVISIONS An Indian resident going abroad for studies or who is on a visit to a foreign country may open, hold and maintain a Foreign Currency Account with a bank outside India during his stay outside India, and on his return to India, the balance in the ...

NRI

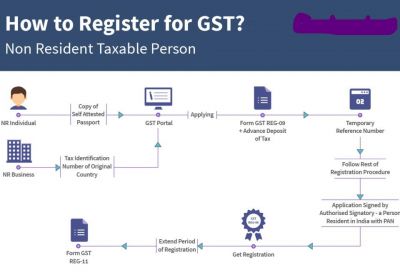

GST Law Applicability on Non Resident Taxable Person

RJA 07 Sep, 2021

Complete Guidance on NRIs GST applicablity Goods and Services Tax Act was passed in 2017, which is an indirect tax. GST was passed to subsume many indirect taxes under one law i.e., GST Law. GST Law in India is comprehensive, multi-stage, destination tax. Non-Resident Taxable Person Under GST Under ...

NRI

Requirements for Lower deduction TDS Certificate For NRI's

RJA 07 Sep, 2021

PROVISIONS TO COMPLY WITH WHILE SALE OF PROPERTY The proceeds arising from the sale of such property be received in an NRO account in India. A properly executed and stamped copy of the sale deed must be obtained for tax compliances (ITR filing) and future tax/tax/another query. Keep ...

TDS

Income Tax and Tax Deducted at Source (TDS) Forms

RJA 07 Sep, 2021

Income Tax and Tax Deducted at Source (TDS) Forms Income Tax Forms Part- 1: Application for allotment of PAN and TAN Sr. No Form Number Description 1. FORM NO. 49A Application For Allotment of Permanent account number [In the case of Indian citizens/Indian Companies/Entities incorporated in India/unincorporated entities formed ...

NRI

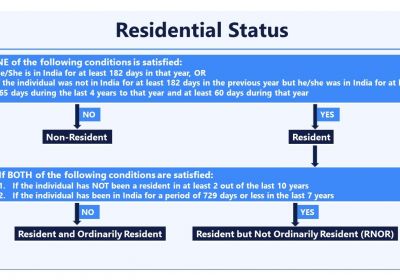

GUIDANCE TIPS FOR NRI RETURNING TO INDIA

RJA 06 Sep, 2021

TIPS FOR NRI RETURNING TO INDIA If you're an NRI returning to India permanently, this blog is for you. During this article, we would be explaining the fundamentals attached with the smoothly transition of an NRI to a Resident Indian and ...

NRI

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS

RJA 06 Sep, 2021

PROBLEMS FACED IN INVESTING IN INDIA BY NRIS BRIEF INTRODUCTION With the rapid growth in the Indian market, NRIs have been eagerly looking for making investment in the Indian market. Several investment options are available in India, like mutual funds, equity stocks, IPOs, ETF, bonds, etc. However, ...

GST Filling

Applicable Forms under Goods and Services Tax Rules, GST Acts

RJA 04 Sep, 2021

https://carajput.com/archives/gstn-issue-standard-operating-procedure-for-tds-under-gst.pdfGoods and Services Tax (GST) Rules & GST Acts Sr. No GST Rules GST Acts 1. CGST RULES, 2017 (UPDATED UPTO 01.06.2021) THE CONSTITUTION (101 AMENDMENT ACT) 2016 2. IGST RULES, 2017 CGST ACT UPDATED TILL 01.01.2021 3. EXTENSION TO JAMMU & KASHMIR CGST ACT, 2017 4. IGST ACT UPDATED TILL 01.10.2020 5. EXTENSION TO ...

OTHERS

All about the APEDA (RCMC) Registration

RJA 27 Aug, 2021

APEDA (RCMC) Registration- Meaning, Benefits, Documents Required for an APEDA License The Agricultural and Processed Food Products Export Development Authority (APEDA) is a government agency that was formed to develop and promote the export of scheduled products. APEDA is a government agency that offers financial aid, knowledge, and rules ...

Nidhi company

FAQs on Nidhi Company in India

RJA 26 Aug, 2021

FAQs ON NIDHI COMPANY Q.1: Will the deposits made with the Nidhi Company safe and secured? Yes, such deposits are safe and secure since the Ministry of Corporate Affairs and Reserve Bank of India has framed certain rules and regulations, to ensure protection and security of Deposits. ...

Business Setup in India

Pre Post Funding Compliance for Start UPs

RJA 04 Aug, 2021

PRE AND POST FUNDING COMPLIANCE FOR STARTUPS ELIGIBILITY CRITERIA Though there's no comprehensive definition for start-ups that have been provided under Indian laws, the govt of India (GoI) under its start-up schemes define start-ups as: · &...

IBC

SUMMARY PROCEDURE FOR WINDING UP OF COMPANIES

RJA 02 Aug, 2021

BRIEF INTRODUCTION Summary procedure for winding up has been introduced in respect of companies and the same has been provided under section 361 of the Companies Act, 2013. We all know that the liquidation process is carried out by an official Liquidator who is ...

Business Setup in India

PRE AND POST FUNDING COMPLIANCE FOR START-UP

RJA 24 Jul, 2021

PRE AND POST FUNDING COMPLIANCE FOR START-UP Compliance basically refers to abiding by the foundations. within the world of business, compliance is integral to survival. Failing this, businesses are susceptible to various fines and penalties under the assorted regulations and laws. With ...

Business Setup in India

COMPLETE UNDERSTANDING OF START-UP FUNDING

RJA 24 Jul, 2021

COMPLETE UNDERSTANDING OF START-UP FUNDING BRIEF INTRODUCTION The startup company you founded is that the brainchild of your ideas and you have got successfully completed your private limited company registration, Finance is that the lifeblood of any business and understanding Fundraising options ...

NGO

FAQs ON SECTION 12AB & 80G REGISTRATION

RJA 15 Jul, 2021

Q.: What is Section 12A & Section 12AA? Ans. All you would like to grasp about the Section 12A & Section 12AA Trust, Society and Section 8 Company can seek registration Under Section 12A of income tax Act to assert exemption under income ...

TDS

Section-by-section analysis on TDS/ TCS perspective on the finance bill 2021

RJA 11 Jul, 2021

The Union Budget, which was presented in Parliament, proposed a number of significant modifications to the Income Tax Act. Certain adjustments to the TDS and TCS sections of the Act have been made in particular. The proposed modifications to the TDS/TCS provisions of the Income Tax Act will be ...

COMPANY LAW

Frequently Asked Question on DIR-3 KYC

RJA 10 Jul, 2021

Frequently Asked Question on DIR-3 KYC Q.: Who is responsible for completing Form DIR-3 KYC? Individuals with a DIN on file in their names on March 31 and who did not file Form DIR-3 KYC the previous year are required to file Form DIR-3 KYC this year. In addition, ...

FEMA

Compounding of Contraventions under FEMA

RJA 10 Jul, 2021

What does it mean to FEMA compound? In some nations, it's also known as the Composition of Offense. Compounding an offence is a method of settling a case in which the offender is given the option of paying money instead of facing prosecution, so avoiding a lengthy legal battle. &...

COMPANY LAW

FAQs on dematerialization of physical share certificates

RJA 06 Jul, 2021

FAQs ON DEMATERIALIZATION OF PHYSICAL SHARE CERTIFICATES Q.: What's the Governing Law? Section 29 read with Rule 9A of the businesses (Prospectus and Allotment of Securities) Rules, 2014. Q.: From when is Rule 9A effective? 02nd October 2018. Q.: What does Rule 9A state? Every unlisted public ...

GST Filling

FAQ’s on E-Invoicing under GST

RJA 06 Jul, 2021

FAQ’s on E-Invoicing under GST Q.: What exactly is E-Invoicing under GST? E-Invoicing under GST is the process of verifying B2B invoices, exporting them online through a unified portal, and assigning a unique IRN and QR code to each authenticated invoice. Q.: When does the system of ...