PRE AND POST FUNDING COMPLIANCE FOR STARTUPS

ELIGIBILITY CRITERIA

Though there's no comprehensive definition for start-ups that have been provided under Indian laws, the govt of India (GoI) under its start-up schemes define start-ups as:

· An entity be termed as a startup, where all the subsequent conditions are satisfied -

1. If it's incorporated/registered as any of the followings:

ü Private limited company, incorporated under the Companies Act, 2013.

ü Partnership Firm, being incorporated under Indian Partnership Act, 1932.

ü Limited liability Partnership, being incorporated under Limited Liability Partnership Act, 2008.

ü One Person Company, being incorporated under Companies Act, 2013.

Provided that such an entity isn't formed by splitting up or reconstruction of a business already in existence.

2. It has not completed ten years since incorporation/registration as above.

3. Its turnover for any of the financial years has not exceeded INR 100 Crore.

4. It satisfies any of the subsequent conditions:

ü It is working towards: innovation of latest products/processes/services or development of new products/processes/services or improvement of existing products/processes/services

ü It must be a scalable business concept with a great potential for creating jobs and profit.

Passionate entrepreneurs aim to create practical unique solutions for customers through their start-up venture. The business is required to concentrate on its potential customer base, its USP and market situation. At the same time Entrepreneur should have or they ought to hire or outsource someone who encompasses a good understanding about the fundamental laws of the land, rules, regulations being applicable and various other government schemes being incorporated in respect of welfare of the budding businesses and their smooth functioning.

PRE & POST FUNDING COMPLIANCE

The concept of Pre & Post Funding Compliance For Startup has gained greater significance, for initiating any business in India. The things which one must keep in mind about pre and post funding compliance for start-up are with registrations, meetings, allotment of shares and issue various certificate etc.

As per the rules of the companies Act, 2013, a private limited company can issue shares in order to raise money by making a preferential allotment of shares. Allotment of shares on preferential basis is required to be authorized by article of association of the corporate entity. Such an allotment shall be authorized by a special resolution, and the price of such shares be determined by the corporate entity valuation report.

The factor involving investment and getting deals is one of the most difficult and at the same time, the most important aspects. Private limited company is also required to adhere to these, while receiving the funds from the investors. The allotment of shares should be authorized by the special resolution, there are included the varied steps with respect to the allotment of shares which are as following: -

1. Board Meeting: meeting is considered because the important compliance under the corporate entity because, with the timely meetings only, the raising factors and also the start-up base will increase. In order to approve the preferential allotment, a board meeting is required to be conducted.

2. Secondly, conducting an extra ordinary meeting. In order to approve the preferential allotment, a special resolution is required to be passed in an extra ordinary general meeting of the shareholders. The said resolution shall be valid for a maximum period of 12 months.

3. Thirdly, issue of the offer letter. The majority of votes shall be made in favor of the proposal, in order to approval various proposal. Once the proposal has been approved by the majority, the corporate entity shall move ahead and issue offer letter to the investors within the specific format. Within the 30 days from the date of issue of letters, a consolidated record of preferential allotment is required to be with the Registrar of Company.

4. Fourthly the important one is that the allotment of the shares, because the corporate entity is required to allot securities to the investors within the 60 days of receiving the funds, and for that too there is a requirement for passing of a resolution in board meeting and filing a return of allotment with the registrar within 30 days of such allotments. There is a need to provide details containing the list of all shareholders, their complete names, address, percentage of shareholders allotted and other relevant information.

5. The final step is about issuance of share certificate. On completion of the allotment, company can finally issue shares, certificate to the investors; later they're going to be the shareholders of the corporate entity.

All the above-mentioned steps are required to be complied with, for the domestic and foreign investors both. It's important for the companies raising capital to be aware and ensure compliance for an improved and smooth business and to understand their business in an exceedingly better way.

PRE-FUNDING COMPLIANCE

1. Change of authorized capital (if required):

Where the Authorized share capital of the corporate entity isn't sufficiently high. Authorized share capital shall be increased before doing the other compliance to issue fresh shares.

2. Prepare Draft of Offer Letter:

Draft of the offer letter for the share offering must be written. All information regarding firm valuation, share allocation, face value of the shares, and so on will be finalised during this phase.

3. Conducting a board meeting:

A board meeting is required to be conducted in order to approve the subsequent points.

· A notice has to be sent to any or all the member before 7 days of the meeting.

· Considering the Valuation report: A valuation report shall be prepared by a CA/Registrar valuer, and the same shall be approved in the board meeting itself.

· List of Allottees: The list of all the new shareholders shall be finalized.

· Offer Period: The choice in respect of the offer period shall be finalized.

· Opening a Bank account: A fresh bank account, shall be opened with a Scheduled bank, for the purpose of receiving the amount of investment only.

· Finalizing the Drafting of Offer Letter: The offer letter to be issued to the shareholder shall be drafted and finalized.

· EGM Finalization: The date, day, venue and time for Extraordinary general meeting (EGM) needs be finalized and spot for EGM and therefore the Explanatory Statement to be attached.

4. Conducting of EGM:

Extraordinary general meeting is required to be conducted with the objective of passing the special resolution for allotment of shares. The said special resolution will be valid for a maximum period of 12 months. A whole record for private placement must be prepared in form PAS-5. The EGM is conducted with the objective of passing the Special Resolution regarding the Preferential Allotment. MGT- 14 has to be filed and PAS – 4 containing the private placement offer is sent to the allottees along with-

o A certified true copy of the Special Resolution.

o Explanatory Statement.

5. Issuance of offer letter:

Once the approval of issue of shares is obtained, the private placement offer letter draft has to be shared with the allotees within 30 days, through physical or electronic message. Complete record of the allotment is required to be filed with the Registrar of Companies. Once it is done the corporate entity can receive funds from the investors.

POST FUNDING COMPLIANCE

1. Allotment of shares:

In case of offer, the appliance money is often paid within the type of cash also. However, in case of private placement, the share application money is required to be received in the Investment account of the corporate entity using the banking channels only.

Once the application money is received, another meeting is required to be held in order to approve the allotment and issue of shares. Within 60 days from the receipt of the funds, the shares are required to be allotted to the allotee and after allotment within 30 days a return of allotment shall be filed with the Registrar of Companies.

2. Issue of share certificate:

The issuing company shall allot and issue share certificate to their investor within 60 days from the date of allotment of shares. The amount of investment cannot be used, until the certificate is issued. If the corporate entity doesn’t issue share certificate within the desired time, it'll must return the cash to investors.

3. Following additional compliances are applicable just in case of Foreign/NRI Investors:

· Advance Reporting Form: this manner is to be filed with reserve bank of India within 30 days of receiving funds. The form contains information in respect of KYC of Investors

· FC-GPR Form: such a firm is required to be filed within 30 days from the date of issue of shares. Under this form, certifications regarding the procedure, compliance must be certified from an organization Secretory. Together with this, valuation certificate certified by a CA must be submitted. These documents are required for filing form-FIRC and the same will be issued by the company’s bank and KYC issued by investor’s bank.

· Once the compliance process is completed, the company would be free to issue share certificates to investors and this will make them shareholders of the company.

· Once the pre-funding compliance and post-funding compliance are done, it is mandatory for a corporate entity to submit funding details to the RBI, where there is any angel investor or venture capitalist from out of India.

If you wish any help with the with the above fee unengaged to reach bent on us at Rajput Jain and Associates or write to us at singh@carajput.com.

INVESTOR’S COMPLIANCE CHECKLIST

Raising capital is a major function for any business and equity funding has gained tremendous popularity over the last decade attributable to the success of ecommerce companies like Flipkart, Snapdeal, In-Mobi and more. The increased interest in startups has led to the development of a robust angel investor community, venture capital investors and private equity firms. All equity investors before making an investment conduct an investment due-diligence of the target company on a large kind of areas. In this article, we would be considering some of the Investor’s compliance checklist, designed to create sure the investee is compliant with relevant rules and regulations.

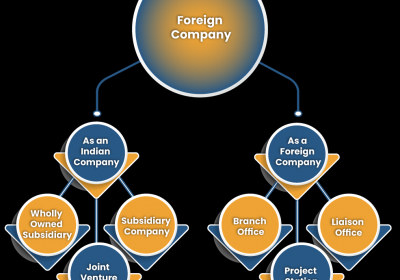

1. Business Entity

Equity investment requires issuance of shares of the corporate entity to the investor in return for equity / shares. Only private limited company or limited company would be capable of providing such a transaction. Hence, the primary step in the fund raise process should be to incorporate entity an organization, if not already done. During incorporation, it's important to make sure that the Memorandum of Association and Articles of Association of the corporate entity are drafted to handle an equity investment without any amendments to the MOA or AOA.

2. ROC Compliance

The company is required to maintain a statutory register and the same shall be in compliance with all the provisions of the Companies Act, 2013. Some of the main compliances post incorporation involves appointment of Auditor, conducting of board meetings, filing of statutory annual returns and maintenance of statutory register. During the investment due-diligence the above areas regarding ROC compliance are going to be verified.

3. Tax Compliance

Tax compliance for a business depends upon the nature of business and state of operation. Businesses involved in selling goods or products would need to comply with state GST regulations, including GST registration, GST payments and filing of GST returns. Businesses involved in providing services would must obtain service tax registration, make service tax payments and file service tax returns.

In addition to service tax or GST regulations, income tax compliance would even be checked. TDS payments and TDS return filing would be checked to make sure that the business complied with the relevant income tax rules and regulations.

4. Labor Law Compliance

If the investee company has an employee workforce of over 20, the business would need to comply with ESI and PF regulations. Hence, ESI registration documents, ESI return filing, PF return filing, ESI payments and PF payments would be checked. If the corporate entity is involved within the development of intellectual property, then due-diligence will also be performed to confirm that the business has the required employee non-disclosure agreements in place.

5. Intellectual Property

Intellectual property is one amongst the biggest asset of a technology-based company. Hence, investors will ensure that relevant belongings of the corporate entity like trademark, copyright, patent and design are protected with a trademark registration or copyright registration or patent registration. even if the registration certificate isn't issued, investors will want to see proof for filing of application for trademark or copyright or patent.

CONCLUSION

Adhering to legal requirements is crucial for any organization; knowledge and compliance with applicable laws is that the initial step to make sure smooth business operations. Compliance with the relevant laws where the startup is doing business is vital for the successful setup and efficient growth of startups. Compliance ensures that no penalty is imposed on a start-up at any point in its growth and helps it stay out of the other possible risks/difficulties. One can conclude that the longevity of a stable depends on how secure its legal foundation is.

For more information please subscribe for Rajput Jain and Associates blog or Contact us.

FAQs on Pre Post Funding Compliance for Start UPs

1. Whether annual compliance is compulsory?

Annual Compliance is mandatory and compulsory in respect of all companies and LLPs registered with MCA. Regardless of the turnover and capital of the business, the annual filing must have complied. Late filing or non-filing of the identical may result in additional fee and penalties.

2. Whether Book-keeping and accounting are compulsory for each business?

Yes, bookkeeping is compulsory for all businesses except the only real proprietorship. Even the only proprietorship has got to maintain accounts after earning a particular turnover. Additionally, the companies need to maintain accounts in accordance with the accounting standards prescribed.

3. What's the time-frame for obtaining a certificate of recognition as a “Start-up” within the case of an already existing entity?

The procedure of registration in such cases shall be real-time and therefore the certificate of recognition would be immediately issued upon successful submission of the applying.

4. If an entity doesn't have a PAN, will they be allowed to register as a “Start-up”?

Yes. An entity may be registered as a Start-up without a PAN. However, it's advised that a legitimate PAN of the entity is provided at the time of registration, as each entity is recognized as a separate taxable person.