Table of Contents

PRE AND POST FUNDING COMPLIANCE FOR START-UP

Compliance basically refers to abiding by the foundations. within the world of business, compliance is integral to survival. Failing this, businesses are susceptible to various fines and penalties under the assorted regulations and laws. With the laws getting amended on an everyday basis so on tighten the slip-ups made by businesses within the past, one cannot ignore the growing importance of compliance during this day and age. Moreover, where any startup is in receipt of funding, there exist the legal duty of its founders to ensure that the investor’s money is in safe and sensible hands.

CHECKLIST

More often than not, early-stage founders tend to approach investors way too early, before they're truly ready.

- Introduction: An introduction about the corporate gives the investors a thought of who they're and what they are doing. Investors always want to understand more about the people behind the scenes, working towards the success of the company; therefore, an introduction of the team is additionally important.

A detailed description of the matter that the corporate aims to eliminate or offer an answer to, what the impact of this problem has been to this point, and its effect on commerce, industry and society.

Investors have to be educated regarding the innovative solution that the corporate is bringing on the point of tackle the matter.

- Marketing Plan: The marketing plan looks to answer the questions on who the target market is, what markets the corporate is looking to enter into, what the proposed pricing strategy is and what the assorted distribution channels are.

- Projected Financials: An estimate of where the corporate aims to be, in financial terms, some years down the road, thereby outlining the feasibility of the business further. The financials will include an income statement, statement of profit and loss and a record.

- Sources of Finance: Funding plays an important role in a very startup’s ability to scale and grow at a gentle pace. It talks about what the capital structure of the corporate are going to be, whether primarily comprising equity or debt or both.

PRE-FUNDING

Before accepting any funding, every startup in India has to be complied as per ROC norms. There are different stages of startup funding.

- Compliance with the Registrar of Companies: As per the provisions of the companies Act 2013, a private limited company may issue its shares to lift funding, either within India or outside India, through the method of a Preferential Allotment of shares.

The Preferential Allotment is a problem of shares by a listed or an unlisted company to a get group of investors. it's one among the quickest ways of raising funds and increasing the share capital of the corporate

- Conducting a Board Meeting: A notice must be sent to any or all the board members a minimum of seven days before the conduct of the meeting. At the meeting, the subsequent matters are to be discussed: -

- Considering the Valuation Report.

- Decision in respect of the number of allottees.

- The decision regarding the offer period.

- Opening of a checking account in a very Scheduled bank to receive the money.

- Finalizing the draft offer letter.

- Details in respect of the day, date, venue and time of the Extraordinary General Meeting (EGM) for getting approval.

- Finalizing the notice for EGM and also the Explanatory Statement to be attached.

- Conducting an extraordinary General Meeting: The EGM is conducted with the target of passing the Special Resolution regarding the Preferential Allotment. The Special Resolution encompasses a validity period of 12 months. MGT- 14 must be filed and PAS – 4 containing the private placement offer is distributed to the allottees along with-

- A certified true copy of the Special Resolution passed by the Shareholders.

- Explanatory Statement.

- Issuance of Offer Letters: Once approval is obtained, the private placement offer letter cum application is too lean to the proposed allottees within 30 days, in writing or through electronic mode. an entire record of the preferential allotment is to be filed with the Registrar of Companies. Once this can be complete, the corporate can receive funds from the investors.

REGISTRAR OF COMPANIES COMPLIANCE

1. As per guidelines mentioned within the Companies Act, 2013:

A private limited company can raise funds by issuing shares within and outdoors India, by making preferential allotment of shares to angel investors, seed investors, and venture capitalists. Such a Preferential Allotment of Shares shall be governed as per the provisions of Section 62(1)(c) of Companies Act, 2013, along with the Associated Rule 13 of Companies (Issue of Share Capital and Debentures) Rules, 2014.

Article of Association (AOA) has to be updated with necessary provisions like

- The issuance of shares under this method should be authorized by the AOA of the corporate.

- A special resolution must be made for authorization of allotment of such shares.

- The share price must determine by the corporate valuation report of a registered valuer.

2. Conducting a board meeting:

A board meeting has to be conducted for approving the subsequent points. A notice has to be sent to any or all the members before 7 days of the meeting.

- Considering the Valuation report: A valuation report has to ne prepared by a CA/Registrar valuer. And same has to be approved within the board meeting.

- List of Allottees: The list of all the new shareholders has to be finalized.

- Offer Period: the choice regarding the offer period has to be finalized.

- Opening a checking account: A fresh bank account during a Scheduled bank has to be opened for the aim of receiving the investment only.

- Finalization of the drafting of the Offer Letter: the offer letter to be issued to the shareholder shall be drafted and finalized.

- EGM Finalization: The date, day, venue and time for the Extraordinary general meeting (EGM) needs to be finalized and spot for EGM and therefore the Explanatory Statement to be attached.

3. Conducting of EGM:

An Extraordinary general meeting must be conducted with the objective of passing the special resolution for the allotment of shares. The said special resolution shall be valid for a maximum period of 12 months. A whole record for private placement must be prepared in form PAS-5.

4. Issuance of offer letter:

Once the approval of the issue of shares is obtained, the private placement offer letter draft has to be shared with the allottees within 30 days, through physical or electronic message. an entire record of the allotment has to be filed with the Registrar of Companies (ROC). Once this is often done the corporate can receive funds from the investors.

POST FUNDING

1. Allotment of shares:

In the case of an offer, the appliance money is often paid within the type of cash also. just in case of a non-public placement, the share application money should come from the Investment account of the corporate through banking channels only.

After receiving application money, the second meeting is held for approving allotment and issue of shares. Within 60 days of receiving the funds, the shares must be allotted to the allottee and after allotment, within 30 days a return of allotment must be filed with the registrar of companies.

2. Issue of share certificate:

The issuing company is required to allot and issue a share certificate to their investor within 60 days from the date of allotment of shares. It cannot use cash until the certificate is issued. If the corporate doesn’t issue a share certificate within the desired time, it'll return the cash to investors.

Following additional compliances are applicable just in the case of Foreign/NRI Investors:

- Advance Reporting Form: this manner is to be filed with the reserve bank of India within 30 days of receiving funds. This contains information regarding funds as KYC of Investors

- FC-GPR Form: this way is required to be filed within 30 days from the date of issue of shares. during this form Certifications regarding the procedure, compliance must be certified from an organization Secretory. together with this, a valuation certificate certified by a CA must be submitted. These documents are required for filing form-FIRC and the same will be issued by the company’s bank and KYC issued by the investor’s bank.

If you wish any help with the above fee unengaged to reach bent on us at Rajput Jain and Associates or write to us at singh@carajput.com.

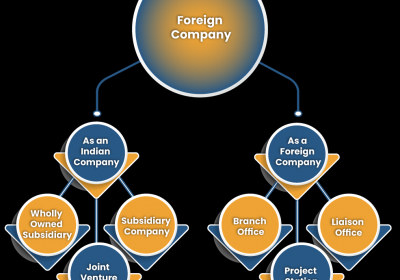

RBI COMPLIANCE FOR FOREIGN INVESTORS

1. After receiving the funds from investors

After receiving funds from foreign investors the corporate has to provide the subsequent details to the reserve bank of India (RBI) in an advance reporting form.

- Name and address of the foreign investors;

- Date of receiving funds and also the amount equivalent in rupees;

- Name and address of the bank/authorized dealer through whom the funds are received;

- Details of the govt approval, if any; and

- KYC report in respect of the non-resident investor, being received from the overseas bank, remitting the said number of considerations.

The share issuance process has to be completed within 180 days from the date of receiving funds. Failure of this might result in a violation of the interchange Management Act (FEMA) regulation.

2. In respect of issuance of shares to foreign investors, located outside India

The company has to report the main points of the difficulty of shares / convertible debentures within the specified form (FC-GPR) to the banking company of India together with the subsequent within 30 days from the date of issuance of shares:

A, A Certificate from the corporate Secretary certifying that

- the company has complied with the procedure for the difficulty of shares, as laid down under the Foreign Direct Investment (FDI) Scheme, and,

- the investment is below the ceiling permissible under the automated Route of the depository financial institution, and/or in terms of the approval of the govt. because the case could also be, which all the necessities of the businesses Act are complied with

B. A certificate from a controller indicating

- the manner of arriving at the worth of the shares issued to the foreign investors.

It is quite an important process after pre-funding and post-funding compliance. For more information subscribe to Rajput Jain and associates blog or contact us.