Goods and Services Tax

GST e-Invoicing is compulsory for businesses limit decreased to INR 20 Cr.

RJA 28 Feb, 2022

The threshold limit for electronic invoicing was decreased in the applicability from INR 50 crore to INR 20 crore with effect from April 1, 2022, as announced by the Central Board of Excise and Customs in Notification No. 01/2022, dated 24 February 2022. A system known as a " electronic-Invoice" allows B2B invoices to be ...

INCOME TAX

CBDT Guidance on uploading of Manually filling 15CA & 15CB

RJA 28 Feb, 2022

CBDT Guidance on uploading of Manually filling 15CA & 15CB CBDT has provided instructions on how to upload manually filed Income Tax Forms 15CA and 15CB with Authorized Dealers between June 7, 2021, and August 15, 2021. In accordance with the Income Tax Department Press Release dated July 20, 2021, The www.incometax.gov.in e-filing ...

NBFC

Understand Growth of India's Non-Banking Financial Company

RJA 25 Feb, 2022

Understand Growth of India's Non-Banking Financial Company Non-banking financial companies, or Non-Banking Financial Companies, have made substantial progress of scale and diversification of activities. They now play a critical role in promoting inclusive growth by giving less-banked customers access to financial services. By leveraging technology in credit disbursement, non-banking ...

COMPANY LAW

Ministry of Corporate Affairs issue Companies (Accounts) Amendment Rules, 2022.

RJA 12 Feb, 2022

Ministry of Corporate Affairs has issued Companies (Accounts) Amendment Rules, 2022 (1) New ROC e-Form CSR-2 has been introduced By MCA. (2) They shall come into force on the date of their publication in the Official Gazette. The Ministry of Corporate Affairs Notification dated 11 feb 2022 All the company covered under provisions section 135(1) ...

INCOME TAX

Crypto is taxed does not mean that it will not be prohibited in India

RJA 12 Feb, 2022

Taxation on Crypto does not mean that it shall not be banned future in India Indian finance minister N. Sitharaman, said on Friday that the government has the sovereign right to tax money earned from cryptocurrency transactions, but that the govt has yet to decide whether to legalise or ban ...

INCOME TAX

New Tax Regime Vs Old Tax Regime

RJA 07 Feb, 2022

Old Tax Regime vs New Tax Regime The Finance Act 2020 made a number of amendments to our direct tax structure. The implementation of the New Tax Regime U/S 115BAC of the Income Tax Act of 1961 was the most significant change. On the one hand, the new regime offers lower ...

COMPANY LAW

Roc Compliance Calendar for LLP & Companies.

RJA 06 Feb, 2022

Roc Compliance Calendar for LLP & Companies. The Registrar of Companies is an office within the Ministry of Corporate Affairs whose primary responsibility is to ensure that companies and limited liability partnerships (LLPs) in India comply with the Companies Act and its related laws. Although incorporating a Company or Limited ...

Limited Liability Partnership

How to strike off a Limited Liability Partnership?

RJA 03 Feb, 2022

What is Limited Liability Partnership (LLP)? A limited liability partnership (LLP) is a mixture of a corporation and a partnership. It's a newer corporate structure that allows for partnership flexibility while also limiting the company's liability and lowering compliance costs. Benefits/Features of Limited Liability Partnership Simple to ...

Goods and Services Tax

How to deal with Goods and Services Tax summon?

RJA 01 Feb, 2022

What should you do if you receive a summons for the GST? Normally Our email inboxes are filled with GST reminders for GST taxpayers. Unfortunately, we constantly overlooked vital notices for other taxpayers. Is it, however, merely a notice that is extremely crucial? Do you think you're losing out ...

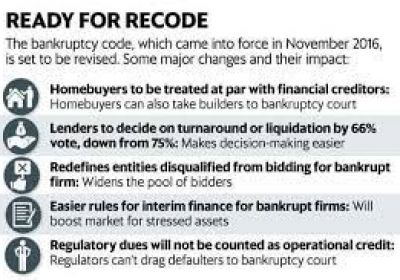

IBC

Overview on Major changes in Insolvency Law - IBC

RJA 01 Feb, 2022

Major changes in Insolvency and Bankruptcy Board of India Eligibility of resolution applicant for submitting resolution plans (barring defaulting promoters to bid for the company) – Section 29A. Voting threshold for decision making by the committee of creditors (from 75% to 66%)- Section 21, 22, 27, 28. Categorization of Home Buyers as Financial Creditors ...

Goods and Services Tax

All about the GST on Reimbursement of expenses

RJA 30 Jan, 2022

All about the GST on Reimbursement of expenses The issue of whether reimbursement of expenses provided by service receiver are to be included in the value of taxable service for purposes of charging service tax was also the subject of much litigation under the service tax regime, wherein the Hon'...

Goods and Services Tax

Reversal of ITC if payment is not made to supplier within 180 days

RJA 28 Jan, 2022

Analysis of validity of section 16(2)(D): Reversal of Input tax credit if payment is not made to supplier within 180 days VALIDITY OF SECTION 16(2)(D) IN THE EVENT OF NON-PAYMENT OF CONSIDERATION WITHIN 180 DAYS WHEN SUPPLY IS FROM ONE GSTIN TO ANOTHER GSTIN OF THE SAME LEGAL ENTITY/PAN ...

Goods and Services Tax

Whether Liable to GST on Discount Received for early payments?

RJA 27 Jan, 2022

GST not applicable on incentive, schemes or cash discount offered by supplier, Rules AAR - M.P. This order is taxpayer favorable order in the matter of M/S RAJESH KUMAR GUPTA OF M/S MAHVEER PRASAD MOHANLAL, GANDHI GANJ, JABALPUR, 482002(MP) AUTHORITY FOR ADVANCE RULING-MADHYA PRADESH Because the cash ...

GST Consultancy

ITC now only for amounts reflected in GSTR 2B:

RJA 25 Jan, 2022

ITC now only for amounts reflected in GSTR 2B We are aware of the change in Input Tax Credit Availment Rules of the entitlement eligibility from GSTR 2B w.e.f. January 1, 2022, Almost each business is concerned about having to implement a new system of Input Tax Credit reconciliation as ...

INCOME TAX

Quick Steps to ensure processing time income tax refund

RJA 23 Jan, 2022

What is Eligibility Conditions of Income Tax Refund The Income Tax taxpayer’s applying for the income tax refund required to make sure that Dept have updated at tax return & validated their bank accounts with the Tax Dept where they would like to obtain their tax refund ...

INCOME TAX

How can we save Income Tax in India?

RJA 23 Jan, 2022

How can we reduce income tax in india You can Reduce your Tax Liability by save money/investment for your future 1. Deductions Upto 80C We can use up to deduction under chapter VI Rs 1.5 lakh ceiling u/s 80C. Income Tax Deductions or investments are all this subjected to ...

GST Filling

Latest New feature in GSTR 3B - under the GST Portal

RJA 22 Jan, 2022

New feature in GSTR 3B - GST Portal The GST Network, which functions as the technology backbone for the indirect tax system, will soon include interest calculator capabilities to the monthly tax payment form GSTR-3B, which will aid taxpayers in computing interest for late payments. In an advisory, GSTN ...

Goods and Services Tax

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022

RJA 21 Jan, 2022

Supply of Restaurant Services via E-Commerce Operator liability to pay GST w.e.f. 01.01.2022 E-Commerce Operators will be responsible to pay Goods and Services Tax on any restaurant service supplied via them, including by an unregistered person. Because there is no exemption for the supply of restaurant services by unregistered ...

NGO

NGOs Receipt of foreign grants & its Utilizations Provisions

RJA 20 Jan, 2022

NGO’s accepts foreign grants & its Utilisation Provisions under Income Tax & FCRA Act Legality of foreign donations/Grants and its Utilisation of the for charitable purpose Provisions under Income Tax & FCRA Act. We hereby giving some applicable provisions of Income Tax Act 1961 and FCR Act 2010,for ...

AUDIT

Compliance of CARO order deferred by one Year: MCA

RJA 14 Jan, 2022

Compliance of CARO order deferred by 1YR: MCA MCA defers the applicability of CARO 2020 to FY 2021-22: MCA Order dated 17.12.2020 changed the date of operation of the Order of the Companies (Auditor's Report) 2020 to the financial years starting on or after 1 April 2021. As a result, the Companies (Auditor&...

NGO

How to register under section 12A online

RJA 13 Jan, 2022

How to register under section 12A online Section 12A Registration As per section 12A of Income Tax Act, 1961, all the NGOs, being registered as a Trust, or Section 8 Company, or a Society, can obtain registration under this section, in order to avail exemption from payment of income tax. Thus, the ...

NGO

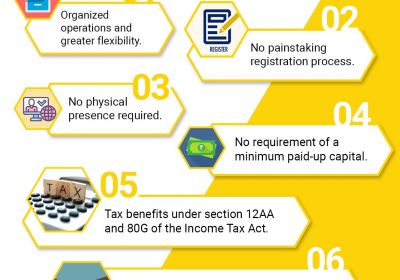

All about the Registration of a section 8 company in India

RJA 13 Jan, 2022

All about the Registration of a section 8 company in India Section 8 Company Registration: NGO can be registered via Section 8 company, which is incorporated under Companies Act, 2013. Such companies work towards charity, religion, trade etc. Benefits of Registration section 8 Company In india No minimum capital requirement in ...

NGO

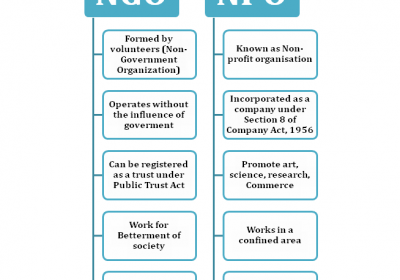

All About Non-Governmental Organization

RJA 13 Jan, 2022

All About Non-Governmental Organization Brief Introduction Non Governmental Organizations, commonly known as NGO’s, work for the benefit of society. These organizations fight for and against the evils of the society and strive to work for creation of a better world and hence help in protecting the rights of ...

NGO

All about the Trust Registration and Society Registration

RJA 13 Jan, 2022

All about the Trust Registration and Society Registration Trust Registration: Trust can be one of the form of Non-Governmental Organization that can be registered in India. These NGO’s work towards the eradication of poverty, and also provide help in the form of education and medical relief. Such ...