HIGHLIGHTS OF GST COUNCIL MEETING HELD

The GST Council in its 28th meeting held today at New Delhi has recommended certain amendments in the CGST Act, IGST Act, UTGST Act, and the GST (Compensation to States) Act.

The major recommendations are as detailed below:

- The upper limit of turnover for opting for composition scheme to be raised from Rs. 1 crore to Rs. 1.5 crore. The present limit of turnover can now be raised on the recommendations of the Council.

- Composition dealers to be allowed to supply services (other than restaurant services), for up to a value not exceeding 10% of turnover in the preceding financial year or Rs. 5 lakhs, whichever is higher.

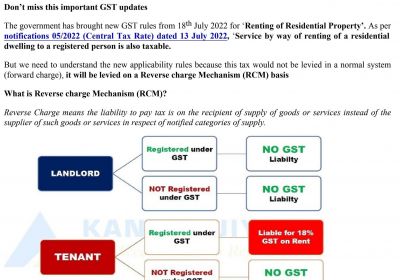

- Levy of GST on reverse charge mechanism on receipt of supplies from unregistered suppliers, to be applicable to only specified goods in case of certain notified classes of registered persons, on the recommendations of the GST Council.

- The threshold exemption limit for registration in the States of Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya, Sikkim, and Uttarakhand to be increased to Rs. 20 Lakhs from Rs. 10 Lakhs.

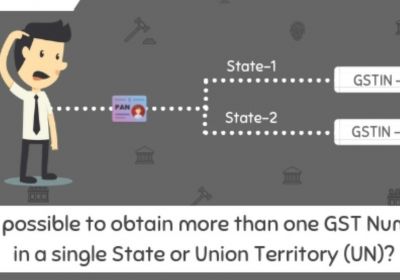

- Taxpayers may opt for multiple registrations within a State/Union territory in respect of multiple places of business located within the same State/Union territory.

- Mandatory registration is required for only those e-commerce operators who are required to collect tax at the source.

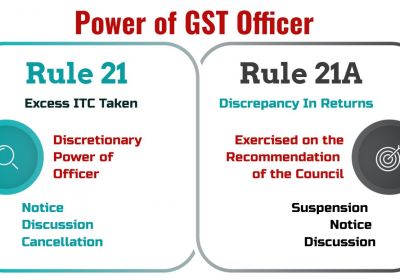

- Registration to remain temporarily suspended while cancellation of registration is under process so that the taxpayer is relieved of continued compliance under the law.

- The following transactions are to be treated as no supply (no tax payable) under Schedule III:

- Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India;

- Supply of warehoused goods to any person before clearance for home consumption; and

- Supply of goods in case of high sea sales.

- Scope of the input tax credit is being widened, and it would now be made available in respect of the following:

- Most of the activities or transactions specified in Schedule III;

- Motor vehicles for transportation of persons having a seating capacity of more than thirteen (including the driver), vessels and aircraft;

- Motor vehicles for transportation of money for or by a banking company or financial institution;

- Services of general insurance, repair, and maintenance in respect of motor vehicles, vessels, and aircraft on which credit is available; and

- Goods or services which are obligatory for an employer to provide to its employees, under any law for the time being in force.

- In case the recipient fails to pay the due amount to the supplier within 180 days from the date of issue of invoice, the input tax credit availed by the recipient will be reversed, but a liability to pay interest is being done away with.

- Registered persons may issue consolidated credit/debit notes in respect of multiple invoices issued in a Financial Year.

- Amount of pre-deposit payable for filing of appeal before the Appellate Authority and the Appellate Tribunal to be capped at Rs. 25 Crores and Rs. 50 Crores, respectively.

- Commissioner to be empowered to extend the time limit for return of inputs and capital sent on job work, up to a period of one year and two years, respectively.

- Supply of services to qualify as exports, even if payment is received in Indian Rupees, where permitted by the RBI.

- Place of supply in case of job work of any treatment or process done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India.

- Recovery can be made from distinct persons, even if present in different State/Union territories.

- The order of cross-utilization of the input tax credit is being rationalized.

Simplified GST Return

- GST Council approved the new return formats and associated changes in the law. The formats and business process approved today were in line with the basic principles with one major change i.e the option of filing quarterly returns with a monthly payment of tax in a simplified return format by the small taxpayers.

- All taxpayers excluding small taxpayers and a few exceptions like ISD etc. shall file one monthly return. The return is simple with two main tables. One for reporting outward supplies and one for availing input tax credit based on invoices uploaded by the supplier

- NIL return filers (no purchase and no sale) shall be given the facility to file the return by sending SMS.

- Council approved quarterly filing of return for the small taxpayers having turnover below Rs. 5 Cr as an optional facility. Quarterly returns shall be similar to the main return with a monthly payment facility. simplified returns have been designed called Sahaj and Sugam. In these returns details of information required to be filled is lesser than that in the regular return.

Reverse Charge Mechanism

- GST Council has recommended to further defer/ suspend the Reverse Charge Mechanism (RCM) up to 30 Sept. 2018, as against the already notified date of 31st March 2019.

migration window for taxpayers

- hose who could not migrate or who are having provisional GST Registration can migrate/ register under GST up to 31 Aug. 2018.

Reduction in GST Rates

- The GST Council has recommended reducing tax rates of about more than 50 items of Goods, including providing relief for women by way of exempting Sanitary Napkins, Rakhi, etc

New CGST (12th Amendment) Rules, 2020 (Dated 15.10.2020)

Rule 80. : GST Audit (GSTR-9C) limit increased from Rs. 2 Crores to Rs. 5 Crores for FY 2019-20 as well (Due Date - 31.12.2020).

Rule 138E. : Relaxation from blocking of eway bill facility during the period 20.03.2020 to 15.10.2020.

Rule 67A. : Form GST CMP-08 was also added in rule 67A for the manner of verification of returns by SMS facility.

GST Return compliances calendar- Nov 2020

For any query, you can write to info@carajput.com. Hope the information will assist you in your Professional endeavours. For query or help, contact: info@carajput.com or call at 09811322785/4,9555 5555 480)