GST Tax Impact On E-Commerce Sector

The most important and painful point of the e-commerce industry is the provision relating to tax collection at the source. E-commerce in India is hindered by the host of taxes such as the VAT, CST, and service tax, TDS with one or more taxes applicable for the single transaction. This has become a heavy compliance burden and multifold reporting.

Participation of the logistics or reverse logistics, promotional services and goods like music, eBooks, and software make it very difficult to differentiate the goods and services components of every transaction. The statutory forms and the e-way bills make the interstate transaction even complicated.

The marketplace must comply with the requirement of the registration and must declare the turnover to the multiple state tax departments. Under the provision of GST, India would become a common marketplace and drive uniformity to reduce compliance costs. Because of the restriction on the cross-utilization of the contribution of the central taxes against the state taxes, there is a growth in price due to the taxes sticking to the sold products.

Many numbers of e-commerce transactions are undefined in the tax law, for example, the gift vouchers, advance receipts, COD, drop shipments etc. the interstate transactions have become neutral in comparison with the local sales under the GST. The warehousing strategy of the e-commerce sectors needs to reconstruct to fulfil the proximity needs of the client and not be driven by tax consideration.

For the e-commerce companies involved in buying and storing the inventory in the place of 12.5% excise, they must shell out 17-18% GST thus driving up the prices. They will be also taxed for the unsold inventory held in the warehouses.

Draft GST Law:

The model draft GST law lies to solve these types of confusion and provides clarity on the evaluation and definition of the goods and services, the point of taxation and the place of supply. The model draft law also defines the terms such as e-commerce, aggregator electronic commerce operator etc.

Business Process Change:

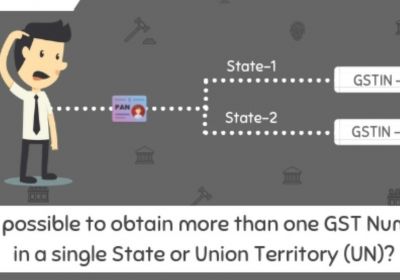

Registration:

The sellers or the suppliers who are involved in the e-commerce platform must register under the GST irrespective of the threshold. This could be unfair if it is not applicable to offline sellers who are below the threshold. E-commerce companies such as Amazon and Flipkart operate under the marketplace model. They store the goods of the sellers in their warehouse and supply those goods to the end-users when they receive orders. These warehouses are registered as the additional place of business under the local VAT by the sellers and the e-commerce sectors do not register under VAT.

Under the GST both the sellers and the e-commerce companies must register the warehouse simultaneously as the principal and additional place for the business. This will be very challenging if these warehouses do not have the dealer wise physically separated or the designated areas within the warehouse.

Stock transfer

The treatment of the stock transfer from the seller to a warehouse under the provision of GST is different as any supply is taxable. This will result in the cascading of taxes as the typical sellers do not sell the stock to the e-commerce sectors.

On the other side, the Flipkart advantage or fulfilled by Amazon or Snapdeal plus model in which the products stored in the dealer’s warehouse are currently dissolved in the states like Karnataka and this may be revived. At present, the registration of the marketplace warehouse as the additional place for the business is not allowed and the GST system may be changed. The marketplace must also be registered in every state and union territory.

Freebies and discounts:

The freebies or the discounts must be mentioned openly in the invoice to arrive at the values of the transaction on which the GST is applicable. Discounts of any post-sale will attract the GST.

Place of Supply:

While determining the supply place of the goods to the customers is very easy. However, determining the place of the service supply by the e-commerce firms to the sellers are a bit difficult.

Tax Deduction at Source (TDS)

Under the prevailing tax law, the sellers who sell the goods under the e-commerce platform are required to deduct the tax at the TDS, they must deposit on TDS and submit the form 16 to the e-commerce players and must get the refund.

All this process has been flipped over in the model draft GST in which the marketplace would deduct its commission as well as the TDS and file the TDS returns. The deducted TDS would automatically appear as a credit in the electronic credit ledger of the seller, the seller uses this to discharge the tax liability. The impact is deeper when the sales returns happen and the deducted TDS must be reversed.

Gst Return Matching:

It is very important for both sellers and e-commerce players to upload the invoice details of the supplies in their returns and the GST system will match them. In case if any supply is reported by the platform and not reported by the marketplace, except the reconciled will be added to the liability of the sellers which results in harsh.

Impact:

Apart from the sudden rise in the compliance needs for both the seller and the e-commerce platform, the new rules have a great impact on the cash flow of the small sellers. If the e-commerce platform reports the supply against the seller wrongfully unless reconciled, this is considered as an unfair supply by the seller. The e-commerce platform must develop the mechanism for all the cash to flow through the e-commerce platform to the sellers then the TDS can be affected. Cash on delivery must be disabled in case of direct shipping of the goods from the seller to the end customer.

System Changes:

The marketplaces must make the necessary changes to their ERPs to switch the new requirements emerging due to GST:

- Each Order or Invoice must carry HSN or SAC code as well.

- Place of Supply must be determined based on the GSTIN for B2B and delivery address for B2C

- ERP must be tweaked for deduction and accounting of TDS, a turnaround of the same in the case of sales return.

- Return filing in itself is a huge process

E-commerces platform under GST

Conclusion:

While the ‘legal recognition of the e-commerce model in India under the provision of the GST Act is a most welcome move, more needs to be fulfilled to address the difficulties in the execution of the same. As soon as they are settled smoothly, the rollout of GST will be carried on smoothly.