Table of Contents

- Key Impact On Gst On Rent Of Residential Property

- What Is Gst Applicability On Residential Property Up To 17th July 2022 ?

- What Is Gst Applicability On Residential Property W.e.f. 18th July 2022 ?

- Gist Of Implication On Gst Of Residential Property Rental

- Important Points Notes :

- An Gist From Cbec Notifications Is Given For Your Access.

- What Is Impact On Of Residential Property Landlord In Case Tenant Is Registered Under Gst ?

- If The Lessor Or Landlord Is Not Registered Under Gst :

- What Is Impact On Registered Tenant Under Gst On Residential Property?

Key impact on GST on Rent of Residential Property

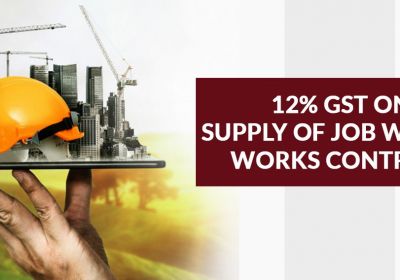

The fundamentals of renting residential property under GST will change Starting on July 18, 2022. 47th GST Council Meeting decided to include the rental of residential properties in the tax net. Immovable property rental is regarded as a provision of services and is subject to GST at a rate of 18% (SAC Code: 9963/9972).

What is GST Applicability on residential property up to 17th July 2022 ?

Goods and Services tax was not applicable/exempted if the residential property was rented out to any person (whether a registered or unregistered person under Goods and Services tax law) up to 17th July 2022.

- Goods and Services tax Liability to pay did not arise as it was particularly exempted through CGST Notification No. 12/2017 issued dated 28.06.2017

What is GST Applicability on residential property w.e.f. 18th July 2022 ?

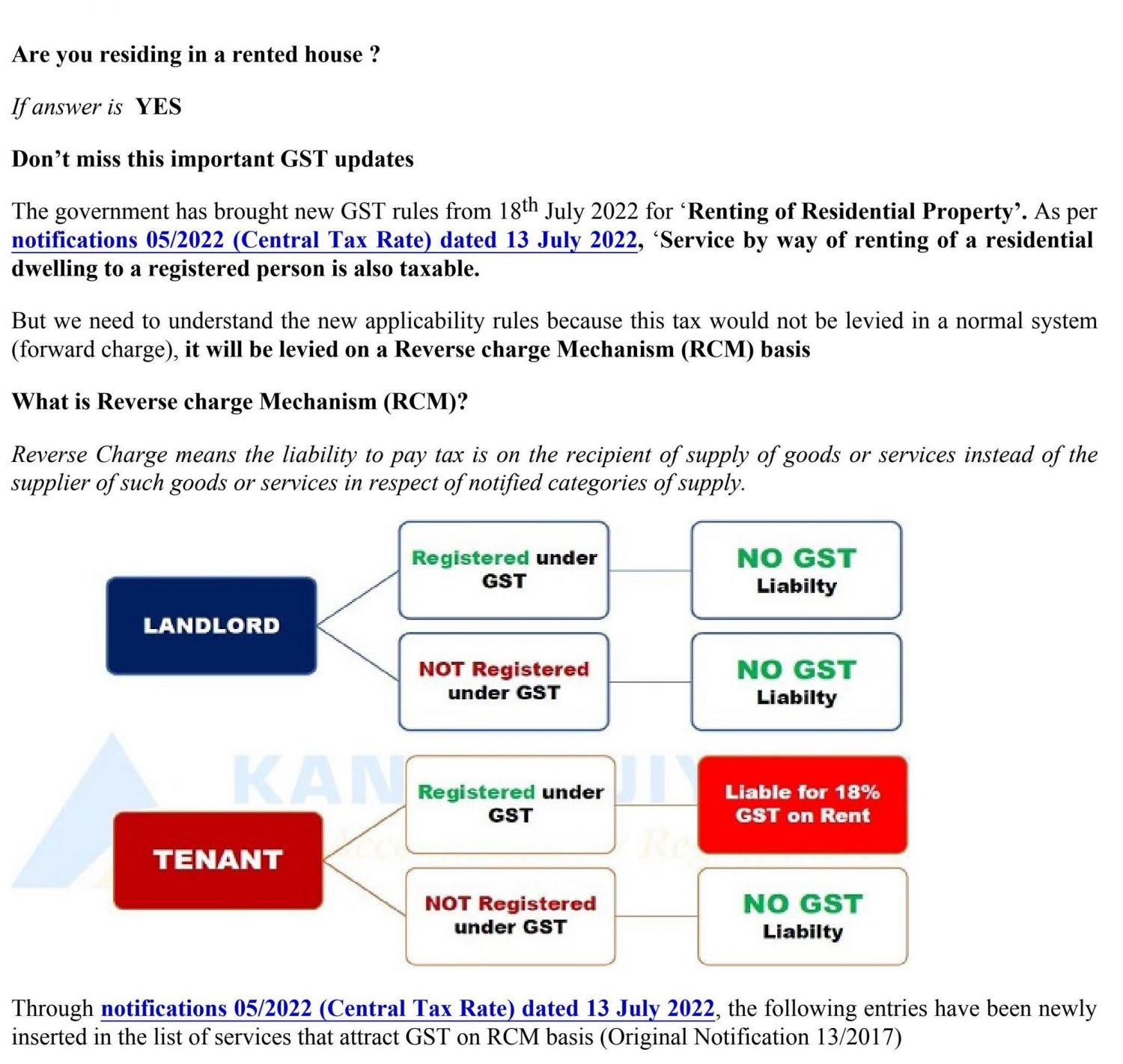

GST Applicability in case residential property is rented out to a registered person under Goods and Services tax with effect from July 18th 2022.

- Goods and Services tax Liability to pay @ 18% under the reverse charge mechanism will arise on the recipient(tenant).

- Earlier Goods and Services tax exemption has been withdrawn through CGST(Rate) Notification no. 04/2022 issued dated 13.07.2022.

- And the said has been notified under reverse charge mechanism Through CGST Notification no. 05/2022 issued dated 13.07.2022.

Goods and Services tax will not be exempted or applicable in case residential property is rented out to an unregistered person under the GST law Goods and Services tax with effect from July 18th 2022.

Payment of GST Liability will not arise as it continues to be particularly exempted through CGST Notification no. 12/2017 dated 28.06.2017.

Gist of Implication on GST of Residential Property rental

Residential house renting for residential use

|

Tenant |

Landlord |

Good and services Tax |

Input tax Credit |

|

Registered Under GST |

Registered Under GST |

Good and services Tax under reverse charge mechanism |

Input tax Credit can be claimed if the property is taken on rent for the furtherance of business |

|

Unregistered |

Registered Under GST |

No Good and services Tax applicable |

N.A. |

|

Unregistered |

Unregistered |

No Good and services Tax applicable |

N.A. |

|

Registered Under GST |

Unregistered |

Good and services Tax under reverse charge mechanism |

Input tax Credit can be claimed if the property is taken on rent for the furtherance of business |

Important Points Notes :

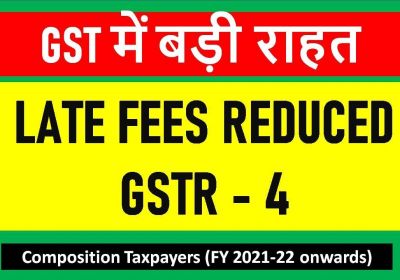

- GST Composition taxpayers shall not be eligible to take Input tax credit as they pay tax at specified lower rates

- Goods and Services tax Taxpayers where inverted duty structure is applicable

- GST Taxpayers who have choose for special concessional rates where Input tax credit is not eligible now e.g. GTA @ 5%, Bricks business @6%, Restaurant @5% etc

- Input Tax Credit is not permitted if the taxpayer used it for personal residence purposes while registered as a proprietorship concern. However, if the owner rents it to one of its employees, that would be deemed a company expansion and would eligible for a tax credit under RCM.

- The rent agreement, how the property is actually used, the type of taxpayer, etc. will all determine whether a registered taxpayer is eligible to claim the credit for taxes paid under reverse charge.

An Gist from CBEC Notifications is given for your access.

CBEC Notification 12/2017 dated 28th June 2017

|

Sr. No. |

SAC/HSN |

Description of services |

Rate |

Conditions |

|

12. |

SAC/ HSN Heading 9963 or 9972 |

Renting of residential house for purpose of use as a residence |

Nil |

No Conditions |

CBEC Notification 04/2022 dated 13th July 2022

|

Sr. No. |

SAC/ HSN |

Description of services |

Rate |

Conditions |

|

12. |

HSN/SAC Heading 9963 or 9972 |

Renting of residential house for use as a residence except where residential house is rented to a GST registered person |

Nil |

NO Conditions |

CBEC Notification 05/2022 dated 13th July 2022

|

Sr. No. |

Supply of Services Category |

service Supplier |

Recipient of Service |

|

5AA |

Renting residential house to a registered person |

Any person |

Any GST registered person |

What is Impact on of Residential Property Landlord in case tenant is registered under GST ?

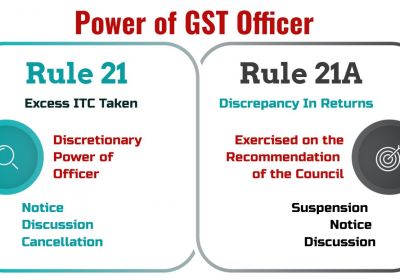

If the lessor or landlord is registered under GST: It will be included as outward supplies subject to the reverse charge mechanism if the supplier (landlord/lessor) is registered for GST. There is no additional GST liability because the recipient (tenant or lessee) is responsible for paying GST. Section 17(2) states that because the outward supply is subject to RCM taxation, there is no issue with taking advantage of the input tax credit.

Note : The same was previously shown as an exempted supply in Table 8, but starting on July 18, 2022, it will be shown on Table 4 as a B2B supply attracting RCM.

If the lessor or landlord is not registered under GST :

There is no new GST burden or GST compliance because the recipient (tenant/lessee) is responsible for paying GST.

What is Impact on Registered tenant under GST on Residential Property?

GST will be applicable under the reverse charge mechanism when a tenant is registered and rents a residential property from everyone (a registered or unregistered person). The recipient (tenant or lessee) of the service will be responsible for paying GST at a rate of 18%. the recipient will also be entitled to claim the input tax credit of the GST paid under reverse charge, because payment of rent is a business expense and is not on the list of blocked input tax credits under section 17(5),

Our Comments:

- For us, it is uncertain How the govt of India will gain from the aforementioned amendment to GST Taxation on rental of residential properties when utilised by a registered person.

- Fact is Nothing actually enters the govt coffers when GST tax is paid under reverse charge; it is handed from one hand & taken back from another.

- Our opinion is that the govt won't see any reap any fruits/ or say curb tax evasion. unless the reporting by the recipient paying tax under the reverse charge mechanism changes.