COMPANY LAW

Start-Ups Companies & The Mistakes They Do Which Cause Them A Big Trouble to expand Their Business

RJA 09 May, 2018

START-UP’S COMPANIES & THE MISTAKES THEY DO WHICH CAUSE THEM A BIG TROUBLE TO EXPAND THEIR BUSINESS Details about start-ups and the mistakes they do which cause them big trouble to expand their business and yes sometimes more serious than that, they have negative remarks on their goodwill. ...

Limited Liability Partnership

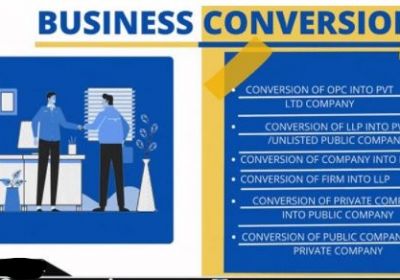

CONVERSION OF LLP INTO COMPANY LIMITED BY SHARES.

RJA 07 May, 2018

LLP Act, 2008 does not cover the conversion of LLP into Company but in Companies Act, 2013 conversion of LLP into Company is covered in section 366. Please note that recently MCA has notified Companies (Authorized to Register) Amendment Rules, 2018 which shall come into force on 16.02.2018 in which form URC–1 has ...

Limited Liability Partnership

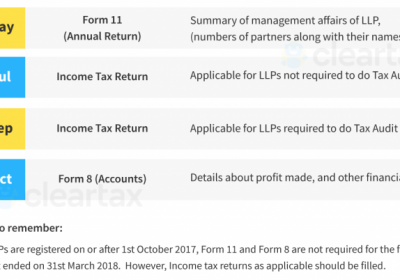

ANNUAL FILINGS OF LIMITED LIABILITY PARTNERSHIPS (LLPS)

RJA 05 May, 2018

ANNUAL FILINGS OF LIMITED LIABILITY PARTNERSHIPS (LLPS) Is the next important task marked in the compliance list? Every Limited Liability Partnerships (LLPs) which are registered with the Ministry of Corporate Affairs (MCA) have to file the Annual Returns and Statement of Accounts for the FY 2018. here are three main ...

OTHERS

HOW TO APPLY TO RBI FOR MOBILE WALLET/ PREPAID PAYMENT INSTRUMENTS

RJA 13 Apr, 2018

The Reserve Bank of India issued guidelines for prepaid payment instruments (PPI) such as closed, semi-closed and open wallets. According to the new guidelines, all the PPIs will now be interoperable, which means will allow transactions with each other A non-bank entity desirous of setting up payment systems for issuance ...

FEMA

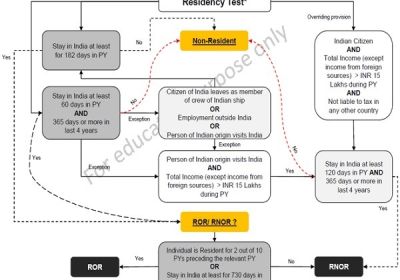

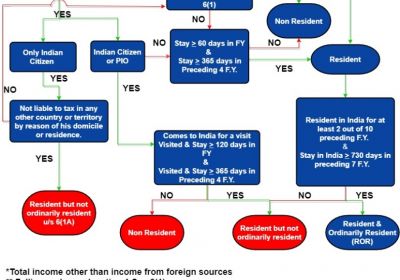

RESIDENTIAL STATUS UNDER INCOME TAX and FEMA

RJA 09 Apr, 2018

Tax incidence on an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in India (or outside India) is ...

INCOME TAX

IMPORTANT ANALYSIS OF ALL MAJOR AMENDMENTS IN INCOME TAX APPLICABLE FOR A.Y. 2018-19

RJA 02 Apr, 2018

Maintenance of Books of Accounts Change in limits for Maintenance of Books of Accounts (Section 44AA): If your net income* from Business or Profession in the financial year 2017-18 is more than Rs 2,50,000 OR if your total sales from Business or Profession in the financial year is more than 25,00,000, then ...

COMPANY LAW

Merger and Amalgamation under Companies Act, 2013 by National Company Law Tribunal (NCLT).

RJA 19 Mar, 2018

Merger and Amalgamation is a restructuring tool available to Indian conglomerates aiming to expand and diversify their businesses for various reasons whether it is to gain competitive advantage, reduce costs, or availing of tax benefits. A merger means an arrangement whereby one or more existing companies merge their identity into ...

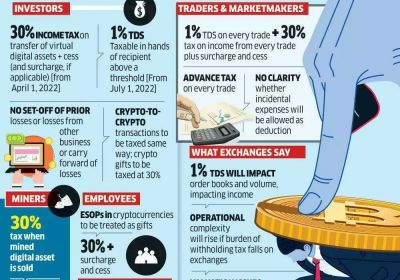

Income tax return

Needed to file income tax returns for your bitcoin profits earn

RJA 17 Mar, 2018

Needed to file income tax returns for your bitcoin profits earn Profited from Bitcoins or other Cryptocurrencies and not sure how to file your income tax returns? Did you know gains from bitcoin is treated as capital gains and hence taxed? We are India’s leading tax ...

INCOME TAX

RESIDENTIAL STATUS UNDER INCOME TAX

RJA 14 Mar, 2018

Residential Status of Individual- Section 6 Tax incidence on an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in ...

OTHERS

QUICK REVIEW Of PREVENTION OF MONEY LAUNDERING ACT, 2002

RJA 13 Mar, 2018

Money laundering is the process by which large amounts of illegally obtained is given the appearance of having originated from a legitimate source. So basically, all the ways to convert black money into white money are Money laundering. But in Money laundering, the black money must ...

OTHERS

APPROVES ARBITRATION AND CONCILIATION (AMENDMENT) BILL, 2018

RJA 09 Mar, 2018

The Union Cabinet on Wednesday approved the Arbitration and Conciliation (Amendment) Bill, which seeks to establish an independent body to make arbitration process user-friendly, cost-effective and ensure speedy disposal and neutrality of arbitrators. The Bill seeks to encourage institutional arbitration for settlement of disputes and make India a centre of ...

OTHERS

Future of Accountancy Profession

RJA 08 Mar, 2018

Future of Accountancy Profession Accountancy profession will face significant challenges in coming times with the evolving technologies, globalization and new form of regulations. Along with tough challenges come exciting opportunities which accountants in business and practice are going to face. Emerging technologies and global trends are definitely reshaping the accountancy ...

COMPANY LAW

Elements of Financial Statements

RJA 07 Mar, 2018

The financial elements of a financial statement are broadly classified into five categories. These are grouped according to the monetary characteristics they possess. Let’s have a brief understanding of all five. Assets An asset is a resource (either tangible or intangible) that is in control of the enterprise ...

Goods and Services Tax

How to file return under UAE VAT

RJA 05 Mar, 2018

As per the official site of the Ministry of Finance, UAE, the majority of the business entities will be required to file the VAT returns on a quarterly basis, within one month/28 days from the end of the respective quarter. USE OF ACCOUNTING SOFTWARE The business in UAE ...

IBC

QUICK REVIEW ON INSOLVENCY AND BANKRUPTCY CODE

RJA 03 Mar, 2018

The meaning of Insolvency and Bankruptcy is not the same. “Insolvency” means the situation where an entity (the debtor) cannot raise enough cash to meet its obligations or to pay debts as they become due for payment Bankruptcy is the term for when an individual is declared bankrupt ...

OTHERS

Everything You Need to Know About SIDBI Loan Schemes

RJA 24 Feb, 2018

SIDBI has proved to be a great support system for all kinds of small businesses in India. This is because they create a series of equity and loan schemes for MSME sector to sanction their growth. In the following article, we will observe some famous SIDBI schemes like- SME IT ...

OTHERS

Cabinet approves New Bill to ban Unregulated Deposit Schemes and Chit Funds (Amendment) Bill, 2018

RJA 24 Feb, 2018

In a major policy initiative to protect the savings of the investors, the Union Cabinet chaired by Prime Minister Shri Narendra Modi has given its approval to introduce the following bills in the Parliament:- (a) Banning of Unregulated Deposit Schemes Bill, 2018 in parliament & (b) Chit Funds (...

GST Compliance

Special GST Audit (Section 66) Under under GST ACT 2017

RJA 22 Feb, 2018

GST AUDIT UNDER GST ACT 2017 Under GST Audit would be done in Two Ways: Section 65 (compulsory audit by tax authorities) Section 66 (special audit by chartered accountant or cost accountant) What is an GST Audit? As per Section 2(13) of CGST Act, 2017’audit’ means the examination of records and other ...

OTHERS

AMENDMENT TO LAW ON CHEQUE BOUNCE

RJA 20 Feb, 2018

Cheques are used in almost all transactions such as re-payment of loan, payment of salary, bills, fees, etc. A vast majority of cheques are processed and cleared by banks on daily basis. Cheques are issued for the reason of securing proof of payment. Nevertheless, cheques remain a reliable method ...

OTHERS

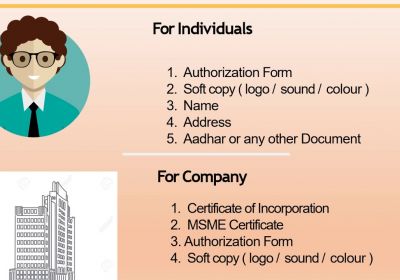

MSME CONSULTANCY & REGISTRATION

RJA 19 Feb, 2018

Micro, Small & Medium Enterprises - The Engine of inclusive growth & development The registration under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 is for facilitating the promotion and development and enhancing the competitiveness of Micro, Small, and Medium enterprises.MSME stands for micro, small and medium ...

Business Licence Registration

WHY TRADEMARK REGISTRATION REQUIED???

RJA 19 Feb, 2018

TRADEMARK REGISTRATION A Trademark is one of the most important business assets you’ll ever own. It distinguishes your company and its products in the marketplace. The marketplace is crowded and it’s hard to distinguish your business from your competitors.Trademarks/brands are an efficient commercial ...

INCOME TAX

DEDUCTIONS UNDER SECTION 80CCD OF INCOME TAX ACT

RJA 17 Feb, 2018

DEDUCTIONS UNDER SECTION 80CCD OF INCOME TAX ACT Income Tax Act, 1961 provides various tax deductions under Chapter VI-A for contribution to pension plans. Such deductions are available u/s 80C, 80CCC, and 80CCD. This guide talks about section 80CCD. This section provides tax deductions for contribution to the pension schemes ...

GST Consultancy

Analysis of Changes in Service Tax & GST via Finance Bill, 2018

RJA 05 Feb, 2018

Analysis of Changes in Service Tax and GST through Finance Bill, 2018 and GST Council 25th Meeting Finance Bill 2018 has been presented by the honourable Finance Minister on 1st February 2018 which has put forward some changes in the indirect taxation regime. Also, in recent days, several modifications have been made ...

OTHERS

HIGHLIGHTS OF UNION BUDGET 2018-2019

RJA 02 Feb, 2018

HIGHLIGHTS OF UNION BUDGET 2018-2019 Slab rates kept the same. Education Cess and SHEC rates increased to 4% from the existing 3%. Charitable / Religious Trusts claiming exemption under section 11 & 12 or under section 10(23C) for a business conducted by them will be needed to follow the provisions of sections 40(a)(ia), 40A, ...