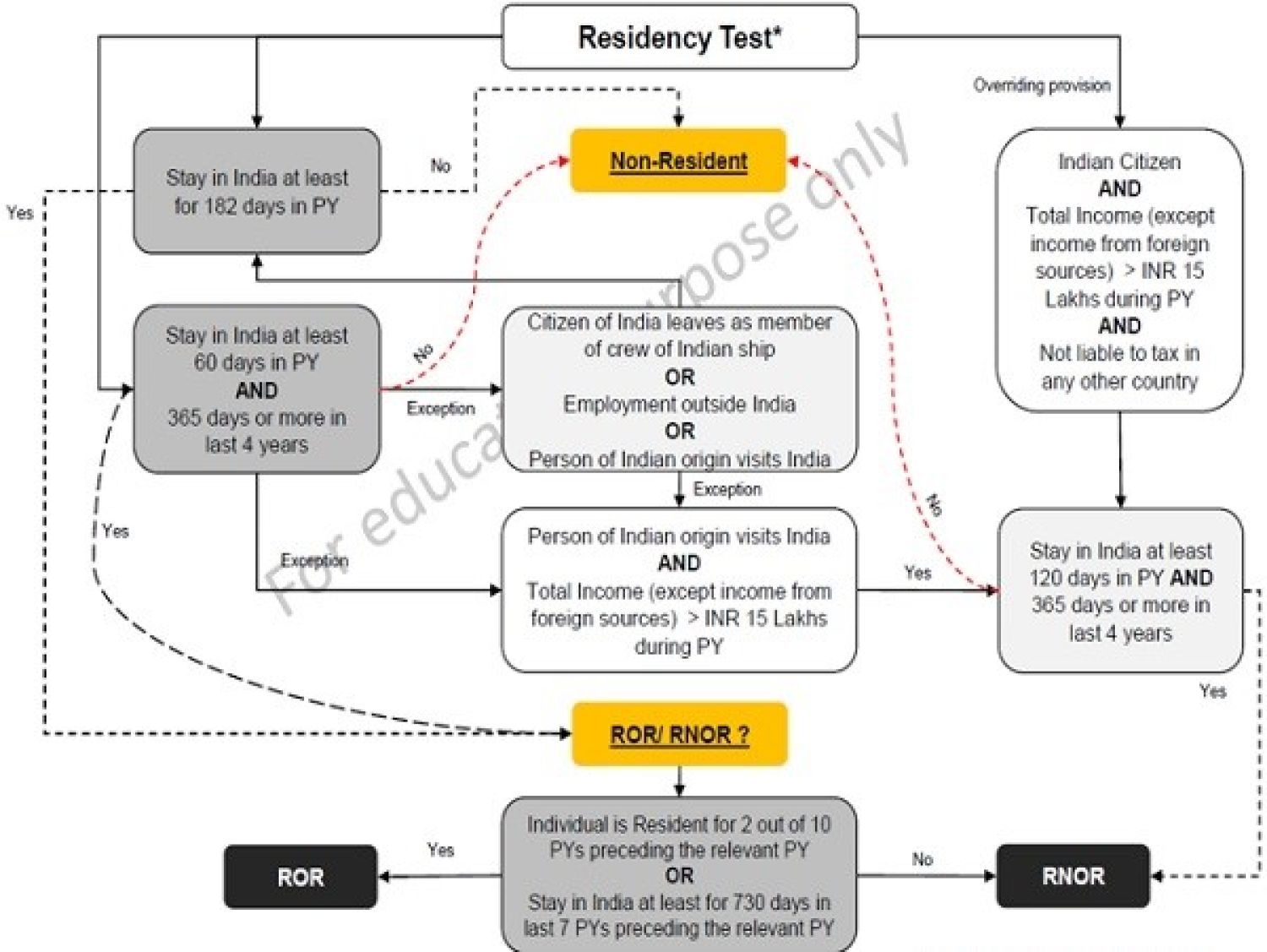

Tax incidence on an assessee depends on his residential status. For instance, whether an income, accrued to an individual outside India, is taxable in India depends upon the residential status of the individual in India. Similarly, whether an income earned by a foreign national in India (or outside India) is taxable in India, depends on the residential status of the individual, rather than on his citizenship. Therefore, the determination of the residential status of a person is very significant.

RESIDENTIAL STATUS ON INDIVIDUAL

An Individual is said to be a resident Indian for the purpose of Income-tax if one of the following Basic conditions are satisfied.

- An Individual is in India for a period of 182 days in the financial year in which he is getting his salary income or,

- An Individual is in India for a period of 60 days or more during the financial year in which he gets his salary and 365 days or more during 4 years immediately preceding that financial year.

If one of the above conditions is satisfied then he is a resident of India as per Income Tax. Non-Resident in India if he satisfies none of the basic conditions.

RESIDENT AND ORDINARILY RESIDENT OR RESIDENT BUT NOT ORDINARILY RESIDENT

If the Individual fulfils one of the following conditions then he is said to be a resident but not ordinarily resident of India:

- An Individual is a non-resident in India for 9 years out of 10 years immediately before the relevant financial year.

- An Individual is in India for a period of fewer than 729 days during 7 years immediately before the relevant financial year.

Else, he is considered as a resident and ordinarily resident in India.

These conditions need to be tested every year for every Individual.

1. When you are calculating the number of days, you have to include the day you left India and the day you arrived in India as part of your total stay in India.

2. Stay in India includes staying in territorial waters of India i.e. up to 12 nautical miles into the sea.

3. The stay need not be continuous. All different periods of stay in India have to be added up.

RESIDENTIAL STATUS OF HUF

A Hindu undivided family is said to be a resident in India if the control and management of its affairs are wholly or partly situated in India. A Hindu undivided family is a non-resident in India if the control and management of its affairs are wholly situated out of India. In order to determine whether a Hindu Undivided Family is a resident or a non-resident, the residential status of the Karta of the family during the previous year is not relevant

Residential status of a company

An Indian company is always resident in India. A foreign company is resident in India only if during the previous year, the control and management of its affairs are situated wholly in India. Conversely, a foreign company is treated as non-resident if, during the previous year, control and management of its affairs are either is wholly or partly situated out of India. A company can never be ordinary or not ordinarily resident in India.

Another person

Every other person is resident in India if control and management of his affairs are, wholly or partly, situated within India during the relevant previous. On the other hand, every other person is a non-resident in India if control and management of its affairs are wholly situated outside India.

Residential status and income to be taxed in India

1. If you are an NR (Non-Resident)

a) You are liable to pay tax "only" on the income earned in India.

b) You are "not taxed" on any income earned outside India "nor" on the income earned outside India out of a business controlled from India or a profession set-up in India

2. If you are RNOR (resident but not ordinarily resident)

a) You are liable to pay tax on the income earned in India + on the income earned outside India out of a business controlled from India or a professional set-up in India

b) You are "not taxed" on any income earned outside India

3. If you are ROR (resident and ordinarily resident)

You are liable to pay tax on all types of incomes i.e.

a) what you earn in India

b) earnings outside India out of a business controlled from India or a profession set-up in India,

c) and also on all other incomes earned outside India

The Foreign Exchange Management Act, 1999 (FEMA):

Section 2(w) - "person resident outside India" means a person who is not resident in India

Section 2(v) - "person resident in India" means-

- a person residing in India for more than 182 days during the course of the preceding financial year but does not include-

- a person who has gone out of India or who stays outside India, in either case-

- for or on taking up employment outside India, or

- for carrying on outside India a business or vocation outside India, or

- for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period;

- a person who has come to or stays in India, in either case, otherwise then-

- for or on taking up employment in India, or

- for carrying on in India a business or vocation in India, or

- for any other purpose, in such circumstances as would indicate his intention to stay in India for an uncertain period;

- a person who has gone out of India or who stays outside India, in either case-

- any person or body corporate registered or incorporated in India,

- an office, branch or agency in India owned or controlled by a person resident outside India,

- an office, branch, or agency outside India owned or controlled by a person resident in India;

Difference between the definition of "person resident in India" as per FEMA and Income Tax Act

Difference between Resident definition under the Income Tax Act and FEMA

- "Financial Year" is not defined under FEMA, but by convention, it is assumed to refer to 1st April to 31st March

- The Income-tax Act requires the physical presence of 182 days or more, whereas, FEMA requires 183 days or more

Income-tax Act considers the physical presence of a person in the Current Financial Year, whereas FEMA considers the physical presence of a person in the Preceding Financial Year

Foreign Exchange Management Act (FEMA)1999

Foreign Exchange Management act 1999 is an Act of Parliament for the amendment and the consolidation of the foreign exchange laws with the main aim of accelerating the external trade and payments for the promotion and development of the foreign exchange market in India. Under FEMA, the government shares ownership to impose restrictions on the payments being made to the residents situated outside India or vice-versa. Transactions involving foreign exchange require permission from FEMA to be processed further and demands to be initiated by the person sharing the authorization for the same. It lies in the interest of the government to restrict an authorized individual from processing foreign exchange deals within the current account based on the interest of the general public. RBI holds the power to for placing restrictions on the transactions of the capital account.

FEMA covers major operations demanding expert advice like an outbound investment, inbound investment, approval from the authorities, statutory compliances, NRI services, setting up of a branch office or liaison office, transfer of shares from residents to non-residents which falls under External Commercial Borrowing and gaining business value certificate.

Q.: What is FEMA's main objective?

Ans. FEMA's main objective is to ease international trade and payments while also fostering the orderly development and maintenance of India's foreign exchange market. FEMA regulates protocols, legalities, dealings, and other aspects of foreign exchange transactions in India. The Foreign Exchange Management Act (FEMA) divides foreign exchange transactions into two categories: (1) current account transactions and (2) capital account transactions.

Q.: What is a capital account transaction?

Ans. A "capital account transaction," as defined in Section 2(e) of the FEMA, is a transaction that alters the assets or liabilities of persons resident in India, including contingent liabilities outside India, or assets or liabilities of persons resident outside India, and includes transactions referred to in Section 6(3) of the FEMA. The following transactions are covered by FEMA Section 6(3): –

• A person residing in India transfers or issues any foreign security.

• Any security transfer or issue by a person residing outside of India.

• Any borrowing or lending in foreign exchange in any form or by whatever name called by any branch, office, or agency in India of a person resident outside India.

• Any borrowing or lending in rupees between a person residing in India and a person residing outside India, in whatever form or under whatever name.

• Deposits between Indian citizens and non-Indian citizens.

• Currency or currency notes export, import, or holding.

• Transfer of immovable property outside of India, excepting a five-year lease by a person residing in India.

• Purchase or transfer of immovable property in India, excepting a five-year lease by a person residing outside India.

• Providing a guarantee or surety in respect of any debt, obligation, or other liability incurred – 1. by a person residing in India and owing to a person residing outside India, or 2. by a person residing outside India.

Note: Section 6(3) of the Finance Act of 2015 has been repealed with effect from a yet-to-be-determined date.

Q.: What is the difference between a current account transaction and a bank account transaction

Ans. A "current account transaction," as defined in Section 2(j) of the FEMA, is a transaction that is not a capital account transaction. Without limiting the generality of the preceding, such a transaction includes:–

• Payments payable in the usual course of business in connection with overseas commerce, other current business, services, and short-term banking and credit facilities

• Payments due as interest on loans and as investment net income

• Remittances for the support of parents, spouses, and children who live abroad, as well as

• Expenses for parents, spouses, and children's international travel, education, and medical care.

• Under section 5 of the FEMA, any person may sell or draw foreign exchange to or from an authorised person if the transaction is a current account transaction, provided that the Central Government may, in the public interest and in consultation with the Reserve Bank, impose reasonable restrictions on current account transactions.

Q.: What are the main provisions of the FEMA Act of 1999?

Ans. The primary provisions of the FEMA Act of 1999 are as follows:

• Foreign exchange dealings, etc.

• Foreign exchange holdings, etc.

• Current account transactions

• Capital account transactions

• Goods and service exports

• Foreign exchange realisation and repatriation

• Certain cases are exempt from realisation and repatriation.

• Authorized persons (e.g., those authorised by the RBI to deal in foreign exchange or foreign securities)

• RBI's power to examine authorised individuals

• Violations and penalties

• Adjudication and appeal

• Directorate of Enforcement

• Miscellaneous clauses

CA Rajput and associates share expertise in providing a huge gamut of professional FEMA services like making the application to RBI for purchase and sale of debentures, setting up of joint venture, setting up a partnership by NRI’s or Indians, Issuance of Statutory services complying with RBI, and FEMA guidelines. We develop a structure for the companies to initiate the trade and manage external payments effortlessly.

Income tax Chart 2020 with covering latest Covid Relaxations & Alternative Tax Regime