CFO

THE NUTS & BOLTS OF A VIRTUAL CFO ENGAGEMENT

RJA 06 May, 2020

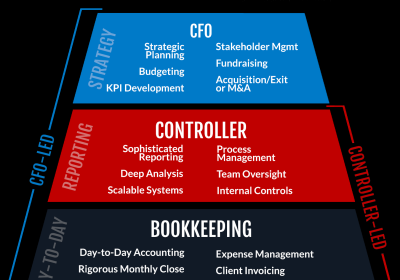

THE NUTS & BOLTS OF A VIRTUAL CFO ENGAGEMENT Interim CFO- Introduction (Interim CFO services) Most times, the Business needs someone to take over the duties of a CFO immediately. It could happen when the new CFO unexpectedly fails or is hospitalized for a prolonged period of time. Under such ...

OTHERS

Complete Information about Service Export from India Scheme (SEIS)

RJA 06 May, 2020

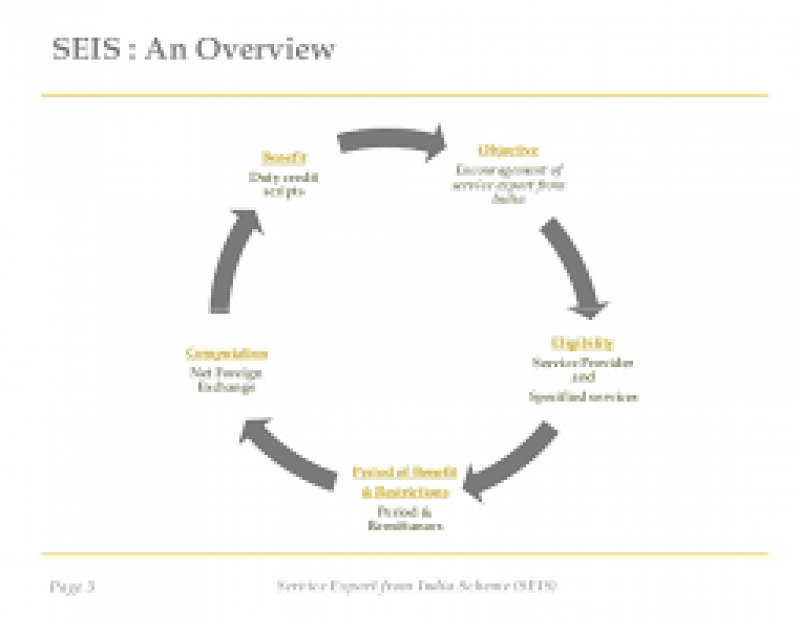

Complete Information about Service Export from India Scheme (SEIS) The Government of India launched the Service Exports from India Scheme (SEIS) under the Foreign Trade Policy (FTP)-2015, replacing the existing scheme 'Served from India Scheme' under the Foreign Trade Policy 2009-15. The key goal of the scheme is ...

COMPANY LAW

List of information document Requirements for New Company Registration/Incorporation

RJA 06 May, 2020

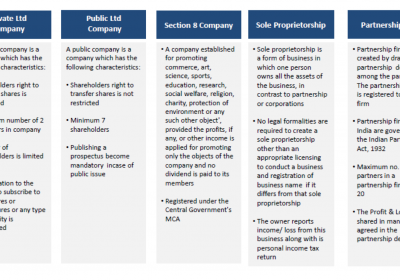

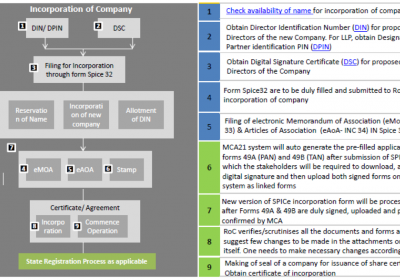

COMPANY FORMATION IN INDIA Company incorporation A company is generally formed through a process known as incorporation of company. When a company is incorporated legally, it becomes a separate entity from those who invest their capital and labour to run it. The legal process of forming a corporate entity ...

OTHERS

New Revised UDIN- FAQ for Bank Audit published by ICAI

RJA 05 May, 2020

New Revised Unique Document Identification Number (UDIN) Frequently Asked Questions for Bank Audit published by ICAI Question 1. When conducting a bank audit, if separate UDINs are needed for LFAR, tax audit, statutory audit report, etc.? Answer No, since UDIN must be generated by assignment to the signatory on a given ...

AUDIT

how to recognize internal signs/Financial Statement fraud: Fraud Red Flags

RJA 01 May, 2020

Learn how to recognize internal signs / Financial Statement fraud: Fraud Red Flags 1. Accounting irregularities, such as increasing sales without a corresponding rise in cash flows. Sales are much harder to control than cash flow, but they can work more or less in parallel over time. 2. Consistent demand growth while existing ...

GST Consultancy

Levy of IGST on ocean freight under RCM is unconstitutional

RJA 23 Apr, 2020

Levy of Integrated Goods and Services Tax on Ocean Freight under RCM is Unconstitutional The GST levy on ocean freight levied on services rendered by a person located in non-taxable territory by means of transport of goods by a vessel from a place outside India to a customs clearance ...

RBI

RBI Governor Announced the refinancing of Rs 50,000 crore for all Indian financial institutions

RJA 22 Apr, 2020

The Reserve Bank of India Governor Announced the refinancing of Rs 50,000 crore for all Indian financial institutions such as Nabard, SIDBI, and NHB. The Reserve Bank of India has turned its focus to fulfilling the borrowing needs of NBFCs, MFIs, and housing markets by offering special refinancing facilities of ...

TDS

NSDL: Extension of QTR TDS/TCS statement filing dates for Quarter

RJA 20 Apr, 2020

NSDL: Update on Extension of Quarterly TDS/TCS statement filing dates for Quarters. Extension of quarterly TDS / TCS statement submission of By the NSDL circular dates for Extension of due date for TDS returns for four Quarters of the Financial year. Due date of TDS/ TCS Return filling ...

COMPANY LAW

Everything about MCA Company Fresh Start Scheme (CFSS) 2020

RJA 01 Apr, 2020

Everything about MCA Company Fresh Start Scheme (CFSS) 2020 The Ministry of Corporate Affairs released Company Fresh Start Scheme 2020 full Circular 12/2020 dt 30.3.2020 which applies to both public and private corporations incorporated under the CoAct 1956/2013. The key provisions are as follows:- (1) Permits to register all outstanding refunds, accounts, records over any ...

ROC Compliance

GST applicability on Bitcoin in India

RJA 31 Mar, 2020

GST applicability on Bitcoin in India GST on Bitcoin – Is Bitcoin trading taxable? There are a lot of situations in which GST tax could be levied on Bitcoin trading and other cryptocurrencies. Let's find out if there's a GST on bitcoin. Authorized Person of India’...

COMPANY LAW

Filing of Director KYC (DIR- Filing of Director KYC (DIR-3 KYC)

RJA 16 Jan, 2020

Filing of Director KYC (DIR- Filing of Director KYC) (DIR-3 KYC): Provision: Provision: In compliance with Rule 12A of the Rules of Procedure of the Companies (Nominations and Qualifications of Directors) 2014, any person holding a DIN as of 31 March of the financial year shall apply an EFORM DIR-3 KYC ...

OTHERS

Complete Understanding on Business Valuation

RJA 01 May, 2019

Complete Understanding on Business Valuation Business valuation is primarily the approach for identifying a business's "economic value." This builds mainly on some financial assumptions and various limitations relating to the valuation date information available to assess the value of the company. The business can be assessed in ...

Transfer Pricing

Rules Penalties methods documentation required in Transfer Pricing

RJA 10 Sep, 2018

RULES, PENALTIES, METHODS, DOCUMENTATION REQUIRED IN TRANSFER PRICING What Is Transfer Pricing, Exactly? Transfer pricing refers to the prices that related parties charge one another for goods and services passing between them. Transfer pricing is a method of accounting that reflects the price charged by one division of ...

OTHERS

SERVICE EXPORTS FROM INDIA SCHEME

RJA 06 Sep, 2018

To encourage the export in the country the Foreign Trade Policy- 2015-2020 has been introducing a Service Exports from India Scheme (SEIS) with effect from 1 April 2015. This scheme provides benefits to ‘Service Providers located in India’ i.e. all service providers of notified services, ...

GST Registration

REQUIREMENT OF GST REGISTRATION

RJA 04 Sep, 2018

Registration is required in case of liability under RCM, even if no taxable supplies are effected In the case of the Joint Plant Committee [2018], the Authority of Advance Ruling held that if Assessee is engaged in providing exempt goods or services only then they not liable to apply for registration ...

GST Consultancy

No GST on Interest on Loan by DEL-Credere Agent

RJA 03 Sep, 2018

NO GST ON INTEREST ON LOAN BY DEL-CREDERE AGENT Act as a guarantor of credit extended to the buyer. A Del credere agent can act as a combination of a salesperson and an insurance firm. A Del credere agent becomes liable to pay the principal if the buyer made ...

Goods and Services Tax

Input tax credit of Goods and Services Tax

RJA 01 Sep, 2018

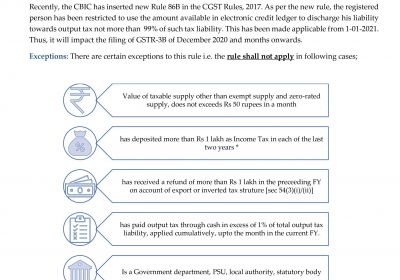

INPUT TAX CREDIT GST is the indirect tax that is imposed on the services and goods on the basis of the primary value addition. Hence, the imposing of the tax is totally based on the value addition at the single stage of the chain of supply until the finished product ...

GST Registration

How to do GST registration for the branches and business verticals?

RJA 28 Aug, 2018

According to the CGST Act, registration is important for suppliers of the taxable goods and services under the GST in the union territory, from the payable supply of the services and goods, is created. In addition, provisions have been given in the GST Registration Rules for getting GST registration ...

COMPANY LAW

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED

RJA 25 Aug, 2018

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED For the purpose of KYC on ROC -Directors database on ROC, ROC has entered for updated all persons holding DIN to complete DIN KYC on or before 30/09/2022. To close DIN KYC, the Director will be required to complete a form file ...

Transfer Pricing

OVERVIEW OF TRANSFER PRICING IN INDIA

RJA 14 Aug, 2018

OVERVIEW OF TRANSFER PRICING IN INDIA Transfer pricing refers to the prices that related parties charge one another for goods and services passing between them. The most common application of the transfer pricing rules is the determination of the correct price for sales between subsidiaries of a multinational corporation. These ...

GST Registration

Cancellation and revocation of Registration under GST

RJA 03 Aug, 2018

Cancellation and revocation of Registration under GST You want to cancel your GST (Goods and Services Tax) registration because GST does not apply to you or because you are closing your business or profession. Or there is some other valid reason due to which you want to cancel your GST ...

Goods and Services Tax

HSN & SAC Codes along with GST Rate

RJA 03 Aug, 2018

What is HSN codes? HSN stands for Harmonized System of nomenclature. This coding system is developed by World Customs Organization (WCO). This is a Global standard of Nomenclature of trading goods in international trade. The HSN is the codification of all tradable commodities into 20 broad sections with each chapter containing ...

Transfer Pricing

Aims & Objective of Transfer Pricing

RJA 03 Aug, 2018

OVERVIEW ON TRANSFER PRICING Transactions between two or more enterprises belonging to the same multinational group have created a new and complex issue as a result of the increasing participation of multinational groups in economic activities in the country. To provide a detailed statutory framework that can lead to the ...

Business Setup in India

Government fees for company registration

RJA 01 Aug, 2018

If you are registering a startup or a new business in India then first and foremost, there are some official procedures of startup or a company has to follow in order to register them in Indian official records, MCA (ministry of Corporate Affairs) will charge registration fees given as ...