Table of Contents

Complete Information about Service Export from India Scheme (SEIS)

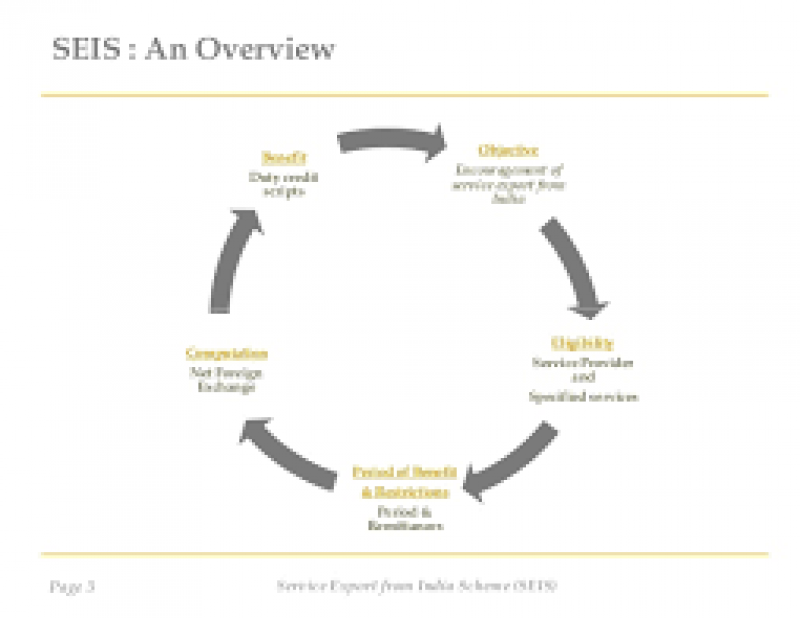

The Government of India launched the Service Exports from India Scheme (SEIS) under the Foreign Trade Policy (FTP)-2015, replacing the existing scheme 'Served from India Scheme' under the Foreign Trade Policy 2009-15. The key goal of the scheme is to keep our companies affordable internationally in terms of costs. Under SEIS, service providers with notified services are incentivized, in the form with obligation credit codes, at a rate of 3 to 5 percent on their net foreign exchange earnings. These SEIS texts are transferable and can also be used for the payment of a variety of central duties/taxes, including specific customs duties.

Criteria for eligibility SEIS benefits –

· The service provider will have a total net free foreign exchange earnings of $15,000 in the year the facilities are delivered.

· In the case of private service providers and sole proprietorships, the required net foreign exchange earnings requirement should be US$ 10,000 in the financial year that the services were delivered.

· The service provider must have an active Import Export Code (IE Code) at the time of making the services for which incentives are sought.

If the service provider fulfills the above-mentioned compliance requirements, SEIS incentives that be obtained in the form of Duty Credit Scrips, but only for certain services specified in Appendix 3D.

When to apply for SEIS Benefits

An electronic application must be sent to the DGFT portal and the appropriate knowledge fields must be included in the SEIS ECOM section. Both related forms ANF3B and Annexure to ANF3B are available online. You will also use the http:/dgft.gov.in/links/appendices-and-anf-ftp2015-2020 page on the DGFT website to access the SEIS Application Forms.

Registration with the Business Export Promotion Council

Either you are a producer or a business supplier, RCMC (Registration Cum Membership Certificate) from the relevant Export Promotion Council is compulsory in your key line of business. Pursuant to Public Notice No. 26/2015-2020 dated 01.08.2018 released by the Directorate-General for International Trade, Department of Commerce, to add the "Others" group to the list of 14 SEPC service sectors. Now all services are provided by SEPC along with the 14 services sectors specifically listed above. Therefore, if you are a service provider and want to make use of SEIS benefits, then SEPC RCMC is mandatory.

The following initial document(s) required for the submission of an application for the grant of SEIS:

1. Invoice(s) against which supplies have been made and remittance(s) have been made in FCC;

2. E-BRC against each invoice(s) on which deliveries have been made and remittance(s) have been made in FCC;

3. Copy of the IEC number,

4. Copy of the current RCMC of the Business Export Promotion Council;

5. Copy of Company Tax / GST Certificate of Registration;

6. Valid Digital Key (DSC Class 3) required for the submission of a SEIS grant application with O / o ADGFT, New Delhi;

CAP /CEILING ON THE ADVANTAGES OF MSIS

- The Export Value of MEIS for the period 01.09.2020 to 31.12.2020 is limited to Rs . 2 crores per IEC.

- MEIS Gain is not available for IEC holder not exporting within the period 01.09.2019 to 31.08.2020 as well as new IEC holder registered after 01.09.2020.

- MEIS benefits are not available w. e. f. from 01.01.2021