Table of Contents

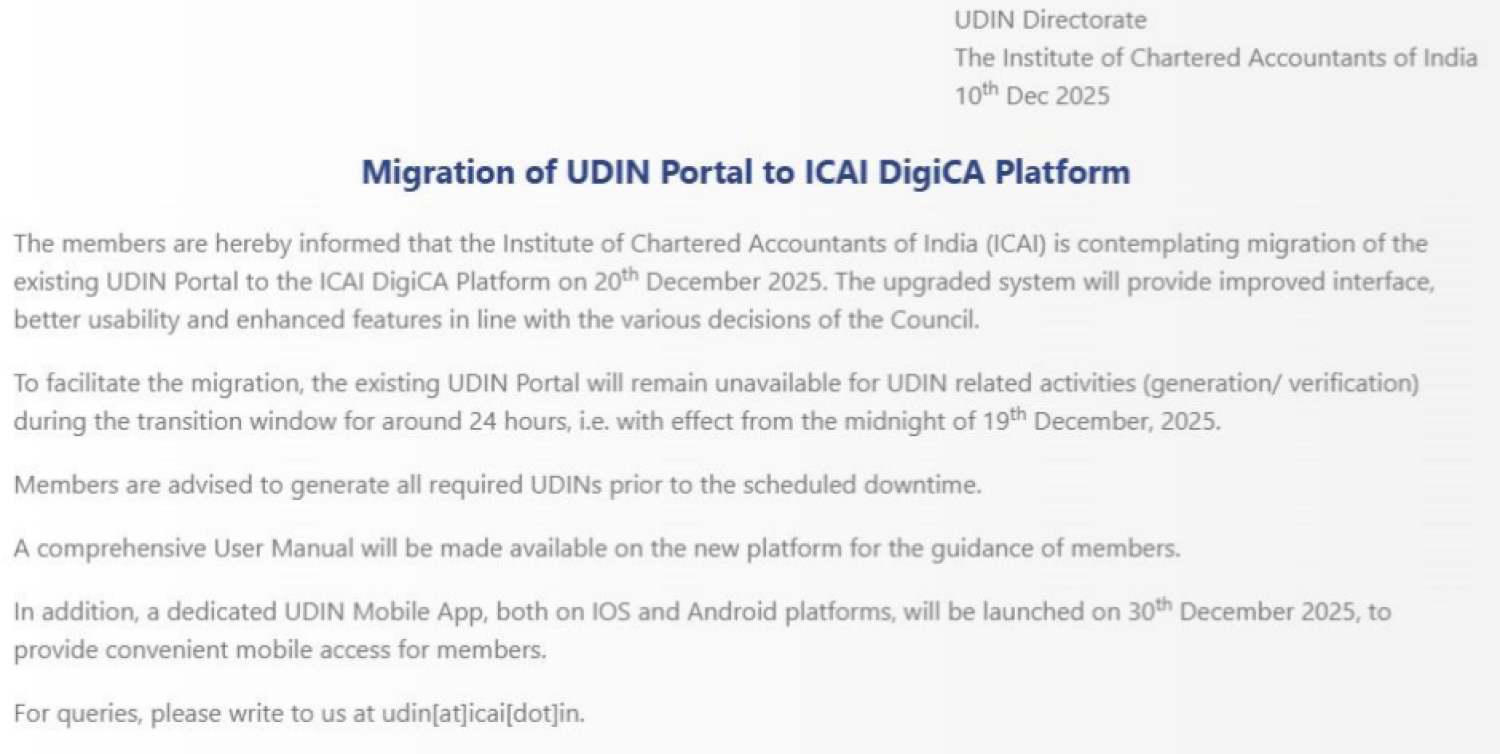

New Revised Unique Document Identification Number (UDIN) Frequently Asked Questions for Bank Audit published by ICAI

Question 1. When conducting a bank audit, if separate UDINs are needed for LFAR, tax audit, statutory audit report, etc.?

Answer No, since UDIN must be generated by assignment to the signatory on a given date, one UDIN will be sufficient for the bank audit report, including LFAR and Certificates. However, separate UDIN will be required to be assigned separately to the Tax Audit Report.

Question 2. Under Bank Audit, should separate UDINs be produced for Certificates signed?

Answer Because the Certificates are part of the Bank's audit assignment and are released with the Bank's audit report along with LFAR, one UDIN is appropriate and no separate UDIN is needed to be created for the Certificates. However, when generating UDIN, the details of multiple reports and certificates can be entered by the "Add more" button.

Question 3. If the Certificate(s)/Report(s) issued under bank audit are signed on different dates, would it be appropriate to have a separate UDIN?

Answer Yes, Separate UDIN will be required as UDIN must be created by the assignment to the signatory on a given date.

Question 4. In the case that certain Certificate(s)/Report(s) are signed by one Partner and others are signed by another Partner, is there a need for a separate UDIN for each particular Partner?

Answer When different parties sign different certificates/reports then separate UDINs must be taken as UDINs to be produced by the signatory.

Question 5. Is UDIN applicable to both statutory central auditors (SCAs) and statutory auditors (SBAs)?

Answer Yes, UDIN refers to both SCAs and SBAs for Bank (Branch) Audit Reports and Tax Audit Reports when performing Bank (Branch) Audits.

Question 6. Is UDIN mandatory for a bank audit report and a tax audit report that is/are filed online using Digital Signature?

Answer UDIN will apply both manually and digitally signed reports uploaded online.

Question 7. That a separate UDIN would be needed by the Joint Auditor?

Answer Yes, Every signatory auditors must receive UDIN separately and show their UDINs separately on the reports certified by them. The auditor may use the same or different keyword phrases/statistics while creating such UDINs.

• A drop-down easily understood list, shown below, appears on the List from which the Member may pick the certification to be issued. In the event that their certificates do not fit the list issued, Members are advised to select others and to indicate the certificate terminology in the Certificate Description.

- Certificate of Short Sale of securities issued by Concurrent Auditors of Treasury Department of Banks

- Certificate of physical verification of securities issued by Concurrent Auditors of Treasury Department of Banks

- Certificate issued for KYC purpose to banks confirming sole proprietorship

- Certificate Regarding Sources of Income

- Certification under the Income-Tax laws for various Deductions, etc.

- Certificates for funds/ Grants utilization for Statutory Authority

- Certificates for funds/ Grants utilization Under FERA/FEMA/other Laws

- Certificates for funds/ Grants utilisation Charitable trust/institution

- Certification for a claim of refund under the GST Act and other Indirect Taxes.

- Certification under Exchange Control legislation for imports, remittances, ECB, DGFT, EOU, etc

- Additional Certification by Concurrent Auditors of Banks not forming part of the concurrent audit assignment

- Certificates for Claiming Deductions and Exemptions under various Rules and Regulations

- Certificates in relation to initial Public Issues/compliances under ICDR and LODR.

- Certificate issued by Statutory Auditors of Banks

- Certificate issued by Statutory Auditors of Insurance Companies

- Certificates issued under LLP Act

- Certificates issued on the basis of Financial books of accounts and annual financial statements-Capital Contribution Certificate/net worth certificate

- Certificates issued on the basis of Financial books of accounts and annual financial statements – Turnover Certificate

- Certificates issued on the basis of Financial books of accounts and annual financial statements -Working Capital Certificate/Net Working Capital Certificate.

- Certificates issued on the basis of Statutory records being maintained under the Indian Companies Act, 2013 and applicable provisions

- Certification of Fair Values of Shares of Company for the scope of merger / de-merger, Buy Back, Allotment of further shares, and transfer of shares from resident to non-resident.

- Certificates for Foreign Remittance outside India in form 15CB.

- Net worth Certificates for Bank finances

- Net worth Certificates for Bank Guarantee

- Certificates for funds/ Grants utilization for NGO’s

- RBI Statutory Auditor Certificate for NBFCs

- Certificate issued under RERA

- Net worth Certificates for Student Study Loan

- *Certificates includes Reports issued in lieu of a Certificate in terms of Guidance Note on Reports or Certificates for Special Purposes (Revised 2016)

- Net worth Certificates for Issuance of Visa by Foreign Embassy

- Certificate in respect of Liquid Asset under Section 45-IB of RBI Act, 1945

- Certification of arms-length price u/s 92 of the Income Tax Act, 1961.

- Others

MEMBERS OF THE ICAI ARE ADVISED TO UPDATE INVALIDATED UDIN AGAIN: THE UDIN UPDATE DEADLINE IS APRIL 30TH.

Few of the Probable resolutions are:

1) Please retry to update UDIN now again.

2) Complain to UDIN Directorate, ICAI:

If the problem is arised, you can submit a complaint via the UDIN portal:

- https://udin.icai.org/complaints.

- Email id: udin@icai.in, ICAI UDIN Help desk cell : 01130110480

If the error persists, take a screenshot and email it to efilingwebmanager@incometax.gov.in with the subject line:

A) Your Login Id ,

B) PAN of Client &

C) UDIN

We needed to update UDIN against pending forms on or before 30th April 2022.

- ·For update Unique Document Identification Number, login to e-Filing portal, go to e-File menu -> Income Tax Forms -> View/ Update UDIN Details.

- ·You can update Unique Document Identification Number

- ·for one Form at a time OR for multiple Forms using bulk Unique Document Identification Number upload feature.

Things to know before updating Unique Document Identification Number UDIN:

- Cross check the Form number and AY with ICAI UDIN portal, before updating UDIN on e-filing Portal

- Cross check the PAN of Assessee(if provided on UDIN portal), before updating UDIN

- UDIN should not be consumed against any other Form

- If you are filing a revised Form, then generate a new UDIN from UDIN portal

- You will be able to update UDIN under ‘View/ Update UDIN Details’ screen, only after the Form is accepted by Assessee.

RBI Update :

MEF - Draft Bank Branch Auditors’ Panel of CA's /firms for the year 2022-23

Popular Articles :

-

Institute of Chartered Accountants of India issues FAQs on UDIN

-

Frequently asked questions (FAQ) on UDIN issued by the income tax department

-

Complete Overviews of Unique Document Identification Number(UDIN)

Regards

Rajput Jain & Associates