Table of Contents

THE NUTS & BOLTS OF A VIRTUAL CFO ENGAGEMENT

Interim CFO- Introduction (Interim CFO services)

Most times, the Business needs someone to take over the duties of a CFO immediately. It could happen when the new CFO unexpectedly fails or is hospitalized for a prolonged period of time. Under such a situation, you could either make every attempt to look for an applicant, and waste valuable time and resources before the new hire begins working for your company, or you could put an experienced CFO from our team, as your Temporary CFO. That would help the organization bridge the void produced by the outgoing CFO and the incoming CFO.

Our Provisional CFO Services will cover the gap of your empty CFO Chair from the time of his absence until a new one is appointed. With our highly trained and seasoned experts on board, you don't need to think about your finances. They'll take over the steering and boost your financial role in the top gear.

While your mandatory CFO is out of the picture, save the energy and time to recruit a skilled CFO for your organization. Hiring our interim CFO would save your money and get an expert on board without any effort!

Our agile interim CFO would relieve you of the pressure that surrounds you and provide you with the right financial outlook.

ONBOARDING

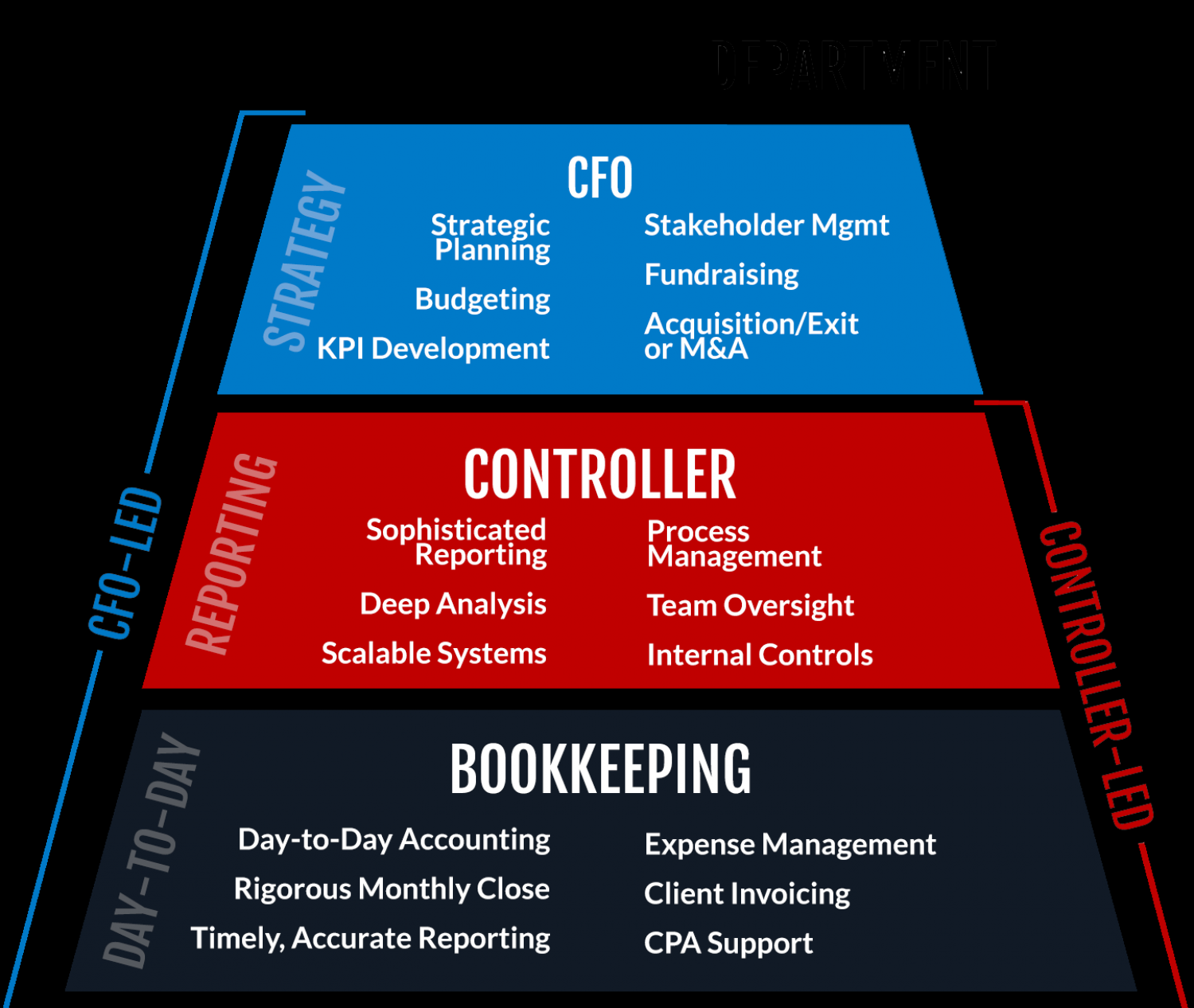

Getting a virtual CFO onboarded, systems in place, and everyone up-to-speed often takes three to four months. A weekly meeting cadence is customary for this period. Some of the common activities accomplished during this time are:

- Goal Setting - Your provider should start by understanding your short and long-term goals. Your goals help determine the information you’ll need to hit the milestones en route to achieving them. Your information requirements, in turn, inform the technology, team, and process needed to generate it.

- Report Design - Your provider should be able to present reports which match the way you interpret data. Some owners digest visual data better and will benefit from more charts and graphs. Others are more numbers-data oriented and can consume reports with numerical data only. The service provider will highlight the few key metrics that you need to be watching now and evolve those as your business challenges and opportunities change.

- Technology Recommendations - Your provider may see that your system would work more efficiently with new software with a balance of price, performance, security, and stability.

- Rebuild Balance Sheet - After some analysis, the provider may need to rework your balance sheet to get a more accurate picture of financial reality.

- Build or Enhance Financial Processes - One benefit of hiring a virtual CFO service provider is that you are not only getting their expertise, but you can benefit by borrowing from their knowledge of processes they've built or used in other businesses. This onboarding time can be used for restructuring your processes for better productivity.

The Virtual CFO service should be able to give you a 90 to 120-day roadmap of everything that will occur in this time period. This roadmap is a crucial first piece in the engagement with the service provider.

ONGOING DELIVERABLES

- Weekly or Monthly Deliverables

After onboarding is completed, the virtual CFO often has a monthly scheduled meeting with your company to review and discuss the financial reporting package. The CFO should also be available at other times as questions come up or when information is needed by either party.

- CFO Insights and Communication

The right virtual CFO service will deliver detailed and comprehensive financial reporting. Additionally, they may schedule meetings to provide context and expert guidance around these reports.

Communication is usually handled via phone or video conference with a service like Zoom or GoTo Meeting. Document sharing may be handled by emails or a document management solution like Box, Smart Vault, or Google Drive.

The frequency of regular reporting will depend on your company and needs. The starting point is usually monthly, though weekly cash flow or daily flash reports may need to be shared and monitored.

The data itself will likely come from a variety of sources. The components of the ultimate reporting package may temporarily live in various formats like Word, Excel, PowerPoint, QuickBooks, or a Business-specific analytics tool like SaaSOptics (for SaaS) or AutoTask (for MSPs). The virtual CFO often delivers the final monthly report in a single, easy-to-read PDF.

Reasons to Hire an Interim CFO

1. Interim CFO is flexible: Flexibility is the main advantage you gain by hiring an expert Interim CFO. Their flexibility is your freedom to get the work done whenever you need it. And they know exactly how to deal with the ever-changing financial conditions. Get your work done at your said time and pay only for what you require.

2. They are seasoned and know what to do

Interim CFOs come with the knowledge and experience required to get you past all your difficulties. Hiring an Interim CFO in the middle of your financial turmoil won’t bother them. They’re well-experienced to quickly adapt, analyze the conditions and work right away.

3. Their work is equivalent to a full-time CFO

Are you experiencing financial turbulence and have no CFO on board? Hiring a new one seems like a tedious job. Instead, try hiring an Interim CFO to resume the pending work and also get the services of a full-time CFO!

4. No paying hefty paychecks for a CFO

Stuck on the thought of hiring an Interim CFO but worried about what price tag they may come with? Interim CFOs act as your full-time CFO but charge you substantially less. Thus, hiring their inexpensive services will help you improve your financial circumstances without burning a hole in your pocket.

When to hire an Interim CFO?

Your business is running at a great pace and suddenly you are stuck because of the unexpected departure of your CFO. There’s no smartness in letting your business suffer due to the gap. Hiring a new CFO in a short time can be a challenging task. It’s difficult to find someone with the same competencies as that of your old CFO who was well-versed with your financial state.

Not having a CFO for even a short span of time can be harmful to your business. Interim CFO fills in the gap from the time of departure of your CFO till the start date of your new one.

When is the right time to hire an Interim CFO?

- When your CFO has departed from your organization

- Your company is going through a Merger & Acquisition procedure

- You are restructuring your business and need financial assistance

- Need an expert on an important upcoming project and to resolve any financial glitches.

- Startups and rapidly growing businesses can benefit from Interim CFO.

Why choose us?

CFO Services is based in Mumbai providing its services across India. We provide well-experienced Interim CFOs that work towards giving you all that you ask for. Our team of experts has the right blend of experience and knowledge that would reap huge benefits.

- Your search for an Interim CFO ends right here!

- We at CFO Services bring you a bundle of services at your convenience and at an affordable price.

- We also offer a free audit for you to know your current position.

- Fill out the form below and contact us right away to save yourself the time and effort of searching for a new CFO!

FAQ’s on Virtual CFO

What is the distinguishes between a Virtual CFO and a traditional CFO?

An company appoints a traditional CFO to carry out the functions of a CFO. A virtual CFO, on the other hand, provides an organisation with the outside guidance and assistance. When compared to a traditional CFO, using a Virtual CFO is beneficial.

Also Read :

- What's Better: online CFO or inhouse fulltime CFO services

- Key ideas & prospects for CA’s practice to develop

- Upgrade your business, redesign your finance mechanism

What are the advantages of hiring RJA as a virtual CFO?

We provide the following services at RJA:

- Professional help & Support.

- Customer 24*7 Support

- Highly Integrated Information technology Team.

- Expert Team of Company Secretary and Chartered Accountants.

Are these services superior to using a typical CFO?

- Yes, virtual services are preferable than traditional services. When compared to traditional services, virtual services are faster. Furthermore, virtual services use a variety of interfaces, such as AI and data analytics, to accelerate the process.

What are the major services that a virtual CFO provides?

- A virtual CFO can provide a variety of services, including:

- Income Tax Filing.

- Financial Management.

- MIS Reporting.

- Budgetary Control.

- GST Filing.

- HR Management.

- Legal Process Work.

Popular Article :