INCOME TAX

No Notional Taxation! If gap in value of stamp duty is no more than 20% of actual transaction,

RJA 18 Jan, 2021

No Notional Taxation! If the gap in the value of the stamp duty is no more than 20% of the actual value of the transaction, Valuing the stamp duty is a benchmark tax price and plays an important role in the tax obligation evaluation of the property's value. Now ...

FEMA

Increasing Foreign Direct Investment Opportunities in India

RJA 17 Jan, 2021

Continuously Increasing FDI in India As the country has one of the most facilitative policies to draw overseas investors. In the midst of the Covid-19 pandemic, Commerce and Industry Minister Piyush Goyal said India is experiencing a fast and sustained recovery in economic performance measures. In the first nine ...

OTHERS

Single Point Registration Scheme

RJA 15 Jan, 2021

Single Point Registration Scheme Overview of Ministry of Micro Small & Medium Enterprise Scheme In 1955, the Indian Government launched the National Small Industries Corporation Limited to foster the growth of small industries in our country. Under this Single Point Registration Scheme (SPRS) for participation in Government Transactions, NSIC registers all ...

IBC

Retention of records by Insolvency Professionals relating to CIRP under IBC

RJA 08 Jan, 2021

Retention of records by Insolvency Professionals relating to CIRP under IBC Insolvency and Bankruptcy Board of India (IBBI) has issued a circular on “Retention of records relating to Corporate Insolvency Resolution Process (CIRP) by an Insolvency Professional” vide circular no. No.: IBBI/CIRP/38/2021 dated 06th January 2021 in the ...

Goods and Services Tax

GST Rule 86B : 1% payment of tax liability in cash in GST

RJA 06 Jan, 2021

What is the restriction imposed pursuant to Rule 86B on ITC? Recently, the CBIC has inserted new Rule 86B in the CGST Rules, 2017. As per the new rule, the registered person has been restricted to use the amount available in the electronic credit ledger to discharge his liability ...

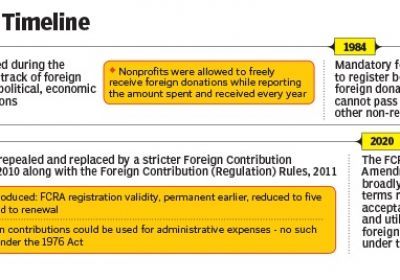

FCRA

Changes to the Annual Return under the FCRA

RJA 01 Jan, 2021

Changes to the Annual Return under the Foreign Contribution Regulations Act : The Foreign Contribution Regulation Act of 2010 (“FCRA”) and the Foreign Contribution Regulation Rules (“FCRR”) have recently undergone some modifications. The modifications are as follows: 1. Registration, Prior Approval, and Renewal of Registration Consolidated Form: Previously, Form ...

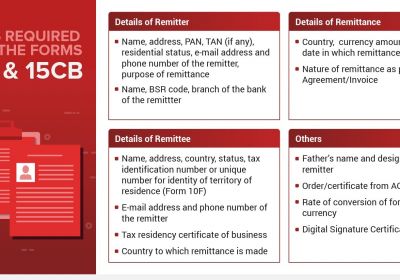

Form 15CA & 15CB Certificate

Applicability of Forms 15CA and 15CB for Goods Importation

RJA 01 Jan, 2021

Applicability of Forms 15CA and 15CB for Goods Importation As previously indicated, Form 15CA and Form 15CB are not necessary for payments on the exempted list; nonetheless, Form 15CA and Form 15CB were required for all types of payments. Importers who are compelled to make regular payments to non-residents may ...

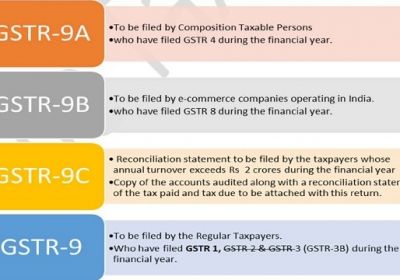

GST Filling

Not required to file GSTR-9C for Financial Year 2019-20 if Total Sale less than INR 5 Cr

RJA 10 Dec, 2020

GST Registered Person having total up to Rs 5 Cr, no needed to file GSTR-9C for Financial Year 2019-20 As per the Central Board of Indirect Taxes and Customs though this notification No. 79/2020-dated 15, Oct 2020 replaced, Subject to Rule 80(3) of the Central Goods and Services Tax Rules 2017 (CGST Rules), the ...

INCOME TAX

Frequently asked questions (FAQ) on UDIN issued by the income tax department

RJA 10 Dec, 2020

Frequently asked questions (FAQ) on UDIN issued by the income tax department The Institute of Chartered Accountants of India has been pioneering in the construct of a unique idea called 'Unique Document Identification Number (UDIN)' after finding false certifications by Non - Chartered Accountants’ that have been misrepresented as ...

INCOME TAX

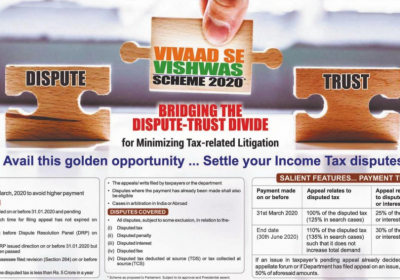

Income Tax dept. permit the revision of declarations filed under Direct Tax Vivad se Vishwas scheme

RJA 09 Dec, 2020

Income Tax dept. permit the revision of declarations filed under the “Direct Tax Vivad se Vishwas Act scheme” The CBDT has explained in FAQ’s that the 'Vivad Se Vishwas' scheme should not be used in a situation where proceedings are pending before the Income Tax Settlement ...

Goods and Services Tax

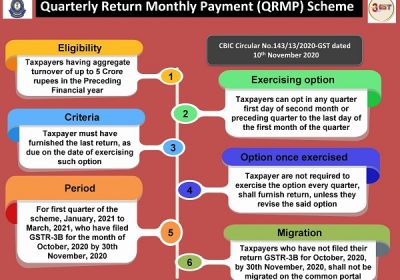

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme

RJA 09 Dec, 2020

GSTN: Features of Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme 1. Who could choose for the scheme: With effect from 1st Jan 2021, Below Registered Persons can opt to submit Qtrly GSTR Returns & Pay tax on a monthly basis: A Registered person’s required to file Form ...

GST Compliance

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR

RJA 08 Dec, 2020

GST Rate @ 12% applies on Mixed Supply of Works Contract & Job Work: WB AAR West Bengal - Authority of Advance Ruling directed that 12 per cent GST Rate be extended to a mixed supply of works and job work contracts. The applicant is the owner of M/s Vrinda Engineers Private ...

GST Filling

Prevent common errors when filing with GSTR-1

RJA 02 Dec, 2020

Avoid Common Errors/Mistakes when making GSTR-1 Filing After the introduction of Rule 59(6) of the CGST Rules 2017, you will have the idea that simply filing GSTR-1 is not sufficient for your business. As per the new regulations, not filing GSTR 3B on a continuous basis will result in a limitation ...

Goods and Services Tax

GSTN has notified supply of identified 49 items contains a 8 digits of HSN in Tax Invoice

RJA 02 Dec, 2020

The GSTN has issued Notified through 90/2020- dated 01.12.2020 whereby the supply of specified 49 products requires mention of 8 digit HSN in Tax Invoice. Currently, companies mention up to a 4-digit tariff code when issuing invoices. The registered person shall indicate in a tax invoice given by him 8 digits of the Harmonized ...

IBC

FRESH NORMAL For ONLINE HEARING AT NCLT & NCLAT

RJA 01 Dec, 2020

FRESH NORMAL AT NCLT & NCLAT– ONLINE HEARING The Year 2020 is an extraordinary year in a unique era. Technology helps us survive. The two Tribunals (online hearing process at NCLT and NCLAT) have only been hearing urgent matters until recently. Now the Tribunals court are moving to standard case ...

GST Compliance

E-invoices details are auto-populated in the Respective GSTR-1 tables.

RJA 01 Dec, 2020

E-Invoicing Applicability E-invoicing applies to businesses with a turnover of more than 20 crores in any of the previous financial years From 2022-23 onwards..The initial ceiling was 500 crores, which was later reduced to 100 crores, and now the restriction has been set at 20 crores. However, regardless of the turnover limit, there ...

INCOME TAX

CBDT Given Explanation on DIRECT TAX VIVAD SE VISHWAS SCHEME

RJA 01 Dec, 2020

CBDT: ISSUE AN EXPLANATION IN RESPECT OF DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Central Board of Direct Taxation through the Circular at the end of October 2020 issued an Explanation in respect of DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Under the current section 5(2) of the Vivad se Vishwas Act, the ...

INCOME TAX

Ministry of Finance discloses the new GST UPI Payment Guidance

RJA 01 Dec, 2020

Ministry of Finance discloses the new GST UPI Payment Guidance The Indian Govt issued the exemption in the fine to those pursuing companies to consume Business to Business transactions for a term of four months from 01 Dec 2020 to 31 Dec 2021 in order to issue invoices except dynamic QR code through ...

INCOME TAX

CBDT: Tax Department hopes to finalize all faceless e-Assessments by mid-September.

RJA 30 Nov, 2020

Income Tax Department hopes to finalize all faceless e-Assessments by mid-September. 3.130 tax officers, including 600 Income Tax officers, are engaged in the operation of the Faceless Income Tax Assessment Scheme. Of the 58,319 cases selected for faceless assessment, 8,700 cases have already been disposed of. The system, 1st announced by FM Minister Nirmala ...

INCOME TAX

Faceless Assessment: Step by step Procedure & Reasons for the implementation in India

RJA 30 Nov, 2020

E-Assessment Process: The E-filing portal is built as a forum for the conduct of various tax procedures online and electronically. E-Assessment under Income Tax Appeal is a mechanism in which tax officers interact via e-mail and to the taxpayer's account on the e-filing site. On further receipt of the ...

INCOME TAX

AMT : Essential of Alternate Minimum Tax(AMT) & Difference with MAT

RJA 29 Nov, 2020

Essential of Alternate Minimum Tax(AMT) & Difference with MAT Alternative Minimum Tax – Essential The aim of the Finance Act 2011 is to tax such LLP differently. A new Chapter XII-BA titled "Special Provisions relating to certain LLP" was adopted on 01 April 2012. Under this chapter, LLPs are now ...

Goods and Services Tax

GST: Upcoming Major Changes under GST Regime may take place in 2021

RJA 29 Nov, 2020

GST: Upcoming Major Changes under GST Regime may take place in 2021 GST Changes w.e.f. 01st January 2021 1. Pre-filled GST returns to become the norm from 1st January 2020: GSTR - 3B: Sales Crossing Rs. Five Crore in Last Financial Year needs to file GSTR-3B on a regular monthly basis ...

GST Registration

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration

RJA 29 Nov, 2020

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration A Standard Operating Procedure (SOP) has been introduced by the CBIC for the verification of taxpayers deemed to be registered. As of August 21, 2020, rule 9 of the 2017 CGST Rules provides that in cases where the applicant has either not ...

Income tax return

Tax filing: changes are taken into account when making the ITR

RJA 27 Nov, 2020

Tax filing: changes are taken into account when making the ITR New Notified ITR forms are subject to certain major changes. Taxpayers should keep these changes into account before filing their ITR for FY 2020-21. The new Financial budget for 2021 adopted the interchangeability of and Aadhaar Vs PAN. ...