Goods and Services Tax

GSTN has notified supply of identified 49 items contains a 8 digits of HSN in Tax Invoice

RJA 02 Dec, 2020

The GSTN has issued Notified through 90/2020- dated 01.12.2020 whereby the supply of specified 49 products requires mention of 8 digit HSN in Tax Invoice. Currently, companies mention up to a 4-digit tariff code when issuing invoices. The registered person shall indicate in a tax invoice given by him 8 digits of the Harmonized ...

IBC

FRESH NORMAL For ONLINE HEARING AT NCLT & NCLAT

RJA 01 Dec, 2020

FRESH NORMAL AT NCLT & NCLAT– ONLINE HEARING The Year 2020 is an extraordinary year in a unique era. Technology helps us survive. The two Tribunals (online hearing process at NCLT and NCLAT) have only been hearing urgent matters until recently. Now the Tribunals court are moving to standard case ...

GST Compliance

E-invoices details are auto-populated in the Respective GSTR-1 tables.

RJA 01 Dec, 2020

E-Invoicing Applicability E-invoicing applies to businesses with a turnover of more than 20 crores in any of the previous financial years From 2022-23 onwards..The initial ceiling was 500 crores, which was later reduced to 100 crores, and now the restriction has been set at 20 crores. However, regardless of the turnover limit, there ...

INCOME TAX

CBDT Given Explanation on DIRECT TAX VIVAD SE VISHWAS SCHEME

RJA 01 Dec, 2020

CBDT: ISSUE AN EXPLANATION IN RESPECT OF DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Central Board of Direct Taxation through the Circular at the end of October 2020 issued an Explanation in respect of DIRECT TAX VIVAD SE VISHWAS ACT, 2020. Under the current section 5(2) of the Vivad se Vishwas Act, the ...

INCOME TAX

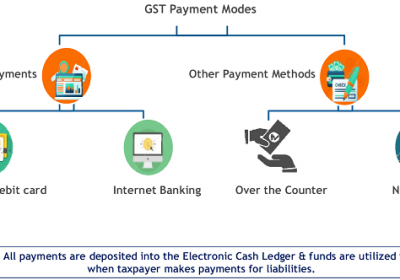

Ministry of Finance discloses the new GST UPI Payment Guidance

RJA 01 Dec, 2020

Ministry of Finance discloses the new GST UPI Payment Guidance The Indian Govt issued the exemption in the fine to those pursuing companies to consume Business to Business transactions for a term of four months from 01 Dec 2020 to 31 Dec 2021 in order to issue invoices except dynamic QR code through ...

INCOME TAX

CBDT: Tax Department hopes to finalize all faceless e-Assessments by mid-September.

RJA 30 Nov, 2020

Income Tax Department hopes to finalize all faceless e-Assessments by mid-September. 3.130 tax officers, including 600 Income Tax officers, are engaged in the operation of the Faceless Income Tax Assessment Scheme. Of the 58,319 cases selected for faceless assessment, 8,700 cases have already been disposed of. The system, 1st announced by FM Minister Nirmala ...

INCOME TAX

Faceless Assessment: Step by step Procedure & Reasons for the implementation in India

RJA 30 Nov, 2020

E-Assessment Process: The E-filing portal is built as a forum for the conduct of various tax procedures online and electronically. E-Assessment under Income Tax Appeal is a mechanism in which tax officers interact via e-mail and to the taxpayer's account on the e-filing site. On further receipt of the ...

INCOME TAX

AMT : Essential of Alternate Minimum Tax(AMT) & Difference with MAT

RJA 29 Nov, 2020

Essential of Alternate Minimum Tax(AMT) & Difference with MAT Alternative Minimum Tax – Essential The aim of the Finance Act 2011 is to tax such LLP differently. A new Chapter XII-BA titled "Special Provisions relating to certain LLP" was adopted on 01 April 2012. Under this chapter, LLPs are now ...

Goods and Services Tax

GST: Upcoming Major Changes under GST Regime may take place in 2021

RJA 29 Nov, 2020

GST: Upcoming Major Changes under GST Regime may take place in 2021 GST Changes w.e.f. 01st January 2021 1. Pre-filled GST returns to become the norm from 1st January 2020: GSTR - 3B: Sales Crossing Rs. Five Crore in Last Financial Year needs to file GSTR-3B on a regular monthly basis ...

GST Registration

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration

RJA 29 Nov, 2020

GSTN notify SOPs for verification of Taxpayers who have granted Deemed Registration A Standard Operating Procedure (SOP) has been introduced by the CBIC for the verification of taxpayers deemed to be registered. As of August 21, 2020, rule 9 of the 2017 CGST Rules provides that in cases where the applicant has either not ...

Income tax return

Tax filing: changes are taken into account when making the ITR

RJA 27 Nov, 2020

Tax filing: changes are taken into account when making the ITR New Notified ITR forms are subject to certain major changes. Taxpayers should keep these changes into account before filing their ITR for FY 2020-21. The new Financial budget for 2021 adopted the interchangeability of and Aadhaar Vs PAN. ...

GST Compliance

Delayed in payment of GST then Interest to be paid on net GST liability from Sep 1, 2020.

RJA 23 Nov, 2020

September 2020 as the date of the entry into force of the provisions of Section 10 of the Delhi Goods and Services Tax (Amendment) Act, 2019 (Delhi Act 06 of 2019)" The Government has admitted that interest on late payment of goods and services tax (GST) will be charged on net tax liability with ...

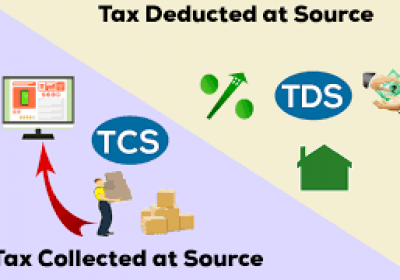

TDS

COMPLIANCES OF TAX DEDUCTED AT SOURCES(TDS)

RJA 12 Nov, 2020

Compliances of TDS/TCS One of the main concepts of the Income Tax Act 1961 is tax Deducted at Source (TDS) and Tax collected at Source (TCS). All registered assessee who&...

IBC

Overview on Personal Guarantor as per IBC Code

RJA 08 Nov, 2020

Overview on Personal Guarantor as per IBC Code The Govt Of India, through the MCA, issued a notification dated on15.11.2019, came into force Part III of the IBC Code (with the exception of the fresh start process) which deal with the insolvency and bankruptcy of partnership ...

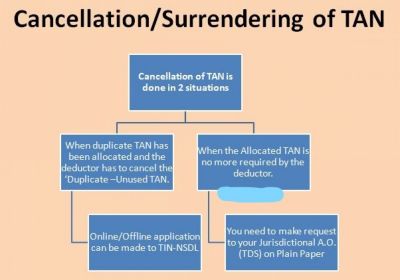

TDS

Process of Cancellation / Surrendering of multiple TANs Allotted

RJA 08 Nov, 2020

What is the Process of Cancellation / Surrendering of multiple TANs Allotted? Although we know, many times the assessee acquires Tax Deduction and Collection Account Number only to make some Tax Deduction at Sources payments, and there is no need for that Tax Deduction and Collection Account Number (TAN) in the ...

Business Setup in India

Steps for Closure of Liaison Office

RJA 06 Nov, 2020

Basic Steps for Closure of Liaison Office Liaison Offices (LOs) are a popular approach for foreign investors to explore the Indian market for the first time, and they are not sure how the country's liberalising FDI caps will affect their business. Unlike other business frameworks, Liaison Offices allow foreign ...

Goods and Services Tax

Complete Overview about GST on OIDAR

RJA 05 Nov, 2020

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL (OIDAR) Businesses are not restricted by geographical borders in today's Scenario. One of the means of delivering services from abroad in India is through the use of the internet. There are several mechanisms in which service users are delivered these services. For instance, ...

COMPANY LAW

Avail Companies Fresh Start Scheme 2020

RJA 04 Nov, 2020

You may Avail Companies Fresh Start Scheme & File ROC Pending Compliances-Save Bulk ROC Penalty -Act Now If you are a struck-off company under Section 164 that has not been able to revive till now or if you are a disqualified director looking to activate your DIN then this is a&...

OTHERS

President promulgates Ordinance on Arbitration and Conciliation (Amendment) Ordinance, 2020

RJA 04 Nov, 2020

President promulgates Ordinance on Arbitration and Conciliation (Amendment) Ordinance, 2020 The President of India today passed the Arbitration and Conciliation (Amendment) Ordinance, 2020, which amended Section 36 of the Arbitration and Conciliation Act byways of amendments. The Eighth Schedule of the Arbitration Act, which addresses the qualifications and experience of arbitrators, has been ...

INCOME TAX

How to get Tax Relief Through TRC under DTAA

RJA 04 Nov, 2020

How to obtain a Tax Resident Certificate for tax relief under a double tax evasion deal Tax Residency Certificate (TRC) The Government of India has modified the Section 90 & 90A of the I T Act, 1961 appears with finance Bill, 2012 to make the provisions provide the submission of the Tax Residency ...

GST Consultancy

What to be do when issue of summons to a person under GST

RJA 01 Nov, 2020

Power to summon persons to give evidence and produce documents in GST Provision of the CGST Act, 2017 under Section 70 mentioned hereunder: Power to summon persons to give evidence and produce documents. The proper officer under this Act shall have the power to summon any person whose ...

Goods and Services Tax

Frequently Asked Questions (FAQs) on Basic concepts of GST

RJA 31 Oct, 2020

Frequently Asked Questions (FAQs) on Basic concepts of GST Q.: How will imports be taxed under GST? Answer: The Additional Excise Duty or CVD, which are now known as the Special Additional Duty or SAD, being levied on imports are subsumed under GST. As per explanation to ...

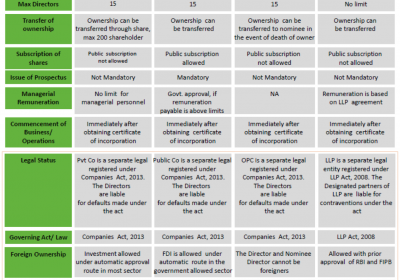

Business Setup in India

Comparative feature of different type of business entity in India

RJA 31 Oct, 2020

Comparative features of different type of business entity in India can be formed In India, we have three major types of business frameworks, respectively sole proprietorship, partnership, and company (Pvt or public), but several years ago a new hybrid form of partnership and company are known as Limited Liability (LLP) ...

Business Setup in India

Private Limited Company Compliance Due Dates in a Year

RJA 30 Oct, 2020

Private Limited Company Compliance Due Dates in FY 2020-21 The compliance requirement for the private limited company has drastically changed over the years 2020 and 2021. Every company registered in India, including private limited, limited company, one-person company, and section 8 company must file annual returns with ROC every year. It ...