COMPANY LAW

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND

RJA 18 Jun, 2021

COMPLETE OVERVIEW ON INTERIM AND FINAL DIVIDEND INTRODUCTION- INTERIM AND FINAL DIVIDEND Funds are the essence of the long term perspective of any business. Companies sought to rely on available for the management of their activities. One of the main sources of funds, available with a company are shareholders. ...

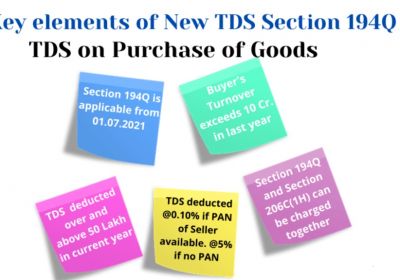

TDS

TDS U/s 194Q when purchasing the goods- Applicability | Analysis of Section 194Q |

RJA 13 Jun, 2021

TDS on Purchase-Tax Deducted at Source (TDS) u/s 194Q when purchasing the goods- Applicability A new section 194Q was introduced in Budget 2021-22, which will come into force on July 1, 2021. In Budget 2021-22 a new section 194Q relating to the payment of a certain sum to purchase goods. As ...

Goods and Services Tax

GST Council 44th & 43th Meeting 2021 Conclusion: Press Briefing

RJA 12 Jun, 2021

Today, Finance Minister Nirmala Sitharaman will preside over the 44th meeting of the GST Council, which is likely to make a decision on relief for COVID-19-related individual items based on the Group of Ministers' report. GST Council 44th Meeting 2021 Conclusion: GST Council agrees to a 5% GST rate for ...

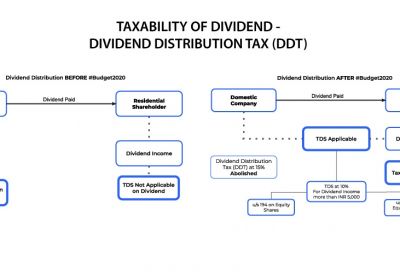

TDS

NRI and TDS on Dividend Income from Equity Shares(194

RJA 11 Jun, 2021

TDS on Dividend on Equity Shares Applicable: This section is effective beginning on April 1, 2020, for the financial year 2020-21. Update on Dividend Tax in Union Budgets 2020 and 2021 After the elimination of the Dividend Tax in Budget 2020, dividends that were previously exempt will now be taxed beginning in FY 2020-21. TDS ...

Form 15CA & 15CB Certificate

LIST OF PAYMENTS FOR WHICH E-FORMS 15CA AND 15CB ARE MANDATED

RJA 10 Jun, 2021

FORM 15CA & FORM 15CB FORM- 15 CA PROVISONS Amount can be remitted to any other non-resident or foreign company Such remittance be made by any resident /non-resident/ domestic company/foreign company from India. The income from which such remittance will be made, shall accrue/ arise/ received or deemed ...

ROC Compliance

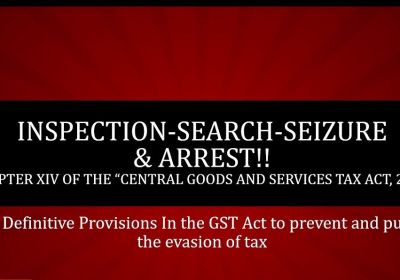

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST

RJA 09 Jun, 2021

FAQS ON INSPECTION, SEARCH AND SEIZURE UNDER GST Q.: What does search mean under GST? Under the law, search has been defined as an action undertaken by government machinery involving visiting, inspection and examination of the place, area, person, object etc., where there is an instinct to find something concealed ...

Income tax return

Latest Features of the new e-filing income tax Launched portal 2.0

RJA 07 Jun, 2021

The income tax Dept introduced a new e-filing portal on June 7, 2021. The Tax Dept of India has updated the official tax filing system in India with a new design and interface. The rebuilt website, dubbed ITR e-filing portal 2.0, aims to improve user experience with a new dashboard that houses all ...

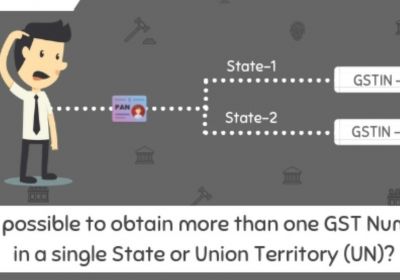

GST Compliance

2 GSTIN IN ONE STATE/UT UNDER 1 PAN

RJA 05 Jun, 2021

BRIEF INTRODUCTION After the introduction of GST, any business entity having an aggregate turnover exceeding the prescribed limit of Rs 20 lakhs and Rs 10 lakhs, depending on the state or UT in which they are operating, are required to get registered under that state/UT. Once registration is granted, a GSTIN ...

Nidhi company

How was the Nidhi Company established in India?

RJA 05 Jun, 2021

How was the Nidhi Company established in India? The Nidhi firm is classified as an NBFC, however, it does not require an RBI licence. Section 406 of the Companies Act, 2013 governs Nidhi company registration. The basic business is to take and give money (borrowing and lending by monitory means) among its ...

Nidhi company

How to Closing of a Nidhi Company?

RJA 04 Jun, 2021

Nidhi Company is a type of Non-Banking Financial Company established under Section 406 of the Companies Act, 2013. The primary goal of a Nidhi Company is to cultivate the norm of thrift and saving within its members. If a Nidhi Company does not comply with the regulations, it is preferable ...

OTHERS

Food Law Relaxations/Extensions for Covid-19-Affected Food Industries

RJA 04 Jun, 2021

Food Law Relaxations/Extensions for Covid-19-Affected Food Industries The Food Processing Industry (FPI) is extremely important because it develops crucial linkages and synergies between agriculture and industry, which are the two foundations of the economy. After China, India produces the second-largest amount of fruits and vegetables in the world, ...

OTHERS

Frequently Asked Questions on FSSAI -Compliance Mechanism

RJA 04 Jun, 2021

Compliance Mechanism under FSSAI: Mandatory compliance was implemented on April 1, 2021. W.e.f FY 2020-21, online submission of Annual Returns on Food Safety Compliance System (FOSCO - https://foscos.fssai.gov.in) has been made mandatory for food businesses involved in food manufacturing and importing (window for return ...

INCOME TAX

Income Tax Notices in India - Meaning & Types

RJA 03 Jun, 2021

Income Tax Notices in India - Meaning & Types An income tax notice is a written letter from the Income Tax Department to a taxpayer informing him of a problem with his tax account. The notification might be given for a variety of reasons, including filing or not submitting ...

FCRA

ONLINE FCRA REGISTRATION PROCESS, DOCUMENTATION & ELIGIBILITY

RJA 02 Jun, 2021

FCRA Registration The 1976 Foreign Contribution Act (FCRA) was implemented in 1975 with the major purpose of regulating the acknowledgement and use of the foreign contribution and of foreign hospitality, by individuals and associations working in the important domestic areas. This is important to ensure that such assistance ...

INCOME TAX

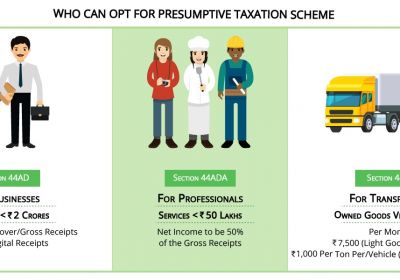

FAQS ON PRESUMPTIVE TAXATION IN INDIA

RJA 01 Jun, 2021

FAQS ON PRESUMPTIVE TAXATION IN INDIA Q.: What does a presumptive taxation scheme mean? Presumptive taxation scheme related to providing relief to small taxpayers. Any small taxpayer whose turnover is less than Rs 2 crores shall be eligible for such a scheme. To facilitate the running of businesses without any burden ...

TDS

TDS/TCS | Non-Filers of Income Tax Return: Analysis of Sections 206AB and 206CCA

RJA 01 Jun, 2021

Analysis of Sections 206AB and 206CCA- Non-Filers of Income Tax Return: The Finance Bill 2021 proposed new section 206AB and section 206CCA, according to the 1961 Income Tax Act, that would provide the higher rate of TDS and of TCS for the deductors who do not file their income tax ...

INCOME TAX

EQUALISATION LEVY ON E-COMMERCE OPERATORS

RJA 01 Jun, 2021

BRIEF INTRODUCTION ON EQUALISATION LEVY ON E-COMMERCE OPERATORS Equilisation levy was introduced in India in 2016 and the same was substantially implemented in the 2020 Budget. Apart from taxing the online advertisement services, the equalization levy shall also be applicable on the consideration, being received by an e-commerce operator, having turnover ...

COMPANY LAW

Listing of Non Convertible Debentures by Private Companies

RJA 31 May, 2021

Listing of Non-Convertible Debentures by Private Companies BRIEF INTRODUCTION The most important step for a corporate entity to begin with its operations is funding. Funding is something that is required, not only for investment and expansion purposes but also for day-to-day operations. Companies, while looking for funding, consider various sources ...

Business Setup in India

COMPLETE TAXATION GUIDANCE FOR FREELANCERS

RJA 30 May, 2021

BRIEF INTRODUCTION Freelancers seek a flexible lifestyle, where people are not bound to 9 to 5 jobs. Freelancers can pursue their other interests, having more family time and thus, is simply a way to avoid a tedious routine. As per the income tax laws, freelancers are also liable to pay taxes on ...

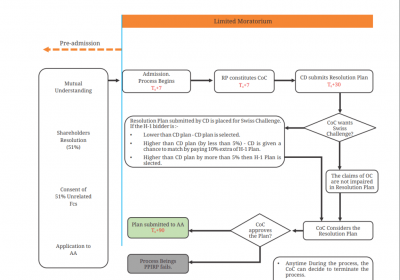

IBC

COMPLETE UNDERSTANDING OF PRE-PACK INSOLVENCY OF MSME

RJA 29 May, 2021

INTRODUCTION With the introduction of IBC 2016, there has been a transformative turnaround in the corporate distress resolution framework of India. The act provided a new lease of life to a Company whose future was earlier based on debt restructuring and sale. In India, most organizations are driven by their promoters. ...

IBC

SECTION 29A CERTIFICATION SERVICES UNDER IBC

RJA 28 May, 2021

SECTION 29A CERTIFICATION SERVICES UNDER IBC In the Corporate Insolvency Resolution Process (CIRP), Section 29A of the Insolvency and Bankruptcy Code, 2016 (“the Code”) has emerged as a fundamental statute in assessing Resolution Applicants' eligibility. The Code did not include any protections to prevent defaulting promoters from purchasing back ...

Goods and Services Tax

ONLINE INFORMATION DATABASE ACCESS OR RETRIEVAL

RJA 27 May, 2021

BRIEF INTRODUCTION In today’s world, with so much technological developments, businesses are nowhere restricted by geographical borders. The Internet is the most easy and affordable means for providing services abroad. To facilitate such services, there are several mechanisms, which are used in conjunction with business activities, to deliver ...

IBC

All about Moratorium U/s 14 of IBC, 2016 including judicial pronouncements

RJA 26 May, 2021

MORATORIUM UNDER IBC 2016 BRIEF INTRODUCTION While undertaking a Corporate Insolvency Resolution Process, the RP is under an obligation to apply for a moratorium as declared by the adjudicating authority and a public announcement be made regarding the last date for submission of claims and the details of the interim resolution ...

NRI

Tax Guidelines for Non Resident Indian (NRI)

RJA 24 May, 2021

TAX GUIDELINES FOR NON-RESIDENT INDIAN (NRI) This article provides detailed information on various tax compliances, required by a Non-resident in India. Starting with the basic information and then going to some technical aspects are the key of this article. BASICS 1. RESIDENTIAL STATUS OF NRI An individual is said ...