GST Filling

Applicable Forms under Goods and Services Tax Rules, GST Acts

RJA 04 Sep, 2021

https://carajput.com/archives/gstn-issue-standard-operating-procedure-for-tds-under-gst.pdfGoods and Services Tax (GST) Rules & GST Acts Sr. No GST Rules GST Acts 1. CGST RULES, 2017 (UPDATED UPTO 01.06.2021) THE CONSTITUTION (101 AMENDMENT ACT) 2016 2. IGST RULES, 2017 CGST ACT UPDATED TILL 01.01.2021 3. EXTENSION TO JAMMU & KASHMIR CGST ACT, 2017 4. IGST ACT UPDATED TILL 01.10.2020 5. EXTENSION TO ...

OTHERS

All about the APEDA (RCMC) Registration

RJA 27 Aug, 2021

APEDA (RCMC) Registration- Meaning, Benefits, Documents Required for an APEDA License The Agricultural and Processed Food Products Export Development Authority (APEDA) is a government agency that was formed to develop and promote the export of scheduled products. APEDA is a government agency that offers financial aid, knowledge, and rules ...

Nidhi company

FAQs on Nidhi Company in India

RJA 26 Aug, 2021

FAQs ON NIDHI COMPANY Q.1: Will the deposits made with the Nidhi Company safe and secured? Yes, such deposits are safe and secure since the Ministry of Corporate Affairs and Reserve Bank of India has framed certain rules and regulations, to ensure protection and security of Deposits. ...

Business Setup in India

Pre Post Funding Compliance for Start UPs

RJA 04 Aug, 2021

PRE AND POST FUNDING COMPLIANCE FOR STARTUPS ELIGIBILITY CRITERIA Though there's no comprehensive definition for start-ups that have been provided under Indian laws, the govt of India (GoI) under its start-up schemes define start-ups as: · &...

IBC

SUMMARY PROCEDURE FOR WINDING UP OF COMPANIES

RJA 02 Aug, 2021

BRIEF INTRODUCTION Summary procedure for winding up has been introduced in respect of companies and the same has been provided under section 361 of the Companies Act, 2013. We all know that the liquidation process is carried out by an official Liquidator who is ...

Business Setup in India

PRE AND POST FUNDING COMPLIANCE FOR START-UP

RJA 24 Jul, 2021

PRE AND POST FUNDING COMPLIANCE FOR START-UP Compliance basically refers to abiding by the foundations. within the world of business, compliance is integral to survival. Failing this, businesses are susceptible to various fines and penalties under the assorted regulations and laws. With ...

Business Setup in India

COMPLETE UNDERSTANDING OF START-UP FUNDING

RJA 24 Jul, 2021

COMPLETE UNDERSTANDING OF START-UP FUNDING BRIEF INTRODUCTION The startup company you founded is that the brainchild of your ideas and you have got successfully completed your private limited company registration, Finance is that the lifeblood of any business and understanding Fundraising options ...

NGO

FAQs ON SECTION 12AB & 80G REGISTRATION

RJA 15 Jul, 2021

Q.: What is Section 12A & Section 12AA? Ans. All you would like to grasp about the Section 12A & Section 12AA Trust, Society and Section 8 Company can seek registration Under Section 12A of income tax Act to assert exemption under income ...

TDS

Section-by-section analysis on TDS/ TCS perspective on the finance bill 2021

RJA 11 Jul, 2021

The Union Budget, which was presented in Parliament, proposed a number of significant modifications to the Income Tax Act. Certain adjustments to the TDS and TCS sections of the Act have been made in particular. The proposed modifications to the TDS/TCS provisions of the Income Tax Act will be ...

COMPANY LAW

Frequently Asked Question on DIR-3 KYC

RJA 10 Jul, 2021

Frequently Asked Question on DIR-3 KYC Q.: Who is responsible for completing Form DIR-3 KYC? Individuals with a DIN on file in their names on March 31 and who did not file Form DIR-3 KYC the previous year are required to file Form DIR-3 KYC this year. In addition, ...

FEMA

Compounding of Contraventions under FEMA

RJA 10 Jul, 2021

What does it mean to FEMA compound? In some nations, it's also known as the Composition of Offense. Compounding an offence is a method of settling a case in which the offender is given the option of paying money instead of facing prosecution, so avoiding a lengthy legal battle. &...

COMPANY LAW

FAQs on dematerialization of physical share certificates

RJA 06 Jul, 2021

FAQs ON DEMATERIALIZATION OF PHYSICAL SHARE CERTIFICATES Q.: What's the Governing Law? Section 29 read with Rule 9A of the businesses (Prospectus and Allotment of Securities) Rules, 2014. Q.: From when is Rule 9A effective? 02nd October 2018. Q.: What does Rule 9A state? Every unlisted public ...

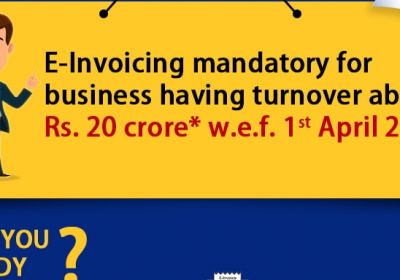

GST Filling

FAQ’s on E-Invoicing under GST

RJA 06 Jul, 2021

FAQ’s on E-Invoicing under GST Q.: What exactly is E-Invoicing under GST? E-Invoicing under GST is the process of verifying B2B invoices, exporting them online through a unified portal, and assigning a unique IRN and QR code to each authenticated invoice. Q.: When does the system of ...

FEMA

RBI reporting under Single Master Form

RJA 30 Jun, 2021

RBI reporting under Single Master Form BRIEF INTRODUCTION The reserve bank of India has announced the new reporting structure for FDI related transactions during which they need combined different reporting into one combined form i.e., the only Master Form (‘...

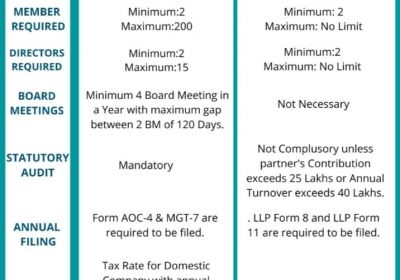

Limited Liability Partnership

The distinction between a private company and an LLP

RJA 30 Jun, 2021

The distinction between a private company and an LLP: Entrepreneurs, businesses, investors have many choices to select a kind of company, such as private companies, public companies, LLPs, partnerships, and so on, in which they want to invest hard money. When deciding between a Private Company and an LLP, many ...

Nidhi company

FAQ’s on open Liaison /Branch office in India

RJA 29 Jun, 2021

Foreign citizens can open an entity in India via either by opening a Liaison Office or Branch Office or Subsidiary Company. A company that is incorporated outside India has the option to have offices in India that are not primarily subsidiary companies. Subject to the Reserve Bank of India (“...

OTHERS

CRYPTOCURRENCY SECURITY: A DIGITAL WAY TO PROTECT INVESTMENT

RJA 27 Jun, 2021

CRYPTOCURRENCY SECURITY: A DIGITAL WAY TO PROTECT INVESTMENT How does one retain a high standard of workflow? How are you able to keep your team connected and receptive to collaboration when they’re separated? is that this the proper time ...

Goods and Services Tax

FAQs ON GOODS AND SERVICES TAX REFUND

RJA 26 Jun, 2021

FAQs ON GST REFUND Q.1 What are the situations which can produce to refund under GST? Ans. Any sought of claim for refund arising in relation to - Export of products or services on payment of tax Supply of products or services to ...

COMPANY LAW

MCA enlarges the definition of a small business, as well as its turnover and borrowing limits.

RJA 24 Jun, 2021

The ministry of corporate affairs has broadened the definition of small and medium businesses (SMBs), allowing them to borrow more money and increase their turnover. According to a statement released on Wednesday, this would allow a broader range of enterprises to benefit from greater flexibility in accounting requirements. Small and ...

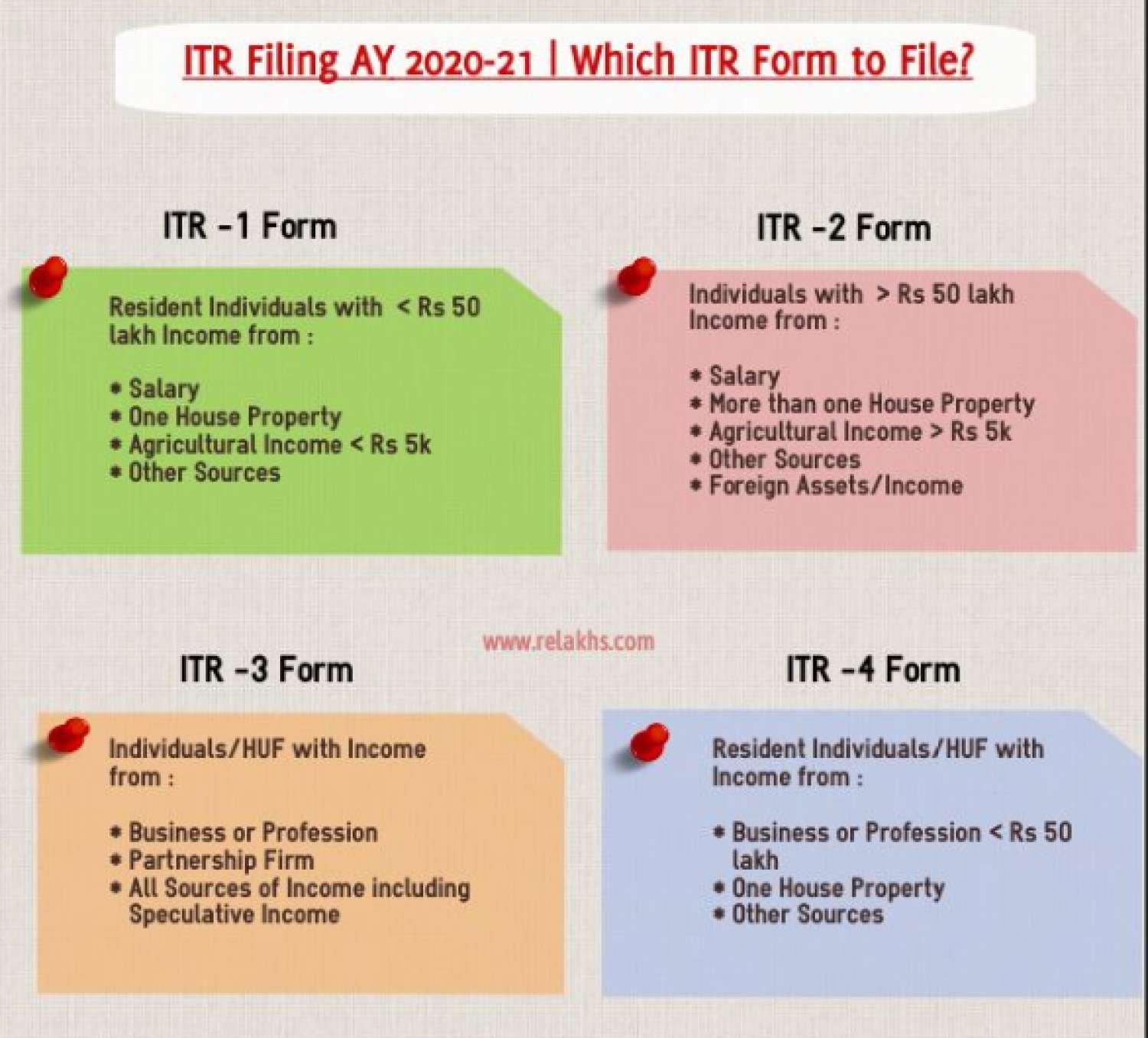

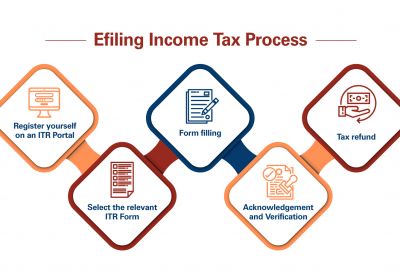

Income tax return

LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21: NEW ITR FORM

RJA 22 Jun, 2021

ITR Forms- LATEST UPDATE ON INCOME TAX RETURN FORMS FOR FY 2020-21 Identifying the ITR form for the specific income of the taxpayer was a very important and technical task when all ITRs were filed in physical mode. However, in today's technological age, this task is done by ...

SEBI

SEBI has issued a framework for a supervisory body for investment advisors.

RJA 21 Jun, 2021

Compliance will be monitored by SEBI-registered investment advisers, who will be supervised by a supervisory body Sebi, the market regulator, released a system/framework for investment adviser administration and supervision on Friday. Sebi may recognize anyone or a body corporate for the purpose of regulating investment advisers (IA) ...

INCOME TAX

Housewives savings deposited in bank A/c up to 2.5 lakh in demonetization cannot be consider income

RJA 21 Jun, 2021

Housewives savings deposited in bank A/c up to Rs. 2.5 lakh in demonetization cannot be income: ITAT Agra Brief Summary of the Case: During the demonetization phase, the assessee, a housewife, deposited cash in her bank account totalling Rs. 2,11,500/-. She was asked to explain the source of the deposit ...

Income tax return

FAQS RELATED TO INCOME TAX RETURN FILLING IN INDIA

RJA 21 Jun, 2021

Frequently Asked Question on Income Tax return filling in India Q.: What is the difference between an ITR-V form and an ITR-Acknowledgement? Form ITR-V contains information from income tax returns filed in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, and ITR-7 but not e-verified. Form ITR-Acknowledgement shows and verifies data ...

OTHERS

Required Only Aadhaar and PAN Card to Complete MSMEs Registration

RJA 19 Jun, 2021

Entrepreneurs who want to start a Micro, Small, or Medium Enterprise should rejoice. Shri Nitin Gadkari, Minister of Micro, Small, and Medium Enterprises (MSME), announced the streamlining of the Micro, Small, and Medium Enterprises (MSME) registration process. Shri Gadkari declared on an occasion that for MSMEs registration, only Aadhaar and ...