Goods and Services Tax

Input tax credit of Goods and Services Tax

RJA 01 Sep, 2018

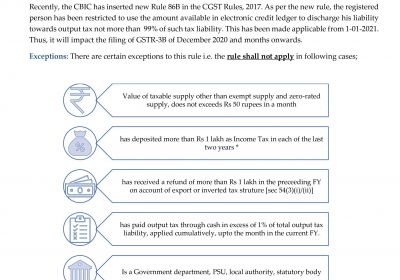

INPUT TAX CREDIT GST is the indirect tax that is imposed on the services and goods on the basis of the primary value addition. Hence, the imposing of the tax is totally based on the value addition at the single stage of the chain of supply until the finished product ...

GST Registration

How to do GST registration for the branches and business verticals?

RJA 28 Aug, 2018

According to the CGST Act, registration is important for suppliers of the taxable goods and services under the GST in the union territory, from the payable supply of the services and goods, is created. In addition, provisions have been given in the GST Registration Rules for getting GST registration ...

COMPANY LAW

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED

RJA 25 Aug, 2018

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED For the purpose of KYC on ROC -Directors database on ROC, ROC has entered for updated all persons holding DIN to complete DIN KYC on or before 30/09/2022. To close DIN KYC, the Director will be required to complete a form file ...

Transfer Pricing

OVERVIEW OF TRANSFER PRICING IN INDIA

RJA 14 Aug, 2018

OVERVIEW OF TRANSFER PRICING IN INDIA Transfer pricing refers to the prices that related parties charge one another for goods and services passing between them. The most common application of the transfer pricing rules is the determination of the correct price for sales between subsidiaries of a multinational corporation. These ...

GST Registration

Cancellation and revocation of Registration under GST

RJA 03 Aug, 2018

Cancellation and revocation of Registration under GST You want to cancel your GST (Goods and Services Tax) registration because GST does not apply to you or because you are closing your business or profession. Or there is some other valid reason due to which you want to cancel your GST ...

Goods and Services Tax

HSN & SAC Codes along with GST Rate

RJA 03 Aug, 2018

What is HSN codes? HSN stands for Harmonized System of nomenclature. This coding system is developed by World Customs Organization (WCO). This is a Global standard of Nomenclature of trading goods in international trade. The HSN is the codification of all tradable commodities into 20 broad sections with each chapter containing ...

Transfer Pricing

Aims & Objective of Transfer Pricing

RJA 03 Aug, 2018

OVERVIEW ON TRANSFER PRICING Transactions between two or more enterprises belonging to the same multinational group have created a new and complex issue as a result of the increasing participation of multinational groups in economic activities in the country. To provide a detailed statutory framework that can lead to the ...

Business Setup in India

Government fees for company registration

RJA 01 Aug, 2018

If you are registering a startup or a new business in India then first and foremost, there are some official procedures of startup or a company has to follow in order to register them in Indian official records, MCA (ministry of Corporate Affairs) will charge registration fees given as ...

INCOME TAX

REBATE U/S 87A OF INCOME TAX ACT , 1961

RJA 31 Jul, 2018

Rebate u/s 87A of the Income Tax Act was introduced in the year of 2013 with the objective of reducing the tax liability of the assessee whose income is not more than Rs 3,50,000 You can claim the rebate u/s 87A if you fulfil the following conditions: You are an ...

Goods and Services Tax

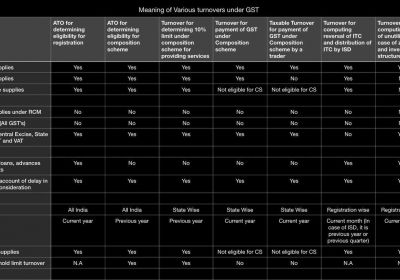

Different Meaning of Turnover In Income Tax Act ,Companies Act & Gst

RJA 30 Jul, 2018

DIFFERENT MEANINGS OF TURNOVER IN INCOME-TAX ACT, COMPANIES ACT & GST As per companies act,2013: - "turnover" means the gross amount of revenue recognized in the profit and loss account from the sale, supply, or distribution of goods or on account of services rendered, or both, by a ...

GST Compliance

Highlights of GST Council Meeting Held

RJA 26 Jul, 2018

HIGHLIGHTS OF GST COUNCIL MEETING HELD The GST Council in its 28th meeting held today at New Delhi has recommended certain amendments in the CGST Act, IGST Act, UTGST Act, and the GST (Compensation to States) Act. The major recommendations are as detailed below: The upper limit of turnover for ...

Goods and Services Tax

All About TDS under GST Applicability, Rate, penalties Provisions

RJA 25 Jul, 2018

Complete Guidance on TDS applicable on Goods and services GST TDS is the system through which a certain percentage of tax is collected at the source of the income. Certain Government departments, Local Authorities, Agencies, and Public Sector Undertaking are required to deduct GST TDS. GST TDS is a ...

Goods and Services Tax

OVERVIEW OF GOODS AND SERVICES REGISTRATION

RJA 24 Jul, 2018

GST REGISTRATION FOR SERVICE PROVIDERS: - like any other category of business, service providers would be required to obtain GST registration, if the entity has an aggregate annual turnover of more than Rs.20 lakhs per annum in most states and Rs.10 lakhs in the Special Category States(The GST Council ...

INCOME TAX

Penalty U/S 234F (Fees) For Late Filling of ITR

RJA 22 Jul, 2018

PENALTY U/S 234F (FEES) FOR LATE FILING OF ITR Under this section, the fee (penalty) is levied if the Income-tax return is not filed within the due date. It is likely to be increased from 1st April 2018 onward as per Section 234F of the Income Tax Act. Provisions ...

INCOME TAX

ALL ABOUT EQUALISATION LEVY/GOOGLE TAX

RJA 21 Jul, 2018

Taxation Indian digital Economy: Equalisation Levy Over the last decade, Information Technology has gone through an expansion phase in India and globally. Consequently, this has given rise to various new business models, where there is a heavy reliance on digital and telecommunication networks. As a result, the ...

Goods and Services Tax

OVERVIEW OF ASSESSMENT UNDER GST

RJA 19 Jul, 2018

ASSESSMENT UNDER GST GST Assessment means the determination of tax liability under GST law. It includes self-assessment, re-assessment, provisional assessment, summary assessment, and best judgment assessment. Normally, persons having GST registration file GST returns and pay GST every month based on self-assessment of GST liability. However, the Government at all ...

COMPANY LAW

ARE YOU A DIRECTOR?-THEN YOU HAVE TO FILE E-KYC DIR-3 FORM

RJA 17 Jul, 2018

As part of updating its registry, MCA would be conducting KYC of all Directors of companies annually through a new e-form viz. DIR-3 KYC as per new The Companies (Appointment and Qualification of Directors) Rules, 2014. Today, E-form DIR-3 KYC now is on the Portal of the ...

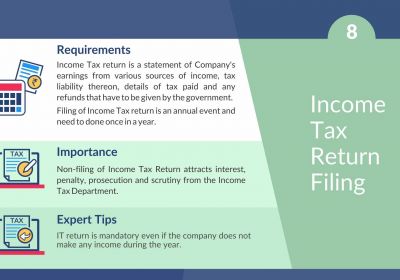

Income tax return

Get aware for penalty of section 234F for late filing of ITR

RJA 13 Jul, 2018

In Budget 2017 our honourable Finance Minister, Mr Arun Jaitley introduced a new section 234F to ensure timely filing of returns of income. As per section 234F of the Income Tax Act, if a person is required to file Income Tax Return (ITR forms) as per the provisions of Income ...

INCOME TAX

HOW TO RESPONSE INCOME TAX DEMAND NOTICE

RJA 11 Jul, 2018

IF a taxpayer income tax return differs from the assessment made by the INCOME TAX OFFICER then taxpayer issued income tax demand notice. This notice is issued when the taxpayer has deposit less Tax for which he is liable to pay. IF You received demand notice then here are ...

INCOME TAX

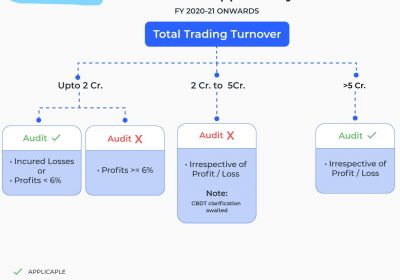

LIMIT APPLICABLE FOR INCOME TAX AUDIT (U/S 44AB) IN INDIA

RJA 09 Jul, 2018

Objective if Tax Audit:- The objective of the tax audit is to report the requirements of Form Nos. 3CA/3CB and 3CD. Other than the reporting requirements of Form Nos. 3CA/3CB and 3CD a proper tax audit will ensure that the books of account and other records ...

Limited Liability Partnership

LLP requirements at the time of Incorporation

RJA 06 Jul, 2018

LIMITED LIABILITY PARTNERSHIPS (LLP) CONSULTING SERVICES The concept of limited liability partnership was introduced in order to adopt a corporate form that combines the organizational flexibility of a partnership firm with the benefit of limited liability for its partners. Some or all of the partners in a limited liability partnership ...

COMPANY LAW

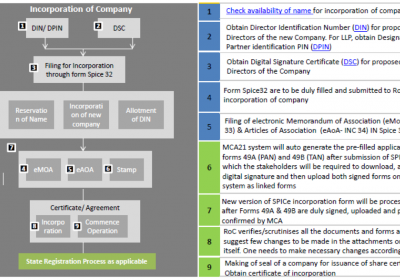

HOW TO INCORPORATE THE COMPANY

RJA 05 Jul, 2018

COMPANY REGISTRATION – START-UP REGISTRATION The first step in start-up registration is choosing the correct and suitable form of business. Such a choice will directly impact their business name, the extent of liability towards business, liabilities towards tax filing & statutory dues. The main factors for the operational and ...

Income tax return

Change in law of belated return in income tax from A.Y. belated return u/s 139(4)

RJA 03 Jul, 2018

Old provision up to the Assessment year:- Any person who has not filed his return within the time allowed us 139(1) he can file his return at any time before the expiry of one year from the end of the relevant assessment year or completion of the assessment whichever is ...

INCOME TAX

QUICK REVIEW ON INCOME COMPUTATION AND DISCLOSURE STANDARDS (ICDS)

RJA 30 Jun, 2018

CBDT issued 12 drafts of Income Computation and Disclosure Standards (ICDS) after taking suggestions from stakeholders and the draft ICDS was open for comments and suggestions till 8 February 2015. After taking suggestion 10 ICDS is finalized by CBDT on 31st March 2015. It will applicable from AY 2017-18. APPLICABILITY RULES OF ICDS:- ...