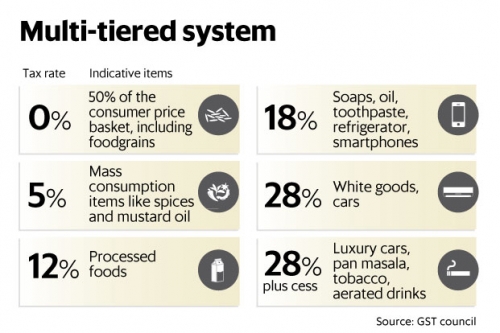

LATEST NEWS FROM THE GST COUNCIL – FINAL GST RATES STRUCTURE IN INDIA

We already know that the GST slabs are pegged at 5%, 12%, 18% & 28%. According to the latest news from the GST council, the tax structure for common-use goods is as under.

GST Rates Structure

|

Tax Rates |

Products |

|

5% |

Edible oil, sugar, spices, tea, coffee (except instant) Coal (instead of current 11.69%) Mishti/Mithai (Indian Sweets) Life-saving drugs |

|

12% |

Computers, Processed food |

|

18% |

Hair oil, toothpaste, and soaps (currently at 28%) Capital goods and industrial intermediaries (big boost to local industries) |

|

28% |

Small cars (+1% or 3% cess) Consumer durables such as AC and fridge Luxury & sin items like BMWs, cigarettes, and aerated drinks (+15% cess) High-end motorcycles (+15% cess) Beedis are NOT included here |

Sugar, Tea, Coffee, and Edible oil will fall under the 5 percent slab, while cereals, milk will be part of the exempt list under GST. This is to ensure that basic goods are available at affordable prices. However, instant food has been kept outside this bracket so, no relief for Maggie lovers!

The Council has set the rate for capital goods and industrial intermediate items at 18 percent. This will positively impact domestic manufacturers as seamless input credit will be available for all capital goods. Indeed, it is time for “Make In India”.

Coal is to be taxed at 5 per cent against the current 11.69 percent. This will prove beneficial for the power sector and heavy industries which rely on coal supply. This will also help curb inflation. Expect a good run for Coal India tomorrow.

Toothpaste, hair oil, and soaps will all be taxed at 18 percent, where currently they are taxed at 28 percent. Most of the cosmetics and fast-moving consumer goods (FMCG) brands should get the benefit of this tax reduction. After all, Fair and Lovely might seem fairer in its pricing from now on!

The ‘mithai’ from the neighbouring sweet shop might lose some of its flavors as Indian sweets will now be taxable at 5 percent. If you have a sweet tooth, this could hurt your pocket a wee bit in the coming days.

Read also : GST Rates for Services specified by CBEC vide Notification No. 11/2017

GST Rate of Goods specified by CBEC via Notification No. 01/2017

It is expected that more rates will be shared by end of the day today. Prominently the rate of GST for various services will be discussed and finalized in today’s meeting some of the sneaks peek rates which we are able to retrieve are:

- For restaurants serving alcohol, the tax bracket will be 18 percent

- Education, healthcare exempted from GST

- Services on Non-AC restaurants will be 12 percent

GST council has made the much-awaited announcements around tax rates on various categories of goods on day one of a two-day meeting of the GST Council at Srinagar. There has been hype around these rates for a while and now these rates are finally in the public domain.