Goods and Services Tax

New Changes in Goods and Services Tax Law which come to be effective from 01.10.2023

RJA 17 Oct, 2023

New Changes in Goods and Services Tax Law which come to be effective from 01.10.2023 ITC for Corporate social responsibility Expenses has been restricted. Time Limit to generate E-Invoice with effect from 01 Nov 2023. Govt may share the information of assessee by taking prior consent. New condition has been inserted for Supply ...

INCOME TAX

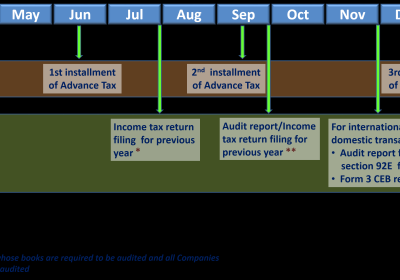

Timeline Date for Payment of Second Instalment of Income Tax Advance Tax

RJA 12 Sep, 2023

Timeline Date for Payment of Second Instalment of Income Tax Advance Tax Tax Dept. has notifies that Second Instalment of Advance Tax Payment is approaching soon. Timeline Date of payment of second instalment of Advance Tax is 15th Sep, 2023. Pay your Second Instalment of Income Tax Advance Tax by 15th ...

IBC

Model time line for CIRP (Corporate Insolvency Resolution Process )

RJA 10 Sep, 2023

Model time line for CIRP (Corporate Insolvency Resolution Process) Under IBC law Section/ Regulation Description of Activity Norm Latest timeline Section 16(1) Commencement of CIRP and appointment of IRP T Regulation 6(1) Public announcement inviting claims within 3 Days of Appointment of IRP T+3 Section 15(1)(e)/Regulations 6(2)(e) and 12(1) Submission of ...

IBC

Filing of Forms under the Insolvency & Bankruptcy Code

RJA 10 Sep, 2023

Filing of Forms under the Insolvency & Bankruptcy Code (1) The insolvency professional, interim resolution professional or resolution professional, as the case may be, shall file the Forms, along with the enclosures thereto, on an electronic platform of the Board, as per the timelines stipulated against each Form, in ...

IBC

Summary of Important Rulings on Insolvency & Bankruptcy Code

RJA 09 Sep, 2023

Summary of Importants Rulings on Insolvency & Bankruptcy Code Court: Supreme Court S.no Name of Case Law Decision 1 Innoventive Industries Ltd Vs ICICI Bank and Anr. IBC has overriding effect of all Acts. Moratorium imposed in IBC will previal aginst all other Acts &...

IBC

Summary of Importants Penalties on Insolvency & Bankruptcy Code

RJA 09 Sep, 2023

Summary of Importants Penalties on Insolvency & Bankruptcy Code CIRP Section 68 to 77 - Penalties on Insolvency & Bankruptcy Code S.No Nature of Offence Punishment Imprisonment Fine 1 Concealment of Property 3-5 1-100 2 Misconduct during CIRP by CD/officer 3-5 1-100 3 Falsification of Books of ...

COMPANY LAW

Taxation & Statutory Compliance Calendar for Sept 2023

RJA 07 Sep, 2023

Taxation & Statutory Compliance Calendar for Sept 2023 Important dates in Sept 2023 for compliance under GST & Income tax & Other Law S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Income Tax Tax Deducted at Source / Tax Collected at Source Liability Deposit Aug-23 7-Sep-23 Timeline ...

INCOME TAX

CBDT issue Circular for Income Tax Section 80P

RJA 28 Jul, 2023

Cooperative Societies may submit requests to Chief Commissioners of Income· tax (CCsIT) / Directors General of lncome·tax (DGsIT) for condonation of delay in filing of Income tax return : CBDT 1. CBDT authorises Chief Commissioners of Income· tax (CCsIT) / Directors General of lncome·tax (DGsIT) to condone delay ...

INCOME TAX

Beware about the Fake income tax refund email

RJA 21 Jul, 2023

Beware about the Fake income tax refund email Please refrain from clicking on any phone links that offer refunds. The Income Tax Department did not send these phishing emails, the I-T department stated in a tweet. For its part, the agency has begun contacting income tax taxpayers through email ...

Goods and Services Tax

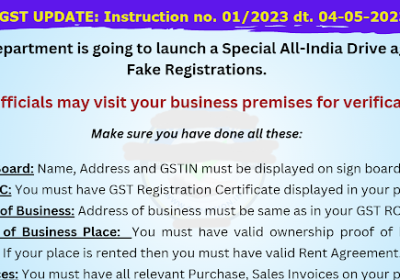

Out- Come of A Special All-India Drive on GST

RJA 19 Jul, 2023

Outcome of A Special All-India Drive on GST A Senior Tax Official of Goods and Services Tax stated that GST officials have so far cancelled over 4,900 bogus GST Registrations as part of a nationwide drive. Moreover, this GST special Drive has been discovered 17,000 GSTINs that do ...

INCOME TAX

Guidelines Compulsory Scrutiny of ITR Returns for FY 2023-24

RJA 14 Jul, 2023

Guidelines Compulsory Selection of Income Tax Returns for Complete Scrutiny during FY 2023-24 Central Board of Direct Taxes issues guidelines for compulsory selection of ITR Returns for Complete Scrutiny during the FY2023-24 along with the compulsory selection of Scrutiny procedure, Compulsory selection Parameters of returns for Complete Scrutiny as ...

GST Consultancy

50th GST council meeting Important Decisions taken

RJA 11 Jul, 2023

50th GST council meeting Important decisions taken- Details are here under System-based intimation to the taxpayers in respect of the excess availment of input tax credit in FORM GSTR-3B vis a vis that made available in FORM GSTR-2B 28% Goods and Services Tax on the full value of the ...

Goods and Services Tax

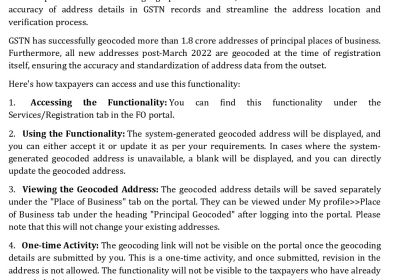

GSTN :Geocoding-Businesses can have to geocode their addresses

RJA 10 Jul, 2023

Geocoding can help in finding out exact location of the registered businesses entity & their addresses, to check bogus registrations. Geocoding makes it possible to pinpoint the location of registered firms and ensures that the address information in GSTN records are streamlined. For the purpose of to assure the accuracy ...

Goods and Services Tax

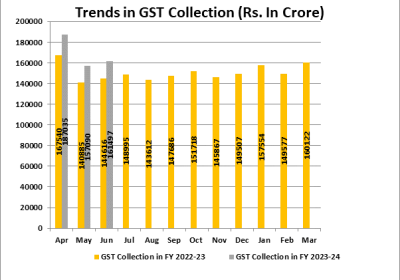

INR 1.61 Cr Gross Goods and Services Tax revenue collected for June 2023;

RJA 05 Jul, 2023

INR 1.61 Cr Gross Goods and Services Tax revenue collected for June 2023, Records 12% Growth Gross Goods and Services Tax Revenue collected in the month of June, 2023 is INR 1,61,497 crore of which Central Goods and Services Tax is INR 31,013 crore, state Goods and Services Tax is INR 38,292 crore, Integrated Goods ...

TDS

New Tax deducted at Source & Tax Collected at Source Update

RJA 01 Jul, 2023

New Tax deducted at Source & Tax Collected at Source Update : CBDT CBDT extends due date certain TDS/TCS Statements Central Board of Direct Taxes extends the due date for submission of certain Tax Collected at Source or Tax deducted at Source TDS Statements. Due date ...

GST Filling

FAQS ON ONLINE RETURN COMPLIANCE IN FORM DRC-01B

RJA 01 Jul, 2023

FAQS ON ONLINE RETURN COMPLIANCE IN FORM DRC-01B : GSTN Advisory Goods and Services Tax Network has developed a functionality to enable the Goods and Services Tax taxpayer to explain the difference in GSTR-3B & GSTR-1 return online mode as directed by the Goods and Services Tax Council. ...

COMPANY LAW

Taxation & Statutory Compliance Calendar for July 2023

RJA 01 Jul, 2023

Taxation & Statutory Compliance Calendar for July 2023 Important dates in July 2023 for compliance under GST & Income tax & Other Law S. No. Under Law Purpose of compliance Period of Compliance TimeLine Date Details of Compliance 1 Income Tax Tax Collected at Source or Tax deducted at Source ...

TDS

Important changes w.r.t LRS Scheme & Tax Collected at Source

RJA 01 Jul, 2023

Important changes w.r.t Liberalised Remittance Scheme and Tax Collected at Source The Finance Ministry, Gov of India has, via a press release dated 28th June, 2023, announced significant changes to the LRS & TCS, which shall be implemented from 1st October, 2023 as against earlier deadline of 1st July, 2023. One ...

Chartered Accountants

ICAI Council: Restricting revocation of UDINs within 48 hours

RJA 25 Jun, 2023

ICAI: Restricting revocation of UDINs within 48 hours ICAI Important New Announcement on Restricting revocation of Unique Document Identification Number (UDINs) within 48 hours– The Institute of Chartered Accountants of India -Council, in its 420th meeting held on 23rd-24th March, 2023, decided that revocation of Unique Document Identification Number (UDINs) would ...

RBI

FATCA Reporting by reporting entities in India

RJA 20 Jun, 2023

Foreign Account Tax Compliance Act (FATCA) Reporting by reporting entities in India 1. United States of America & India have entered into FATCA Non tax treaty for for disclosure of foreign assets of United States of America residents located outside United States of America . 2. Internal Revenue Service (IRS) of United ...

RBI

Clarification on FATCA Reportable Accounts

RJA 20 Jun, 2023

Foreign Tax & Tax Research Division issue Clarification on FATCA Reportable Accounts Foreign Tax & Tax Research Division has issued a Clarification on frequently asked questions issued by United States of America Internal Revenue Service for Foreign Account Tax Compliance Act - FATCA Reportable Accounts: 1. The Indian ...

INCOME TAX

Central Board of Direct Taxes Amends Rule 11AA of Income Tax Rules

RJA 01 Jun, 2023

Central Board of Direct Taxes Amends Rule 11AA of Income Tax Rules Central Board of Direct Taxes has issued a notification proposing change to Rule 11UA to implement the changes brought by the Finance Act 2023, The change expand scope of section 56(2)(viib) to include share application premium/money from ...

COMPANY LAW

Tax & Statutory Compliance Calendar for June 2023

RJA 01 Jun, 2023

Tax & Statutory Compliance Calendar for June 2023 S. No. Statue Purpose Compliance Details Compliance Period Due Date 1 Income Tax Tax deduction at source / Tax collected at source Liability Deposit TimeLine date of depositing Tax deduction at source / Tax collected at source liabilities for the previous month. May-2023 7-Jun-23 2 Income Tax ...

INCOME TAX

Statement of Financial Transactions to be filed by 31.05.2023.

RJA 31 May, 2023

Statement of Financial Transactions to be filed by 31.05.2023. SFT is a report of specified financial transactions by specified persons including specified reporting specified financial transactions. The income tax authority or another specified authority or agency must provide Statement of Financial Transactions from such specified persons who register, retain, or ...