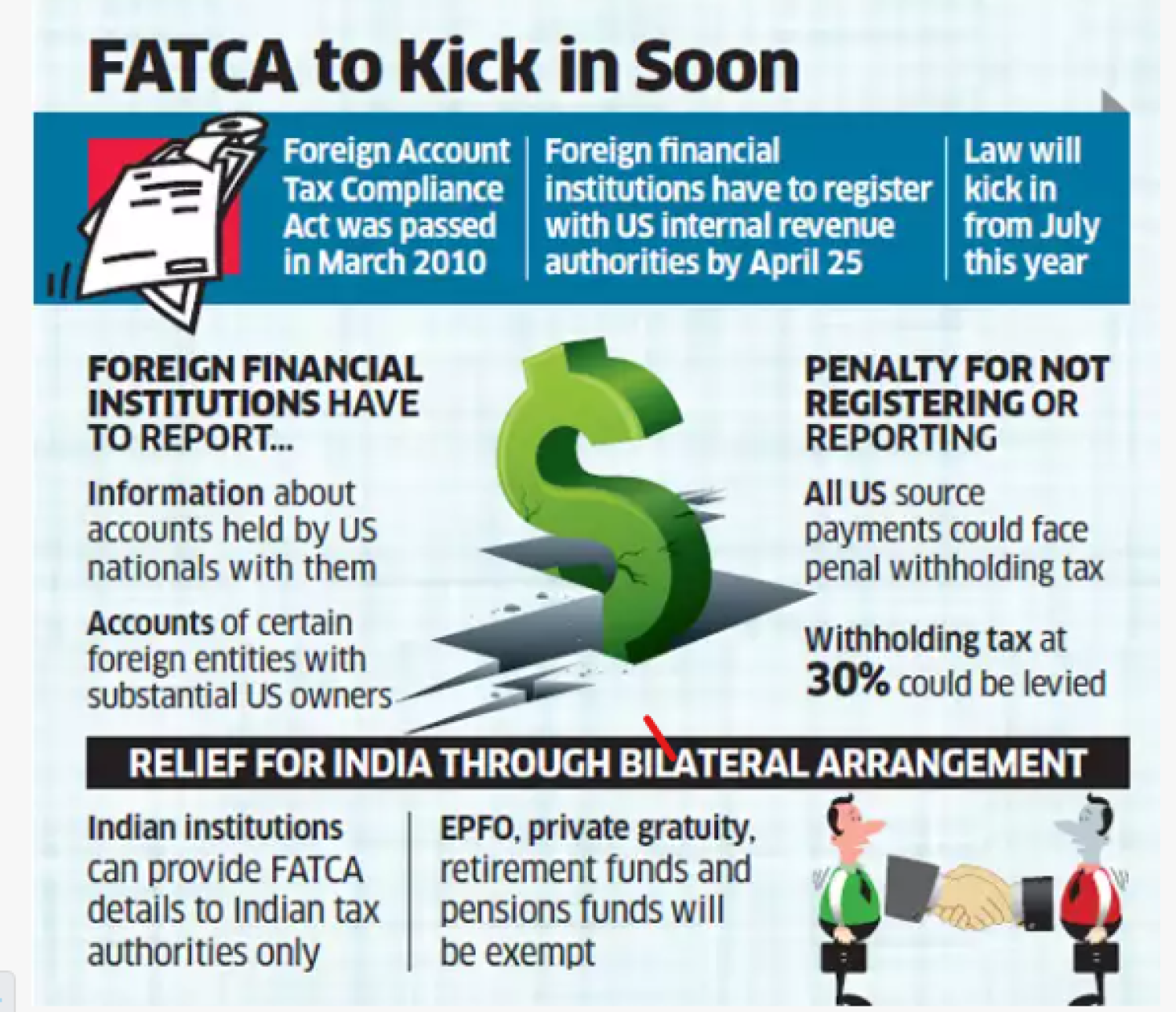

Foreign Account Tax Compliance Act (FATCA) Reporting by reporting entities in India

1. United States of America & India have entered into FATCA Non tax treaty for for disclosure of foreign assets of United States of America residents located outside United States of America .

2. Internal Revenue Service (IRS) of United States of America has been permitted to take reports annually from Indian banks and foreign banks located in India against bank accounts maintained by tax resident of United States of America like maximum outstanding balance in account in calendar year (December 31) in India.

3. Reporting Indian banks are required to send Foreign Account Tax Compliance Act - FATCA letters to customers located in India for knowing about their assets, bank accounts, citizenship and residential status.

Disclaimer: The content of this post isn't considered to be professional or legal advice, We aren't responsible for any damages arising from your access to the location content & must not be relied on or used as a substitute for legal advice from a lawyer professional in your jurisdiction. CARajput is among India's big digital compliance services platform which committed to helping people have started & developed their businesses. We had started with the goal of creating it easier for start-ups to start out their business. Our main aim is to assist the businessman with applicable laws & regulations compliance and providing support at each & every level to make sure the business stays compliant and growing continuously. For any query, help or feedback you may in touch on singh@carajput.com or Call or what’s-up on 9-555-555-480