A Survey conducted after taking input from around 30 Insolvency Professionals

The survey conducted by the Indian Institute of Insolvency Professionals of ICAI reveals that Insolvency Professionals face significant challenges when dealing with statutory authorities and enforcement agencies during the Corporate Insolvency Resolution Process.

Insolvency Professionals face significant challenges during the Corporate Insolvency Resolution Process, particularly when dealing with statutory authorities and enforcement agencies, according to a survey by the Indian Institute of Insolvency Professionals of ICAI (IIIPI).

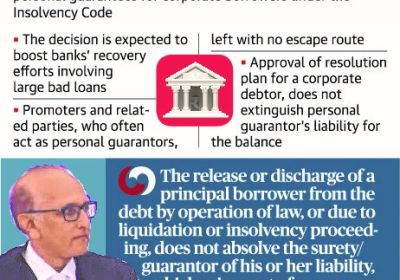

The survey emphasizes the need for enhanced cooperation and communication between statutory authorities and Insolvency Professionals to improve the insolvency resolution process under the IBC framework. Addressing these issues would ensure that the process is more streamlined, allowing IPs to focus on the primary goal of resolving stressed assets within the given timelines. The survey, which included input from around 30 IPs, highlighted several key issues: Key findings from the survey, which included around 30 IPs, point to several obstacles:

Statutory and Penal Proceedings:

- Despite the imposition of a moratorium, IPs often encounter statutory or penal actions initiated against the Corporate Debtors, which adds an additional layer of complexity.

Summons for Pre-CIRP Issues:

- Insolvency Professionals receive summons or notices for civil or criminal matters that pertain to periods before the commencement of Corporate Insolvency Resolution Process. Addressing these issues further complicates their role, as these matters are often linked to acts or omissions by prior management or promoters.

Time-Consuming Interactions:

- Dealing with statutory authorities and enforcement agencies consumes a substantial portion of the Corporate Insolvency Resolution Process timeline, sometimes accounting for up to 25% of the total process. This affects the efficiency of the Insolvency and Bankruptcy Code, which is designed for a time-bound resolution.

Access to Records:

- One of the most significant hurdles is the lack of access to past records or incomplete handover of critical documents, making it challenging for Insolvency Professionals to respond adequately to authorities.

Other key issues & Practical Difficulties Faced by Insolvency Professionals:

- Even after the imposition of a moratorium, IPs often find themselves dealing with statutory or penal proceedings against the Corporate Debtors, which complicates the Corporate Insolvency Resolution Process.

- Insolvency Professionals frequently receive summons or notices related to civil and criminal matters linked to the period before the commencement of Corporate Insolvency Resolution Process, which increases their workload.

- According to the survey, a significant portion of the Insolvency Professionals time—up to 25% of the total Corporate Insolvency Resolution Process timeline—is spent interacting with statutory authorities and enforcement agencies. This hampers the time-bound resolution process mandated under the Insolvency and Bankruptcy Code.

- Ashok Haldia, Chairman of the Indian Institute of Insolvency Professionals of ICAI Board, noted that statutory authorities expect timely resolutions of claims against Corporate Debtors, but Insolvency Professionals face practical difficulties, such as dealing with matters from before the Corporate Insolvency Resolution Process commencement or where past records are unavailable. Often, only the promoters or ex-management are accountable for these issues.

Practical Difficulties Faced by Insolvency Professionals

- Indian Institute of Insolvency Professionals of ICAI Board Chairman Ashok Haldia highlighted that statutory authorities expect timely conclusions of their proceedings or claims against CDs, but Insolvency Professionals struggle with the practical challenges of addressing issues linked to the period before Corporate Insolvency Resolution Process Many of these issues arise because only former management or promoters are accountable, and critical documentation may not be available.

The Insolvency and Bankruptcy Code is designed to provide a time-bound and market-linked resolution of stressed assets, but these challenges hinder the efficiency of the process and add to the IPs' burden in managing insolvencies effectively.

IP Hand book on Best Practices during CIRP Process under IBC Code