Table of Contents

- Lok Sabha Select Committee Unveils Game-changing Ibc Amendment Recommendations

- Key Recommendations- Lok Sabha Select Committee On The Ibc (amendment) Bill, 2025

- Additional Structural & Procedural Reforms

- Reforming Insolvency Profession: Opportunity Missed By Ibc Amendment Bill

- Implications For Stakeholders

Lok Sabha Select Committee Unveils Game-Changing IBC Amendment Recommendations

The IBC (Amendment) Bill, 2025, introduced in Lok Sabha on August 12, 2025, seeks to overhaul the Insolvency and Bankruptcy Code, 2016, by addressing delays, judicial ambiguities, and creditor recovery issues through measures like mandatory admission on default proof and clarified security interests.​

The Lok Sabha Select Committee on the IBC (Amendment) Bill, 2025, submitted its report on December 17, 2025, chaired by Baijayant Panda, proposing refinements to enhance efficiency, governance, and stakeholder value in insolvency processes.​

Key Recommendations- Lok Sabha Select Committee on the IBC (Amendment) Bill, 2025

The Committee suggests expanding "service provider" to include registered valuers with consistent references throughout the Bill for better coherence. It widens resolution plan definitions to permit multiple plans for corporate debtors with diverse operations, aiming to maximize asset value.

Additional reforms codify monitoring committees with resolution professionals, creditors, and successful applicants; apply the clean slate principle retrospectively as declaratory while preserving promoter criminal liability; bar RPs from liquidator roles to prevent conflicts; prioritize inter-creditor deals over government dues in liquidation; impose a 3-month NCLAT appeal timeline; decriminalize Sections 74/76 procedural errors into civil penalties; set CoC decision timelines; and codify UNCITRAL-based cross-border protocols while clarifying foreign corporate debtors.​

The Lok Sabha Select Committee has released its high-impact recommendations on proposed amendments to the Insolvency and Bankruptcy Code (IBC) aimed at strengthening resolution efficiency, legal certainty, and value maximization. Here are the key insights from the article:

- Service Provider Expansion: Registered valuers to be expressly included in the definition of service providers, with consequential amendments across the Bill.

- Resolution Plan Flexibility: Explicitly permit multiple resolution plans for corporate debtors with diversified business verticals to optimize asset value.

- Monitoring Committee Codification: Statutory recognition of Monitoring Committees, mandating inclusion of the Resolution Professional (RP), creditors, and the successful resolution applicant.

- Clean Slate Principle: Clarified as declaratory and retrospective, preventing reopening of concluded cases while retaining criminal liability of promoters.

Additional Structural & Procedural Reforms

- Separation of Roles: Prohibit resolution professionals from acting as liquidators in the same CIRP/PPIR to mitigate conflicts of interest.

- Liquidation Waterfall Clarity: Inter-creditor contractual arrangements to take precedence over government dues during asset distribution.

- NCLAT Timelines: Introduce a statutory 3-month limit for disposal of appeals to curb procedural delays.

- De-Criminalisation : Convert offences U/s 74 and 76 into civil penalties for procedural or technical non-compliance.

- CoC Decision Timelines: Prescribe clear decision-making timelines for the Committee of Creditors (CoC) to enhance predictability.

- Cross-Border Insolvency Framework: Incorporate UNCITRAL Model Law principles and clarify provisions applicable to foreign corporate debtors.

Reforming Insolvency Profession: opportunity missed by IBC Amendment Bill

“Opportunity Missed by IBC Amendment Bill” critically examines why the IBC Amendment Bill, 2025, fails to address structural flaws in India’s insolvency profession. Details are mentioned here under :

- Missed Reforms for Insolvency Professional Agencies (IPAs) : Current IPAs are under the control of sponsoring institutions (ICAI, ICMAI, ICSI), creating conflict of interest and lack of independence. Suggestion: Merge IPAs into a single independent regulator under IBBI.

- Capability Gaps in Insolvency Professionals (IPs) : Resolution of stressed assets requires multidisciplinary expertise (law, finance, management, and industry knowledge). Current practice allows IPs to handle multiple complex cases simultaneously, which is inefficient.

- Recommendations: Sector-specific panels of IPs. Mandatory one-year practical training before granting practice rights. Increase CPD from 10–20 hours to 60 hours annually.

- Independence from the Committee of Creditors (CoC) : Committee of Creditors controls IP appointment and remuneration, leading to fee undercutting and conflicts of interest. Proposed solution: IBBI should appoint RPs for large/public interest cases, with remuneration based on reasonable cost estimates.

- Cooperation from Promoters and Banks : Non-cooperation from promoters and banks delays CIRP. Suggestion: Amend Section 19 of IBC to include bank officers and impose penalties for non-compliance.

- Restoring Trust in the IP Profession : Need for 360-degree inspections by IBBI covering governance, infrastructure, and quality control. Make inspection reports public and introduce peer review mechanisms.

- Globalization of the Indian Insolvency Profession: The bill introduces a cross-border insolvency framework. Opportunity to pursue mutual recognition agreements and global CPD programs.

- Other—Key Provisions

- Mandatory NCLT admission of financial creditor applications upon proven default, complete documentation, and no RP disciplinary issues, with a strict 14-day timeline.​

- Restrictions on withdrawals post-admission (90% CoC approval needed; barred before CoC formation or after first plan invite) to curb misuse.​

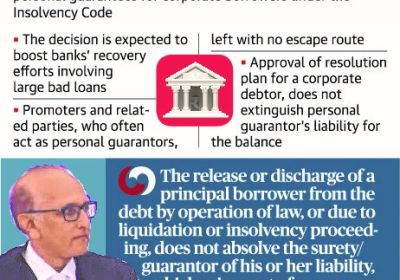

- Reforms for group/cross-border insolvency, guarantor asset transfers into CIRP, and a two-year cap on government dues priority over secured creditors.​

Implications for Stakeholders

- These changes address delays and litigation by enforcing timelines and standards, reducing fear from technical penalties, and improving cross-border clarity, potentially boosting recoveries for creditors like banks in India. For professionals such as CAs involved in valuations and audits, registered valuer inclusion strengthens roles in CIRP without conflicts. Overall, the proposals build on the original bill's creditor empowerment while mitigating risks like prolonged appeals.