Table of Contents

Key Highlights IBBI Notifies 4th Amendment to CIRP Regulations

- The Insolvency and Bankruptcy Board of India (IBBI) has introduced key amendments to the Corporate Insolvency Resolution Process (CIRP) regulations to further strengthen the insolvency framework, enhance investor interest, and uphold creditor rights.

- IBBI Amends Corporate Insolvency Regulations to Enhance Flexibility and Transparency The objective of this change is to enhance procedural efficiency, protect creditor rights, and encourage broader investor participation under the Corporate Insolvency Resolution Process (CIRP). – Effective May 26, 2025

Key Amendments in IBBI Notifications Fourth Amendment to CIRP Regulations

- Expanded Scope for Resolution Proposals: Resolution Professionals (RPs), with approval from the Committee of Creditors (CoC), may now invite Expressions of Interest (EOIs) for The entire corporate debtor, Specific individual assets, or A combination of both.

- Flexible Invitation for Resolution Plans: This flexibility aims to reduce resolution timelines, prevent erosion of value in viable segments, and widen the pool of potential investors. Resolution Professionals (RPs), with CoC approval, can now invite Expressions of Interest (EOIs) for the entire corporate debtor, individual assets, or a combination of both. Which aims to reduce timelines, prevent value erosion, and attract diverse investors.

- Staggered Payment Structure: In phased resolution plans, dissenting financial creditors (those who voted against the plan) must now be paid on a pro rata basis and before creditors who supported the plan. This will balance dissenting rights with practical implementation constraints.

- Interim Finance Providers—Observer Role in CoC can invite interim finance providers to attend meetings as observers (without voting rights). The basic objective is to improve transparency and enable informed interim funding decisions.

- Priority Payments to Dissenting Financial Creditors: Under resolution plans with staggered implementation, financial creditors who did not vote in favor of the plan will now receive payments at least on a pro-rata basis and before the consenting creditors. This ensures a balanced approach between creditor rights and phased execution of plans.

- Disclosure of All Resolution Plans: RPs are now mandated to present all received resolution plans, including non-compliant ones, to the CoC with full details. And RP ensures complete visibility and supports transparent and informed decision-making by the CoC.

- Observer Role for Interim Finance Providers: The CoC may instruct the RP to invite interim finance providers to attend CoC meetings as observers (without voting rights). This amendment gives financiers a clearer picture of the corporate debtor’s operational and financial condition, facilitating better-informed funding decisions.

Our Key Services include:

-

Drafting & filing Resolution Plan Applications (Sec. 30) and Liquidation Applications (Sec. 33).

-

Filing & prosecuting applications under Secs. 7, 9, 10, 60, and other relevant provisions.

-

Comprehensive support to Resolution Professionals (RPs) and Committees of Creditors (CoC) – including drafting, vetting, rejoinders, affidavits, and compliance reports.

-

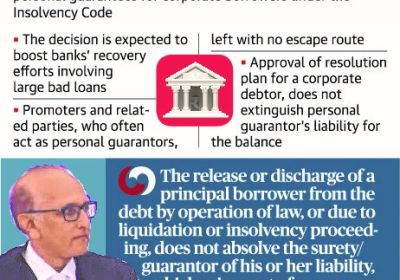

Representation of financial creditors, operational creditors, corporate debtors, and personal guarantors before NCLT/NCLAT.