Table of Contents

Encouraging Restructuring Over Liquidation in the IBC Framework

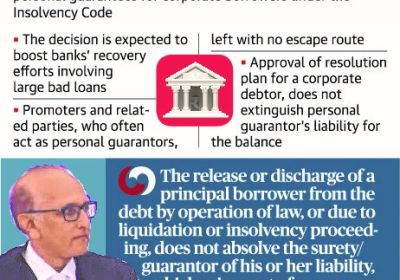

The IBC was conceived as a mechanism to prioritize the revival of distressed companies over liquidation, ensuring a balance between creditors’ recoveries and the economic viability of corporate debtors. However, recent amendments to the Insolvency and Bankruptcy Board of India Regulations have amplified concerns regarding strict eligibility criteria, particularly under Section 29A. While these amendments aim to plug loopholes and safeguard creditor interests, they also present challenges that could inadvertently discourage restructuring.

Key Issues with Current Amendments

- Bar on Compromise or Arrangement at Liquidation Stage: The prohibition on ineligible persons, including former promoters, from participating in compromise or arrangements during liquidation reduces the pool of potential bidders. Genuine promoters, who may have the best understanding and ability to revive their businesses, are excluded.

- Restrictions on Secured Creditors: Secured creditors are now barred from selling assets to ineligible parties, even under Section 52 of the Insolvency and Bankruptcy Codes. While this ensures integrity, it also removes flexibility, limiting competitive bidding and potentially reducing recoveries.

- Blanket Restrictions U/s 29A: The rigid ineligibility framework u/s 29A, combined with its broad interpretation, disqualifies many capable bidders, including promoters willing to repay dues or offer higher recoveries than third-party acquirers.

- One-Man Governance During Moratorium: Resolution professionals are entrusted with sole control over the debtor’s operations during the moratorium. Without sufficient checks and balances, this can lead to operational inefficiencies and missed opportunities for restructuring.

- Impact on Creditor Recoveries: The exclusion of promoters and related parties often reduces competition among bidders, resulting in lower recoveries for creditors.

Opportunities to Encourage Restructuring

- Selective Relaxations for Promoters: Genuine promoters willing to repay dues or meet stringent safeguards should be allowed to participate in resolution or liquidation processes. A middle-ground approach could include:

- Mandating upfront payments or escrow arrangements.

- Allowing promoters to bid under strict oversight from the CoC.

- Enhanced Flexibility for Secured Creditors: Amend regulations to allow secured creditors to sell assets to ex-promoters under specific conditions, ensuring no compromise on integrity while maximizing recoveries.

- Strengthening the Role of Resolution Professionals: Introduce mechanisms to enhance transparency and accountability in RP decision-making, such as oversight committees or regular audits.

- Use of Technology for Due Diligence: Solutions like Rajput Jain and Associates 29A Eligibility Check system can streamline the due diligence process, reducing delays and ambiguities. This would help ensure that only genuinely ineligible parties are excluded, avoiding unnecessary disqualifications.

- Incentivizing Restructuring Plans: Encourage restructuring by offering tax benefits or financial incentives to successful resolution applicants who preserve jobs, enhance creditor recoveries, or retain business viability.

Addressing Concerns Raised by Amendments: Recommendations and Alternatives for Improvement of Section 29A

- Middle-Ground Approach: Allow promoters to bid if they clear all outstanding dues or demonstrate credible intent to revive the corporate debtor, subject to strict oversight by the CoC.

- Competition Among Bidders: Revisiting blanket restrictions u/s 29A will foster competition by allowing more parties, including promoters with credible restructuring plans, to bid.

- Time-Bound Relief for Promoters : Allow promoters to bid if they:

- Repay all dues within a specified timeframe.

- Provide a clear revival plan under strict oversight.

- Clarity in Definitions: Narrowing the scope of "connected persons" and specifying relevant disqualification criteria can reduce ambiguities and avoid unnecessary exclusions. Redefining related and connected parties can prevent unwarranted exclusions while maintaining fairness.

- Safeguards for Creditor Interests: Introduce mechanisms to balance morality with practicality, such as escrow arrangements or upfront payments, ensuring creditors receive the highest possible returns while safeguarding the process.

- Balancing Creditor and Stakeholder Interests: Flexibility in the eligibility criteria will enable higher recoveries for creditors while promoting business continuity, benefiting employees, suppliers, and other stakeholders.

- Exemptions for MSMEs: Expand the limited exemptions for Micro, Small and Medium Enterprises to promote entrepreneurial revival without compromising creditor recoveries.

- Encourage MSME Participation: Expand exemptions for MSMEs to foster entrepreneurial growth and avoid liquidation.

- Judicial Relaxation in Exceptional Cases: Courts should adopt a nuanced approach, considering financial viability and stakeholder impact in cases where Sec 29A disqualifications seem overly restrictive. Courts should adopt a pragmatic approach, especially where promoters offer higher recoveries to creditors.

- Filling Gaps in Insolvency Law: Recent amendments clarify ambiguities but must evolve to avoid contradictions with the Insolvency and Bankruptcy Code’s objective of revival over liquidation.

Conclusion

While the Insolvency and Bankruptcy Codes has been instrumental in transforming India’s insolvency landscape, encouraging restructuring over liquidation remains vital. Revisiting the restrictive aspects of Section 29A and the recent amendments can create a more inclusive and competitive framework. Strategic use of technology, coupled with pragmatic relaxations, will ensure that the Insolvency and Bankruptcy Codes continues to prioritize the revival of distressed companies while safeguarding creditor interests and economic stability. Sec 29A is instrumental in maintaining the integrity of the IBC by barring unethical or incapable individuals from the CIRP. But its rigid application can sometimes hinder the revival of distressed assets. A balanced approach—tight safeguards coupled with practical leniencies—can enhance the resolution process, ensuring the IBC remains a robust tool for insolvency management in India