Table of Contents

QUICK CLARITY ON TAX DEDUCTED AT SOURCE & TAX COLLECTED AT SOURCE UNDER GST:

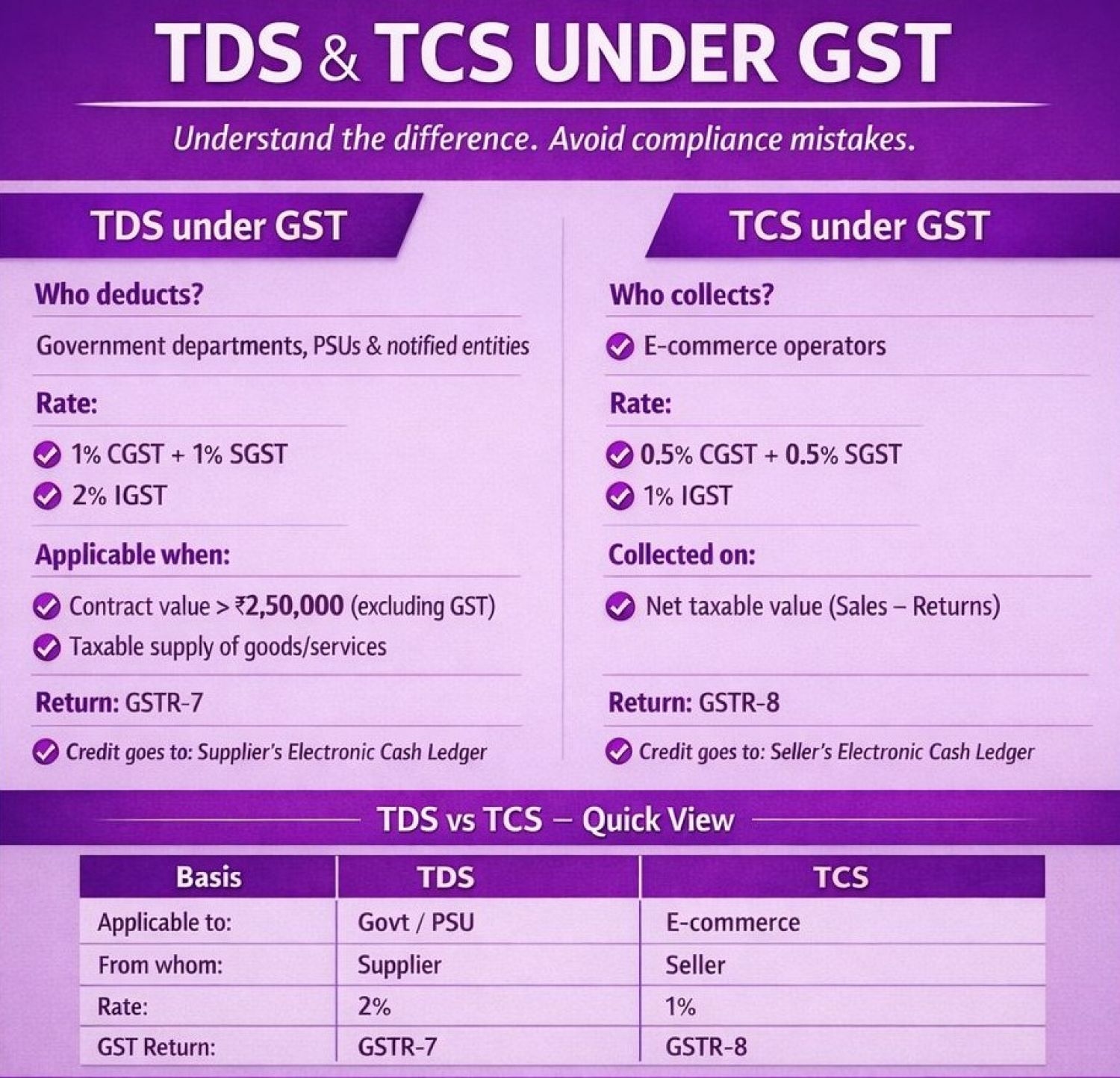

Many GST mismatches don’t happen due to wrong tax rates; they happen because TDS and TCS are misunderstood. A clear understanding of tax deducted at source & TCS under GST helps avoid unnecessary mismatches and compliance stress. Although both Tax Deducted at Source and Tax Collected at Source appear as cash ledger credits, they are very different in applicability, return filing, reconciliation process, and compliance impact.

Why Tax Deducted at Source & Tax Collected at Source under GST Matter: Tax Deducted at Source & TCS under GST Directly Impact Cash Flow, Proper Reconciliation Is Needed Before Filing GSTR-3B, and Errors in Tax Deducted at Source & TCS under GST May Trigger Notices, Follow-Ups, or Blocked Credits.

Tax Deducted at Source under GST:

Applicability of TDS under GST

- Tax Deducted at Source under GST applies from 1 October 2018. It must be deducted when certain notified persons make payment to suppliers and the contract value exceeds INR 2.5 lakh (excluding GST). Applies mainly when supplies are made to government departments, PSUs, and notified entities. If the contract value exceeds INR 2.5 lakh (excluding GST), the recipient deducts GST Tax Deducted at Source and deposits it with the government. This deducted amount Reflects in the supplier’s Electronic Cash Ledger and Can be used to pay GST liability

Who must deduct tax deducted at source under GST?

- Tax Deducted at Source is applicable when payment is made by Central/State Government departments, local authorities, and government agencies: Notified bodies include authorities/boards with 51% or more government participation, societies set up by govt under the Societies Registration Act, 1860, and public sector undertakings.

Rate & Value for Deduction under Tax Deducted at Source under GST:

- Tax Deducted at Source rate: 2% (1% CGST + 1% SGST or 2% IGST). TDS Deduction in GST applies on contract value, not invoice-wise, and GST components (CGST, SGST, IGST, Cess) must be excluded when checking the INR 2.5 lakh condition

Transitional Provisions

- Supply before 1‑10‑2018 but invoice after that → Tax Deducted at Source applies

- Invoice before 1‑10‑2018 but payment after → TDS does not apply

Registration Requirements for TDS Deduction under GST

- Compulsory GST registration under Section 24 (no threshold exemption)

- Can register with TAN instead of PAN

- DDO (Drawing & Disbursing Officer) is personally responsible for compliance

- Mobile and email required for OTP verification

When TDS is Not Required (Exemptions) under Tax Deducted at Source under GST:

- Contract value ≤ INR 2.5 lakh: Even if multiple contracts exist, each contract is tested separately. Examples provided in the PDF illustrate this.

- Place of Supply Mismatch (Location triangle): TDS does not apply when Location of Supplier ≠ Place of Supply ≠ Location of Recipient. Example: Delhi Govt hiring Radisson Haryana (POS Haryana, supplier Haryana, recipient Delhi) → No Tax Deducted at Source

Payment, Return Filing, and TDS Certificate under GST

- TDS must be deposited by 10th of next month via GSTR‑7

- Tax Deducted at Source certificate GSTR‑7A must be issued within 5 days of deposit

- Delay in issuing certificate → INR 100 per day (max INR 5,000)

- TDS amount appears in supplier’s Electronic Cash Ledger

Penalties for Non‑Compliance

|

Event |

Consequence |

|

Tax Deducted at Source not deducted |

Interest & recovery |

|

TDS certificate not issued |

INR 100/day (max INR 5,000) |

|

Tax Deducted at Source deducted but not paid |

Interest & recovery |

|

Late filing of GSTR‑7 |

INR 100/day (max INR 5,000) |

Excess tax deducted at the source can be claimed as a refund unless already credited to the supplier's cash ledger.

Tax Collected at Source under GST:

Tax collected at the source under GST applies to e-commerce operators. The Tax Collected at Source under the GST platform collects tax on the net taxable value of sales. Tax collected at source under GST is to be deposited on behalf of sellers. This also reflects the seller’s Electronic Cash Ledger, but through GSTR-8 compliance.

Applicability of Tax Collected at Source under GST

Tax Collected at Source applies to every e‑commerce operator. They must collect 0.5% CGST + 0.5% SGST, or 1% IGST (for inter-state supplies). This collection is on the net value of taxable supplies made through the platform.

Registering as a Tax Deducted at Source or Tax Collected at Source under GST

The registration application for a tax deductor or tax collector must be filed online on the GST portal. Applicants submit the prescribed form in the registration section. The process can be completed by the applicant directly—no physical submission is required.

Preconditions for registration as Tax Deducted at Source / Tax Collected at Source

The taxpayer must have the following details mentioned below:

- For Tax Deducted at Source Registration: A valid PAN or TAN

- For TCS Registration: A valid PAN

- Common Requirements for Tax Deducted at Source and TCS registration

- Valid mobile number

- Valid email ID

- Required documents and information for all mandatory fields

- A place of business

- An authorized signatory with proper authentication details

Will I get a taxpayer? It will not get registered automatically after submitting the application. Taxpayer registration must be approved only after the tax officer verifies and approves your application. Only then does the taxpayer receive the registration certificate.

GSTIN (for Tax Deducted at Source / Tax Collected at Source)

- After filling out Part A of the registration application and clicking Proceed, the GST portal automatically displays all Existing GSTINs, provisional IDs, UINs, and GST Practitioner IDs that are mapped to the same PAN across India.

- Taxpayers can use the same mobile number, email ID, and PAN for multiple GST registrations: The GST portal allows multiple registrations using the same email address, mobile number, and PAN.

- In case the taxpayer is an e-commerce operator registered for TCS. If you supply goods or services in multiple states, you must obtain separate TCS registrations in each state/UT. The taxpayer must also appoint a responsible person in each state who will handle GST compliance.

Principal place of business: For TCS registrations:

- In Part A of the application, mention the State/UT where you want to register, even if you don’t have a physical presence there.

- In Part B, you can specify the principal place of business, which may be different.

- The State/UT field in Part B can be edited if required.