Table of Contents

Auditor Appointment for Newly incorporated Private Limited Company

It is to be noted that, as per section 139(6) of The Companies Act, 2013 you are required to appoint First Auditor within 30 days of incorporation of the company, the same shall be appointed at the First Board Meeting.

Rule 24(8) exempts the LLP from the Audit of its accounts if its turnover does not exceed, in any financial year, Rs. 40 lakhs or its contribution does not exceed Rs. 25 Lakhs. LLPs have to appoint an auditor within 30 days before the end of the financial year.

About 60% of new stakeholders are not aware of the ROC formalities and without proper guidance, many of them end up paying heavy penalties. Directors are liable to run the company and thus held responsible for any misadventures during their tenure. Understanding the subject matter with proper guidance from VerslasGuru can help you save time and money and also ease the process of running the business. For a better understanding, we have provided extensive details about the requirements of our company in a manner we can comprehend easily.

Mandatory Annual Compliance for a Private Limited Company - Financial Year 2020-21.

- Preparation & Filing of Form ADT - 01 (Auditor Appointment)

- Commencement of Business Form 20A

- Assistance & Documents Preparation for Bank Account Opening

- Preparation of Balance Sheet, P & L Accounts, Audit Report, Director's Report, Extract of Annual Returns & Financial Statements

- Preparation & Filing of Form AOC 04 (Financials Related Annual Return)

- Preparation & Filing of Form MGT 07 (Management Related Annual Return)

- Use of DSC of Auditor in Form AOC - 04

- Preparation of 04 Minutes of Board Meeting

- Preparation of Minutes of AGM

- Income Tax Returns (Company)

- Income Tax Returns(Directors)

- Share Certificate

- Preparation of 07 Registers

- Preparation of MPB-01 (Disclosure of Interest by Directors)

- Preparation of DIR - 08 (Disclosure of Non-Disqualification by Directors)

- DIR 3 e-KYC Filing

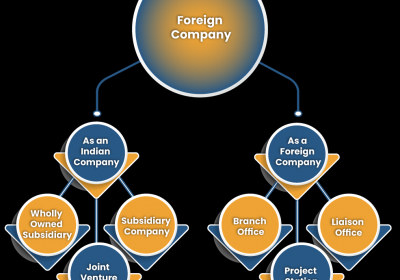

Mentioned above are mandatory Compliance requirements for a Private Limited Company, for a complete checklist of LLP, Trust, Nidhi Company, and all other entities registered under Companies Act 2013

Non-Compliant Companies are heavily penalized by the Ministry of Corporate Affairs. Directors have advised a cautious approach towards running the company or it may lead to prosecution as well as monetary punishment.

Our Services at Glance

- Company Registration

- GST Registration

- Filing of GST Returns

- Bookkeeping & Accounting

- Filing of TDS Returns

- PF & ESI Registration

- PT (Professional Tax) Registration

- IEC (Import Export Code) Registration

- Trademark/Copyright Registration

- Website for your business

- Online Marketing and Promotions

- MSME Registration

- Startup India Registration

- Nidhi Company Software

- Accounting Software and more

Need Our Expertise?

Reply to us on this email or WhatsApp/call us on +91- 9555 5555 480 for further assistance. Once appointed as associates we will be responsible for all the work that requires a professional approach with MCA/authorities and will also keep you in the loop for a peaceful state of mind.