Table of Contents

Wholly Owned Subsidiary in India.

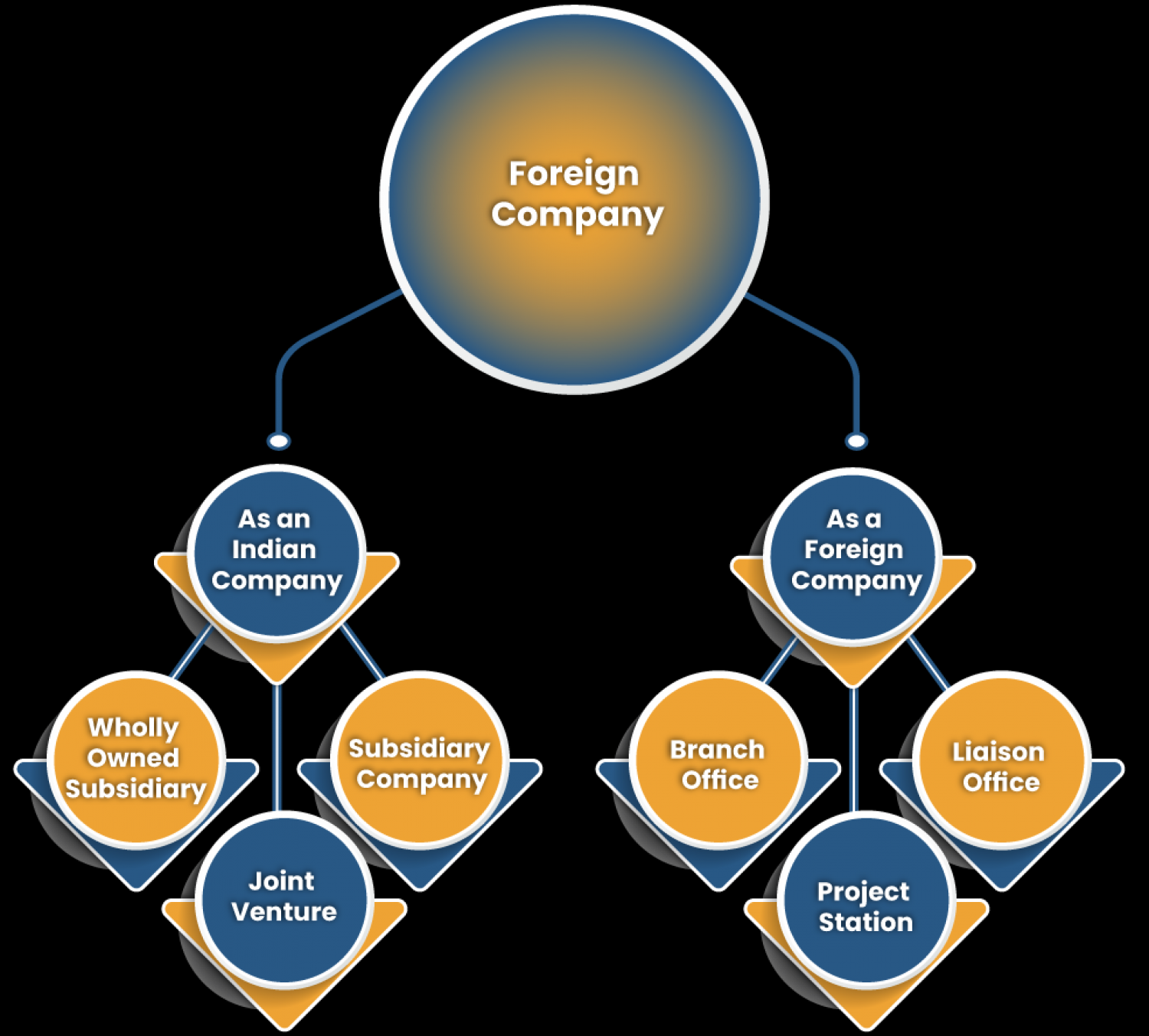

- foreign companies may establish fully owned subsidiaries in areas that allow 100% foreign direct investment Under India's national FDI policy, For incorporation & registration, a set of applications have to be filed with Registrar of Companies (ROC). Once a company has been duly registered and incorporated as an Indian company, it is subject to Indian laws and regulations as applicable to other domestic Indian companies.

Main characteristic of 100% Wholly Owned subsidiary:

- Where 100% FDI is permitted no prior approval of RBI is needed. It is treated as domestic company under Income Tax Law and is eligible for all exemptions, deductions benefits as applicable to any other Indian Company,

- Funding can be made in the form of Share Capital, A wholly owned subsidiary is a company whose common stock is 100% owned by a parent company.

- 100% Wholly own Subsidiary is regulated by Indian Law along with companies Act, 2013.

Minimum criteria Pre-Conditions of 100% Wholly Owned subsidiary:

Below are pre- requirements to Set Up a100% Wholly Owned subsidiary:

- A minimum of Two Directors.

- The shareholders should also be at least Two.

- Paid-up Rs 1,00,000/- capital at least.

- At Least Two Directors: Directors should be individual only. No Body corporate/ Hindu Undivided Family or Partnership Firm can be appointed as Directors. (At least one Director should be Indian Resident).

- At Least Two Promoters: Promoters who will promote/ incorporate the company. Promoters will be body corporate (In case of 100% Wholly Owned subsidiary of Foreign Company Promoter will be Company Incorporated outside India).

- Registered Office in India.

Key Notes :

- Directors’ Boards: Companies Act, 2013 permits the directors of the Indian Business to be NRIs, PIOs, Foreign Nationals & Foreign Citizens. To be an Indian company’s director, the basic requirements the person should have are the: first receive a DIN & DSC.

- In case of foreign 100% Wholly Owned subsidiary of Foreign Company, foreign company wants to use same prefix as per their Foreign Company for Incorporation of Indian Company. {NOC from the foreign Company on their letter head required to use prefix)

- A wholly owned foreign company subsidiary in India can only be formed if it is 100 % Foreign Direct Investment is approved & Reserve Bank of India is no longer registered for prior approval. under Automatic Route, FDI is permitted without Govt’s prior consent & Reserve Bank of India.

FOREIGN DIRECT INVESTMENT (FDI) POLICY

- Forign Direct Investment under automatic route is now allowed in all sectors, including the services sector, Except a few sectors where the existing and notified sectoral policy does not permit Forign Direct Investment beyond a ceiling.

Automatic Route

- No prior approval is required for Forign Direct Investment under the Automatic Route. Only information to the Reserve Bank of India within 30 days of inward remittances or issue of shares to Non Residents is required. Reserve Bank of India has prescribed a new form, Form FC-GPR (instead of earlier FC-RBI) for reporting shares issued to the Foreign Investors by an Indian company within 30 days to Reserve Bank of India. Non compliance may face the penal action.

|

Foreign Investors |

Non Resident Indians |

|

Application for such cases are to be submitted in FC/IL form or on plain paper to Foreign Investment Promotion Board (FIPB) in Department of Economic Affairs, Ministry of Finance, Government of India North Block, New Delhi 110001. |

Non Resident Indians are required to submit their proposals to the Secretariat for Industrial Assistance (SIA) Department of Industrial Policy and Promotion, Government of India for consideration of Foreign Investment Promotion Board. |