Goods and Services Tax

SALIENT FEATURES OF NEW GST SYSTEM IN INDIA

RJA 22 May, 2017

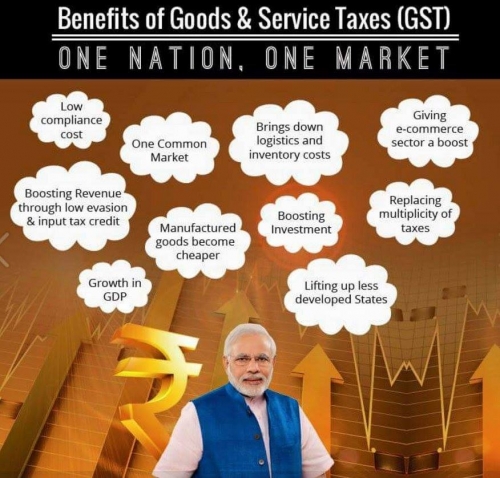

SALIENT FEATURES OF NEW PROPOSED GST SYSTEM IN INDIA : In keeping with the federal structure of India, it is proposed that the GST will be levied concurrently by the central government (CGST) and the state government (SGST). It is expected that the base and other essential design features would be ...

Goods and Services Tax

Latest news from the GST council - final GST rates structure in India

RJA 22 May, 2017

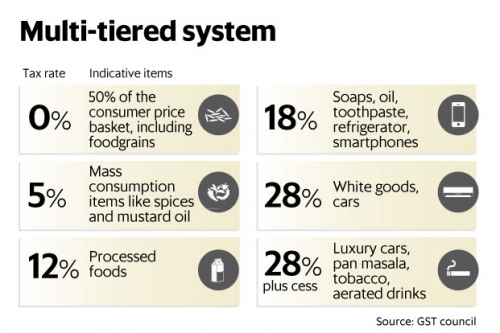

LATEST NEWS FROM THE GST COUNCIL – FINAL GST RATES STRUCTURE IN INDIA We already know that the GST slabs are pegged at 5%, 12%, 18% & 28%. According to the latest news from the GST council, the tax structure for common-use goods is as under. GST Rates Structure Tax Rates Products 5% Edible ...

Goods and Services Tax

GST : Value of supply under GST Act

RJA 09 Apr, 2017

VALUATION OF SUPPLY UNDER G.S.T Calculation of Value of Supply under GST Supply value is an important concept in the sense of GST as it specifies the GST payable in a transaction. Pursuant to the GST Act, the value of the supply of products or services is the ...

One Person Company

Inc-29 One Person Company Registration

RJA 20 Mar, 2017

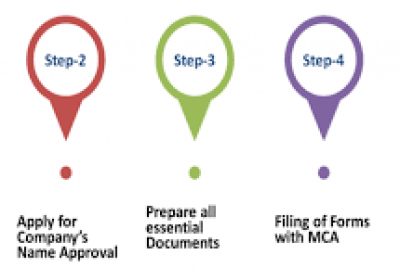

The company registration process is being fast-tracked by Form INC-29 which is formed by the ministry of corporate affairs. The Companies Act of 2013 includes the One Person Company. This is why the fast track registration process is also applied to the One Person Company Registration. This particular article will talk ...

Business Setup in India

Everything That You Need To Know About Limited Liability Partnership

RJA 20 Mar, 2017

It is a tactful process and it includes a step by step process. LLP is an emerging small business entity practised in India under a certain act known as LLP Act, 2008. The relaxation of the FDI rules which concern LLP has drastically increased the interest amongst certain NRIs and Foreign ...

One Person Company

Registration of One Person Company

RJA 18 Mar, 2017

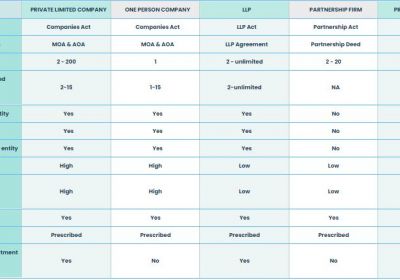

Registration of One Person Company Start a business, sure? One of the first considerations that could come to mind is the legal structure of your business? In this article, we will explore the various types of organization structures that are available and how we can settle on the best corporate ...

Business Setup in India

How To Name Your Indian Business

RJA 18 Mar, 2017

Shakespeare said, "what's there is a name"? Well, it means a lot in the industry. The name of your firm is the first and new start to determine when you start a business and it has to be wisely selected because it will be your company's ...

Limited Liability Partnership

Conversion of the Partnership Firm into LLP

RJA 17 Mar, 2017

Conversion of the Partnership Firm into LLP The Limited Liability Partnership in India was introduced by the Limited Liability Partnership Act of 2008. It was organized for a number of reasons which include creating a flexible environment for small enterprises and uplifting the service sector so that the business synergies can ...

Business Setup in India

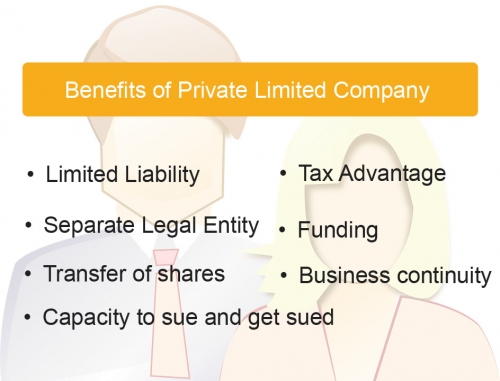

Advantages of a Private Limited Company

RJA 15 Mar, 2017

Beginning a company is an exciting and gratifying process and these days, virtually everybody wants to operate a business. The selection of a corporate company is one of the essential choices before going into a business venture. This can be a proprietorship, corporation, joint corporation or private business. A good ...

One Person Company

The Rules for Incorporation of the One Person Company

RJA 12 Mar, 2017

INCORPORATION OF ONE PERSON COMPANY It was recommended in 2005, by the committee by Dr. JJ Irani. The One Person Company was introduced in India in the year 2013. The Draft Rules under the act known as the Companies Act 2013 has defined the incorporation process of the One Person Company. ...

Limited Liability Partnership

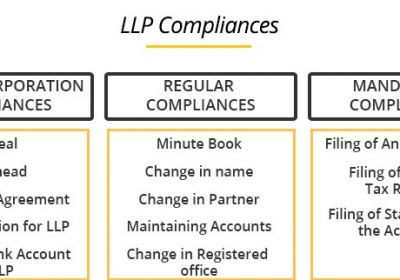

All About Compliance Post LLP Incorporation

RJA 03 Feb, 2017

All about Compliance Post LLP Formation For the perfect and efficient functioning of the Limited Liability Partnership, there are compliances and legal matters that need to be settled. To file an LLP Agreement: This agreement looks over the powers and entitlements of the partners and the organization itself. This ...

Business Setup in India

What Are The Duties Of Partners in Limited Liability Partnership?

RJA 02 Feb, 2017

Limited Liability Partnership or in short LLP is a kind of partnership in which, as the name says, has limited partnership rights and liabilities. General Duties of the partners in LLP: The foremost thing in any of these kinds of partnerships is the trust factor among every partner. No one ...

Goods and Services Tax

Overall Impacts of GOods and Service Tax

RJA 28 Dec, 2016

One of the most emerging taxes of the future that is added on consumption goods and value-added basis is the Goods and Services Tax (GST). From now one cannot distinguish between the ‘Dual GST’ that is going to be imposed on goods and services. The tax will be ...

Goods and Services Tax

GOODS AND SERVICES TAX Impact on Tea industry

RJA 27 Dec, 2016

The two tea associations i.e. the Indian Tea Association (ITA) and the United Planters’ Association of Southern India (UPASI) are worried about the GST rates. They believe that if the GST rates, which will be announced soon, are higher than the present VAT rates which are between 5-6 ...

Goods and Services Tax

Impact of Goods and service Tax on Pharmaceutical Sector

RJA 26 Dec, 2016

The current tax structure of our country contains many complications because of the multiplicity of taxes, tax surging, and a large number of necessary responsibilities. In order to create a more uncomplicated tax structure, various Indirect taxes have been incorporated in the GST. In the GST act, there has been ...

Goods and Services Tax

Impact of GST on Textile Industry

RJA 24 Dec, 2016

Impact of GST on Textile Industry The textile industry and especially the cotton value chain are going to be affected negatively by the changing GST rates. Although the GST rates are not announced yet it is likely to bring a great change. Dr. Arvind Subramanian Committee has recommended putting down ...

Goods and Services Tax

Impact of GST on telecommunication industry

RJA 23 Dec, 2016

With the model draft of GST law, the industry has been transformed in a great way. This has changed the new industry due to ease of registration, smooth credit flows and a single tax approach. The business and the State government must be directly involved. This is a basic requirement ...

Goods and Services Tax

Effect of GST on the Real Estate Sector

RJA 22 Dec, 2016

Effect of GST on the Real Estate Sector The indirect taxes which are received from the Real Estate Sector are to be soon combined together under the GST regime. There are several reasons as to why the Real estate Sector is to be made a part of the tax base ...

Goods and Services Tax

GST Impact On Traveling Business

RJA 21 Dec, 2016

The effect of GST will certainly initially affect the hospitality sector, which is a significant part of the tourism industry. Nevertheless, it can prove to be of long-term value to the industry. Within the GST system, the incentives are required to be pursued, R&D cessation would be reduced ...

Goods and Services Tax

Impact of Goods and Service Tax on the Power Sector

RJA 20 Dec, 2016

India staged a decision to implement GST (unified Good and Services Tax), which was proposed almost 30 years ago, after obtaining nod from both the upper and lower houses. The uniform tax is helpful for the tax payers across the nation. The new tax law considering including Countervailing duty, VAT, ...

Goods and Services Tax

Goods and service Tax effect on manufacturing sector

RJA 19 Dec, 2016

Countries that are emerging are largely supported economically by the country's manufacturing sector. But when all other emerging economies are seeing an increase in manufacturing sector growth, India is a way behind. The topographical and the demographical position of India are promising but the country has not been ...

Goods and Services Tax

GST effect on Logistics Industry

RJA 18 Dec, 2016

As soon as the parliament gave a green light to the Goods and Services Tax bill, the Indian companies had a moment of ecstasy. The implementation of the GST was intended to ensure that a uniform tax structure existed in the country by removing the multi-layer taxation system in both ...

Goods and Services Tax

Goods and Service Tax Impact On Automobile Sector

RJA 17 Dec, 2016

Due to the multiplicity of taxes, elaborate compliance obligations, and cascading of taxes, there is a complex system of taxes existing in our country. A number of complex systems occur in the automotive industry. It may be the longer investment period, vendor/part maker growth, significantly outsourced processes, specific business ...

Goods and Services Tax

Effects of Goods and Services Tax on the Energy Sector

RJA 16 Dec, 2016

If the economy continues to expand then the energy market is one of its key engines, but it is currently plagued by political instability and regulatory hurdles. The biggest problem of indirect taxes cutting into this sector's income has also, unfortunately, persisted into the Goods and Services Tax (GST). ...