The company registration process is being fast-tracked by Form INC-29 which is formed by the ministry of corporate affairs. The Companies Act of 2013 includes the One Person Company. This is why the fast track registration process is also applied to the One Person Company Registration. This particular article will talk about the process in which the INC-29 One Person Company registration works.

One Person Company

The Companies Act 2013 has brought about a new type of business entity, namely the One Person Company. It stands to be a good option for those entire businessmen who are in need of a corporate legal entity and who want to start a new business without their partners. This is a type of business entity where 100% shareholder could be only one particular person who also stands to be the sole director of the Company. However, this cannot be the case for a Private Limited Company. There is a minimum requirement of two shareholders here.

One Person Company registration-

Step 1: Digital Signature Certificate

The main director of the One Person Company requires the Digital Signature Certificate. The digital signature application form is required to obtain the Digital Signature Certificate. It also requires certain other things like the attested copies of the PAN card and address proof which include driver license, aadhaar card, electricity bill etc. One can receive the Digital Signature Certificate within 1 to 2 working days. It should be noted that foreign citizens are not permitted to start a One Person Company in India.

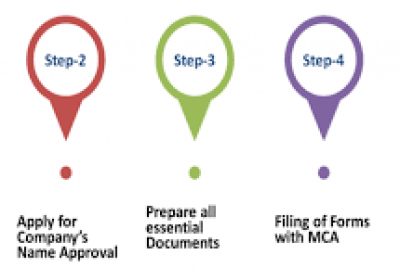

Step 2- Prepare the Incorporation Documents

The incorporation of the One Person Company can only be done by presenting the following documents. It can be also prepared by the entrepreneur with the support of IndiaFilings.com. The document which is needed for filing Form INC-29 are-

- Memorandum of Association.

- Articles of Association.

- Declaration.

- Affidavit.

- Copies of utility bill of registered office address which is not more than two months old.

- Identity and address proof of the nominee director.

- Identity and address proof of the main director.

- Proof of the registered office address.

Prepare INC-29

The form INC-29 can be easily prepared after the submission of the above-mentioned documents. These documents are prepared by the CA Rajput or a Financial Professional. It is required to submit the INC-29 to the MCA along with the Digital Signature of the Chartered accountant or it can also be signed by the Company Secretary. The Cost Accountant or an Advocate can also sign it. This is why certain professional help is always required.

One should keep in mind that the process of receiving the approval of the name is always integrated along with the incorporation process when you are using the INC-29 form. The incorporation process only allows one name to be included here. The name which is chosen should in no way match with the existing company or LLP name or with any trademark. The following articles will help you to know how you can choose the right name.

The DIN is not necessary in name of the nominee director. However, it is certainly required to obtain a letter from the nominee who is chosen. This letter should express his/her consent to be a director of the One Person Company.

STEP 3- File for Incorporation

After preparing all the above-mentioned documents and the form INC-29 which is mentioned above, it is required to affix the Digital Signature of a financial professional. It can be a CA/CS/CWA or a lawyer. It also required for the main director to sign the INC-29 FORM. Only after doing all these forms, INC-29 is finally ready to be filed by the MCA.

STEP 4: One Person Company Registered

The One Person Company will only be registered in the form INC-29 and all the above-mentioned documents are attached which are in conformance with the Companies Act 2013. After all this, the incorporation would also be issued by the Registrar. If there are any errors or mistakes with the filing of the INC-29 it is required to submit it again after making the mentioned changes. It should be submitted within 15 days.