INCORPORATION OF ONE PERSON COMPANY

It was recommended in 2005, by the committee by Dr. JJ Irani. The One Person Company was introduced in India in the year 2013. The Draft Rules under the act known as the Companies Act 2013 has defined the incorporation process of the One Person Company. A one-person company is a company that has only one person its member. The one-person company is incorporated as a private company therefore all the provisions of a private company apply to one person company. There are certain definite rules one should follow while incorporation of the One Person Company. These have been explained below-

Who has the right to incorporate the One Person Company?

According to the draft rules written in the Companies Act of 2013, only a natural person who is known to be an Indian citizen and the resident of India has the ultimate right to incorporate the One Person Company. He also has the right to be the sole member of this new business entity known as the One Person Company. A ‘resident of India’ is known to be a particular person who has lived in India for a time which is more than 182 days. It should be immediately during the previous financial year. It should be noted that a single person does not have the right to incorporate more than five One person Companies.

REQUIREMENTS RELAXATION OF ONE PERSON COMPANY

- Member should be a citizen and resident of India.

- The nominee should be a citizen and resident of India.

- Can have only one director or member in the company.

RELAXATION OF ONE PERSON COMPANY

- No need to hold annual general meetings.

- Cash flow statements are not included in financial statements.

- provisions of independent directors do not apply to the one-person company.

- Articles of association provide additional grounds for the vacation of a director's office.

- Provisions relating to the quorum of the meeting do not apply to them.

- One person company can pay extra remuneration to directors than other companies.

Who is the Nominee of the One Person Company?

The original owner who is the person incorporating the One Person Company is responsible to nominate a particular person who has the ability to become a member of the One Person Company. He should be able to carry out his duty when the original owner has died or when he is incapable to carry out the contract. It is necessary to mention the name of the nominee in the memorandum of the one person Company. Also, it is necessary to get the consent of the nominated person of the one-person company.

The automatic conversion of OPC into Private Limited or Limited Company

The Companies Act 2013 has stated that the limit to which the paid-up share can increase is fifty lakh. If it happens to exceed the limit of fifty lakh rupees or if something like the turnover somehow exceeds two crores rupees then this company will be automatically converted into the Private Limited or Limited Company. It is necessary for the conversion of the One Person Company to take place within a stipulated period of six months of which the paid-up share capital has somehow increased beyond fifty lakh rupees or that the average turnover exceeds two crore rupees.

the Govt, vide Notification GSR 91(E) dated 01st Feb 2021 has changed the Companies (Incorporation) Rules, 2014 which shall come into force on the 1st day of April 2021 & it can be called the Companies (Incorporation) Second Amendment Rules, 2021. In the Current Amendment Now, Non-Resident Indians is also permitted to registered One Person Company in India. (a) shall be eligible to incorporate an OPC; Now, One Person Company can be transformed into any kind of company at any time without any limit of paid-up capital and turnover with effect from 1 April 2021. OPC means a company incorporated with only 1 person as a member, unlike the traditional manner of having at least 2 members to form a company.

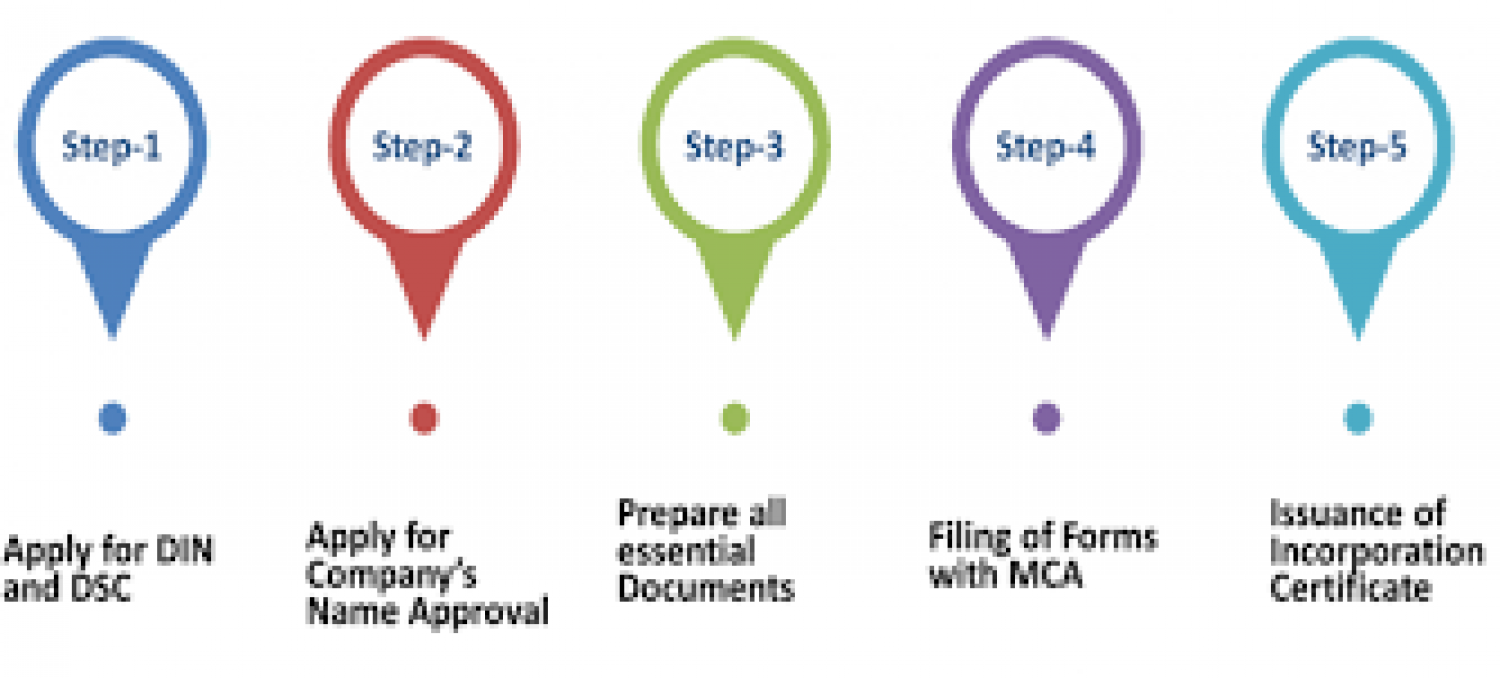

INCORPORATION PROCESS OF ONE PERSON COMPANY

DIGITAL SIGNATURE CERTIFICATE- digital signature certificate is obtained by the proposed director. Following documents are required to obtain a digital signature certificate-

- Address proof

- Photo

- Aadhaar card

- Pan card

- Address proof

- Phone number

DIRECTOR IDENTIFICATION NUMBER- DIN is applied by the proposed director by form SPICe along with the name and address proof. Form DIR – 3 is the option available for the existing company. SPICe form can be applied to up to three directors.

NAME APPROVAL- the name of the one-person company end with the word private limited. Application for name approval can be made from SPICe and RUN web service of the ministry of corporate affairs. Now the ministry has permitted two proposed names for the company.

DOCUMENTS TO BE SUBMITTED OF ONE PERSON COMPANY

- Following documents are submitted to the registrar of the companies-

- There is only one director in the one-person company therefore a nominee is appointed who can perform the duties of the director in case of dies or unable to perform his duties. Nominee's consent is taken in FORM INC – 3 along with his pan card and aadhaar card.

- Memorandum of association of the company

- Articles of association of the company

- Proof of registered office of the company.

- FORM INC – 9 (declaration of the proposed director ) FORM DIR -3 ( consent of proposed director ) is to be submitted.

- Declaration by the company secretary chartered accountant, cost accountant is to submit that all compliances have been made.

FILING OF FORMS-

all the documents are attached to the FORM SPICe. SPICe – memorandum of association and SPICe – articles of association along with the digital signature certificate of the director will be uploaded on the ministry of corporate affairs website.

CERTIFICATE OF INCORPORATION- after submitting all the documents the registrar of companies will verify the documents and after verification registrar of companies shall issue the certificate of incorporation.

FAQ OF ONE PERSON COMPANY

Q1- How many names can be proposed by the person company during incorporation?

Ans.-one-person company can apply for two proposed names through RUN.

Q2- Is the nominee of the director is given mandatory for the one-person company in document submission?

Ans.-yes, the name of a nominee of the director is submitted mandatory by the company because in case of incapacity of performing his duties bt the director the nominee takes his duties in the company.

Q3- Is there is need to file any separate application for pan card and tan?

Ans.-no, there is no need to file a separate application for pan card and tan. Pan number and tan are generated automatically at the time of incorporation.