Table of Contents

Virtual CFO Outsource

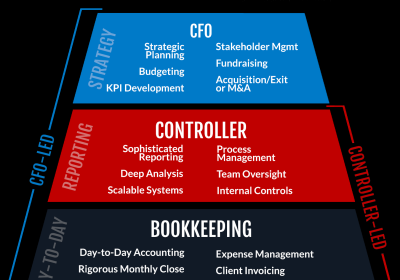

Virtual CFO assist in undertaking all major business operations for the company to achieve its financial and business goals. They are a team of professionals who by establishing close contact with the clients provide deep insight into major arenas and aspects of the company.

Virtual CFO Services

- Growing small businesses frequently reach an internal critical threshold where they require a CFO to handle financing strategies, budgets, and act as a sounding board before making major decisions.

- Small businesses, on the other hand, can't afford and often don't need a full-time CFO. For small businesses, outsourced CFO services are the best option.

- However, given that poor cash management is responsible for 82 percent of business failures, hiring an outsourced CFO has never been more important.

- Outsourced CFO services manage the essential financial affairs for financial success while giving you control over your cash flow.

- Furthermore, the timely and accurate information given by an outsourced — or virtual — CFO enables small business owners to concentrate on day-to-day operations.

Virtual CFO Outsourcing Services in New Delhi

Vertical CFO outsourcing helps the companies utilize the company’s resources in the best manner so as to achieve the target. With increased time savings and real-time access to high-quality data, accounting firms leveraging cloud technology virtual CFO has gained fresh momentum. Unlike CFO, a virtual CFO is not a member of the company.

Virtual CFO Outsourcing Services in India

A professional virtual CFO analyses a company’s financial information, advice on strategical planning and direction, monitoring risk management by evaluating the investments, actively participates in executive discussions, and the decision-making processes. The biggest advantage of hiring a virtual CFO is the flexible communication level on a sincere level.

Virtual CFO Outsource in Delhi – Consult us for Critical Matters

With a virtual CFO by your side, you can discuss the crucial matters which otherwise go neglected and help you plan out-of-the-box strategies for the company’s business challenges. Conducting proper analysis, we at CA Rajput create reports based on historical and contemporary data for the business owners to have insight into the important aspects to work upon for standing at par in the corporate world.

Also Read :

- Strong reasons for Small business hire CFO Services

- CFO Service for small business

- What is Virtual CFO?

- Factors to be Consider while Choosing a Accountant

Virtual CFO Outsource in India - Deploy Cash Efficiently

We help you deploy cash efficiently and find opportunities for greater production and expansion. A virtual outsourced CFO offers cash management and planning, interpreting financial results on regular basis, managing the annual budgeting process, and the key metrics for developing a concrete business strategy. Outsourcing business operations for better insight is great for the company’s growth.

What Are the Advantages of outsourcing Accounting Functions?

- According to Chartered Accountants Practice Advisor, there are numerous advantages to outsourcing accounting. Perhaps the most significant advantage is that you can keep the office running efficiently while also cutting costs.

- Outsourcing is the practice of paying a third-party service provider to perform one or more different business tasks in order to keep the busy running smoothly.

- The company doing the outsourcing will agree to pay a fixed or fluctuating fee by signing a contract outlining the services that will be provided.

- Accounting Outsourcing has become a popular choice for small and medium-sized businesses looking to reduce overhead costs without sacrificing efficiency.

CFO outsourcing service offerings typically include the following:

1. Planning, Budgeting, and Forecasting

- An outsourced CFO makes plans, does budgeting, as well as forecasts to provide a feasible and predicted outlook of an organization's long and short term financial goals.

- By comparing actual performance to budget, the CFO assists the company in identifying areas where profits can be maximized.

- A virtual CFO combines all aspects of budgeting, planning, and forecasting, allocating limited resources in accordance with the company's strategy.

2. Management of Cash Flow and Revenue

- Outsourced CFO services can suggest ways to improve the company's cash flow.

- Virtual CFO can evaluate current cash management practices to make recommendations for better management of the company's capital, cash flow, and debt obligations, as well as ensure the ability to invest in new projects.

- This strategic service delves into your financials and explains how to maximise the bottom line, from resolving cash flow issues to optimising cash flow forecasting.

- A virtual CFO can predict and assess the company's financial situation, estimate financing needs, and track cash flow sources.

3. Mergers and Acquisitions Assistance

- When organic growth opportunities are limited, an outsourced CFO's role includes assisting with business mergers and acquisitions as well as raising capital.

- The virtual CFO validates the profitability thesis of the deals and evaluates the risks, from negotiating terms and conditions to completing compliance for potential mergers and acquisitions, assessing crucial components like tax compliance, product/service compatibility, financial impact, and cash-flow considerations.

4. Financial Modeling and Analysis

- To guide key business decisions and maximize the bottom line, an outsourced CFO evaluates historical financial performance alongside industry benchmarks and competitor analysis.

- Virtual CFOs also offer dynamic economic modelling and provide cash flow forecasts and revenue projections for actionable insights to improve decision making, maximize profits, and accelerate growth.

Popular Article :

- What's Better: online CFO or inhouse fulltime CFO services

- Key ideas & prospects for CA’s practice to develop

- Upgrade your business, redesign your finance mechanism

Rajput Jain & Associates