What is Virtual CFO?

Page Contents

What is a Virtual CFO?

Companies that do not have an in-house Chief Financial Officer can hire a Virtual CFO, whose major function is to handle the company’s finances, including its cash flow (financial risks, financial record & reporting). details are mentioned below :

- Virtual CFO is a completely new concept that helps small businesses for a period of time by the financial.

- Here is the definition that consists of the detail examination of the virtual CFO

- The virtual CFO plays the role of CFO for the part-time.

- Who acts as the CFO and provides financial stability

- As well as maintain the wellbeing of the business.

- In the last few years, the awareness of Virtual CFO services has been increased drastically. It is the time in which CFO’s understand the importance of the Virtual CFO.

What Virtual CFO does?

The services of the Virtual CFO:

- Virtual CFO takes care of all the financial functions of the organization. It also takes the control of finance and accounting functions.

- Financial advisory, cash flow forecasting, budgeting, accounting rules and procedures, internal control, debt planning, and corporate governance are all areas where a Virtual CFO can help SMEs.

- Virtual financial services also help in focusing on the company’s other commercial tasks.

- The Virtual CFO works at the top level by performing the same activities as CFO.

Advantage of Outsourcing CFO Services

- Redeployment of Staff

- Increase Profitability

- Daily Tracking of Accounting Rules and Implementation

- Faster Making of Decision

- Ensure Timely Payroll

- Access to Advanced Technology Know-How

- Minimize Risk

- Easy access of Financial Data Anytime

- Flexibility & Scalability

- Maintain Security & Confidentiality

What are the things to be Considered Before the use of Virtual CFO Services?

- The Best Outsourced Accounting Team

- Compare Pricing

- Contact References

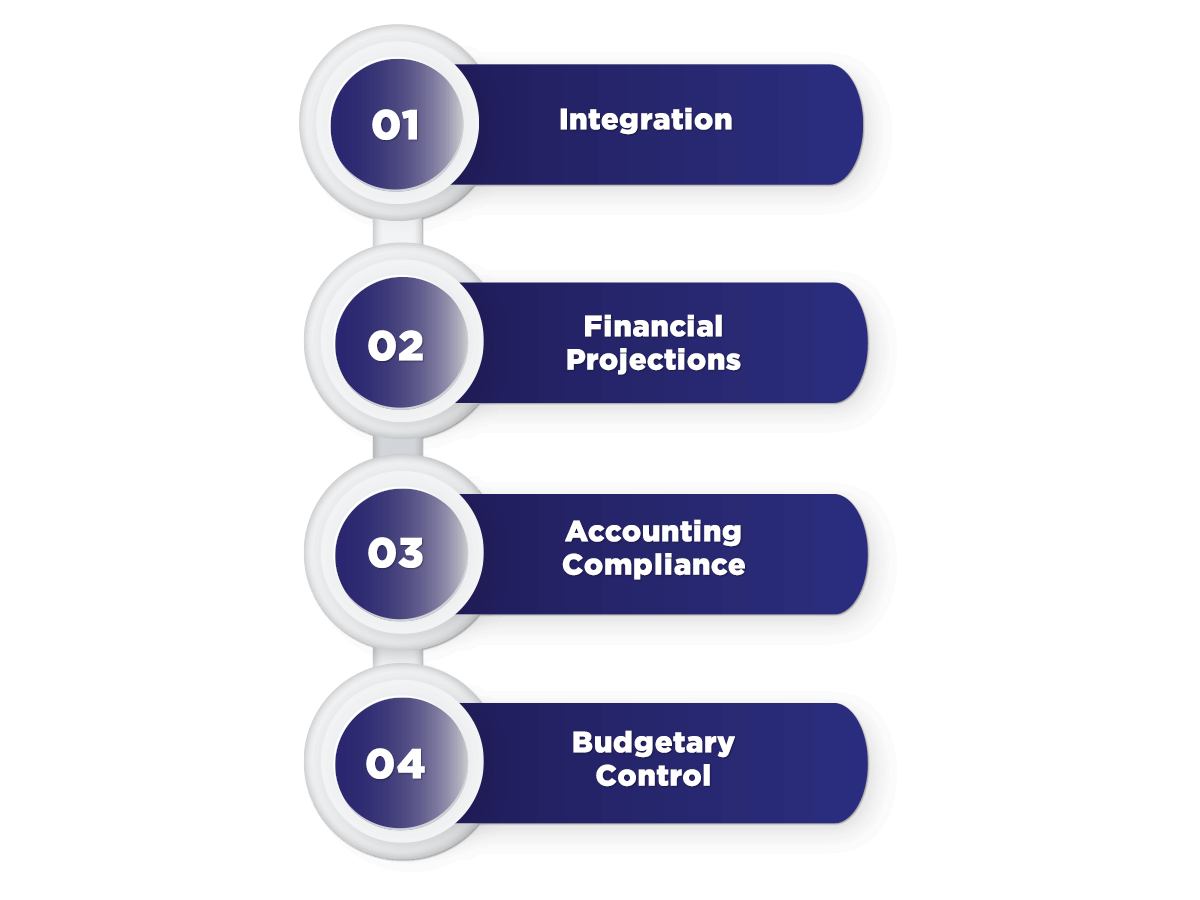

Virtual CFO and related function:

The following services are provided by the Virtual CFO to help businesses understand their financial capability and health.

- Most Businesses fail during its initials and to deal with that failure CFO needs support from outsiders to make the business profitable and reputed.

- Financial and cash flow projections using Virtual CFO services and income and financial statements, as well as a cash flow statement.

- Virtual CFO has practical knowledge of cloud-based accounting software, modern data analytics, and mobile technology to support businesses.

- To understand cash utilization, the virtual CFO manages cash flow as well as debtors and creditors through the identification of key operational indicators, which is a significant aspect in risk management.

- Virtual CFO assists in budgeting, which aids in analyzing financial requirements and, as a result, aid in balancing the company’s income and expenses.

- The Virtual CFO’s main purpose is to forecast financial and cash flow estimates, as well as to help reduce resource waste and adopt strategies that improve productivity.

- Virtual CFO plays a crucial role in the success of businesses. It helps to achieve financial goals as expected.

Responsibilities of Virtual CFO:

- Managing Finance: It is the responsibility of the virtual CFO to maintain the stability of finance because

- The stakeholders are used to depending upon it. He is also responsible to prevent fraud in the business.

- Maintaining the stability of the budget: Virtual CFO has to focus on maintaining the expense and performance as defined in the budget plan. It is the responsibility of the CFO to take the right approach to maintain the budget.

- Risk management and mitigation: CFO is also responsible to analyze the risk that comes with taking.

- The decision and the company’s profile. He also has to take care of the insurance and relates systems.

- Maintain professional relationships: He has to maintain business relations with employees to solute problems. He also works as a Mediator between the board of directors and stakeholders.

- Financial engineering: It is the responsibility to use the funds of the company in an appropriate way and in the right place.

Why the role of Virtual CFO is becoming crucial?

- Due to increased competition

- Virtual technology is supporting businesses.

- The agreement work is commoditizing.

- There is an increment in the fees.

- It needs knowledge and capabilities to play the role of virtual CFO and the demand will increase in the near future because many financial firms want to work smarter not harder.

Popular blog:-