Table of Contents

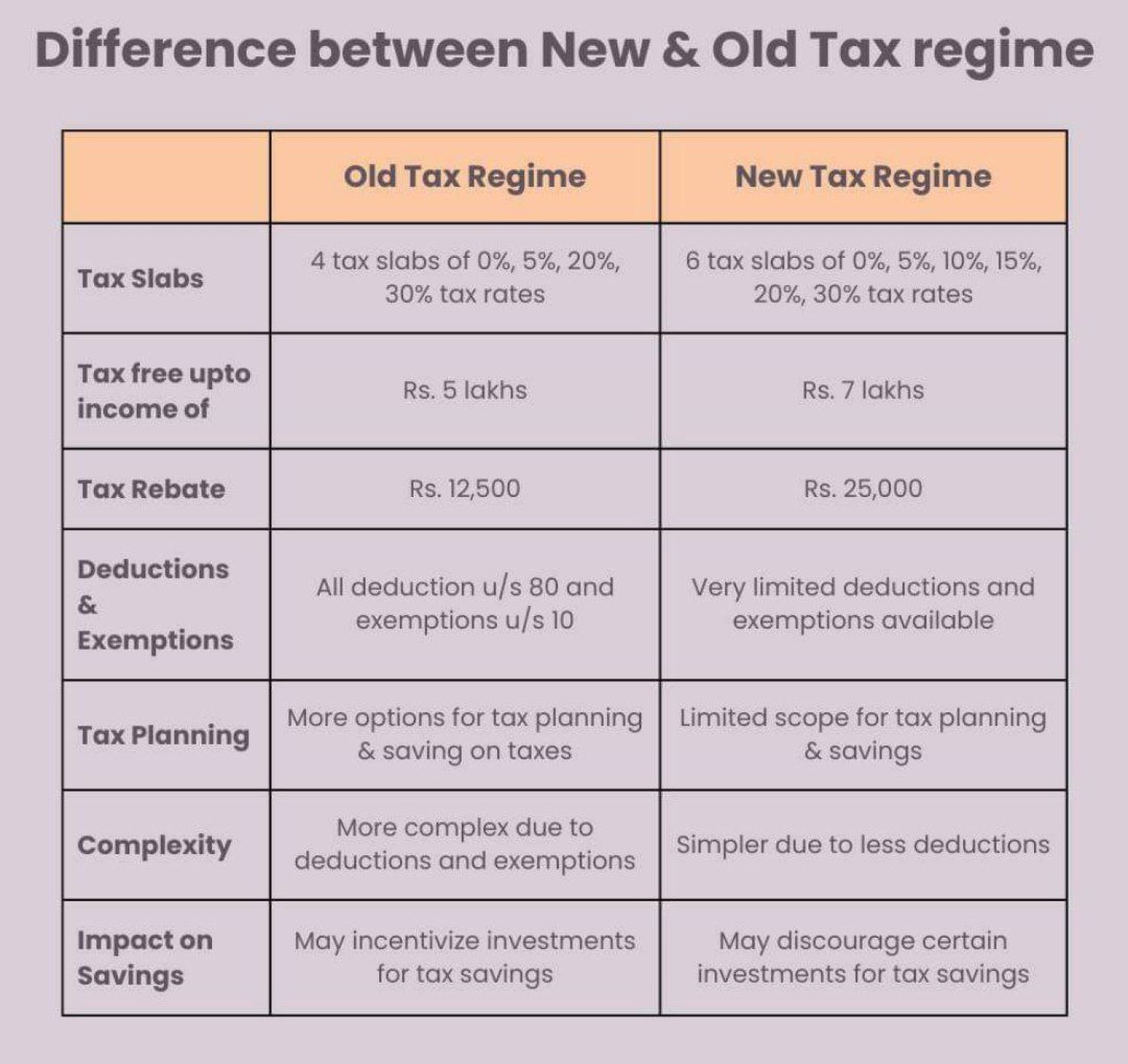

Old vs. New Tax Regime: Understanding the Differences

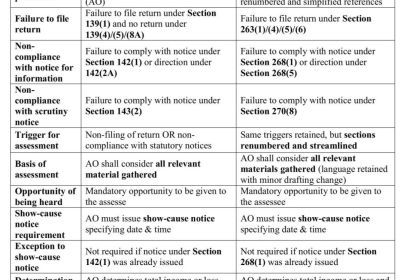

For the assessment year 2024-25, individuals and Hindu Undivided Families (HUFs) have to pay taxes under the new tax regime unless they opt for the old regime while filing their return of income before the due date. The new tax regime requires that total income be calculated without considering certain deductions and exemptions. These provisions ensure clarity and help taxpayers decide between the old and new tax regimes based on their financial situation and eligibility for various deductions and exemptions.

Calculate potential deductions under the old regime. Use tax calculators to estimate liabilities under both regimes. Evaluate if you prefer simplicity or are willing to invest time in tax planning. Both the old and new tax regimes have distinct benefits and drawbacks. The new regime offers simplicity and is suitable for those with fewer deductions, while the old regime encourages savings and offers extensive deductions, benefiting those with significant eligible expenses. Taxpayers should evaluate their financial situation, potential deductions, and personal preferences before deciding which regime to opt for.

New Tax Regime:

- Under the New regime it is Simplified Tax Structure & Ideal for individuals who do not wish to deal with extensive tax preparation and documentation. Especially beneficial for consultants and non-salaried individuals who do not qualify for various Section VIA exemptions and deductions. Suitable for those not receiving a pension and therefore ineligible for the INR 50,000 standard deduction.

- New regime have Concessional rates with fewer deductions and exemptions. Reduced documentation and record-keeping. Lower potential for fraud due to the simpler structure.

- New regime have Drawbacks like Lack of deductions can discourage saving habits. & May not be suitable for those who can claim significant deductions and exemptions.

Old Tax Regime:

- Old regime is Suitable for individuals who benefit from various exemptions and deductions, fostering a habit of saving. Secure for seniors with significant interest income, eligible for INR 50,000 deduction under Section 80TTB.

- Comes with higher rates but allows multiple deductions and exemptions. Benefits include Section 80C, 80D, home loan interest, HRA, etc. Old regime is More flexibility in tax planning through investments and savings.

- Old regime have Drawbacks Requires meticulous record-keeping and documentation. More time needed for tax preparation and filing.

Practical Scenarios:

- Non-Salaried Taxpayers (Consultants, Freelancers): New Regime is Beneficial due to fewer available deductions and simpler compliance. & Old Regime is Less advantageous if not eligible for many deductions.

- Older Individuals without Pension: New Regime is Preferable due to the absence of pension-related deductions. and Old Regime is Offers limited benefits without the standard deduction.

- Senior Citizens with Interest Income: New Regime May not fully leverage the benefits of interest income deductions. & Old Regime is Secure and beneficial due to Section 80TTB deduction.

CBDT issue the Clarification via Circular No. C1 of 2020

To address employer concerns regarding tax deduction at source (TDS) in light of Section 115BAC, This CBDT clarification helps avoid excessive tax withholding, which previously led to refund claims. The CBDT's clarification on Section 115BAC ensures employers accurately compute TDS based on employees' chosen tax regimes, reducing ambiguities and easing the tax filing process for employees. The CBDT issued Circular No. C1 of 2020, clarifying the following:

- Once an employee has intimated the choice of the new tax regime for a financial year, it cannot be altered for TDS purposes during that year.

- For taxpayers with business income, once the new regime is chosen, it applies to all subsequent years unless specific conditions are met to change it.

- Impact on Withholding Taxes from Salary : Employers must now consider the employee's choice between the old and new tax regimes for accurate TDS calculation.

- Intimation by Employee:

- Employees must inform their employers each year if they opt for the new tax regime under Section 115BAC.

- If an employee fails to provide such intimation, the employer will compute TDS based on the old tax regime.

- Employer's Role:

- Employers are required to compute TDS based on the employee's intimation regarding the new tax regime.

- The employee's intimation to the employer does not constitute a formal exercise of the option under Section 115BAC(5); the final decision can differ when filing the income tax return.