Table of Contents

Documentation for Peer Review- Audit work For CA in Practices.

-

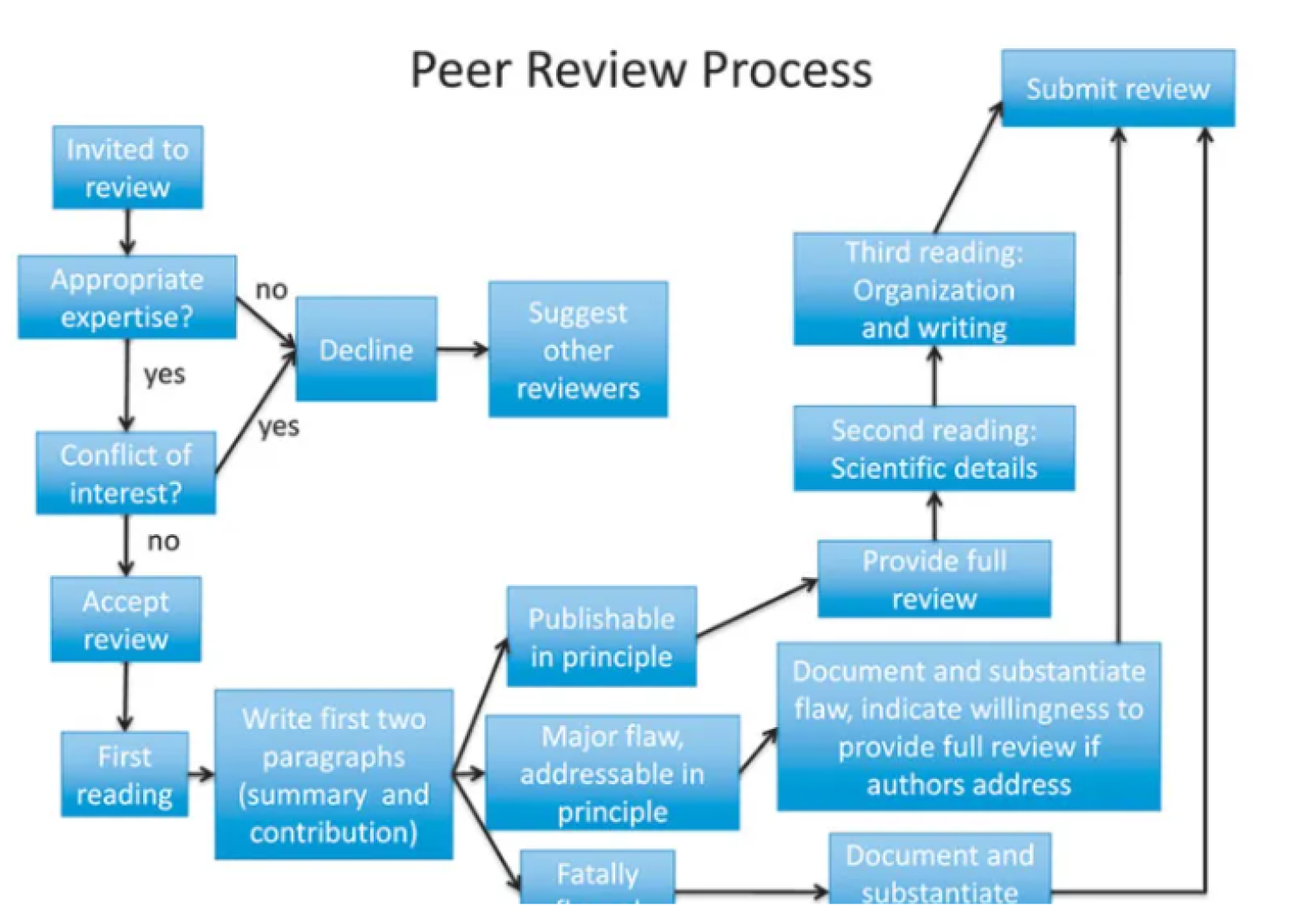

Peer review is a process where the audit work and practices of a Chartered Accountant (CA) or a CA firm are reviewed by another CA or CA firm to ensure adherence to professional standards and regulatory requirements. Proper documentation is crucial for a successful peer review.

- Even the best of the professionals need approbation. They are only human beings. They need and deserve the reconfirmation of their abilities and the way they work, from their peers. Such reconfirmation that professional seek is provided by the process of “Peer Review” (PR).

- The dictionary meaning of the word “Peer” is “A person who has equal standing with another or others” and the term “Review” is defined as “subject to a formal inspection or appraisal and reassessment of the matter in question”.

- Peer Review for chartered accountants would mean evaluation of a colleague’s work professionally.

- Peer Review Board was established by the Council of the Institute in March 2002 to conduct the system of PR.

- It is mandatory for all the practice units who are auditing listed companies and also Bank branches.

Structure of Peer Review Documentation

A.Indexing and Cross-Referencing: Ensure all documentation is properly indexed and cross-referenced for easy retrieval and review.

B. Content Organization

- General Information Section: Firm’s Profile, Organizational Chart, Quality Control Policies

- Engagement Letters Section : Copies of Engagement Letters

- Audit Planning Section : Audit Planning Memoranda, Risk Assessment, Documentation, Audit Programs

- Independence and Ethical Compliance Section, Independence Declarations, Ethical Compliance Documentation

- Working Papers Section : Planning Documents, Risk Assessments, Internal Control Evaluations, Substantive Testing Workpapers, Analytical Review Workpapers, Conclusion and Reporting Workpapers

- Financial Statements and Reports Section : Audited Financial Statements, Audit Reports, Management Letters

- Quality Control Reviews Section : Internal Quality Reviews, Previous Peer Review Reports, Corrective Actions

- CPE Records Section : Continuing Professional Education Records

- Client and Engagement Selection Section : Client Lists & Engagement Selection Criteria

- Regulatory Compliance Section : Compliance Documentation

Working papers can be listed for Peer Review :

The need for Working papers can be listed as follows:

- They aid in the planning and performance of the audit;

- They aid in the supervision and review of the audit work and to review the quality of work performed, in accordance with AAS 17 “Quality Control for Audit Work”;

- They provide evidence of the audit work performed to support the auditor’s opinion

- They document clearly and logically the schedule, results of test, etc.

- The working papers should evidence compliance with technical standards

- They document that Internal control has been appropriately studied and evaluated; and

- They document that the evidence obtained and procedures performed afford a reasonable basis for an opinion.

- They retain a record of matters of continuing significance to future audits of the entity;

- They enable an experienced auditor to conduct quality control reviews in accordance with Statement on Peer Review issued by the Institute of Chartered Accountants of India;

- The process of preparing sufficient audit documentation contributes to the quality of an audit

- They fulfil the need to document oral discussions of significant matters and communicate to those charged with governance, as discussed in AAS 27, “Communication of Audit Matters with those Charged with Governance.

List of documentation needed for Peer review

Below is a detailed list of documentation needed for peer review:

1. General Information

- Firm's Profile: Overview of the firm's history, structure, services offered, and key personnel.

- Organizational Chart: Diagram showing the firm's structure and hierarchy.

- Quality Control Policies and Procedures: Documentation of the firm's quality control policies and procedures.

2. Engagement Letters :

- Engagement Letters: Copies of engagement letters for all audit clients, outlining the scope and objectives of the audit.

3. Audit Planning

- Audit Planning Memoranda: Detailed planning documents for each audit engagement.

- Risk Assessment Documentation: Identification and assessment of risks of material misstatement.

- Audit Programs: Detailed audit programs for various audit areas.

4. Independence and Ethical Requirements

- Independence Declarations: Statements of independence from all partners and staff involved in audit engagements.

- Ethical Compliance: Documentation demonstrating compliance with ethical standards and regulations.

5. Working Papers

- Audit Working Papers: Comprehensive working papers for selected audit engagements, including:

- Planning Documents

- Risk Assessments

- Internal Control Evaluations

- Substantive Testing Workpapers

- Analytical Review Workpapers

- Conclusion and Reporting Workpapers

6. Financial Statements and Reports

- Audited Financial Statements: Copies of audited financial statements for selected clients.

- Audit Reports: Final audit reports issued to clients.

- Management Letters: Letters issued to clients detailing audit findings and recommendations.

7. Quality Control Reviews

- Internal Quality Reviews: Documentation of any internal quality control reviews conducted by the firm.

- Peer Review Reports: Copies of previous peer review reports, if any.

- Corrective Actions: Documentation of actions taken to address any findings from previous peer reviews or internal quality reviews.

8. Continuing Professional Education (CPE)

- CPE Records: Records of continuing professional education for all partners and staff, demonstrating compliance with CPE requirements.

9. Client and Engagement Selection

- Client Lists: Lists of all audit clients, indicating the nature and size of each engagement.

- Engagement Selection Criteria: Criteria used for selecting engagements for peer review.

10. Compliance with Regulatory Requirements

- Compliance Documentation: Evidence of compliance with relevant regulations, standards, and guidelines issued by regulatory bodies (e.g., ICAI guidelines, Companies Act, Income Tax Act).

Proper Maintaining Peer Review Documentation

Proper documentation for peer review not only ensures compliance with professional standards but also enhances the quality and reliability of the audit process. Guidance to staff on Audit documentation:

- Ensure consistency in the format and content of documentation across all engagements. Documentation should be clear, concise, and comprehensive. Ensure all required documentation is complete and up to date. Regularly review and update documentation to reflect current practices and regulatory changes. Maintain the confidentiality and security of all client information and documentation. adhere to regulatory requirements for the retention period of peer review documentation. Also needed to take care the following points

- Filing/keeping of working papers

- Checklist of documents to be obtained and maintained

- Indexing of documents/ working papers

- Proper numbering/ sequencing of working papers

- Summarizing of overall findings

- Writing of queries

- Discussing with seniors on matters of importance

- Disposing of Query -at staff level/ senior level/ partner level

- Importance of the working papers to be signed, dated and approved by relevant level of audit staff with sufficient cross reference

Tips for Auditors on documentation / working papers

- Clarity and Understanding

- Completeness and Accuracy

- Logical Arrangement

- Legibility and Neatness

- Safety

- Initial and date

- Summary of conclusions