Table of Contents

- Summary Of Amendments Made In Tax Audit Income Tax Form 3cd W.e.f. Ay 2024-2025

- Clause 8a: Special Tax Regime With Lower Tax Rates:

- Clause 12: Reporting Of Profits Assessable Under Presumptive Tax Schemes

- Clause 18: Depreciation Admissible

- Clause 19: Deduction Under Sections 35, 35d, Etc.

- Clause 21(a): Amounts Debited To P&l Covered By Explanation 3 To Section 37(1)- Disclosure Of Expenses For Violation Of Law In India Or Outside India

- Disclosure Of Expenditure For Compounding Of Offences

- Clause 26: Amounts Covered U/s 43b- Amendment In Clause 26 For Disallowance Of Delayed Payment To Micro And Small Enterprises (mses)

- Clause 32: Brought Forward Loss Or Depreciation - New Disclosure Of Specified Domestic Transactions Under Section 115bae(4)

- Amendments Related To International Financial Services Centre (ifsc) And Deduction Claimed Under Section 80la

- All About The Income Tax Audit

Summary of Amendments made in Tax audit Income Tax Form 3CD w.e.f. AY 2024-2025

The Central Board of Direct Taxes has introduced several significant amendments in the Tax Audit Report forms, including Form 3CD, Form 3CEB, and Form 65. These changes are aimed at enhancing transparency and ensuring compliance with the latest tax regulations. These amendments in Tax audit Income Tax Form 3CD align with recent tax reforms and ensure that the reporting requirements are up-to-date with the latest provisions of the Income Tax Act.

Clause 8a: Special Tax Regime with Lower Tax Rates:

- A reference to Section 115BAE has been added. This Clause 8A now requires reporting whether the company has opted for the special tax regime u/s 115BAE, which offers lower tax rates under specific conditions.

Clause 12: Reporting of Profits Assessable under Presumptive Tax Schemes

- A specific reference to Section 44ADA has been added. This Clause 12 change mandates the reporting of profits assessable under the presumptive tax scheme for professionals as per Section 44ADA, ensuring accurate disclosure in the Profit & Loss Account.

Clause 18: Depreciation Admissible

- For AY 2024-25, individuals, HUFs, AOPs, BOIs, etc., opting for Section 115BAC(1A) must adjust the opening Written Down Value (WDV) as per the provisions of the section. This Clause 18 ensures proper computation and adjustment of depreciation for entities opting for the new tax regime under Section 115BAC(1A).

Clause 19: Deduction under Sections 35, 35D, etc.

- Additional entries for Section 35ABA and an option for "Any other relevant section" have been inserted. This Clause 19 amendment broadens the scope of reporting deductions, allowing for the inclusion of new and other relevant sections, such as Section 35ABA.

Clause 21(a): Amounts Debited to P&L Covered by Explanation 3 to Section 37(1)- Disclosure of Expenses for Violation of Law in India or Outside India

- Additional entries have been added for amounts paid for compounding of offences and expenses related to offences prohibited by law. This Clause 21(a) ensures that such payments, which are not allowable as deductions, are explicitly reported, enhancing transparency and compliance.

- Clause 21 of Form 3CD, which requires the disclosure of various expenditures debited to the Profit and Loss (P&L) account, has been expanded.

- Now includes reporting of expenses incurred for purposes that constitute an offence or are prohibited by law.

- It also requires disclosure of expenditures by way of penalty or fine for the violation of any law, whether in India or outside India.

- This amendment ensures that all expenditures related to illegal activities or violations, both domestically and internationally, are transparently reported.

Disclosure of Expenditure for Compounding of Offences

- Clause 21 has also been modified to require details of expenditures incurred for compounding offences. Key Changes:

- This now includes expenditure incurred to compound offences under any law, whether in India or outside India.

- This addition ensures that expenditures related to the compounding of offences are disclosed, further enhancing the comprehensiveness of financial reporting.

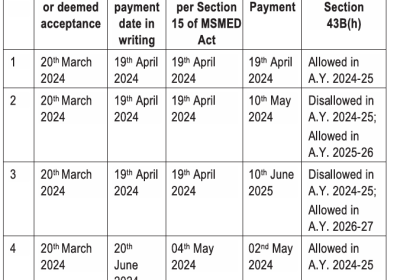

Clause 26: Amounts Covered u/s 43B- Amendment in Clause 26 for Disallowance of Delayed Payment to Micro and Small Enterprises (MSEs)

- The word "(h)" of Section 43B has been added after "(g)". This Clause 26 amendment incorporates any new additions u/s 43B(h), ensuring comprehensive reporting of amounts that are deductible only upon actual payment. Clause (h) of Section 43B has been inserted into Form 3CD.

- This amendment seeks details of delayed payments to Micro and Small Enterprises that are in violation of Section 43B(h). The inclusion of this clause highlights the importance of timely payments to MSEs and ensures that any delays are reported and potentially disallowed.

Clause 32: Brought Forward Loss or Depreciation - New Disclosure of Specified Domestic Transactions under Section 115BAE(4)

- The reference to "115BAD" has been updated to "115BAD/115BAE". This Clause 32 amendment reflects the inclusion of Section 115BAE, ensuring accurate reporting of brought forward losses or depreciation in cases where entities have opted for these specific tax regimes.

- Form 3CEB has been updated to include new disclosure requirements. Key Changes:

- The form now requires particulars regarding specified domestic transactions that fall under Section 115BAE(4) and result in more than ordinary profits.

- This change ensures that transactions generating unusually high profits are reported, aiding in the detection of transfer pricing or profit shifting issues.

Amendments Related to International Financial Services Centre (IFSC) and Deduction Claimed under Section 80LA

- Form 65 has been amended with new fields under the "Verification" section. Key Changes:

- The applicant must now certify that the company is a unit of an International Financial Services Centre (IFSC).

- Form requires the date when the deduction under Section 80LA ceased to apply and when the company lost its qualifying status.

- This amendment ensures that companies availing of deductions under Section 80LA are properly monitored and that their status is accurately reported when the deduction is no longer applicable.